- Trump’s victory alerts a significant shift in U.S. vitality coverage, doubtlessly boosting oil and gasoline output.

- Corporations like MPLX LP and Chevron stand to realize from coverage adjustments geared toward growing manufacturing.

- Devon Power faces a crucial help degree, with the potential for vital worth motion.

- Uncover the highest shares poised to learn from Trump”s insurance policies utilizing InvestingPro’s highly effective instruments – now as much as 55% off amid the Prolonged Cyber Monday supply!

The win by Donald Trump and the Republican camp units the stage for a significant shift in U.S. vitality coverage—one that would ramp up home oil and gasoline manufacturing considerably.

With this victory, anticipate the ‘drill, child, drill’ technique to take middle stage, unleashing the total mining potential of the US. The aim? To extend business competitiveness and decrease client payments.

Trump’s choose for Secretary of Power, Chris Wright, the CEO of Liberty Power, sends a transparent message to buyers: the brand new administration is critical about opening up U.S. sources.

If applied, this might maintain downward strain on , though the technique may not profit upstream firms.

1. MPLX LP: Steady Earnings and Robust Dividends Profit from Trump’s Win

For MPLX LP (NYSE:), a U.S.-based infrastructure firm centered on transportation, storage, and processing of crude oil, Trump’s election brings constructive information.

Buyers are hopeful that the brand new administration will streamline the allowing course of for brand spanking new pipelines and different essential infrastructure.

Supply: InvestingPro

MPLX has already proven spectacular stability, with average revenue progress and minimal fluctuation lately. The corporate’s 7.57% dividend yield and an 80% payout ratio make it a strong choose for revenue buyers.

The corporate can be well-positioned to learn from Europe’s growing demand for U.S. vitality sources as a result of ongoing conflict in Ukraine. This demand may drive additional growth of U.S. vitality logistics and transmission capability.

2. Devon Power: Approaching Key Help Amid Downtrend

Devon Power (NYSE:), an oil and gasoline producer with property within the Permian Basin and Anadarko, faces a crucial juncture. The corporate’s inventory has been trending downward since April and is nearing an vital help degree round $35 per share.

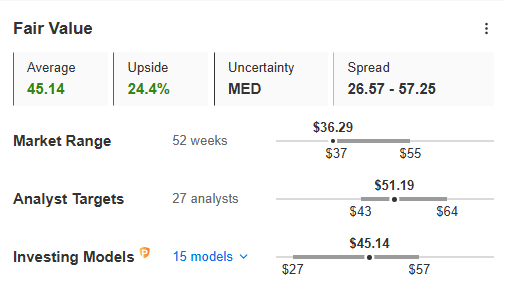

Supply: InvestingPro

A rebound may align with InvestingPro’s honest worth indication, which suggests a possible upside of 24%. Nevertheless, a breakdown beneath $35 may push the inventory even decrease, doubtlessly testing the $30 per share mark.

3. Chevron: Aiming for a Return to an Uptrend

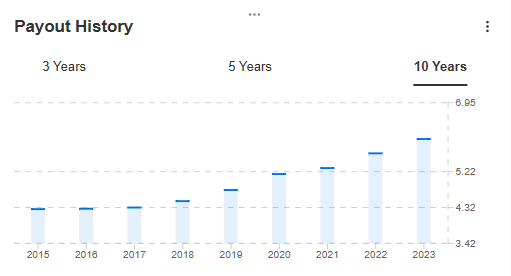

Chevron (NYSE:), a significant participant within the U.S. vitality sector with a robust international presence, seems poised for a return to an uptrend. The corporate’s dividend historical past, marked by 37 years of consecutive payouts, stays a key attraction for buyers.

After latest worth will increase, Chevron’s inventory is testing resistance on the $164 per share degree. A breakout above this level may sign a return to progress.

In conclusion, with a concentrate on growing home oil and gasoline manufacturing, the brand new administration’s insurance policies may drive vital shifts throughout the sector. Keep watch over these firms as they navigate these adjustments.

***

Prolonged Cyber Monday is right here! Benefit from 55% off InvestingPro’s superior instruments and acquire the sting it’s essential to maximize earnings.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or advice to speculate as such it’s not supposed to incentivize the acquisition of property in any approach. I wish to remind you that any kind of asset, is evaluated from a number of views and is very dangerous and subsequently, any funding resolution and the related danger stays with the investor.