takasuu

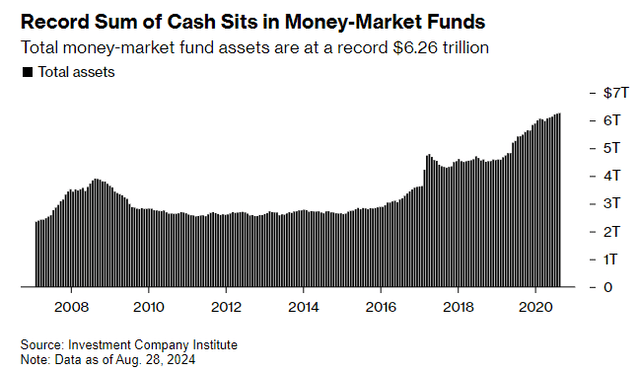

There may be now over $7T sitting in US cash market funds. That’s up from $5 trillion on the finish of the primary quarter 2023. At the moment, these cash market funds earn simply over 5% and traders are t-billing and chilling, because the decrease threat appeals to many traders fearful about frothy markets and rising charges.

Nevertheless, the height in charges is in and pretty quickly they are going to begin seeing that cash market yield bleed decrease. That’s the reason investing in high-quality intermediate-to-long-term company bonds is a compelling choice right here. Historically, they’ve carried out nicely when the Federal Reserve begins chopping charges.

ici.org

Listed here are 4 causes to think about transferring a few of your allocation in the direction of bonds:

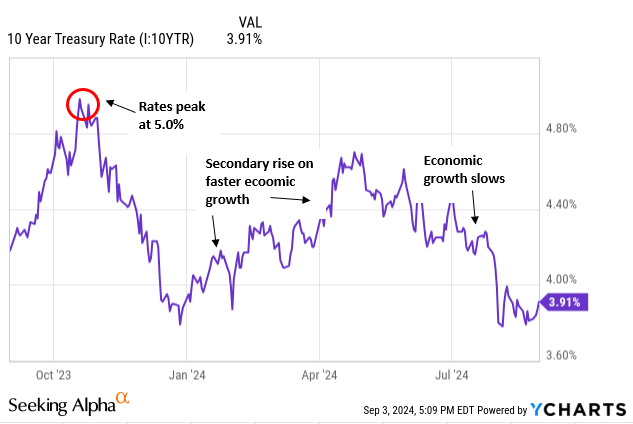

(1) Yields are rolling over and time is of the essence!

Bear in mind, beginning yields are a great indicator of your bond’s complete return over the time interval to maturity. The upper the beginning yield, the higher your return will probably be.

Rates of interest have doubtless already peaked and, since Powell introduced the Fed’s pivot from mountaineering charges, have steadily declined. They’re already down greater than 100 bps on the 10-year treasury since final October.

AGC, YCharts

Nevertheless, the yield said if you buy your cash market fund is NOT a great indicator of that funding return. That’s as a result of cash market charges should not a hard and fast coupon and might change day by day.

As of this writing, there are nearly 4 0.25% price cuts forecasted for the Fed Funds price for 2024 and 9 by the top of 2025. Cash market yields are slated to be lower drastically over the subsequent yr. Whether or not or not 9 cuts or fewer come by, it’s nearly sure that cash market charges will probably be lowered 12 months from now. They usually might be considerably decrease.

Buyers are being handed a golden alternative to LOCK IN these present yields and benefit from the dislocation within the bond markets. Whereas charges are decrease and spreads are tighter, traders, particularly risk-averse traders, will doubtless nonetheless profit from allocating a portion of their portfolios into high-quality longer-maturity, bonds.

