Gustavo Muñoz Soriano/iStock via Getty Images

Apple (NASDAQ:AAPL) has now dominated as the world’s largest company for more than 20 months, while 2022 has marked a significant milestone as they became the first company in history to surpass $3T in market cap (even if just momentarily). I (like most of you) have been a beneficiary of Apple’s household name and the evolution of their hardware innovation throughout the years. From using the early Macintosh computers in grade school for projects, to listening to my iPod during my more rebellious years, and now today – typing on my Macbook Pro while listening to classical music on my AirPods. The fact that Apple has consistently generated exceptional products is undisputed. What remains contentious however, are Apple’s prospects for sustained growth going forward. While I may be currently immersed in the Apple ecosystem, it is noteworthy that the classical music I am listening to is being streamed over Spotify, and my 2017 Macbook Pro is only marginally inferior to its 2022 successor (Apple’s new M1 chip is the major distinction). These are symptoms of an overall stagnation in Apple’s ability to generate growth organically through innovation, or new ventures. We will go on a chronological journey of sorts to discuss stagnation in core products, as well as their attempts at growth through ancillary products and services, and ambitious future projects like the Apple Car and AR/VR.

Core Products

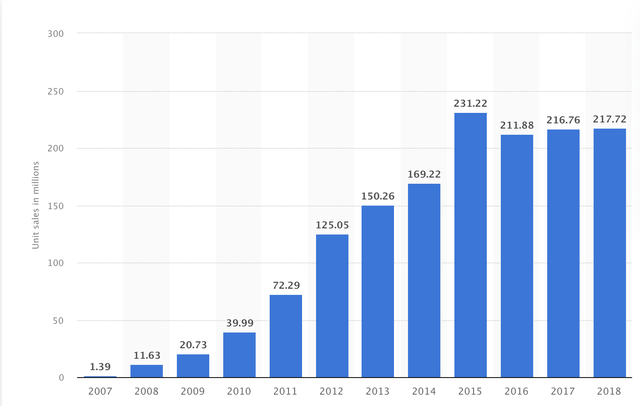

The bulk of Apple’s revenue is heavily concentrated in their core hardware products, with over half attributed to iPhone and approximately 70% when including Macbook and iPad. Looking at all 3 of these products, the rate of change and innovation has been decelerating over the past few years. There was no better bellwether for this trend than the criticism Apple received in late 2016 following the release of iOS 10, and the subsequent impact it had on battery health and overall phone performance. The incident even garnered its own name (Batterygate), prompted multiple lawsuits and resulted in Apple cutting their battery replacement cost by over 60% for a year. Some of the public characterised the move in the name of planned obsolescence and the context didn’t help Apple’s case: they had just realized their first year of negative growth in iPhone sales history, nearly a decade after the phone’s inception. While Apple has managed to grow iPhone revenue (although with volatility) since 2016, unit sales actually plateaued through 2018 (Apple interestingly stopped reporting iPhone unit sales after 2018):

Statista

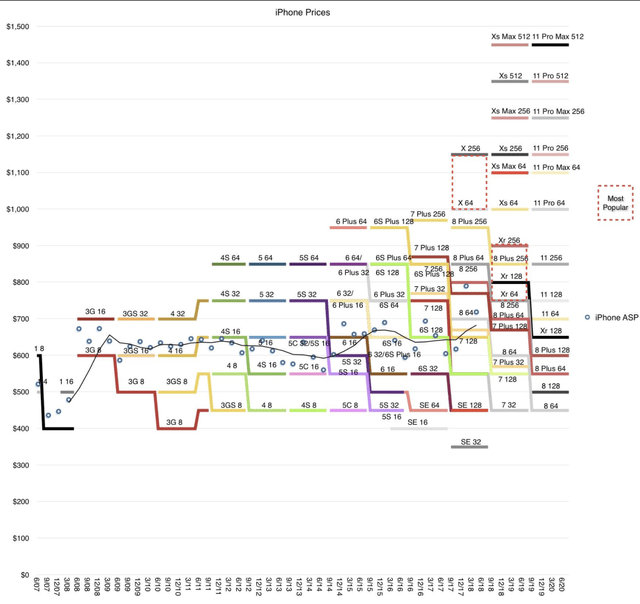

Although Apple stopped reporting iPhone unit sales after 2018, sources have reverse engineered figures using phone prices, and estimate that unit sales even declined 10% from 2018 to 2020. iPhone sales are reported to have had an anomalous year in 2021, selling slightly more units than the previous peak in 2015 (several manufacturers experienced double-digit unit sales growth in 2021). Overall, this general trend indicates Apple’s growth in the iPhone segment, their main driver of revenue, has been mainly boosted by higher prices:

