Updated on June 3rd, 2022 by Bob Ciura

Spreadsheet data updated daily

What are high dividend stocks?

They are stocks that pay out a dividend significantly in excess of market average dividends. The S&P 500 currently has a dividend yield of just 1.4%.

The high dividend stocks in this article all have dividend yields of 5% or more.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Not all high-yield stocks make equally good investments…

This article examines the 7 highest yielding securities in the Sure Analysis Research Database with Dividend Risk Scores of C or better, with a minimum yield of 5%.

Notes: We update this article near the beginning of each month so be sure to bookmark this page for next month. The spreadsheet uses the Wilshire 5000 as the universe of securities from which to select, plus a few additional securities we screen for 5%+ dividend yields.

With yields of 5% and greater, these securities all offer high dividends (or distributions). And with Dividend Risk Scores of C or better, they don’t suffer from the usual excessive riskiness of truly high-yielding securities.

In other words, these are relatively safe, high dividend stocks for you to consider adding to your retirement or pre-retirement income portfolio.

Table Of Contents

All high dividend stocks in this list have dividend yields above 5%, making them very appealing in an environment of low interest rates.

Separately, a maximum of three stocks were allowed for any single market sector to ensure diversification. Finally, all the stocks are based in the United States.

The 7 high dividend stocks with Dividend Risk scores of C or better are listed in order by dividend yield, from lowest to highest.

High Dividend Stock #7: Universal Health Realty (UHT)

- Dividend Yield: 5.3%

- Dividend Risk Score: B

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities. Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers. Universal Health’s portfolio consists of 69 properties in 20 states.

On April 25th, 2022 Universal Health released Q1 results. Net income decreased to $0.39 from $0.41 in the year-ago period. Funds from operations stood at $0.90, down from $0.92 in the year-ago period primarily due to the decrease in net income and decrease in depreciation and amortization expense.

Meanwhile, UHT declared $275.1 million of outstanding borrowings pursuant to the terms of its credit agreement, and had $96.7 million of available borrowings, net outstanding borrowings and letters of credit outstanding on March 31, 2022. Revenue increased 7.1% to $22.18 million.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

High Dividend Stock #6: Western Union (WU)

