Japanese Yen Costs, Charts, and Evaluation

- FOMC resolution on Wednesday, the Financial institution of Japan on Friday.

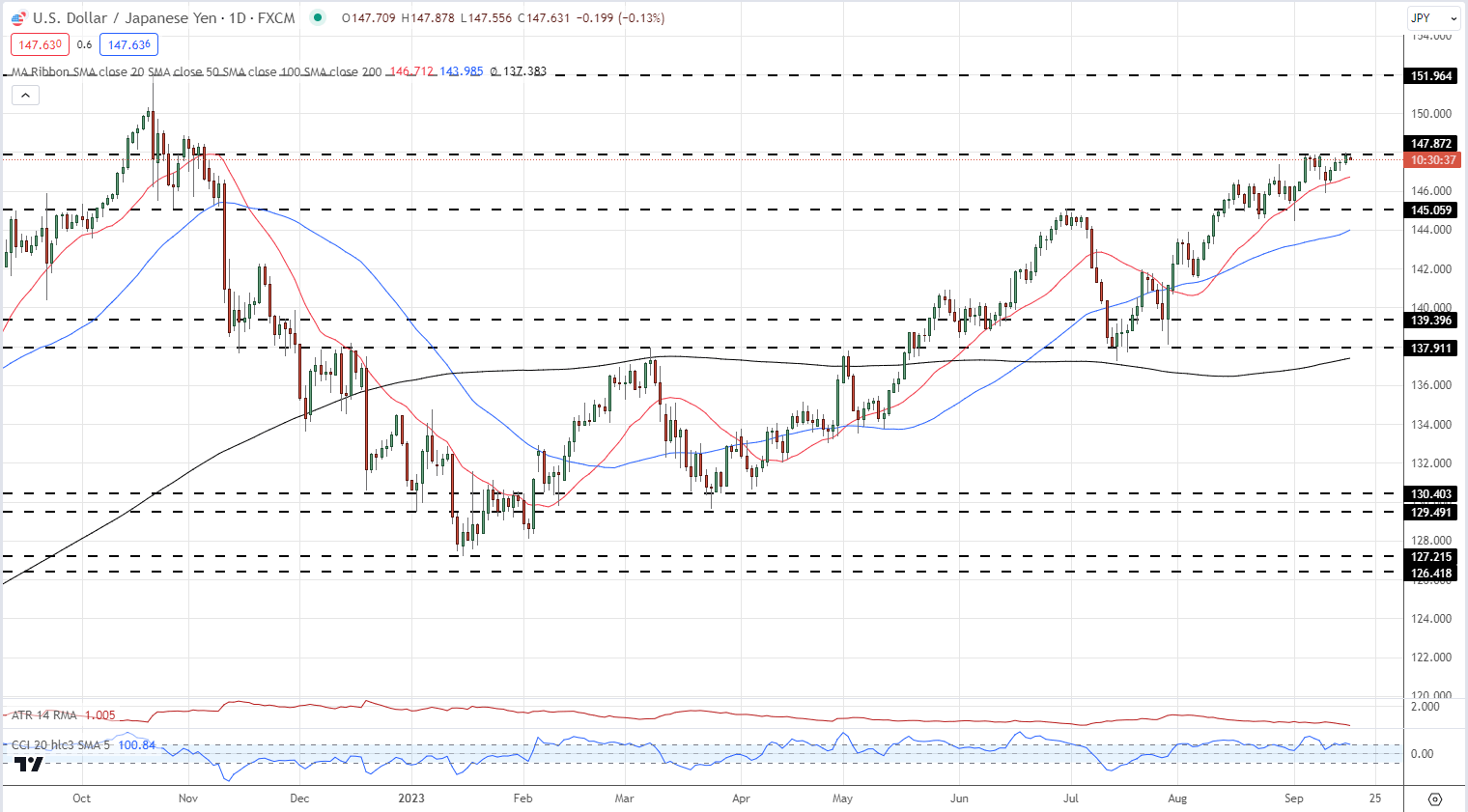

- USD/JPY struggles with resistance.

Be taught Find out how to Commerce USD/JPY

Advisable by Nick Cawley

Find out how to Commerce USD/JPY

The Federal Reserve (Fed) and the Financial institution of Japan (BoJ) will each announce their newest financial coverage resolution this week – Wednesday and Friday respectively – with each central banks anticipated to depart rates of interest untouched. Each choices nonetheless have the potential to maneuver markets, with the BoJ presumably the more durable response to name.

The Fed is totally anticipated to depart unchanged at a present stage of 525-550, and if the most recent market pricing is appropriate, the US central financial institution will depart charges untouched throughout to Might subsequent yr when they’re forecast to start out reducing charges. The post-decision press convention will seemingly see chair Powell reiterate that charges can go increased if wanted, partially to maintain some central financial institution flexibility. It is going to be some months but till the Federal Reserve lastly says that charges are at their peak.

CME FedWatch Instrument

Be taught About Central Banks

Advisable by Nick Cawley

Traits of Profitable Merchants

The BoJ will depart charges untouched however current remarks from central financial institution governor Kazuo Ueda that the BoJ could conclude its detrimental rate of interest coverage by the top of the yr will maintain merchants attentive to any accompanying post-decision commentary.

Japanese Yen Rallies on Financial institution of Japan’s Ueda Feedback. Will USD/JPY Reverse?

USD/JPY has moved sharply increased over the course of 2023 on the widening USD and JPY rate of interest differential. Whereas the Fed has pushed charges to multi-year excessive ranges, the BoJ has stored bond yields in detrimental territory in an effort to stoke inflation and development. The Japanese Yen has been used as a funding forex towards the US greenback in addition to towards a variety of different high-yielding currencies together with the South African Rand and the Mexican Peso.

The day by day USD/JPY stays biased in direction of additional features with the pair supported by all three easy transferring averages. This month’s a number of touches, and rejections, just below 148.00 do flag up a warning signal that merchants have gotten more and more cautious the BoJ or MoF could quickly give discover that they’re following yen strikes carefully. Again in late September 2022, the Japanese Finance Ministry intervened within the FX market, shopping for JPY. That intervention induced USD/JPY to fall from 151 in late September all the best way again to 127.20 in early January 2023. Additional upside in USD/JPY seems to be restricted except the BoJ turns dovish once more on Friday.

USD/JPY Each day Worth Chart – September 18, 2023

Obtain the Newest IG Sentiment Report back to See How Each day/Weekly Modifications Have an effect on the USD/JPY Worth Outlook

| Change in | Longs | Shorts | OI |

| Each day | 10% | 0% | 2% |

| Weekly | -8% | 16% | 10% |

What’s your view on the Japanese Yen – bullish or bearish?? You may tell us by way of the shape on the finish of this piece or you’ll be able to contact the creator by way of Twitter @nickcawley1.