We’re up 31.40%; is up 25.7% thus far this 12 months. The highest window is the SPY. We famous in shaded pink the instances when the SPY was up 5 days or extra in a row. 5 days up or extra suggests the market will probably be larger inside 5 days over 70% of the time. This “rule” is now being stretched to greater than 5 days, extending to greater than 10 days earlier than a brand new excessive is seen. We identified on the amount chart the “Promoting Climax” of final Friday’s suggesting the pull again as ended. There could be checks of the “Promoting Climax” low however is just not required. Seasonality is bullish into yearend, and the pattern stays up. Lengthy SPX on 10/29/24 at 5832.92.

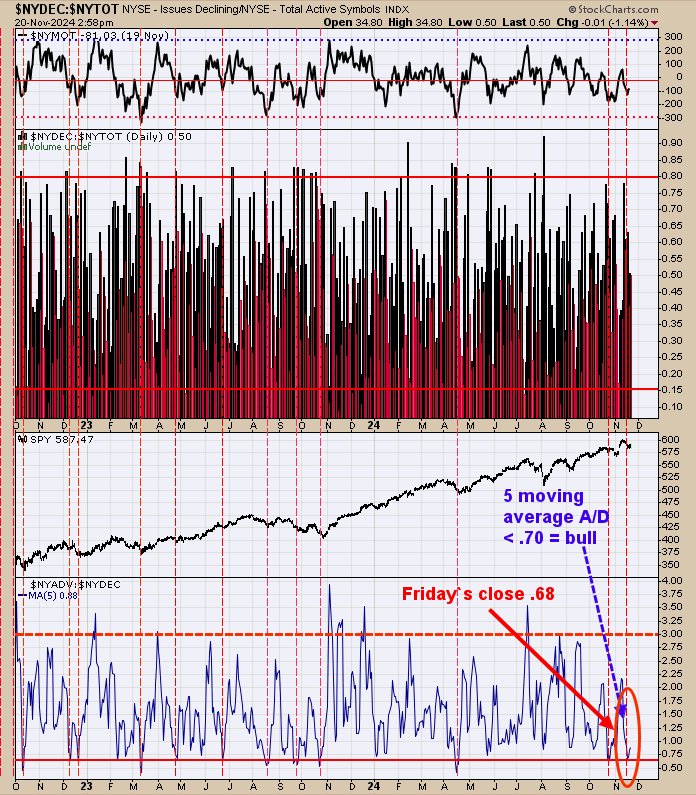

We up to date this chart from yesterday, we stated, “The underside window is the NYSE advancing/NYSE declining with a 5 day common. Lows within the SPY are discovered when this indicator falls under .70 (Friday’s shut got here in at .68). We used to make use of .65, however .70 appears to work simply as nicely. We used this indicator on the final low in late October. Discover that when the indicator reaches .70 or decrease, the market decline is mostly over, although there could be minor new lows. The intermediate-term pattern is up till a minimum of year-end.”

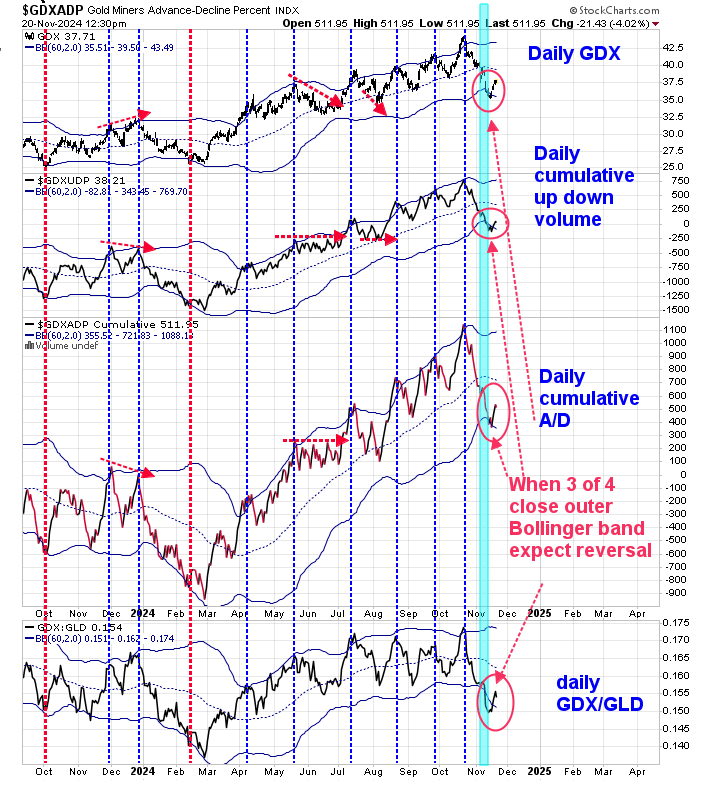

We up to date this chart from yesterday and yesterday’s commentary nonetheless stands, “GDX could have turned the nook to the upside. The underside window is the every day GDX/GLD ratio with its Bollinger band; the Subsequent (LON:) larger window is the GDX (NYSE:) cumulative Advance/decline with its Bollinger band; Subsequent larger window is the GDX cumulative up-down quantity with its Bollinger band, and the highest window is the GDX with its Bollinger band. Bearish alerts are triggered when 3 of the 4 indicators attain the higher Bollinger band and switch down (famous with blue dotted traces). Bullish alerts are triggered when 3 of the 4 indicators attain the decrease Bollinger bands and switch up (famous with dotted purple traces). We shaded the present setup in shaded inexperienced; discover that each one 4 indicators turned up, suggesting a low has been made.”