Este artículo también está disponible en español.

Because of a bullish prediction by analyst EGRAG Crypto, XRP is now inflicting ripples within the crypto market once more. He has not too long ago accomplished an evaluation that reveals the token is approaching a vital juncture. Within the quick time period, costs might improve greater than $1.50 if it might probably surpass the Real Wake-Up Line (GWUL).

Associated Studying

Merchants take note of the numerous resistance ranges of XRP because it shows the value sample of the cryptocurrency. By the primary of November in 2024, CoinCodex anticipates a 19.57% acquire. This means {that a} important variety of market gamers consider the asset will improve in worth.

Resistance At The Real Wake-Up Line

EGRAG not too long ago launched the GWUL following XRP’s profitable passage of the Last Wake-Up Line, one other key barrier. Since its formation following XRP’s excessive of $1.96 in April 2021, this new line has proved to be a formidable resistance.

The analyst theorizes that XRP is now on the fringe of breaking this stage of resistance, that means there might be a powerful shift in market temper. Maybe the token would begin rallying in direction of $1.50 if it might shut above the GWUL and handle to remain above after having breached above it. Mid-term projections are much more optimistic, with potential targets set between $5.50 and $7.50.

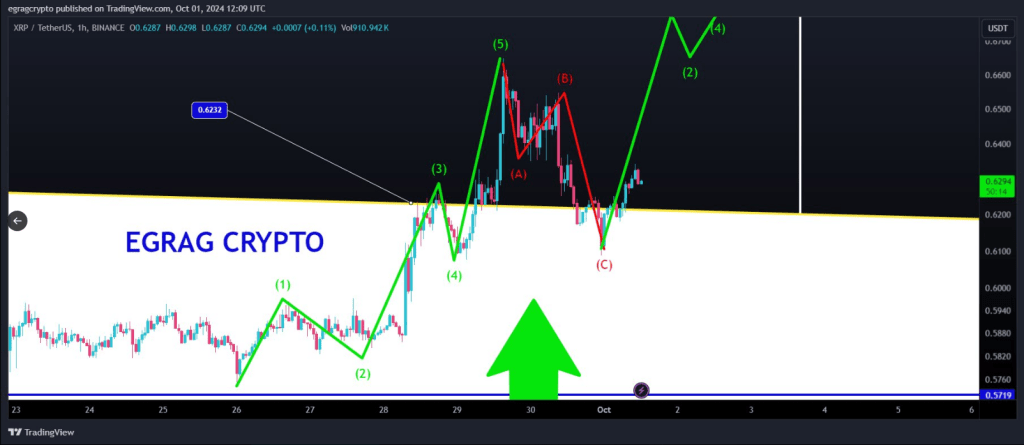

#XRP Real Wake-Up Line (Micro Strikes – Decrease Time Body) 🚨🚨🚨🚨🚨🚨🚨

🔍 A better have a look at the borders of the GWUL (Real Wake-Up Line) reveals an intense battle ⚔️ between the #Bulls 🐂 and #Bears 🐻. The motion is heating up, however guess what? The wave rely is on our aspect!… https://t.co/RJoVyM8RiL pic.twitter.com/QcYFFQn0vl

— EGRAG CRYPTO (@egragcrypto) October 1, 2024

EGRAG emphasizes that it’s inadequate to easily barrel previous the GWUL; XRP should keep its place above this line for no less than three days. This affirmation is crucial for the institution of a positive pattern. For the time being, XRP is buying and selling at roughly $0.58, which is why the following few days are so vital for its worth motion.

Patterns Counsel A Battle Between Bears And Bulls

On EGRAG’s chart, the GWUL and a yellow triangle point out the buying and selling situations’ higher restrict, with the Atlas Line supporting it. Throughout the bigger yellow triangle, a smaller white triangle has additionally emerged, illustrating the continued market tug-of-war between bulls and bears.

The stakes are excessive as XRP approaches the convergence level of those triangles. If traders are in a position to elevate XRP above this triangle, it might set off a considerable bullish wave, thereby verifying the breach of the GWUL.

Reaching the $1.50 threshold is especially important, as it will conclude Wave 1 of a extra in depth Elliott Wave sample, in keeping with EGRAG. Within the occasion that XRP surpasses this threshold, a corrective Wave 2 might happen, leading to a decline to roughly $0.75 earlier than a extra substantive rally. This rally might in the end end result within the bold goal of $7.50.

Associated Studying

Monitoring Help Ranges

Though the outlook remains to be optimistic, there’s a caveat in that XRP has to stay buying and selling above its key assist at $0.62. XRP is buying and selling just under this vital stage of assist now, so there may be some concern about how lengthy it’d maintain its bull run.

Markets are cautious whereas awaiting occasions. The remainder of the week will present if XRP has promise. If it stays over $0.62, the token might spark a breakout.

Featured picture from SETI Institute, chart from TradingView