- Nvidia leads the AI race, however Broadcom is rapidly catching up.

- Which inventory affords extra potential for 2025: Nvidia’s dominance or Broadcom’s development?

- With AI reworking markets, one inventory stands out for its 2025 prospects.

- Kick off the brand new yr with a portfolio constructed for volatility and undervalued gems – subscribe now throughout our New 12 months’s Sale and rise up to 50% off on InvestingPro!

Synthetic intelligence has electrified markets in recent times, driving a transformative rally throughout industries. But, with surging investments and the unimaginable developments of AI fashions, this revolution is probably going simply getting began.

In relation to corporations capitalizing on AI’s explosive potential, two giants stand out: Nvidia (NASDAQ:) and Broadcom (NASDAQ:).

Each boast spectacular development tales and compelling strengths, however in addition they include distinctive challenges. Should you needed to decide only one, which inventory affords one of the best guess for 2025?

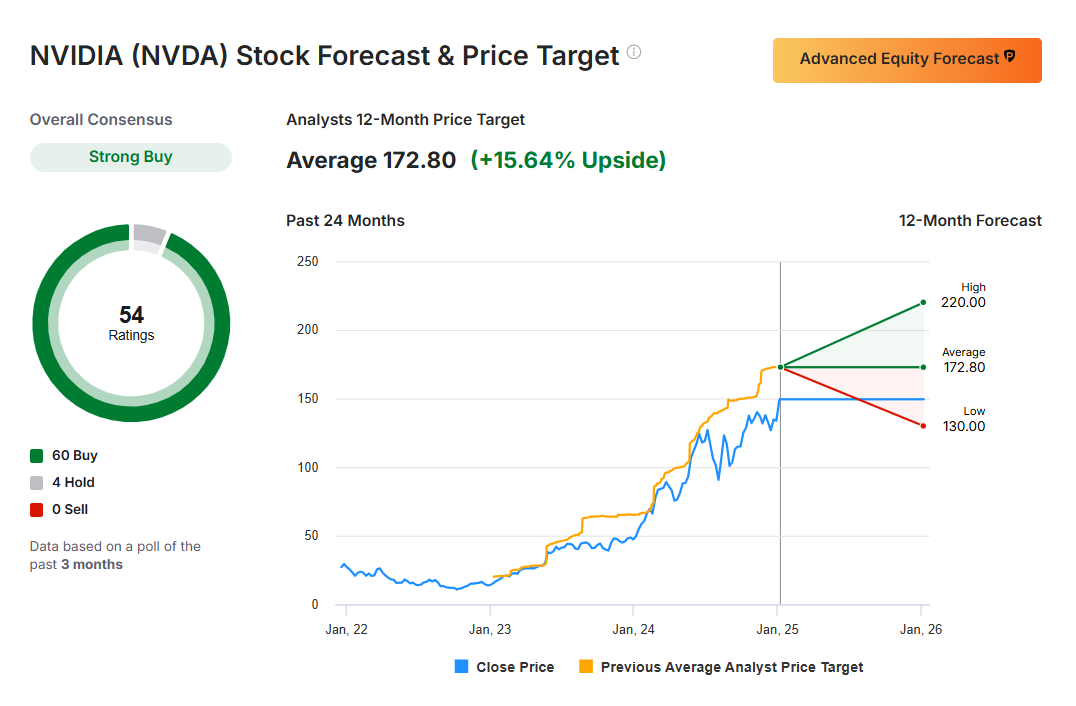

Supply: InvestingPro

Nvidia: The AI Powerhouse With Room to Run

Few corporations have harnessed the AI increase as successfully as Nvidia. Over the previous yr, its inventory has tripled in worth, solidifying its place because the undisputed chief in AI and GPU expertise. With a whole ecosystem spanning {hardware}, software program, and companies, Nvidia has change into synonymous with AI innovation.

For skeptics calling it a bubble, Nvidia counters with numbers that command consideration. Its fundamentals embrace:

- Good Piotroski Rating of 9: An indication of monetary power.

- Gross Revenue Margins of 75.86%: Among the many business’s highest.

- Present Ratio of 4.1: Highlighting strong liquidity.

Regardless of its dominance, Nvidia isn’t with out dangers. The corporate’s reliance on semiconductor provide chains exposes it to potential disruptions. Geopolitical tensions, significantly involving China, and market volatility—mirrored in its beta of 1.63—additionally loom massive. Furthermore, its valuation, with a price-to-earnings (P/E) ratio of 58x, stays elevated.

Even so, Wall Road is overwhelmingly bullish. With 60 Purchase scores, 4 Maintain, and no Promote suggestions, analysts see extra upside for Nvidia. Their common worth goal of $172.80 suggests a possible achieve of over 15% from its January 6 closing worth of $149.43.

Broadcom: A Worthy Challenger within the AI Enviornment

Whereas Nvidia has dominated the AI highlight, Broadcom is making vital strides to problem its throne. Having surpassed $1 billion in market capitalization, Broadcom is leveraging its sturdy partnerships with tech giants like Google (NASDAQ:), Meta (NASDAQ:), and ByteDance. Its deepening collaboration with OpenAI positions it to play a vital function in creating next-generation ChatGPT fashions.

Supply: InvestingPro

Broadcom’s monetary efficiency is equally spectacular, with:

- Gross Revenue Margins of 75%.

- 44% 12 months-on-12 months Income Progress.

- A Observe Report of Beating Earnings Forecasts for 8 Consecutive Quarters.

The corporate’s AI ambitions are bold. For fiscal 2025, Broadcom expects AI income between $15 billion and $18 billion, up from $12.2 billion in 2024. It additionally tasks an AI market alternative of $60 billion to $90 billion by 2027.

Nevertheless, replicating 2024’s staggering 220% AI income development will likely be difficult, probably introducing volatility within the yr forward. Nonetheless, analysts stay optimistic, with 38 Purchase scores, 5 Maintain, and no Promote suggestions.

Nvidia vs. Broadcom: The Verdict

When evaluating the 2, Nvidia edges out Broadcom for 2025, at the least in analysts’ eyes. Nvidia affords a extra favorable upside of 15.64%, in comparison with Broadcom’s modest 0.43% potential achieve. Moreover, Broadcom’s sky-high P/E ratio of 180x dwarfs Nvidia’s already elevated 58x, elevating questions on its valuation.

Whereas each corporations are primed to trip the AI wave, Nvidia’s confirmed observe document and ecosystem dominance make it the inventory to observe in 2025. Traders betting on the AI revolution might discover Nvidia’s mixture of development and market management laborious to beat.

***

How are the world’s high traders positioning their portfolios for subsequent yr?

Don’t miss out on the New 12 months’s provide—your last likelihood to safe InvestingPro at a 50% low cost.

Get unique entry to elite funding methods, over 100 AI-driven inventory suggestions month-to-month, and the highly effective Professional screener that helped establish these high-potential shares.

Click on right here to find extra.

Disclaimer: This text is written for informational functions solely. It isn’t supposed to encourage the acquisition of belongings in any means, nor does it represent a solicitation, provide, advice or suggestion to speculate. I wish to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding determination and the related threat belongs to the investor. We additionally don’t present any funding advisory companies.