- Dividend Yield: 5.5%

- Dividend Risk Score: B

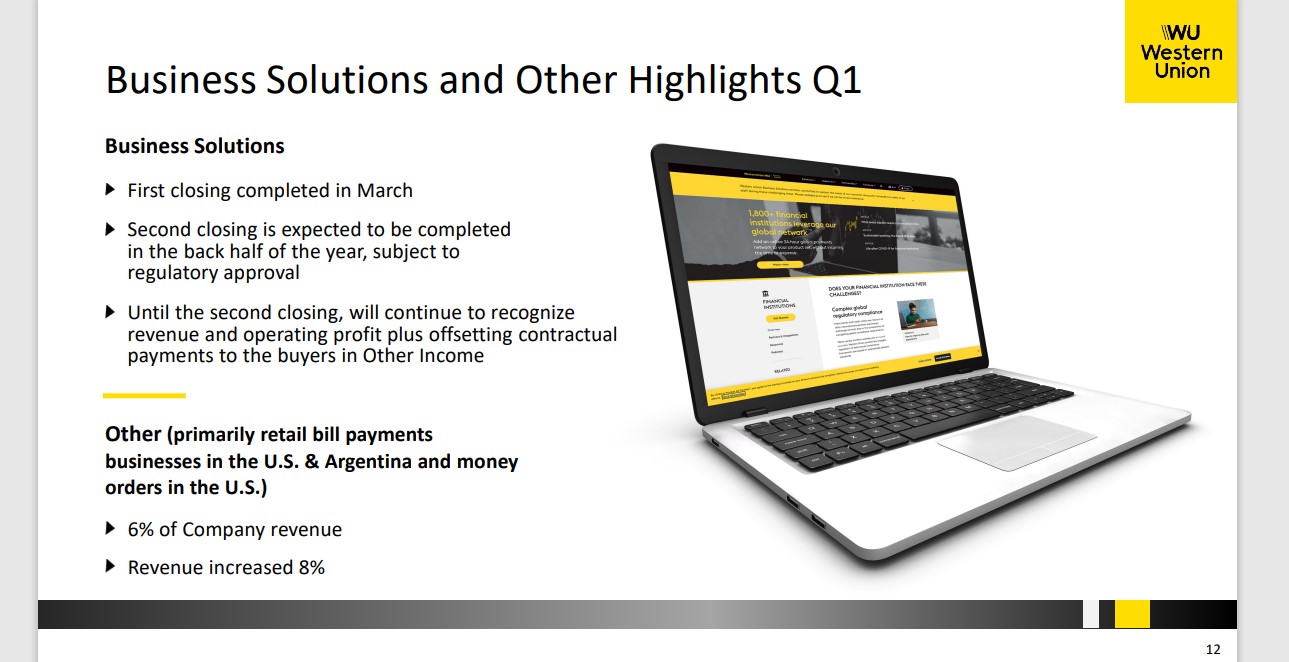

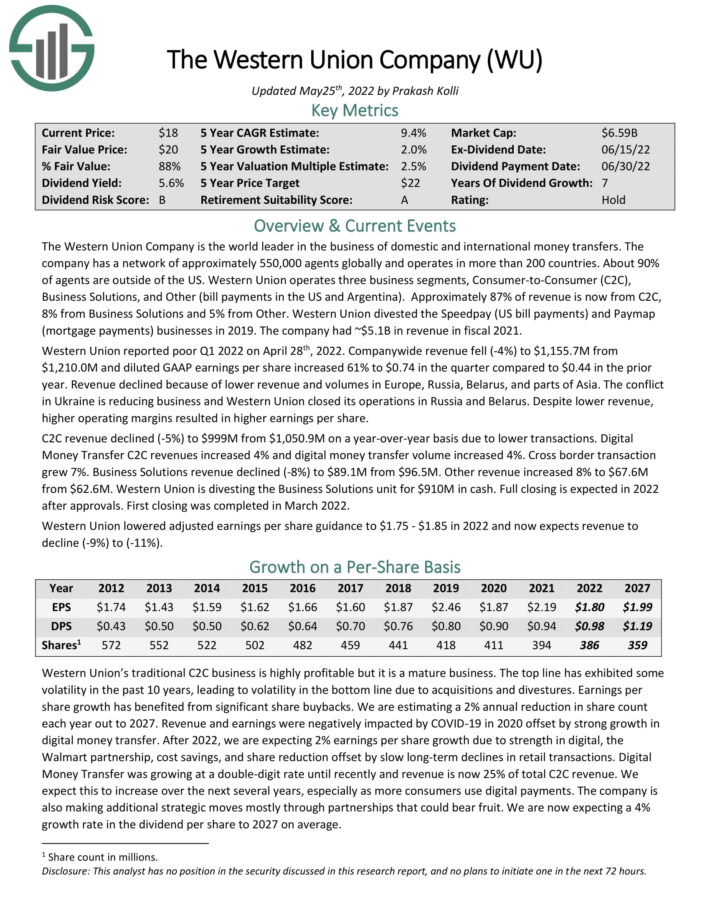

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries. About 90% of agents are outside of the US.

Western Union operates three business segments, Consumer-to-Consumer (C2C), Business Solutions, and Other (bill payments in the US and Argentina). Approximately 87% of revenue is now from C2C, 8% from Business Solutions and 5% from Other. Western Union divested the Speedpay (US bill payments) and Paymap (mortgage payments) businesses in 2019. The company had ~$5.1B in revenue in fiscal 2021.

In the 2022 first quarter, total revenue fell 4% and diluted GAAP earnings per share increased 61% to $0.74. Revenue declined because of lower revenue and volumes in Europe, Russia, Belarus, and parts of Asia. The conflict in Ukraine is reducing business and Western Union closed its operations in Russia and Belarus. Despite lower revenue, higher operating margins resulted in higher earnings per share.

Source: Investor Presentation

C2C revenue declined (-5%) to $999M from $1,050.9M on a year-over-year basis due to lower transactions. Digital Money Transfer C2C revenues increased 4% and digital money transfer volume increased 4%. Cross border transaction grew 7%. Business Solutions revenue declined (-8%) to $89.1M from $96.5M. Other revenue increased 8% to $67.6M from $62.6M.

Western Union lowered adjusted earnings per share guidance to $1.75 – $1.85 in 2022 and now expects revenue to

decline (-9%) to (-11%).

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

High Dividend Stock #5: City Office REIT (CIO)

