Klaus Vedfelt/DigitalVision via Getty Images

Dear Nordstern Capital Partners and Friends:

Come gather ’round people Wherever you roam

And admit that the waters Around you have grown…

…The slow one now will later be fast As the present now will later be past The order is rapidly fadin’.

And the first one now will later be last For the times they are a-changin’.

– Bob Dylan

Change

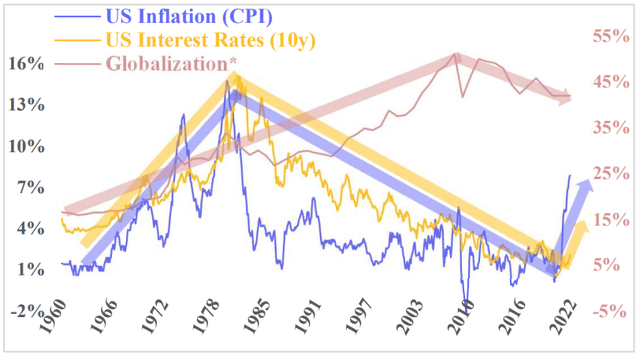

Raw data from TheGlobalEconomy.com; *Globalization: Merchandise Trade as %World-GDP

We saw 40 years of deflation and declining interest rates. In addition, the last 15 years saw a tremendous increase in the money supply and government debt. We enjoyed an addictive cocktail of massive economic stimulus. Inflationary pressures didn’t materialize, partly due to the rise of China and increased global trade. Outsourcing to Asia kept prices low.

The entire picture is about to change. China’s growth is slowing, wages are rising, nationalistic tendencies are resurfacing, global trade is declining. The inflation genie is out of the bottle, interest rates are going to rise, and the FED announced to transition from quantitative easing to deleveraging. All of this means pain for the US economy.

This massive paradigm shift was well underway, then Russia started a war. It surely doesn’t help to ease the troubles.

Constant

Valuation is important. If we pay 50 cents for something that produces and pays out $1 tomorrow, that is a bargain. This is true regardless of a recession. During the past few years, financial markets were abnormal and exuberant, but valuation mistakes might prove costly when the ‘everything-bubble’ bursts. However, Nordstern Capital owns companies at low prices compared to their near-term cash flow generation and, I believe, will emerge as a winner in the new era of high inflation (and potential recession).

Inflation

“The cure for high prices is high profits”

– Johannes Arnold

It is common lore that ‘the cure for high prices is high prices’…the idea behind this phrase is that higher prices attract more competition. Increased competition (on price) will in turn lead to lower prices. The issue with this argument is that what attracts more competition is not higher prices per se, but higher profits.

The root cause of rising prices is an imbalance of supply and demand. Our problem is that the US does not have enough supply for its demand. The scarce supply goes to the highest bidder (theoretically, the one who needs it most). The capitalist remedy is that people want to reap those profits and will invest (time and money) into production of additional supply. Denying ‘windfall profits’ to the beneficiaries of high prices, e.g. by putting additional tax levies on the oil industry as it is proposed by certain law makers, exacerbates the problem. Who wants to invest if they can’t reap the spoils?

Prices will climb and shortages will worsen until inflation beneficiaries are rewarded by profits high enough to attract additional investment. As long as we are a capitalist society, inflation beneficiaries will get their outsized returns, either now or over time.

That is, unless demand collapses. The FED’s ‘money printing’ increased demand for years, which might be about to change. The FED recently u-turned and intends to fight price increases through rate increases and ‘quantitative tightening’, both measures are essentially intended to suppress demand. However, this recipe might lead the US into a recession.

Investing

The ideal investment is priced cheaply in relation to the present value of its future cashflows, and the future cashflows should be benefitting from inflation and should be antifragile in a recession.