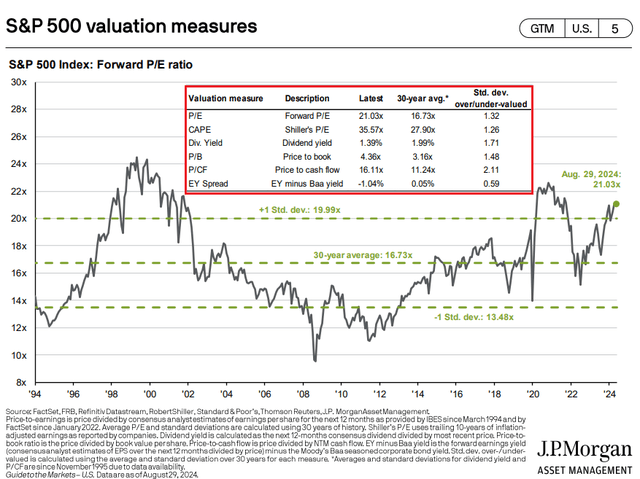

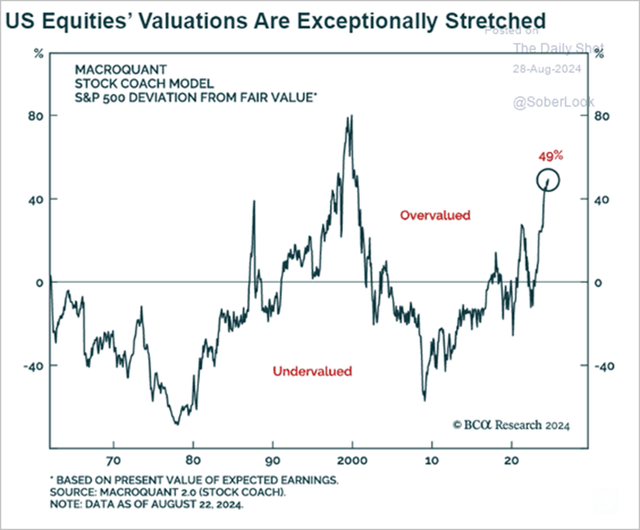

(2) Fairness valuations are prolonged

On the identical time, bonds are generationally low-cost as measured by yields, shares are generationally costly. Some would say that is warranted, due to the appearance of synthetic intelligence and its quick progress. ‘This time is totally different’ has not often labored out nicely for traders.

The ahead price-to-earnings ratio is now at 21x. Traditionally talking, that’s over one customary deviation above the 30-year common of 16.7x. And that 30-year interval was one of many costlier intervals out there’s historical past.

JP Morgan

Exterior of ahead P/E, you possibly can choose certainly one of every other measures to worth the markets within the purple field. Most are reasonably to considerably increased than their long-term averages.

That’s not to say that the market is because of right, though it is definitely attainable. I’m not going to faux to forecast what the market will do. Nevertheless, I take a look at historical past and alter my asset allocation accordingly primarily based on return per unit of threat obtainable to me.

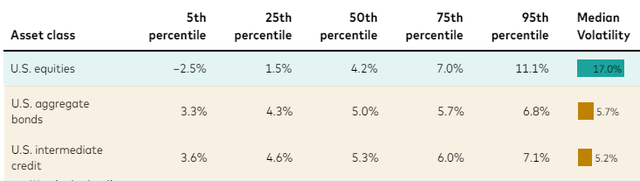

Proper now, Vanguard estimates that the S&P will return simply +4.2% over the subsequent ten years. That’s about half of its long-term common annualized return. In the meantime, look the place they put bonds- each the US Mixture Bond Index (half funding grade company bonds and half US Treasuries) and US Intermediate Credit score (5-10 yr US company bonds).

Vanguard

In different phrases, you are able to do higher over the subsequent ten years right now in intermediate to long-term company bonds versus shares as judged by long-term averages. Then, issue within the volatility column on the finish displaying bonds are a 3rd of the chance, and you’ve got a VERY compelling argument to allocate one thing to bonds.

BCA exhibits that the US inventory market is a bit wealthy….