- Dividend Yield: 5.8%

- Dividend Risk Score: C

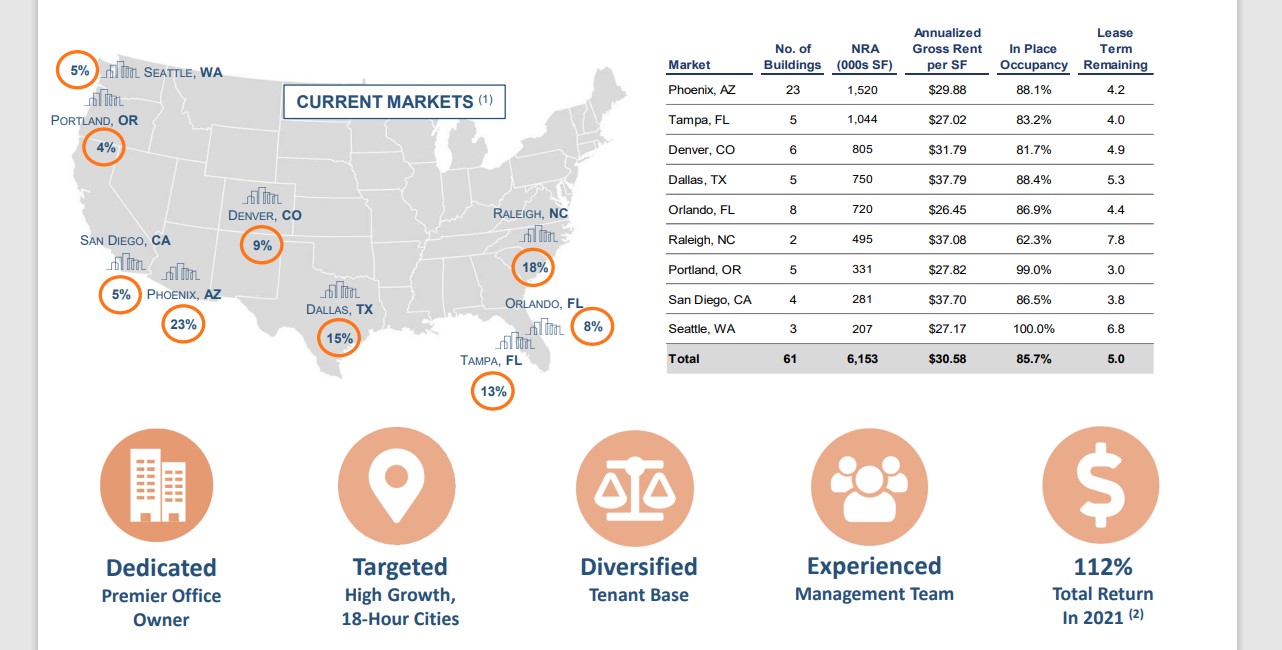

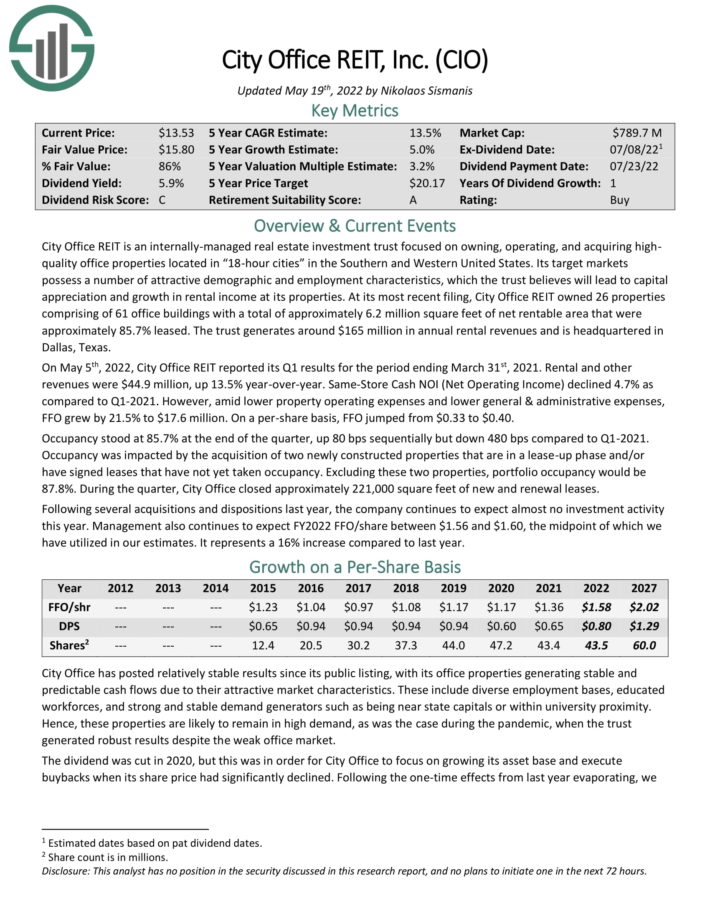

City Office REIT is an internally-managed real estate investment trust focused on owning, operating, and acquiring highquality office properties located in “18-hour cities” in the Southern and Western United States. Its target markets possess a number of attractive demographic and employment characteristics, which the trust believes will lead to capital appreciation and growth in rental income at its properties.

Source: Investor Presentation

At its most recent filing, City Office REIT owned 26 properties comprising of 61 office buildings with a total of approximately 6.2 million square feet of net rentable area that were approximately 85.7% leased. The trust generates around $165 million in annual rental revenues and is headquartered in Dallas, Texas.

On May 5th, 2022, City Office REIT reported its Q1 results for the period ending March 31st, 2021. Rental and other revenues were $44.9 million, up 13.5% year-over-year. Same-Store Cash NOI (Net Operating Income) declined 4.7% as compared to Q1-2021. However, amid lower property operating expenses and lower general & administrative expenses, FFO grew by 21.5% to $17.6 million.

On a per-share basis, FFO jumped from $0.33 to $0.40. Occupancy stood at 85.7% at the end of the quarter, up 80 bps sequentially but down 480 bps compared to Q1-2021. Occupancy was impacted by the acquisition of two newly constructed properties that are in a lease-up phase and/or have signed leases that have not yet taken occupancy. Excluding these two properties, portfolio occupancy would be 87.8%. During the quarter, City Office closed approximately 221,000 square feet of new and renewal leases.

Following several acquisitions and dispositions last year, the company continues to expect almost no investment activity this year. Management also continues to expect FY2022 FFO/share between $1.56 and $1.60, the midpoint of which we have utilized in our estimates. It represents a 16% increase compared to last year.

Click here to download our most recent Sure Analysis report on CIO (preview of page 1 of 3 shown below):

High Dividend Stock #4: Altria Group (MO)

- Dividend Yield: 6.6%

- Dividend Risk Score: B

Altria Group was founded by Philip Morris in 1847. Today, it is a consumer staples giant. It sells the Marlboro cigarette brand in the U.S. and a number of other non-smokeable brands, including Skoal and Copenhagen.

