As you verify your portfolio, you is likely to be questioning how issues will play out after the Federal Reserve’s fee reduce on September 18. With beneath a month to go, it is pure to be inquisitive about what may occur subsequent.

The reply? It’s not precisely easy. Historic information reveals that fairness efficiency following a Fed fee reduce can fluctuate broadly.

A giant issue is whether or not the Fed is chopping charges in response to a recession or as a proactive transfer to normalize coverage. Recession, specifically, is a wild card right here.

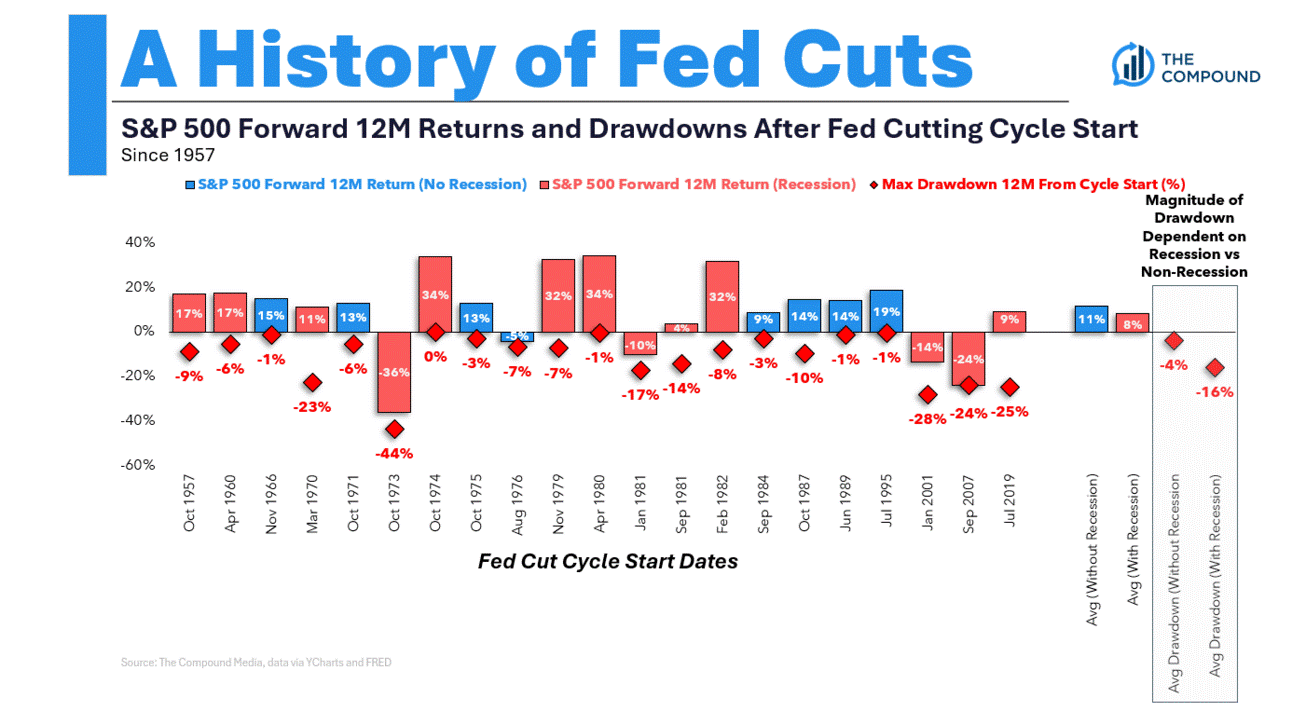

Wanting on the information, the has risen in 16 out of 21 rate-cut cycles—about 76% of the time. When there is not any recession, the typical acquire is round +11%.

Throughout recessions, the typical acquire drops to +8%. Nonetheless, drawdowns do occur. On common, we see declines of -4% with out a recession and -16% with one. Some drawdowns even exceed -20%.

Since 1900, the U.S. has been in recession roughly 22.4% of the time.

However as issues stand, there are a few causes to belive within the bullish case.

2 Knowledge Factors That Help the Bullish Case After Cuts

1. New Highs for the Dow Jones Industrial Common

The just lately hit a brand new all-time excessive. Traditionally, such milestones scale back the probability of a recession, occurring solely 8.9% of the time after new highs.

The final occasion of a brand new excessive throughout a recession was in late 1982, which preceded a powerful bullish market.

2. Excessive-Yield Bonds Sign Danger on

The high-yield bond ETF stays close to two-year highs, signaling a risk-on sentiment amongst traders. Throughout occasions of concern and uncertainty, these bonds usually undergo.

Their present power suggests confidence available in the market and helps the notion of a sustained bullish pattern.

Backside Line

Whereas historical past gives some steering, the true affect of the upcoming Fed fee reduce will rely on the present financial panorama and the way traders react.

The robust efficiency of the Dow and high-yield bonds means that optimism nonetheless lingers, however staying vigilant is vital. Markets could be unpredictable, particularly with recession dangers in play.

***

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of belongings in any approach, nor does it represent a solicitation, provide, advice or suggestion to take a position. I want to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger is on the investor’s personal danger. We additionally don’t present any funding advisory companies. We are going to by no means contact you to supply funding or advisory companies.