- Charge cuts are on the horizon—uncover which sectors are poised to profit.

- Defensive shares may thrive as decrease rates of interest enhance profitability.

- Discover high picks for a lower-rate surroundings utilizing InvestingPro’s inventory screener.

- Not but a subscriber? Unlock entry to InvestingPro now for below $9 a month!

The ‘s first fee minimize of the approaching coverage easing cycle is imminent. Nevertheless, the massive query persists: will it’s 25 or 50 bps?

With easing and the labor market slowing, consideration has began to shift from combating inflation to stimulating financial progress.

Whether or not the Fed opts for a 25 or 50 foundation level minimize, decrease charges are on the horizon. For traders, this prompts a vital query: is it time to rebalance your portfolio?

In mild of that, let’s take a look at some sectors and shares that may do nicely in a decrease rate of interest surroundings, particularly those who analysts consider are undervalued.

Which Sectors Stand to Profit the Most?

Traditionally, defensive sectors – similar to utilities The Utilities (NYSE:), healthcare (NYSE:), and industrials – are inclined to thrive when charges fall. Decrease borrowing prices can scale back debt burdens and improve profitability, particularly for corporations that outperform market expectations.

This enhance in earnings typically interprets into larger inventory costs, rewarding traders. Moreover, as rates of interest decline, bond yields drop, making dividend-paying corporations extra engaging, significantly these with yields larger than authorities bonds.

Charge cuts can even present reduction for closely indebted mid- and small-cap corporations. Nevertheless, given the heightened volatility and ongoing financial uncertainty, specializing in well-established corporations with market caps above $5 billion could provide extra stability on this part.

Discovering the High Shares

Now that we’ve recognized the important thing sectors, we are able to leverage InvestingPro’s inventory screener to pinpoint shares more likely to profit from these fee cuts.

By making use of filters similar to Truthful Worth, goal worth progress, and stable monetary well being, we slender down essentially the most promising alternatives.

Listed below are the screening parameters:

- Truthful Worth enhance larger than 25%

- Analysts’ goal worth enhance larger than 25%

- Sectors: vitality, healthcare, fundamental shopper items, industrials, and utilities

- Monetary well being rating of three out of 5 or larger

- Market capitalization exceeding $5 billion

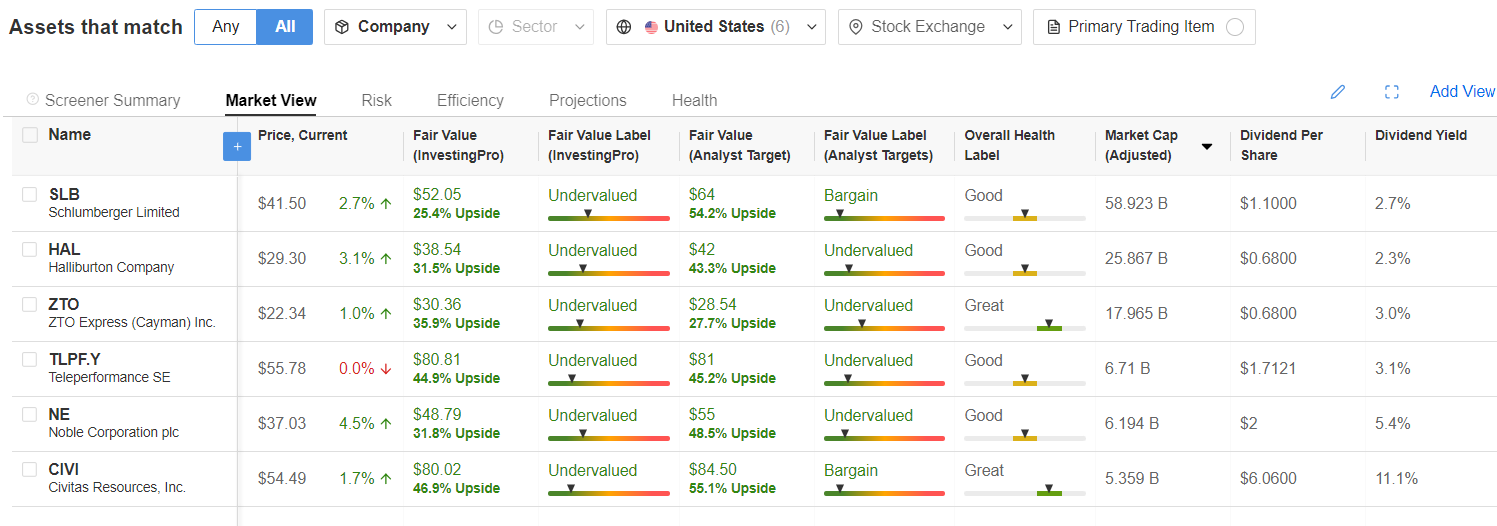

After operating the display screen, six shares emerged as sturdy candidates, primarily based on their progress potential and analysts’ targets over the following 12 months:

- Schlumberger NV (NYSE:): Present worth $41.50, Truthful Worth upside 25.4%, analysts’ goal up 54.2%

- Halliburton Firm (NYSE:): Present worth $29.30, Truthful Worth upside 31.5%, analysts’ goal up 43.3%

- ZTO Categorical (Cayman) Inc (NYSE:): Present worth $22.34, Truthful Worth upside 35.9%, analysts’ goal up 27.7%

- Teleperformance SE (EPA:): Present worth $55.78, Truthful Worth upside 44.9%, analysts’ goal up 45.2%

- Noble Corp (CSE:): Present worth $37.03, Truthful Worth upside 31.8%, analysts’ goal up 48.5%

- Civitas Sources Inc (NYSE:): Present worth $54.49, Truthful Worth upside 46.9%, analysts’ goal up 55.1%

InvestingPro subscribers can recreate this display screen utilizing the parameters above, or customise their very own to match particular funding targets.

You will get entry to InvestingPro at this time. Subscribe now with an unique low cost and unlock entry to a number of market-beating options, together with:

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- AI ProPicks: AI-selected inventory winners with confirmed observe file.

- Inventory Screener: Seek for the very best shares primarily based on a whole lot of chosen filters, and standards.

- High Concepts: See what shares billionaire traders similar to Warren Buffett, Michael Burry, and George Soros are shopping for.

***

Disclaimer: This text is written for informational functions solely. It isn’t meant to encourage the acquisition of belongings in any method, nor does it represent a solicitation, provide, suggestion or suggestion to speculate. I want to remind you that every one belongings are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related threat is on the investor’s personal threat. We additionally don’t present any funding advisory companies. We are going to by no means contact you to supply funding or advisory companies.