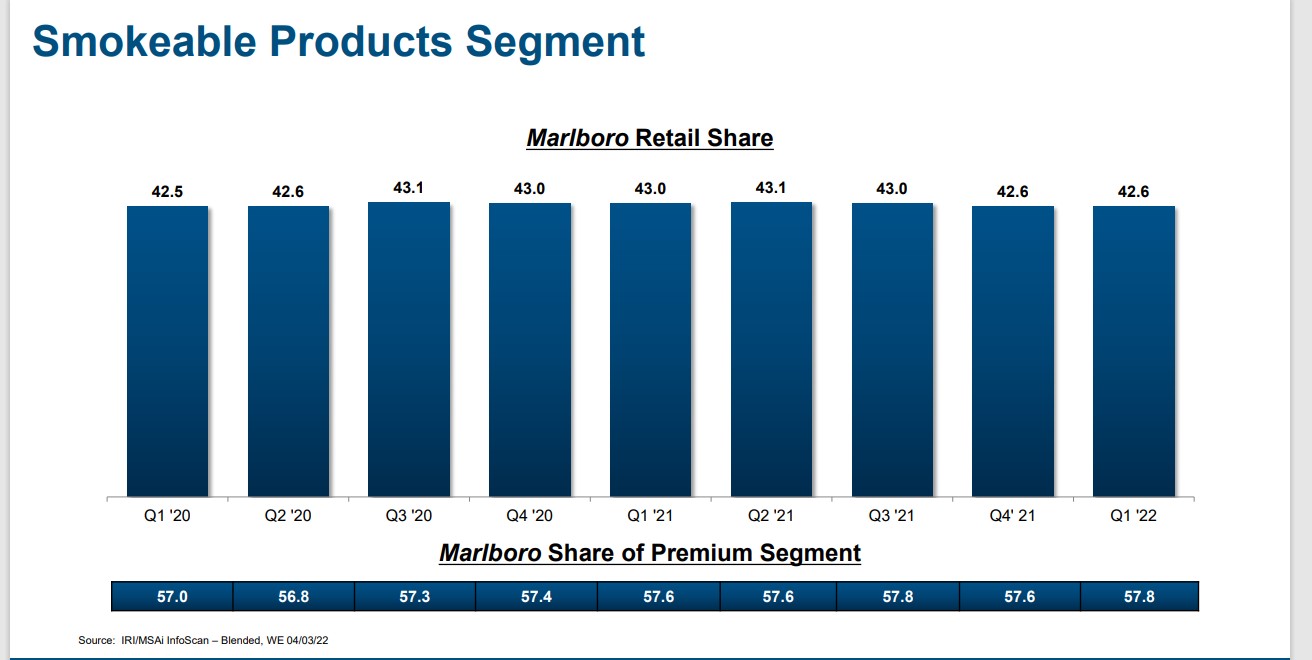

The flagship brand continues to be Marlboro, which commands over 40% retail market share in the U.S.

Source: Investor Presentation

Altria also has a 10% ownership stake in global beer giant Anheuser-Busch InBev, in addition to large stakes in Juul, a vaping products manufacturer and distributor, as well as cannabis company Cronos Group (CRON).

On 04/28/22, Altria reported first quarter FY22 results. Adjusted diluted earnings-per-share increased 4.7% to $1.12 year-over-year. Net revenue stood at $5.9 billion, down by 2.4% mainly caused by the sale of the wine business in October 2021. Reported diluted earnings per share stood at $1.08, up by 40.3% year-over-year. Revenue decreased 1.2% to $4.82 billion year-over-year.

Meanwhile, Altria reported approximately $1.2 billion remaining under the company’s existing $3.5 billion share repurchase program which is expected to complete by December 31, 2022. The company also reaffirmed full-year 2022 adjusted diluted earnings-per-share guidance of $4.79-$4.93.

Altria has increased its dividend for over 50 years, placing it on the exclusive Dividend Kings list. It is also a Dividend Champion.

Click here to download our most recent Sure Analysis report on Altria Group (preview of page 1 of 3 shown below):

High Dividend Stock #3: Sunoco LP (SUN)

