As September unfolds, it is essential to notice that this month usually ranks as one of the vital difficult for equities traditionally.

One key ratio I am monitoring proper now’s the efficiency of know-how shares (NYSE:) relative to the , which has not too long ago climbed again to ranges seen through the dot-com bubble.

Why does this matter? Know-how shares make up over 30% of the S&P 500, and for the primary time in over 20 years, this ratio has hit the March 2000 highs, simply earlier than the tech crash.

Presently, the market is respecting these ranges, with know-how shares lagging and falling to new 52-week lows in comparison with the S&P 500.

Might Worth Shares Be the Subsequent to Shine?

Since June, the bullish market has been pushed by large-cap know-how shares, which led to a swift market enlargement and a shift in management. Might worth shares be the following to shine?

Certainly, the market’s enlargement has spurred momentum in worth shares. The Vanguard Worth Index Fund ETF (NYSE:), as an illustration, has reached new all-time highs this yr, with a +15.6% return (excluding a +2.29% dividend yield).

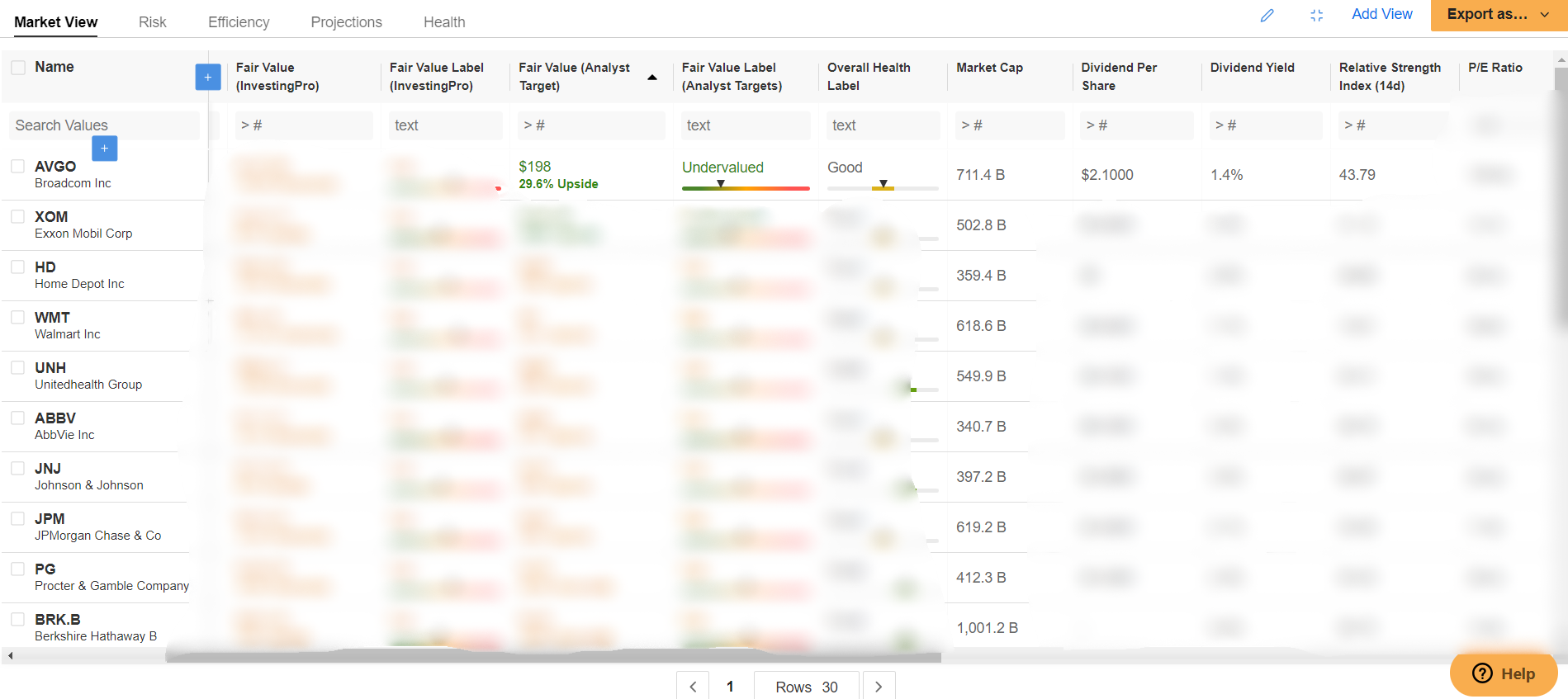

This Worth ETF focuses on large-cap shares, and its prime 10 holdings embody:

- Broadcom (NASDAQ:)

- Berkshire Hathaway (NYSE:)

- JPMorgan Chase & Co (NYSE:)

- Exxon Mobil Corp (NYSE:)

- UnitedHealth Group (NYSE:)

- Johnson & Johnson (NYSE:)

- Procter & Gamble Firm (NYSE:)

- House Depot (NYSE:)

- AbbVie (NYSE:)

- Walmart (NYSE:)

We’ve added the ten worth shares that might push this ETF to new highs to our Professional Watchlist.

