- Nonfarm payrolls gradual to the smallest achieve since Dec 2020

- Greenback opens Monday with unfavorable hole on US election ballot

- What is going to Fed officers resolve simply after the election?

- RBA will get the ball rolling tonight; anticipated to face pat

Greenback Brushes Off Very Weak Nonfarm Payrolls

The completed Friday’s session up in opposition to most of its main friends, regardless of nonfarm payrolls slowing to 12k final month, the smallest achieve since December 2020.

Regardless of the surprisingly low quantity, the market disregarded the report, contemplating it an outlier reasonably than portray a transparent image of the US labor market and the broader well being of the financial system. Certainly, job development virtually stalled in October as a consequence of strikes by aerospace manufacturing unit staff and as hurricanes shortened the gathering interval for payrolls.

The response fee dropped as nicely to 47.4%, which is the bottom since January 1991 and nicely beneath the 69.2% common for October within the final 5 years.

Ballot Reveals Harris Taking a Lead in Iowa; Greenback Pulls Again

Having mentioned all that although, the dollar was unable to carry onto Friday’s positive factors, opening at this time’s session with a unfavorable hole as, in response to a US election ballot launched on Saturday, US Democratic presidential candidate Kamala Harris has taken a lead of three share factors in Iowa, a state that Trump simply received in 2016 and 2020 and had a 4-point lead only a few months in the past in September.

Trump has pledged to chop taxes and impose import tariffs, particularly on Chinese language items, insurance policies which might be seen as inflationary. Subsequently, every time his probabilities of returning to the Oval Workplace have been rising, the US greenback strengthened as larger inflation might imply slower fee reductions by the Fed. Maybe that is why the greenback reacted negatively to the ballot displaying that Trump is shedding Iowa.

This additionally corroborates the notion {that a} potential Harris win will lead to a weaker greenback, regardless of Harris being thought of the present administration’s continuity candidate, as her insurance policies will not be seen to be as inflationary as Trump’s.

Will the Election Consequence Influence Fed Pondering?

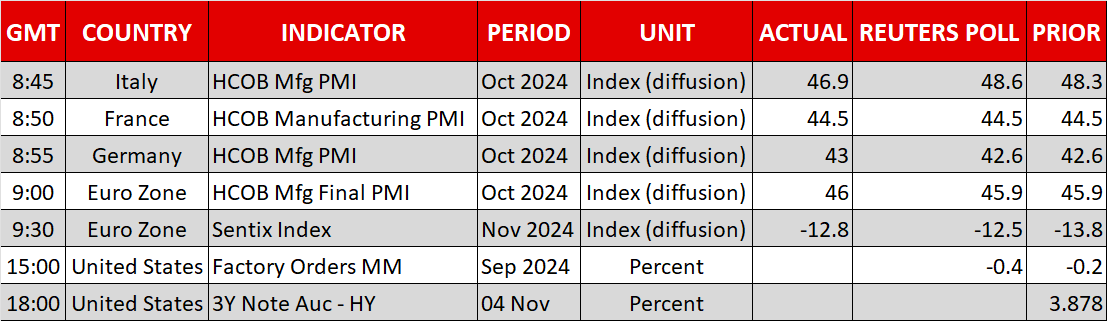

How a brand new president will influence the Fed’s pondering will begin being revealed on Thursday, as simply two days after the US elections, the Fed will resolve on rates of interest. The Committee is broadly anticipated to chop rates of interest by 25bps, however there was a good probability for a pause in December.

Forward of the US jobs information, that chance was 30%. Nevertheless, after the slowdown in nonfarm payrolls and after the weekend ballot displaying Trump is shedding Iowa, that probability dropped to round 17%. Ought to Fed officers certainly seem extra cautious on future fee reductions after a possible Trump win, Treasury yields might rise additional, and the US greenback might get pleasure from positive factors.

RBA Might Stay on Maintain for a Whereas Longer

Nonetheless, for now, central financial institution fans might flip their consideration to the RBA coverage determination due out tonight. Australian policymakers haven’t hit the speed reduce button but, noting at their September assembly that underlying inflation stays too excessive.

With inflation expectations additionally remaining elevated, it’s unlikely for this Financial institution to chop charges this time. Buyers will not be anticipating a reduce in December both, assigning solely a 20% probability for such a transfer.

Thus, if their view is confirmed, the might immediately achieve some floor, however its newest downtrend is probably not reversed till merchants turn out to be satisfied that China will proceed with significant measures to shore up its financial system. China’s Nationwide Folks’s Congress (NPC) standing committee meets this week, and it will likely be fascinating to see whether or not extra particulars on stimulus can be revealed.