- Dividend Yield: 7.9%

- Dividend Risk Score: B

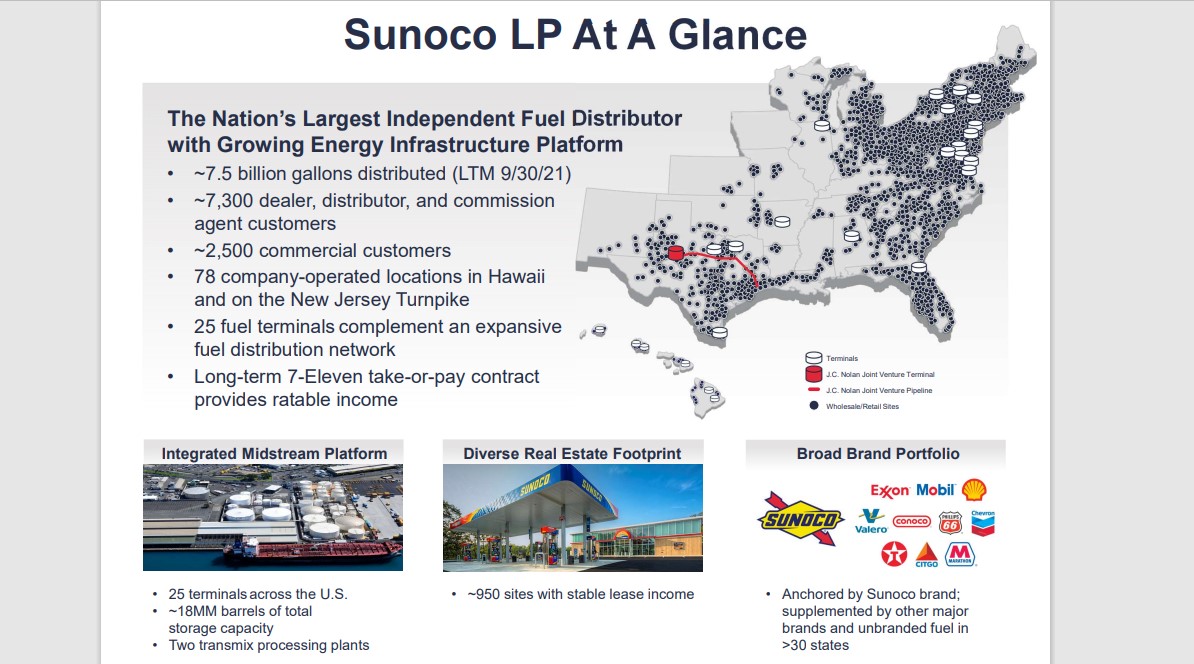

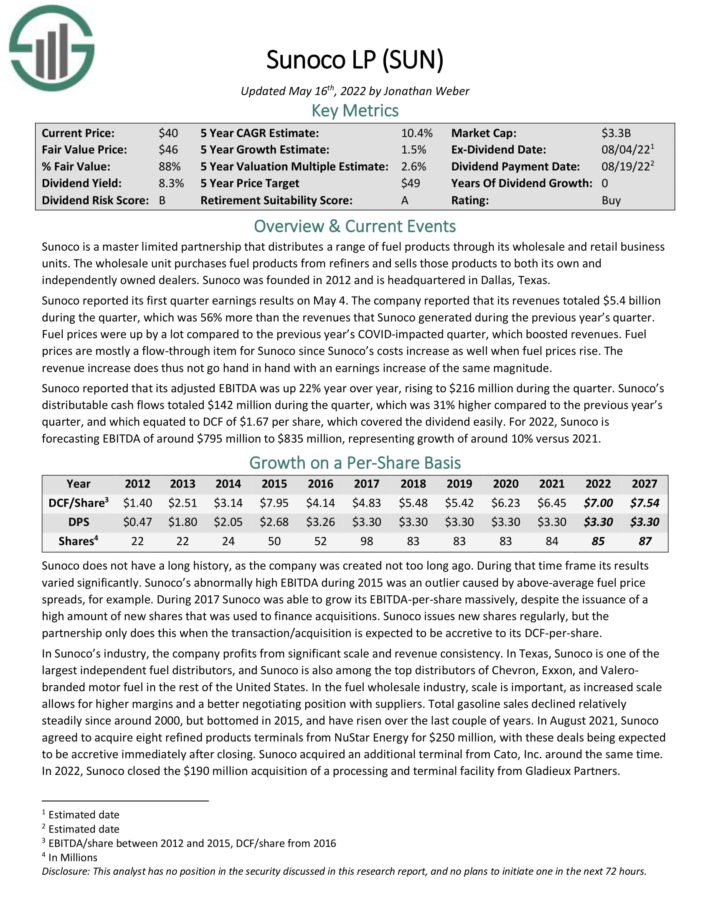

Sunoco is a Master Limited Partnership that distributes fuel products through its wholesale and retail business units. The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently-owned dealers.

The retail unit operates stores where fuel products as well as other products such as convenience products and food are sold to customers.

Related: The Top 20 Highest Yielding MLPs Now

Source: Investor Presentation

Sunoco reported its first quarter earnings results on May 4. Revenues totaled $5.4 billion, which was 56% growth from the previous year’s quarter. Fuel prices rose heavily which boosted revenues. But fuel prices are mostly a flow-through item for Sunoco as its costs increase when fuel prices rise. Therefore, adjusted EBITDA was up 22% year over year, rising to $216 million during the quarter.

Distributable cash flows totaled $142 million during the quarter, which was 31% higher compared to the previous year’s quarter, and which equated to DCF of $1.67 per share, which covered the dividend easily. For 2022, Sunoco is forecasting EBITDA of around $795 million to $835 million, representing growth of around 10% versus 2021.