BCA analysis

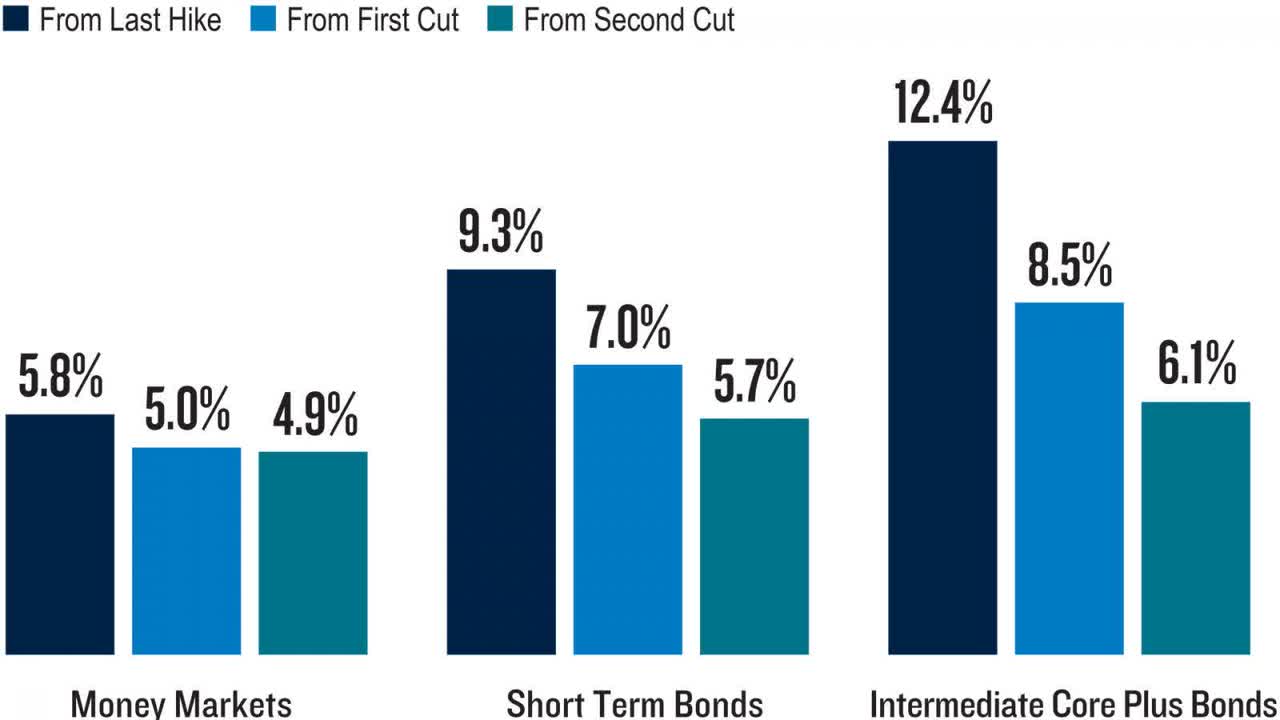

(3) Length has historically been your buddy when the Fed begins chopping charges

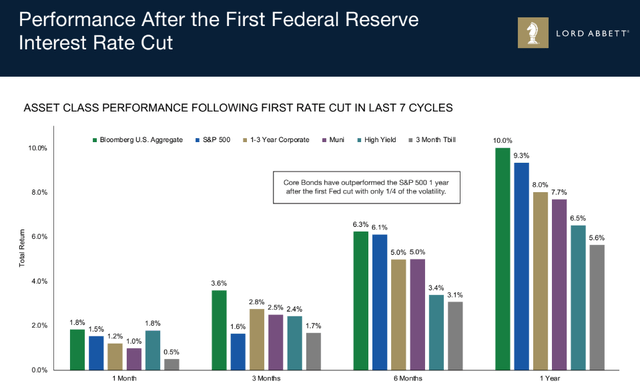

Extending the period forward of the Federal Reserve begins to chop charges throughout a cycle shift tends to create important outperformance. Because the chart under exhibits, intermediate core plus bonds (that is trade converse for a multisector fund that’s largely funding grade however juices returns/yields with some junk bonds combined in) can produce robust returns over the following 12 months.

PGIM

Money and cash markets could seem secure, however they arrive with hidden dangers. In 2024, period is now not a four-letter phrase. A heavy allocation in money and/or equivalents will doubtless miss out on substantial capital appreciation alternatives.

The dangers of sitting on the sidelines are important. Personally, I feel the biggest threat many traders face, particularly earnings traders reliant on their portfolios like retirees, is reinvestment threat.

Reinvestment threat is the probability that money flows acquired from an funding will earn much less when put to make use of in a brand new funding.

As an alternative, you may buy a long-term, high-quality bond that LOCKS YOU IN TO CURRENT RATES. I can’t stress this sufficient.

Many particular person traders have by no means bought a person bond themselves, and something new is usually a bit scary. Nevertheless, latest technological advances on the main brokerages make it as straightforward as shopping for a inventory or ETF.

One instance of a great bond choice can be a brand new concern from JPMorgan (JPM). That is the JPMorgan 5.25% 2044 (48130CRK3), A-, YTW: 5.30%. The bond is name protected till 2029. With a yield-to-worst of 5.30%, you have primarily locked in barely higher than cash market charges for the subsequent 5 years (on the worst), and as much as 20 years. The bond could be very low threat.

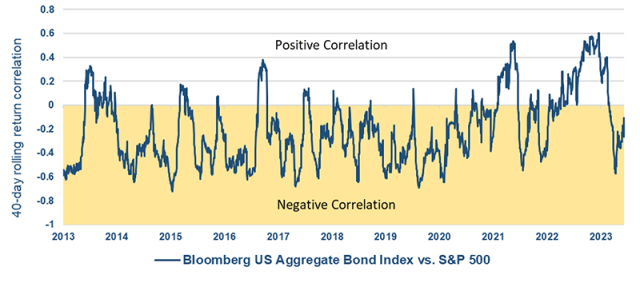

(4) Adverse Correlation Creates a Pure Hedge

One of many higher and most stealth optimistic options of proudly owning these high-quality bonds is the pure hedge to your fairness positions. This hasn’t been the case for a variety of years, however we now have lastly moved again to a destructive correlation between shares and bonds.

CFAinstitute.org

We’re again to an atmosphere the place dangerous information is dangerous information, sending shares decrease and a ‘flight to security’ in the direction of bonds. That pushes up bond costs and lowers bond yields. In different phrases, shares down, bonds up.

A variety of traders are continually on the lookout for ‘hedge’ their portfolios when one of many best methods, and non-costly methods, is correct in entrance of them. I say ‘non-costly’ since you are being paid to personal these bonds, whereas in most different hedging mechanisms it’s a must to pay with the intention to personal them. And if they’re unused, you lose that capital, a la’ insurance coverage.

An excellent instance is on September third, markets have been down greater than 1% on a transparent ‘threat off’ day within the markets. Nevertheless, charges fell materially as traders rushed into the security of bonds. That helped our portfolios be UP on the day.

Concluding Ideas

Now could be the time to get into bonds for the perfect risk-adjusted returns you might be prone to earn in your portfolio in a while. You’ll not earn Nvidia-like returns, however it is possible for you to to sleep nicely at evening understanding that you’re being paid 5.5% or extra with a minimal diploma of threat.

I’ll depart you with the next chart from Lord Abbett. It exhibits within the final seven chopping cycles that after one yr, the bond index really returns MORE THAN the S&P 500. Given the present valuations of shares, I feel that might be the case once more, one yr from right now.

Lord Abbett