Top Nordstern Capital Investments

Embracer Group (OTCPK:THQQF, stock price: – 18% in 1Q 2022)

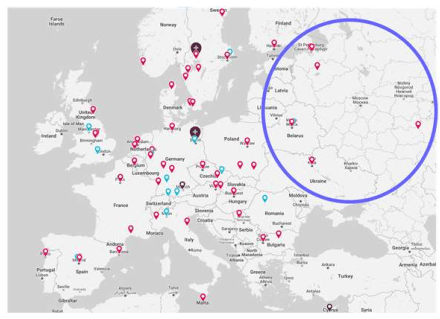

Embracer Group is our largest holding and its stock price declined 18% last quarter. The video-gaming industry is still unloved by ‘the market’ post-lockdown. Embracer’s footprint in the European conflict region has raised concerns: 1,000 employees in Russia, 250 in Ukraine, and 250 in Belarus, together about 12% of Embracer’s total headcount.

The Russian war is a tragedy. Embracer Group is spending $5m for humanitarian aid and is assisting with relocation and other forms of support for employees and their families. The group’s revenues are affected by the war by approximately 1% only and all publishing and intellectual properties are owned and managed outside the region.1 Most of Embracer’s war-struck employees work at the subsidiary Saber Interactive. Nonetheless, Saber’s release of the major title Evil Dead: The Game in three weeks (on Friday, May 13) is not only on track but also sports promising pre-sales numbers2.

Video games are a comparably low-cost form of entertainment, and the industry is traditionally resilient in economic downturns3. Lower economic activity and more time spent at home might in fact increase demand for video gaming. Inflation, on the other hand, is currently driving up wages in the sector. However, since price tends to be only a subordinate criterion for most consumers of a video game, I believe that long-term margins in the video game business will prove not only recession resilient but also inflation resistant.

Embracer Group expects to generate $1.3bn in EBIT two years out. This management forecast implies that Embracer Group will grow profits way over 50% per year and that the enterprise would cost less than 6- times EBIT at the current share price.

Embracer Group, in my view, is a durable high-growth high-quality cash-generator and is currently available for the same price that a low-quality business in decline could demand. Embracer is an obvious bargain, and the price drop was exploited by executive Matthew Karch, who oversees the Russian and Ukrainian employees. He bought Embracer shares worth more than $7m for his own account in March4.

Imperial Metals (OTCPK:IPMLF, stock price: + 19% in 1Q 2022)

Gold and copper prices both increased during the quarter as inflation ravages. Gold is regaining interest as the store of value in uncertain times.

Mount Polley operations resuming (www.mountpolley.com)

The Mount Polley mine is reopening as I am writing this letter. A recent initiation report on Imperial Metals5 estimates about CAD$115m free cash flow from this mine in 2023 (assuming $4 per pound copper and $1,850 per ounce gold6). Based on this estimate Imperial Metals is currently priced at less than 5-times 2023 free cash flow of the Mount Polley mine alone.

I expected some update on early mining of the high-grade pods at Red Chris during Newcrest’s earnings release in March. Unfortunately, nothing of this sort was published. Imperial Metal’s CEO Brian Kynoch believes however, that early mining of the high-grade pods remains highly likely with an unchanged timeline (starting in 2023). Those pods at current commodity prices should bring in more than $1bn revenue (more than twice the company’s market cap) for Imperial Metals before 2024.

I believe that Imperial Metals over the next couple years will become a high-growth high-margin cash- machine and is available today for a small fraction of its future cash flows.

Evolution (OTCPK:EVVTY, stock price: – 25% in 1Q 2022)

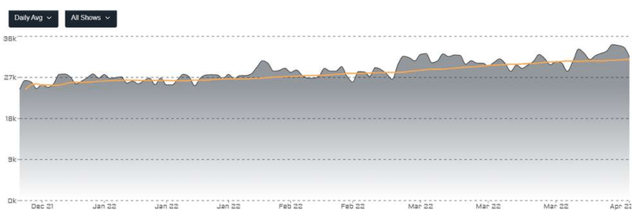

Player numbers, successful new game releases, and new operator contracts in existing as well as in new geographies indicate that Evolution AB had another strong quarter in 1Q2022, yet the share price declined.