Click here to download our most recent Sure Analysis report on Sunoco (preview of page 1 of 3 shown below):

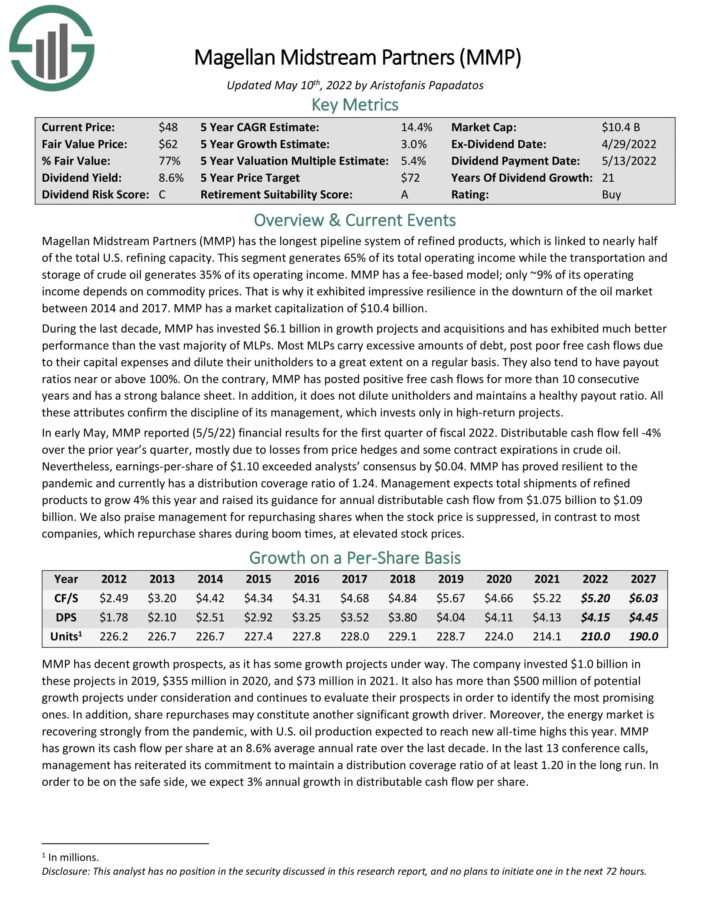

High Dividend Stock #2: Magellan Midstream Partners LP (MMP)

- Dividend Yield: 7.9%

- Dividend Risk Score: C

Magellan Midstream Partners is a Master Limited Partnership, or MLP. Magellan has the longest pipeline system of refined products, which is linked to nearly half of the total U.S. refining capacity.

This segment generates ~65% of its total operating income while the transportation and storage of crude oil generates ~35% of its operating income. MMP has a fee-based model; only ~10% of its operating income depends on commodity prices.

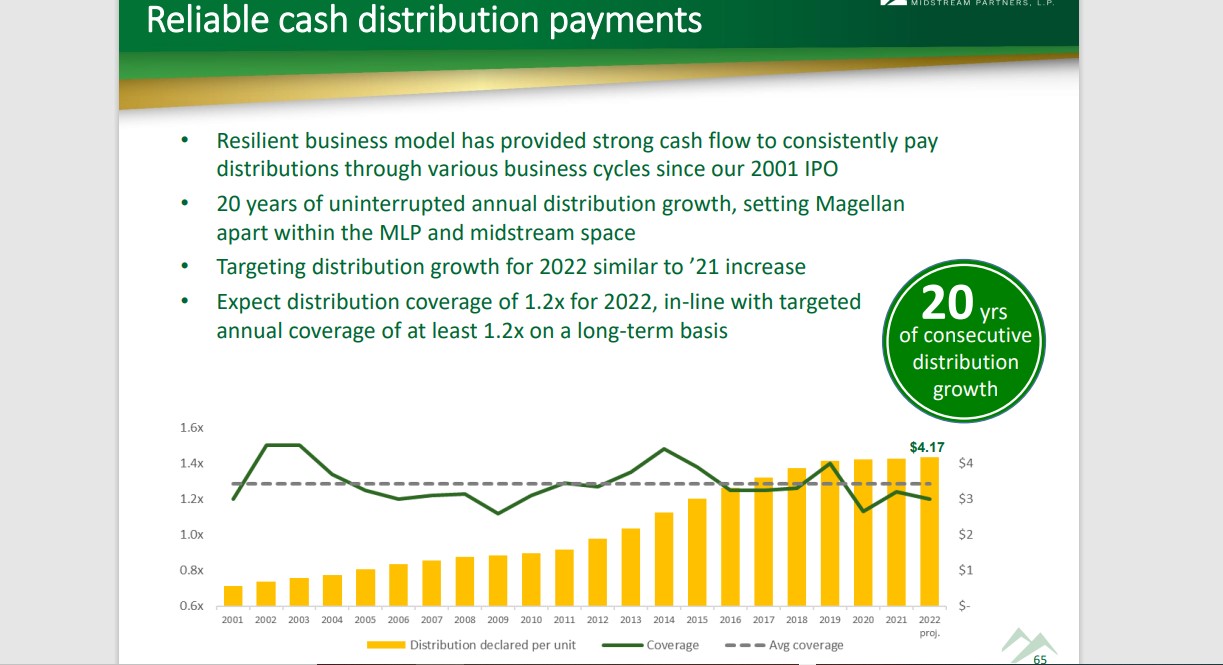

MMP has a long history of steady distributions:

Source: Investor Presentation

In early May, MMP reported (5/5/22) financial results for the first quarter of fiscal 2022. Distributable cash flow fell -4% over the prior year’s quarter, mostly due to losses from price hedges and some contract expirations in crude oil. Nevertheless, earnings-per-share of $1.10 exceeded analysts’ consensus by $0.04. MMP has proved resilient to the pandemic and currently has a distribution coverage ratio of 1.24.

Management expects total shipments of refined products to grow 4% this year and raised its guidance for annual distributable cash flow from $1.075 billion to $1.09 billion.

