After a robust rally earlier this yr, the know-how sector stumbled as September kicked off, with many shares experiencing sharp corrections.

This pullback has left some buyers cautious, however it’s additionally created alternatives for these searching for worth in the long run.

Regardless of the latest volatility, a number of shares on this sector are nonetheless displaying exceptional potential. Analysts are overwhelmingly optimistic about these names, with most providing purchase scores and none marked as promote.

Within the sections beneath, we’ll discover these prime tech shares, analyzing why they proceed to face out even in a difficult market surroundings.

1. Dell Applied sciences

Dell Applied sciences Inc (NYSE:) has proven exceptional development over the previous yr, far outperforming the . The inventory is up roughly 39% this yr to date, outperforming the index’s achieve of 15.2%.

Dell’s success is underpinned by stable demand for its AI-optimized servers. Orders and shipments of those servers have grown steadily, and this momentum continued within the second quarter of this yr.

As well as, Dell’s cooled AI servers and strong storage and networking options present a stable basis for long-term development, implying that the momentum in its enterprise is more likely to be sustained within the coming years.

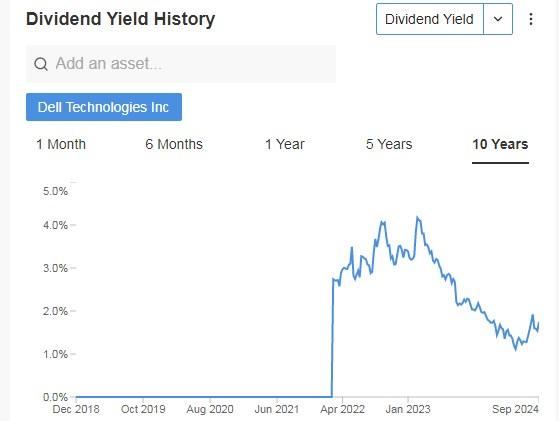

Its annual dividend yield is 1.75%.

Supply: InvestingPro

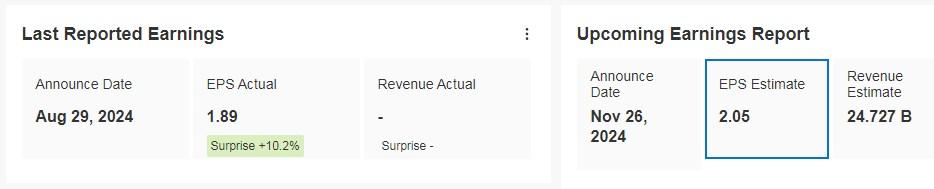

It can report its outcomes for the quarter on November 26. Dell had an 83% enhance in web revenue within the second quarter of its fiscal yr, reaching $846 million. Its web revenue additionally confirmed a 9.1% development.

Supply: InvestingPro

Past AI, Dell may even profit from a restoration in PC gross sales. By specializing in industrial PCs, high-end shopper fashions, and gaming units, Dell is well-positioned to bolster its earnings and improve shareholder worth.

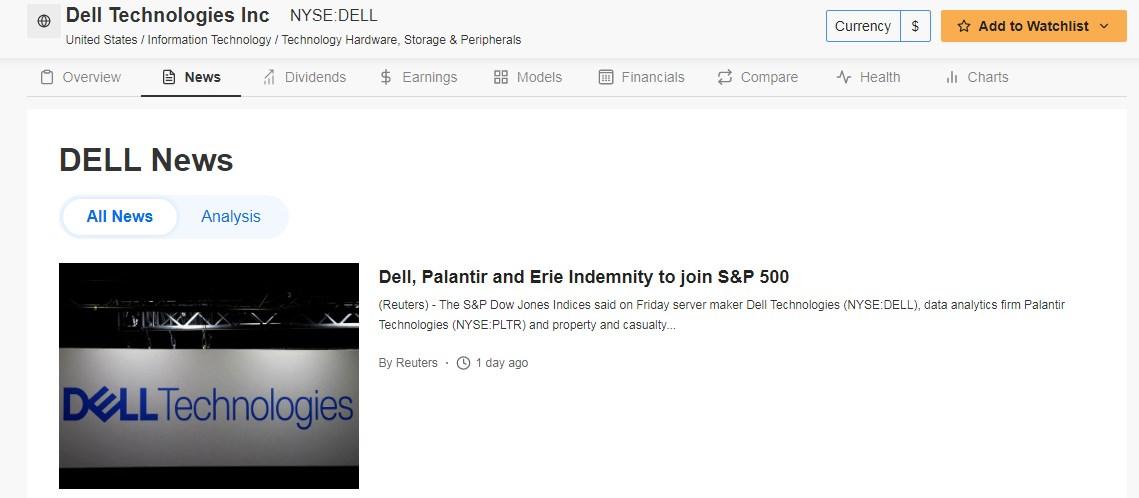

Dell (together with Palantir Applied sciences (NYSE:) and Erie Indemnity) will be part of the S&P 500 as a part of its newest quarterly weighting change, changing American Airways (NASDAQ:), Etsy (NASDAQ:) and Bio-Rad Laboratories Inc (NYSE:). The adjustments will take impact earlier than the opening bell on Sept. 23.