Fears persist that Evolution’s business might suffer from a complaint about the company’s gray market operations that a law firm has filed with The Division of Gaming Enforcement in New Jersey last year. The state’s regulatory agency has not yet responded in this matter. Nonetheless, CEO Martin Carlesund declared the allegation report ‘falsified’ in the company’s

Evotracker.live indicates significant increase in player numbers

February earnings call7. In addition and undeterred by the above allegations, the leading US online casino and sports betting operator FanDuel signed a contract to make Evolution the sole provider of live dealer table games not only for New Jersey but for the entire United States8.

Evolution is the dominant B2B service provider, essentially ‘the only game in town’ for online live casino operators and enjoys a great deal of pricing power. Hence, inflation should not be a concern. In addition, online gambling is also historically resilient in economic downturns9. Nordstern Capital expects continued hyper-growth at hyper-margins for an extended period of years. In combination with a free cash flow payout ratio of more than 50% this warrants an earnings-multiple significantly higher than the 25-times implied by the current share price. The company continued to buy back its undervalued shares throughout the quarter.

StoneCo Ltd (STNE, stock price: – 31% in 1Q 2022)

StoneCo Ltd (Stone) shares suffered a steep price decline in the quarter, extending last year’s fall. However, while 2021 was a disaster for Stone, the March earnings call indicated a strong recovery for the business.

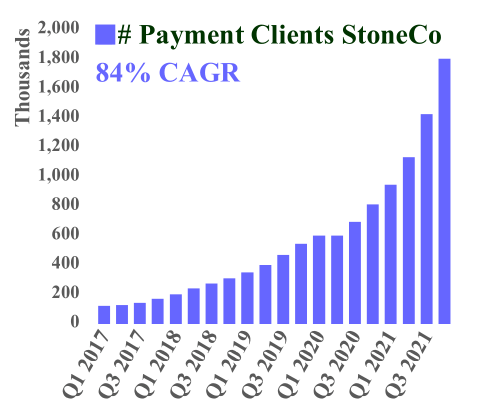

Management expects Stone to improve margins and at the same time to continue hypergrowth throughout 202210. The business is profitable and currently trades at around 4-times EBITDA. Such a low multiple implies that ‘the market’ expects the business to significantly decline. Either management or the market must be wrong.

Stone has grown clients for its payment services every quarter over the past five years from 83,000 to 1.8 million. Throughout the past year Stone made multiple acquisitions, donated money to causes related to the pandemic, repurchased shares, massively increased headcount, and bought shares in other listed companies. This does not sound like a business that is headed for bankruptcy. Stone is going to be a winner.

Arch Resources (ARCH, stock price: + 51% in 1Q 2022)

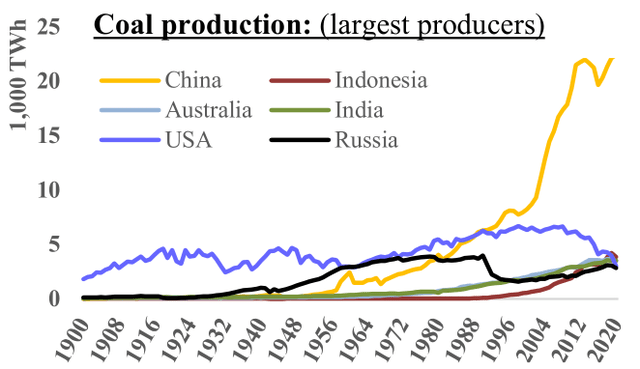

Arch Resources is a low-cost high-quality metallurgical ((met)) coal producer for the global steel industry. Coal might be among the most hated products in the world, due to its reputation for being a dirty climate killer. However, steelmaking requires coal, solar panels and wind turbines require steel. Our modern society relies on steel and modernizing countries such as China, India, Indonesia therefore rely on coal.