Click here to download our most recent Sure Analysis report on MMP (preview of page 1 of 3 shown below):

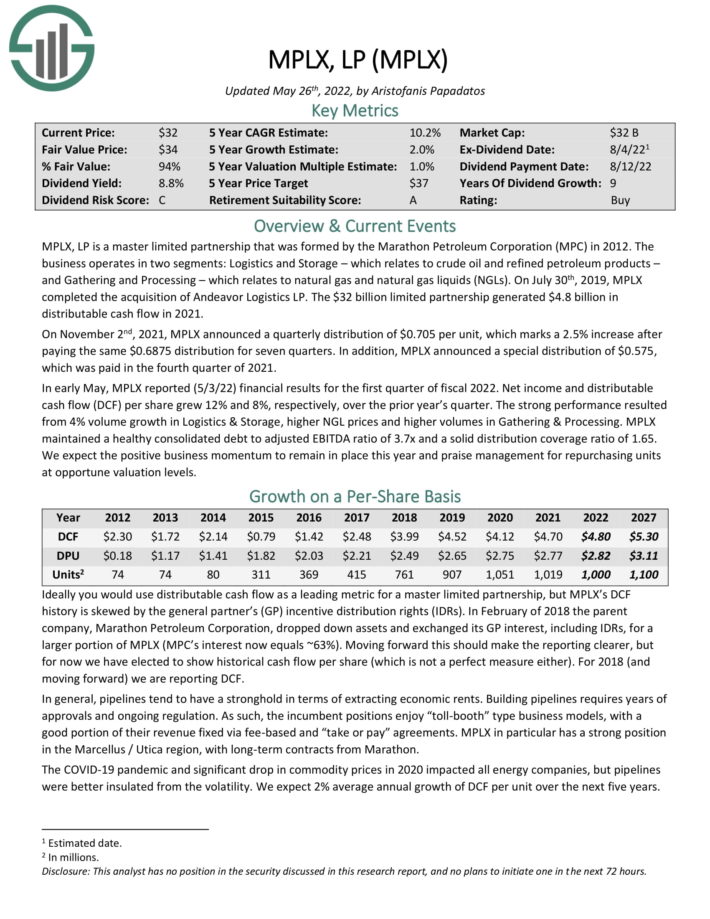

High Dividend Stock #1: MPLX LP (MPLX)

- Dividend Yield: 8.5%

- Dividend Risk Score: C

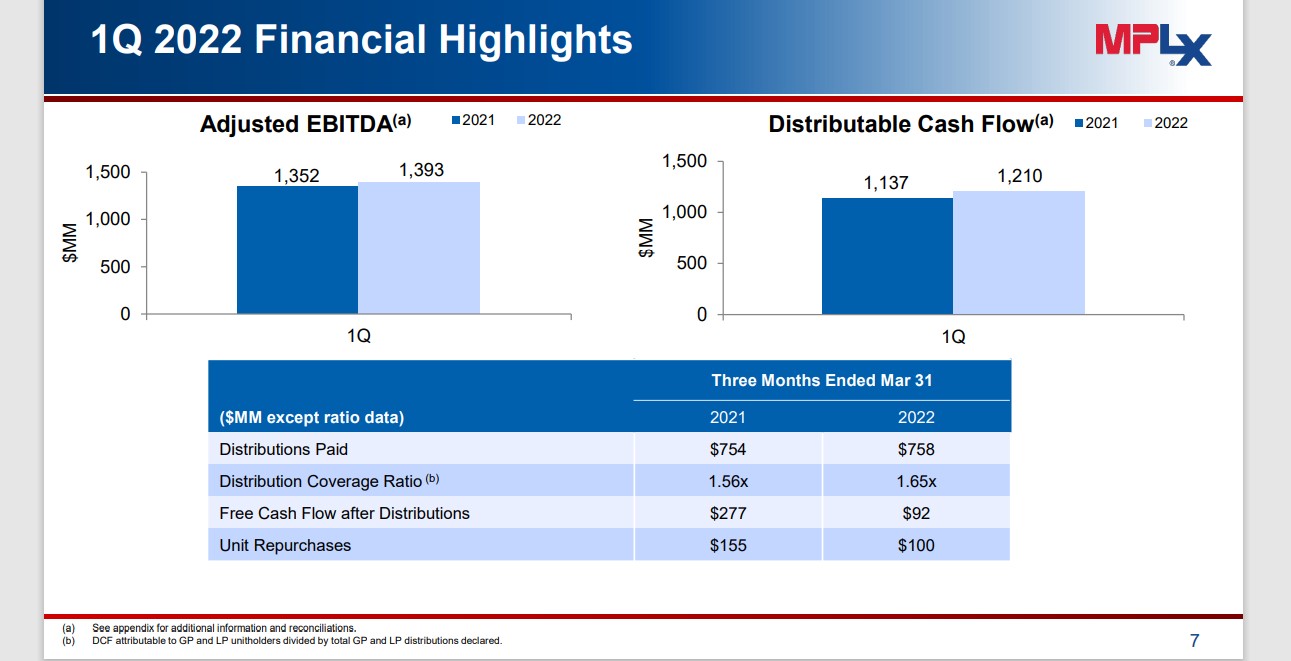

MPLX, LP is a Master Limited Partnership that was formed by the Marathon Petroleum Corporation (MPC) in 2012.