Supply: InvestingPro

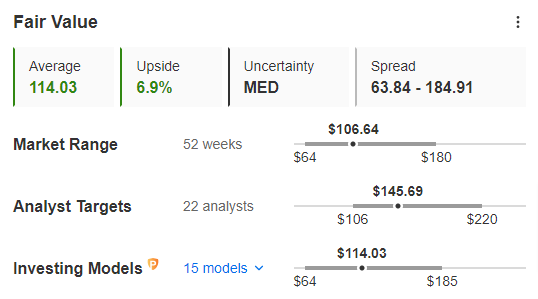

At the moment, it’s buying and selling at a reduction of 6.9%, as its worth goal on fundamentals could be at $114.

The market sees potential at $149.70.

Supply: InvestingPro

2. Sony

Sony (NYSE:) is a Japanese multinational firm based mostly in Tokyo (Japan) and one of many world’s main producers of shopper electronics: audio and video, computer systems, pictures, video video games, and cell telephones.

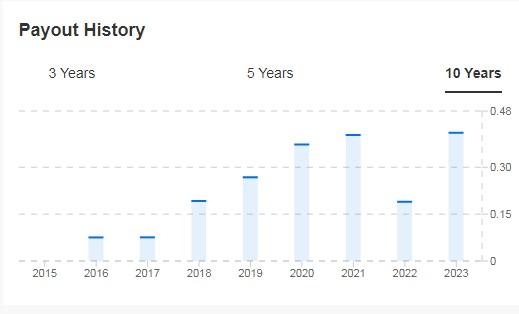

Its dividend yield is 0.46%.

Supply: InvestingPro

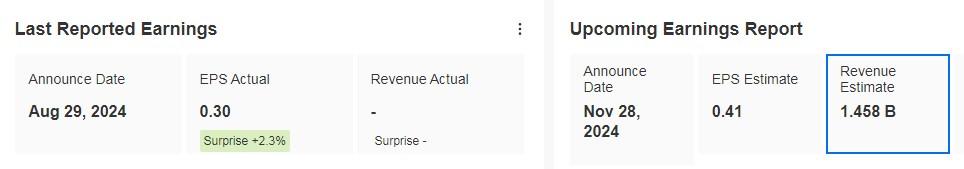

On November 8, we are going to know its revenue assertion. The anticipated enhance in revenue till its fiscal yr 2026 (the fiscal yr in Japan begins in April) could be 14%.

There have been robust rumors that Sony may launch a PS5 Professional, an improved mannequin of the present PS5. If true, it may enhance margins and enhance earnings to some extent, though it could depend upon the price of items offered construction.

Three causes would assist the rumor being true:

- Launching a Professional mannequin now, 5 years after the launch of the unique PS5, aligns with a pure product cycle, particularly since Sony launched the PS4 Professional three years after the PS4.

- Sony’s choice to take part within the Tokyo Recreation Present in 2024, after a five-year absence, means that the corporate could possibly be planning a big announcement.

- The introduction of rival consoles may push Sony to counter with an improved PS5 mannequin.

Supply: InvestingPro

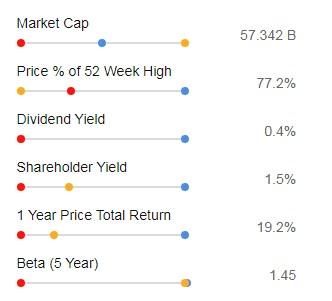

It options 22 scores, of which 20 are purchase, 2 are maintain and none are promote.

The market provides it a possible at $115.48.

Supply: InvestingPro

3. Marvell Know-how

Marvell Know-how (NASDAQ:) develops and produces semiconductors and associated know-how. Based in 1995.

Its dividend yield is 0.36%.

It can launch its outcomes for the quarter on November 28. It expects 135% earnings development within the three-year interval.

Supply: InvestingPro

Marvell Know-how is on the forefront of a shift within the world knowledge middle panorama, pushed by the speedy adoption of synthetic intelligence applied sciences and is uniquely positioned to profit from the rising demand for AI-driven knowledge facilities.

It additionally leads the electro-optics market with over 60% market share, which is attention-grabbing as this sector is anticipated to expertise explosive development of 150% by 2024 and 50% by 2025.

Its beta is 1.45, which implies that its shares transfer in the identical course because the market however with higher volatility and motion.

Supply: InvestingPro

The market sees potential for it at $92.16.

Supply: InvestingPro

***

Disclaimer: This text is written for informational functions solely. It’s not meant to encourage the acquisition of belongings in any approach, nor does it represent a solicitation, provide, advice or suggestion to speculate. I wish to remind you that every one belongings are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger is on the investor’s personal danger. We additionally don’t present any funding advisory providers. We’ll by no means contact you to supply funding or advisory providers.