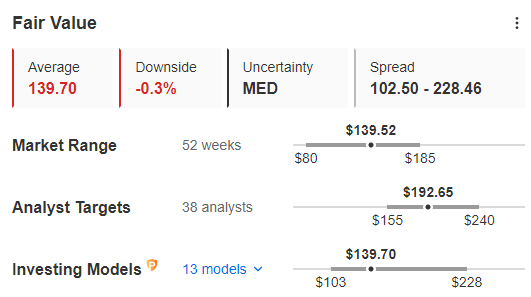

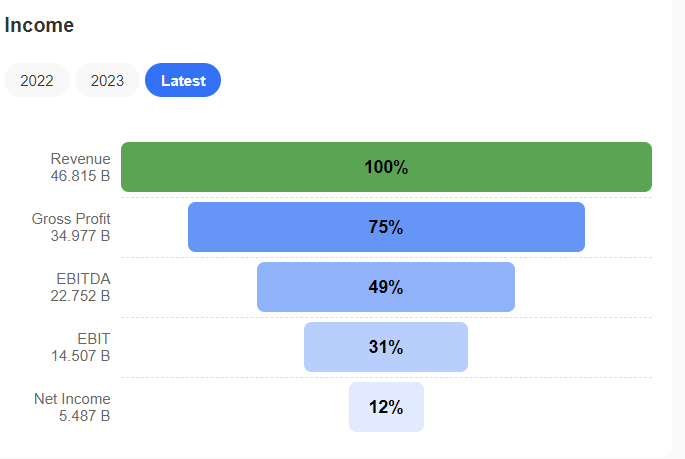

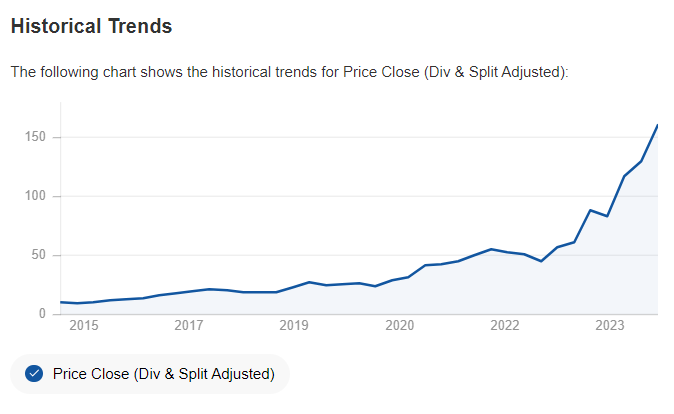

Analyzing these shares utilizing InvestingPro’s instruments, Broadcom stands out. Regardless of a 29.6% anticipated rebound, InvestingPro’s Honest Worth suggests the inventory is at present pretty valued.

Broadcom is nearing earlier highs, and whereas uncertainty stays short-term, its Well being Rating—an indicator of economic well being—displays a robust efficiency, incomes a 4 out of 5.

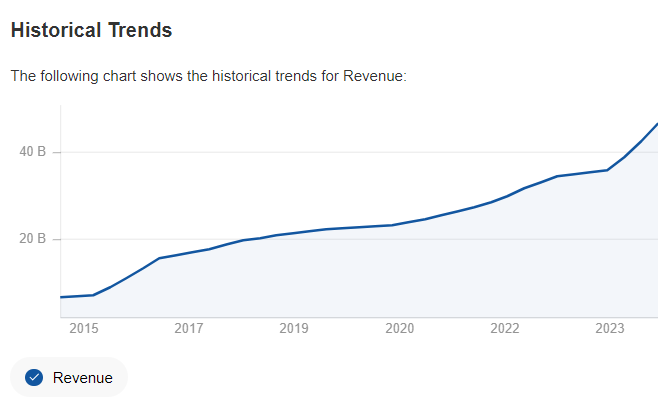

Analysts forecast a 43.4% gross sales progress for Broadcom this yr, outpacing opponents. This anticipated progress may sign elevated profitability and a better share worth, which is a constructive signal for buyers.

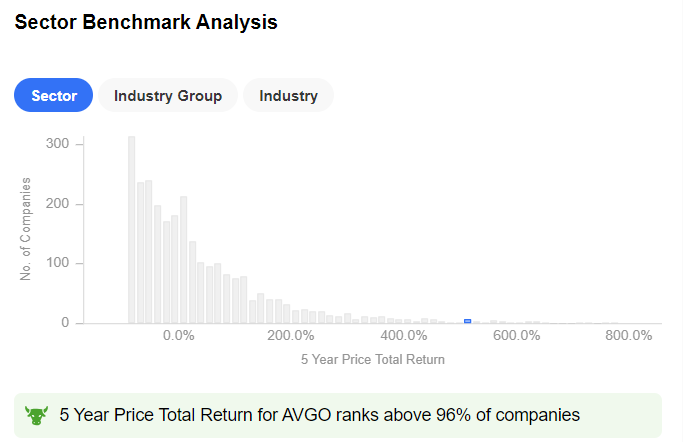

Furthermore, Broadcom has delivered a exceptional 511.1% return over the previous 5 years, outperforming its friends.

This long-term uptrend highlights efficient enterprise methods and strong shareholder worth, affirming the inventory’s constructive trajectory.

Backside Line

In abstract, September’s traditionally powerful market atmosphere highlights the renewed curiosity in know-how shares reaching previous highs.

As know-how yields to worth shares, the Worth ETF’s robust efficiency, notably with main corporations like Broadcom, suggests potential for continued positive aspects.

Buyers ought to look ahead to rising alternatives in worth shares as they may drive the following wave of market progress.

***

Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and unlock entry to a number of market-beating options, together with:

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- AI ProPicks: AI-selected inventory winners with confirmed monitor report.

- Superior Inventory Screener: Seek for the very best shares based mostly on tons of of chosen filters, and standards.

- Prime Concepts: See what shares billionaire buyers resembling Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or advice to speculate as such it’s not meant to incentivize the acquisition of belongings in any approach. I wish to remind you that any sort of asset, is evaluated from a number of views and is extremely dangerous and due to this fact, any funding resolution and the related danger stays with the investor.