The business operates in two segments: Logistics and Storage – which relates to crude oil and refined petroleum products – and Gathering and Processing – which relates to natural gas and natural gas liquids (NGLs). In 2019, MPLX acquired Andeavor Logistics LP.

You can see highlights of the company’s first-quarter report in the image below:

Source: Investor Presentation

Net income and distributable cash flow (DCF) per share grew 12% and 8%, respectively, over the prior year’s quarter. The strong performance resulted from 4% volume growth in Logistics & Storage, higher NGL prices and higher volumes in Gathering & Processing.

MPLX maintained a healthy consolidated debt to adjusted EBITDA ratio of 3.7x and a solid distribution coverage ratio of 1.65.

Click here to download our most recent Sure Analysis report on MPLX (preview of page 1 of 3 shown below):

The High Dividend 50

You can see analysis on the 50 highest-yielding stocks below, excluding international securities, royalty trusts, REITs, and MLPs.

The High Dividend 50 are listed in order of their dividend yields as of March 14th, 2022. The newest Sure Analysis Research Database report for each security is included as well.

- Artisan Partners Asset Management (APAM) | [See newest Sure Analysis report]

- Lumen Technologies (LUMN) | [See newest Sure Analysis report]

- Antero Midstream (AM) | [See newest Sure Analysis report]

- Via Renewables (VIA) | [See newest Sure Analysis report]

- Vector Group (VGR) | [See newest Sure Analysis report]

- B&G Foods (BGS) | [See newest Sure Analysis report]

- Altria Group (MO) | [See newest Sure Analysis report]

- New York Community Bancorp (NYCB) | [See newest Sure Analysis report]

- ONEOK Inc. (OKE) | [See newest Sure Analysis report]

- Southern Copper Corporation (SCCO) | [See newest Sure Analysis report]

- Universal Corp. (UVV) | [See newest Sure Analysis report]

- Western Union (WU) | [See newest Sure Analysis report]

- Northwest Bancshares (NWBI) | [See newest Sure Analysis report]

- Philip Morris International (PM) | [See newest Sure Analysis report]

- Blackstone Group (BX) | [See newest Sure Analysis report]

- Xerox Holdings (XRX) | [See newest Sure Analysis report]

- International Business Machines (IBM) | [See newest Sure Analysis report]

- Foot Locker (FL) | [See newest Sure Analysis report]

- Gilead Sciences (GILD) | [See newest Sure Analysis report]

- M.D.C. Holdings (MDC) | [See newest Sure Analysis report]

- Viatris Inc. (VTRS) | [See newest Sure Analysis report]

- Verizon Communications (VZ) | [See newest Sure Analysis report]

- AT&T Inc. (T) | [See newest Sure Analysis report]

- Mercury General (MCY) | [See newest Sure Analysis report]

- Phillips 66 (PSX) | [See newest Sure Analysis report]

- Leggett & Platt (LEG) | [See newest Sure Analysis report]

- Pinnacle West Capital (PNW) | [See newest Sure Analysis report]

- Dow Inc. (DOW) | [See newest Sure Analysis report]

- PetMed Express (PETS) | [See newest Sure Analysis report]

- Cracker Barrel Old Country Store (CBRL) | [See newest Sure Analysis report]

- Prudential Financial (PRU) | [See newest Sure Analysis report]

- Unum Group (UNM) | [See newest Sure Analysis report]

- International Paper (IP) | [See newest Sure Analysis report]

- Edison International (EIX) | [See newest Sure Analysis report]

- Valero Energy (VLO) | [See newest Sure Analysis report]

- Franklin Resources (BEN) | [See newest Sure Analysis report]

- Gap, Inc. (GPS) | [See newest Sure Analysis report]

- Newell Brands (NWL) | [See newest Sure Analysis report]

- ExxonMobil Corporation (XOM) | [See newest Sure Analysis report]

- OGE Energy (OGE) | [See newest Sure Analysis report]

- Kraft-Heinz (KHC) | [See newest Sure Analysis report]

- H&R Block (HRB) | [See newest Sure Analysis report]

- Weyco Group (WEYS) | [See newest Sure Analysis report]

- Kontoor Brands (KTB) | [See newest Sure Analysis report]

- 3M Company (MMM) | [See newest Sure Analysis report]

- TrustCo Bank Corp. (TRST) | [See newest Sure Analysis report]

- Huntington Bancshares Inc. (HBAN) | [See newest Sure Analysis report]

- Spire Inc. (SR) | [See newest Sure Analysis report]

- United Bankshares Inc. (UBSI) | [See newest Sure Analysis report]

- Washington Trust Bancorp (WASH) | [See newest Sure Analysis report]

Final Thoughts

The 7 high dividend stocks analyzed above all have dividend yields of 5% or higher. And importantly, these securities generally have better risk profiles than the average high-yield security.

That said, a dividend is never guaranteed, and high dividend stocks are potentially at risk of dividend reductions or suspensions if a recession occurs in the near future.

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

Additionally, the following Sure Dividend databases contain the most reliable dividend stocks in our investment universe:

You can download the free spreadsheet below for more high-yield investment ideas.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].