Horace Dediu, Twitter

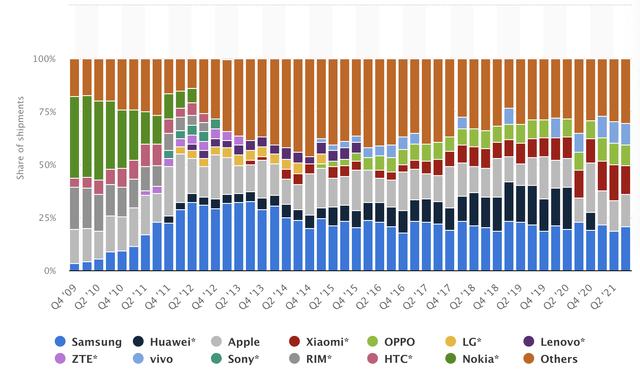

It is impressive that Apple has been able to command increasingly higher prices for the iPhone lineup, however this is a trend that cannot be sustained ad infinitum, especially when considering the iPhone is already a premium priced product relative to its peers. Smartphones have also been converging in terms of hardware features and design over the years, reducing the amount of points of differentiation Apple is able to sustain – although the software and ecosystem advantages remain. We can also see that while Apple seized a growing global smartphone market over the first half of the past decade, their share of the mobile phone market has remained static over the years in a very saturated space:

Statista

It is no surprise then that the Apple iPhone 13 is already showing signs of weaker demand, as Apple communicated with suppliers in December. One needs to simply compare the iPhone 12 and 13 on Apple’s website to discover that a magnifying glass is required to spot out differences between the models. As a result, little incentive exists for customers to upgrade. The same story goes for iPad and Mac: just compare the clunky 2012 MacBook Pro to the 2017 model, and then to today’s model. The deceleration in innovation is quite palpable. As a caveat and to Apple’s credit, I do not want to fault them entirely, as this outlook is just an inevitable reality of approaching the asymptotic physical limitations of what a mobile, phone, laptop, and tablet can be.

Wearables

Moving beyond core products, wearables is a segment that has performed remarkably well for Apple over the past 5 years (in relative terms at least), and mainly consists of AirPods, Apple Watch, Apple TV and Beats – among other smaller product lines. The segment has more than tripled since 2016 while iPhone revenue grew 40% over the same period. Despite the recent success, I don’t believe the trend in Wearables will be significant enough to prop up Apple’s overall growth. AirPods and the Apple Watch makeup the bulk of the segment’s business, and the reality is that these products don’t share the same key cyclical properties of the core iPhone business: Mobile phone customers are programmed to 2-3 year purchase cycles due to the cadence of phone plans, and are therefore accustomed to the inevitable obsolescence built into the products.

Mobile phones also inherently carry far more permutations that can be modified and innovated upon in contrast to AirPods (Apple Watch may have more parameters for potential innovation than AirPods, but is still a less sophisticated product than then iPhone). This drastically lessens the potential for significant improvements to incentivize consumers to upgrade. Incidentally, given the long time horizon of typical watch purchases, consumers will be less inclined to upgrade their watches as frequently. All of this adds up to a product profile that does not match the recurring HaaS (hardware-as-a-service) model the iPhone has enjoyed.

