Up to date on August twenty sixth, 2024 by Bob Ciura

Traders are sometimes drawn to dividend paying shares due to the earnings they produce. Dividend shares present earnings, even whereas the worth of the inventory can fluctuate.

There are some firms that pay month-to-month dividends, which give extra constant money circulation for traders. There are practically 80 shares that pay a month-to-month dividend.

You may obtain our full listing of month-to-month dividend paying shares (together with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the hyperlink under:

Ellington Monetary Inc (EFC) is a Actual Property Funding Belief, or REIT, that pays a month-to-month dividend. Even higher, the inventory has a really excessive dividend yield of 11.7%.

Nevertheless, such high-yielding shares could be flashing a warning signal that the underlying enterprise is going through challenges. Shares with extraordinarily excessive yields above 10% would possibly disappoint traders with a dividend reduce afterward. These “yield traps” must be averted.

This text will look at Ellington Monetary’s enterprise mannequin, prospects for development, and the security of its dividend.

Enterprise Overview

Ellington Monetary solely transitioned right into a REIT originally of 2019. Previous to this, the belief was taxed as a partnership. It’s now categorised as a mortgage REIT.

Ellington Monetary is a hybrid REIT, which means that the belief is a mix of an fairness REIT, which owns properties, and mortgage REITs, which spend money on mortgage loans and mortgage-backed securities.

The mortgage-backed securities the corporate manages are backed by prime jumbo loans, Alt-A loans, manufactured housing loans, and subprime residential mortgage loans.

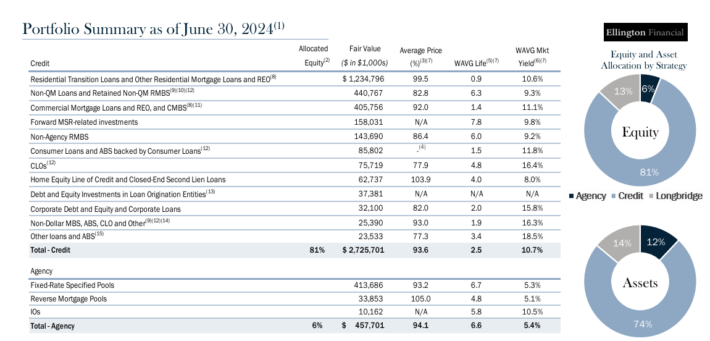

Ellington Monetary has a market capitalization of about $1.1 billion. You may see a snapshot of Ellington’s funding portfolio within the picture under:

Supply: Investor Presentation

On August sixth, 2024, Ellington Monetary reported its Q2 outcomes for the interval ending June thirtieth, 2024. Because of the nature firm’s enterprise mannequin, Ellington doesn’t report income. As an alternative, it information solely earnings.

For the quarter, gross curiosity earnings got here in at $104.3 million, up 2.8% quarter-over-quarter. Adjusted (beforehand known as “core”) EPS got here in at $0.33, 5 cents increased versus Q1-2024.

The rise was primarily as a result of increased curiosity earnings towards secure curiosity bills, offset by a better share rely. Ellington’s ebook worth per share rose from $13.69 to $13.92 over the last three months.

Progress Prospects

Ellington’s EPS era has been fairly inconsistent over the previous decade, as charges have largely been reducing over that point. Because of this, its per-share dividend has additionally largely been falling since 2015.

Nevertheless, the corporate has achieved its greatest to diversify its portfolio and scale back its efficiency variance.

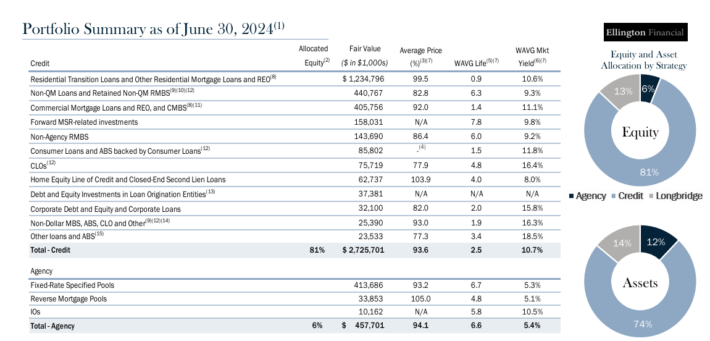

Moreover, its residential mortgage investments are diversified amongst many various safety varieties (Non-QM, Reverse mortgages, REOs, and so on.).

Ellington has taken steps to not focus its threat its portfolio, which improves financial return volatility.

Supply: Investor Presentation

Ellington has designed its portfolio in such a manner that actions in charges over time received’t have a significant influence on its total portfolio.

The Federal Reserve has said it’s more likely to elevate rates of interest within the close to future. EFC would profit from declining rates of interest.

At Ellington’s present portfolio building, a 50 foundation level decline in rates of interest would end in $6.6 million in fairness beneficial properties (i.e., 0.42 % of fairness), whereas a 50bp enhance in charges would additionally end in losses of $11.6million (-0.74% of fairness).

General, we anticipate 1% annual EPS development over the following 5 years for EFC.

Aggressive Benefit & Recession Efficiency

Ellington doesn’t possess any main aggressive benefit, however one optimistic is that the steadiness sheet stays of top of the range.

As an illustration, EFC’s recourse debt to fairness ratio decreased to 1.8x in Q2, down from 2x on the finish of 2023, as a result of a decline in borrowings on its smaller, however extra extremely levered Company RMBS portfolio, and a drop in its recourse borrowings associated to its securitization of proprietary reverse mortgage loans.

With reference to recession efficiency, Ellington Monetary was not a public firm within the Nice Recession, however the firm’s share worth was decimated on the onset of the COVID-19 pandemic.

EFC’s earnings and dividend have recovered because the pandemic ended, however each measures stay under ranges seen in 2014.

Dividend Evaluation

Ellington Monetary has a risky dividend historical past, with a number of reductions adopted by will increase. The corporate reduce its month-to-month dividend from $0.15 to $0.08 in Q1 2020 as a result of pandemic, however administration has elevated it a number of occasions since then.

In This fall-2023, EFC reduce the dividend from a month-to-month charge of $0.15 to $0.13, which the board permitted to construct some fairness worth. Presently, EFC has an annualized dividend payout of $1.56 per share.

This can be a problematic signal for the dividend’s security and due to this fact the corporate’s DPS shouldn’t be seen as secure in the interim.

With a yield above 10%, the inventory is definitely engaging for earnings traders, though a excessive degree of volatility is to be anticipated.

Since its IPO, the corporate has paid cumulative dividends in extra of $30/share, which works out to greater than 2x its present share worth. Subsequently, it has delivered a stable earnings stream to its shareholders through the years.

Last Ideas

Excessive-yield dividend shares at all times have to be thought of rigorously because the elevated yield is usually a warning signal of elementary deterioration.

Within the case of Ellington Monetary, this appears to be the case, as the corporate has exhibited quite a lot of volatility in its dividend funds.

The belief has a diversified mortgage portfolio and has confirmed profitable at growing its profitability over time. Ellington Monetary’s dividend yield additionally appears to be like secure for now, although one other reduce may very well be doable, if the belief had been to see a slowdown in its enterprise.

EFC has a sexy yield above 11%, however the inventory carries an elevated degree of threat.

Extra Studying

Don’t miss the assets under for extra month-to-month dividend inventory investing analysis.

And see the assets under for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].