Bitcoin’s stint at its new all-time excessive of $108,200 was short-lived. In lower than every week, its worth dropped by over 12%, reaching $95,000 on Dec. 23.

Whereas pullbacks starting from 20% to as excessive as 30% are commonplace dulling bull rallies, this worth reversal was accompanied by a cascade of lengthy liquidations, which additional amplified the downward worth stress over the weekend.

Between Dec. 17 and Dec. 22, over $540 million in lengthy positions had been liquidated throughout exchanges. The most important single day for liquidations was Dec. 19, when roughly $214 million in longs had been worn out.

The variety of liquidations we’ve seen previously week reveals the dangers of overleveraged buying and selling. As quickly as BTC started to retrace from its ATH, merchants with high-leverage lengthy positions had been compelled to shut their positions as their margin ranges had been rapidly breached. These compelled liquidations added to the promoting stress, accelerating Bitcoin’s decline under the important thing psychological assist of $100,000.

Lengthy liquidations happen when the worth of an asset drops under a dealer’s liquidation threshold, usually set by the extent of leverage they use. The extra leverage, the smaller the worth motion wanted to set off a liquidation.

On this case, Bitcoin’s steep drop triggered a wave of liquidations because the market deleveraged. The Federal Reserve’s tighter financial coverage probably contributed to the sell-off by dampening investor sentiment and growing market volatility. As soon as Bitcoin failed to take care of its worth above $100,000, the next liquidation cascade turned what might need been a managed pullback right into a sharper decline.

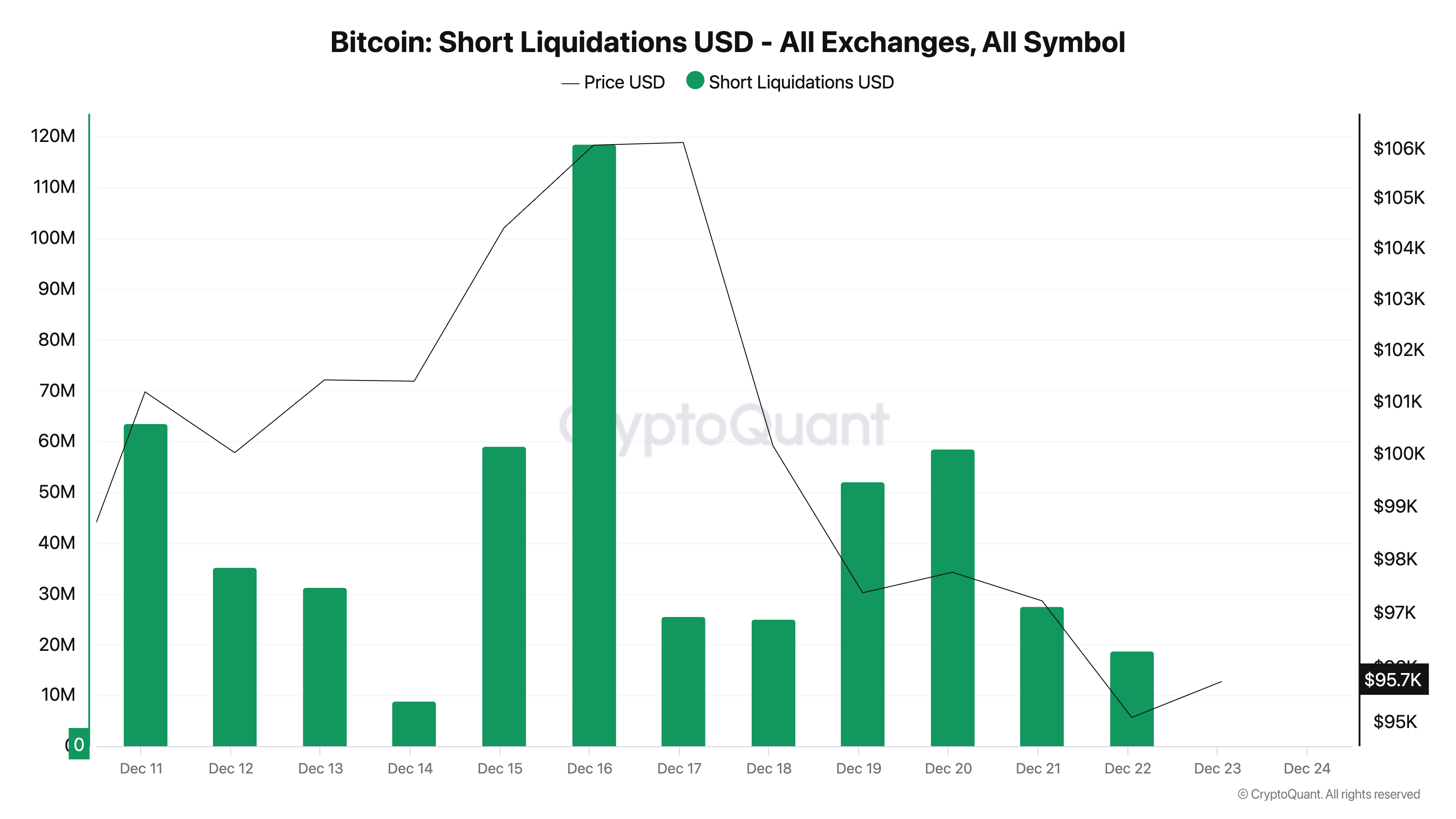

Whereas lengthy liquidations dominated through the worth drop, it’s additionally vital to investigate the sooner spike briefly liquidations that occurred on Dec. 16, simply as Bitcoin was approaching its all-time excessive. That day, roughly $120 million briefly positions had been liquidated as Bitcoin surged towards $108,200.

This transfer invalidated bearish bets made by merchants who anticipated the rally to falter. The fast worth improve triggered a brief squeeze, forcing merchants to shut their positions by shopping for Bitcoin, which in flip added upward stress on the worth.

The distinction between longs and shorts reveals the position leverage performs in shaping worth actions during times of volatility. Longs, which totaled $540 million, far exceeded the $120 million briefly liquidations, reflecting how market sentiment had shifted from over-optimism to a pointy correction.

Quick liquidations peaked through the rally as bearish merchants misjudged the energy of the bullish momentum. In distinction, lengthy liquidations intensified through the sell-off, as bullish merchants discovered themselves overextended when the worth reversed.

The timing and magnitude of those liquidations additionally provide insights into dealer conduct. Quick liquidations occurred as Bitcoin reached new highs, indicating that some market individuals underestimated the rally’s energy. However, the lengthy liquidations through the worth drop present {that a} considerably greater variety of merchants had been caught off guard by the pace and depth of the correction, notably as Bitcoin broke under $100,000.

Evaluating the 2 traits, it’s evident that Bitcoin’s rally and subsequent drop had been closely influenced by leveraged positions. The quick liquidation spike on Dec. 16 contributed to the rally’s momentum, pushing Bitcoin to its all-time excessive. Nevertheless, the lengthy liquidations that adopted had been much more vital by way of market affect, driving Bitcoin’s worth down by over 12% inside a number of days.

The submit Bitcoin tumbled to $95k after $540 million in lengthy liquidations appeared first on CryptoSlate.