Streaming

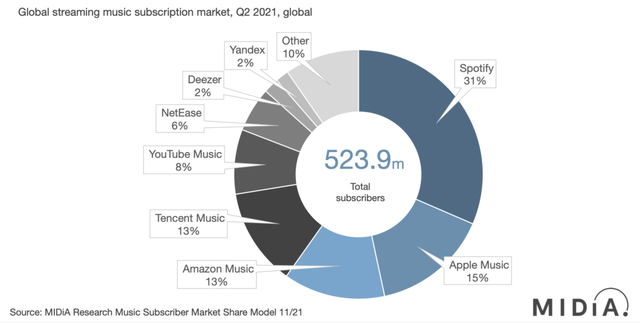

Apple’s foray into the world of audio and video streaming was a natural progression following the origins of iTunes and the Apple TV platform, respectively. Apple Music has no doubt secured a spot as a major player in the audio streaming race, however their market share has hovered at around half of Spotify’s and shows no sign of encroaching further:

MIDiA

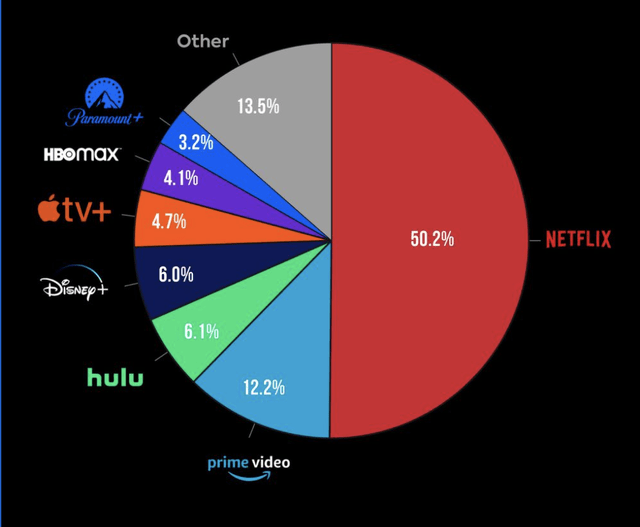

As a pure player, Spotify has built a moat that is very deep and reinforced by the feedback loops built-in to their data advantage, which I elaborated on in a previous article. To add, 55% of Spotify users are under the age of 35 while this figure is only 40% for Apple, which is most popular among the 55+ cohort (tied for first). This trajectory only bodes further for Spotify’s widening lead moving forward as time progresses. The dynamic is even more pronounced in the video streaming race against pure player Netflix:

Parrot Analytics

Bottom line, a diversified tech player like Apple does not stand to compete with the streaming specialists that have established dominance in their respective markets through curated user experiences and high quality exclusive content.

Growth Prospects

We’ve spent a lot of time looking at the stagnation of Apple’s core products and failure of recent ventures to live up to a monstrous valuation, there are two ambitious moonshots that could justify a high price, although they are embedded with much uncertainty: augmented and virtual reality (AR/VR), as well as electric vehicles.

AR/VR

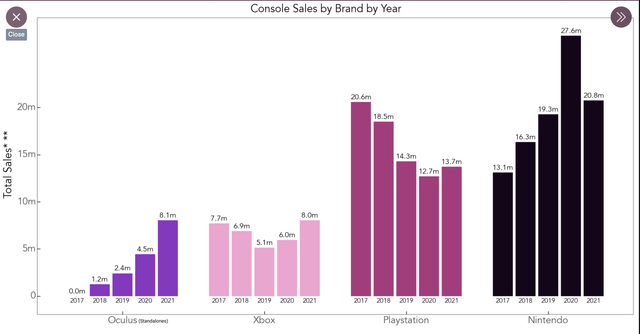

2021 will forever go down as the year the concept of the metaverse was first imprinted on the public conscious. Facebook rebranded to Meta and for the first time, more Oculus headsets were sold than Xbox units:

VGChartz

Apple is admittedly well-positioned for the movement and even got placed in the highest exposure band of Bloomberg Intelligence’s Metaverse Theme Index, as a mark of validation. Apple is expected to launch a premium immersive mixed-reality (limited augmented reality) headset in the near future, with iOS 16 beta already making reference to a VR headset and iPhone integration. The anticipated launch date is sometime in 2023, and the headset is expected to carry a much higher price tag (some reports suggest $2000+) than current mass market options like Oculus Quest, which is priced comparably to conventional gaming consoles.

With iPhone hardware integration and Apple’s entertainment ecosystem, their foray into mixed-reality headsets is logical, and the futuristic augmented reality glasses (similar to Google Glass) are expected to follow the headset in 2024 or 2025. While I have no doubt Apple will produce an exceptional headset, as an investor I am not convinced the nature of these products will garner anywhere as large of a market as smartphones, nor the same dynamics of recurring revenue. As for Apple’s AR glasses, while a cool concept, they are difficult to envision capturing a large market from a practical perspective, especially when considering the trajectory of Google Glass which has settled into an enterprise niche. While Apple may have a better chance at selling to those who wear glasses regularly, they will have a very challenging time convincing non-glasses users to convert. Already, many glasses wearers are motivated to ditch the lenses via corrective surgery or contacts, and as costs decline and technology improves, this trend will only continue.