Data Source: BP Statistical Review of World Energy

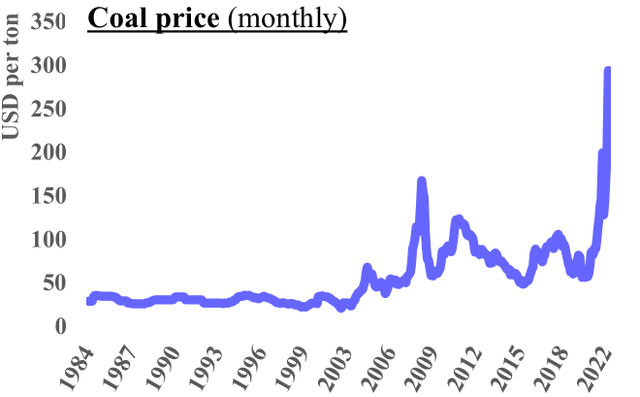

Data Source: World Bank

Coal is an essential commodity, yet the industry was ‘left for dead’ by Wall Street, ESG-driven investment flows, politics, the public, and everyone else. This will probably continue to pose a wide moat for potential new entrants. Years of constrained supply and underinvestment now meet with global supply-chain issues, increased demand post-lockdowns, and inflationary pressures. In addition, the sanctions against Russia are crippling one of the big six producers, China is shifting away from Australia11and Germany’s governing Green Party suddenly considers more coal12. Demand up, supply down → price: moon.

Value investing veteran Bob Robotti argues in “revenge of the old economy” that US producers of physical goods are benefitting from sustained inflation. Inflation driven energy costs in China and Europe increase much faster than in the US. Hence, US energy-intensive industries such as steelmaking are at a relative advantage.13 A healthy US steel industry will bode well for US met coal producers such as Arch Resources.

ARCH is not only an inflation beneficiary, but also a growth company. Its met coal production is guided to increase more than 20% this year. Leer South, a large brand-new modern coal mine will reach full capacity only later this year. ARCH wisely used its cash flow and the financial market neglect to reduce basic share count from 25 million in December 2016 to around 15 million as of December 2021.

ARCH trades at around $2.5bn enterprise value and is expected to deliver close to $1.5bn EBITDA in 2022 alone (assuming $200 per ton coal, whereas current prices are above $300).14 ARCH’s current tax rate is essentially zero.15 Management guided CAPEX at $150m for this year and announced to payout 50% of free cash as dividends, the remaining 50% might be used for share buybacks16. Thus, at less than 2-times EBITDA, an investment in ARCH today might result in a 25% cash payout and another 25% reduction in the share count this year (assuming such a large buyback would not increase the share price). Handsome.

The Nordstern Capital partnership can flourish thanks to our partners’ trust, which empowers us to ignore short-term stock price volatility and to focus on decision making for long-term investment success. I am convinced that the dedicated focus on the long-term cash flow prospects of our investments will result in better long-term returns.

Long-term oriented accredited investors who are not partners yet are encouraged to apply. Looking forward to hearing from all of you.

Sincerely,

Johannes Arnold, Nordstern Capital Investors LLC

Footnotes

1Update on the situation due to the war in Ukraine – Embracer

2Currently #1 pre-ordered game on Epic Store as well as Amazon’s PS5 and Xbox Series X stores

3https://www.nielsen.com/wp-content/uploads/sites/3/2019/04/valuegamer_final1.pdf

4Sök

5Argentis Capital: Initiating Coverage of Imperial Metals, 2022-04-07

6Current market prices are $4.70 per pound copper and $1,950 per ounce gold

7CEO’s comments in Evolution AB 2021 year-end report, February 9, 2022

8https://www.evolution.com/news/fanduel-group-and-evolution-extend-us-live-casino-partnership

9Gross Gaming Revenue (GRR) for the iGaming industry grew during the economic downturn 2007ff., according to H2GC

10StoneCo 4Q2022 earnings presentation, March 17, 2022

11https://www.power-technology.com/analysis/coal-supply-chain-china-australia-india-international-trade/

12https://www.bloomberg.com/news/articles/2022-02-28/germany-mulls-extending-coal-phaseout-to-wean-off-russian-gas

13Robert Robotti, Douglas Meehan, Michael van Biema “As Inflation Bites…”, BARRON’S, January 28, 2022

14BRiley Securities Research, March 8, 2022

15Arch Resources has $1.3bn net operating loss carryforwards as of December 2021

16Arch Resources 4Q2022 earnings report, February 15, 2022

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.