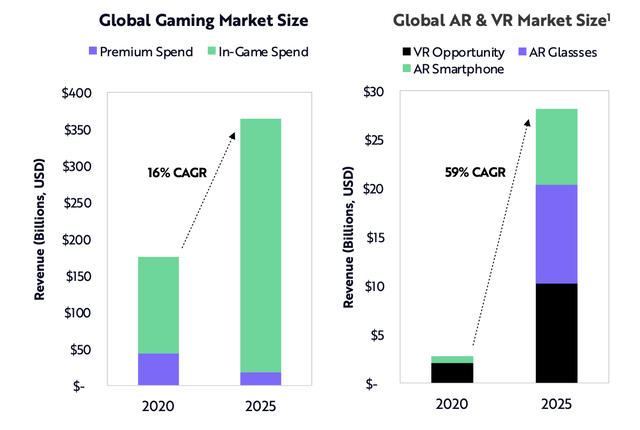

Our interactions with virtual worlds will primarily occur through gaming, as well as entertainment, social media and retail. Goldman Sachs expects the AR and VR market to grow to nearly $100 billion by 2025, however the scale is much more grandiose when factoring in these industries the technology will impact, like gaming:

ARK Invest

So while the hardware potential pales in comparison, the more significant opportunities lie in the integration of software and content. As previously discussed Apple has yet to succeed in dominating content, however in 2020 they acquired two virtual entertainment companies: NextVR and Spaces. NextVR has VR live streaming partnerships with the likes of the NFL, NBA and HBO, while Spaces creates VR experiences and games, as well as a new VR video conferencing extension.

Major VR player Meta (FB) on the other hand is focused on transforming their social media pedigree into virtual worlds via their new platform Horizon Worlds. If Apple manages to take a cut from metaverse creators on a platform of their own, similarly to how they currently do with iOS developers on the App Store, this could prove to be lucrative. Such initiatives however will face lots of backlash from developer communities given Web 3’s decentralized ethos, so they will have to tread carefully.

Electric Vehicle

GQ

Apple’s announcement of an electric vehicle may have seemed outlandish to many, but in my eyes it’s the best chance for Apple to defend their crown as the world’s largest company. As vehicles transition to autonomous and driver attention is liberated, much of the utility will shift to infotainment (which is why it is no surprise Tesla (TSLA) is placing such an emphasis on gaming and entertainment in its EVs). Few (if any) are better at collective infotainment than Apple and that’s why this moonshot concept has some glimmer of hope.

The challenging party, is profitably scaling automotive manufacturing. There is some survivorship bias at stake given Tesla’s recent successes and it is still early days for many of the EV manufacturers who have yet to fail (startups and legacy co’s alike), but the last successful automotive startup to scale production prior to Tesla was Chrysler – over 90 years ago. Margins are tight and it is an incredibly capital intensive business, especially at the start. Fortunately for Apple they have the capital sorted, but profitably will be of paramount concern.

In Closing

Steve Jobs was responsible for the creation of Apple’s core product lines that are still paying dividends to this day: Mac, iPhone and iPad. But nothing lasts forever, and Apple will need to continuously evolve to avoid resting on their laurels for too long. Given revenue growth projections for the upcoming years sit just above US GDP projections, it is clear Apple is officially a mature company.

Some of Apple’s behemoth tech peers like Microsoft (MSFT) have managed to reinvent themselves – in Microsoft’s case, embracing the new age of cloud computing and making bold acquisitions in social networks and gaming via LinkedIn and Activision. While Apple hoards cash, they have not made the kind of pivot or investments required to future proof their lead, and instead have risked spreading themselves too thin by dabbling in diverse ventures. This is reflected for example in IMD’s Future Readiness Indicator, which scores Microsoft at 91.6 and Apple at 62.2. Time will tell how wholeheartedly Apple can commit and execute on virtual worlds and an electric car, but anything short of mastering these moonshots is a nearly certain fall from grace.