Shares closed decrease yesterday, with the falling by 89 foundation factors. The drop may have been steeper if not for a late 19 foundation level rebound in a one-minute candle at 3:59 PM.

I used to be stunned by the market-on-close (MOC) orders yesterday. Not solely had been they predominantly promote orders, however their dimension was unusually small—lower than $1 billion. Usually, substantial shopping for or promoting on the shut signifies systematic funds are energetic, particularly if it occurs recurrently.

Yesterday’s smaller MOC raises questions. It’s the primary time shortly we have seen such a minor shut, suggesting that yesterday’s decline might need prompted a shift in these systematic funds.

With that in thoughts, listed here are 4 key market indicators merchants ought to watch as Powell prepares to talk at .

1. S&P 500 Breaks Channel

Quantity was larger yesterday on the , and it additionally seems that the futures broke an upward-sloping channel. It appears the market finds it simple to rally when there’s low quantity, however as quickly as that quantity begins to tick larger, the rally stops. This means there could also be extra of an absence of sellers within the market than patrons speeding in.

The break of the upward-sloping channel can also be noteworthy as a result of it resembles a flag sample with an upward-sloping channel. These patterns typically break decrease, which is exactly what occurred right here.

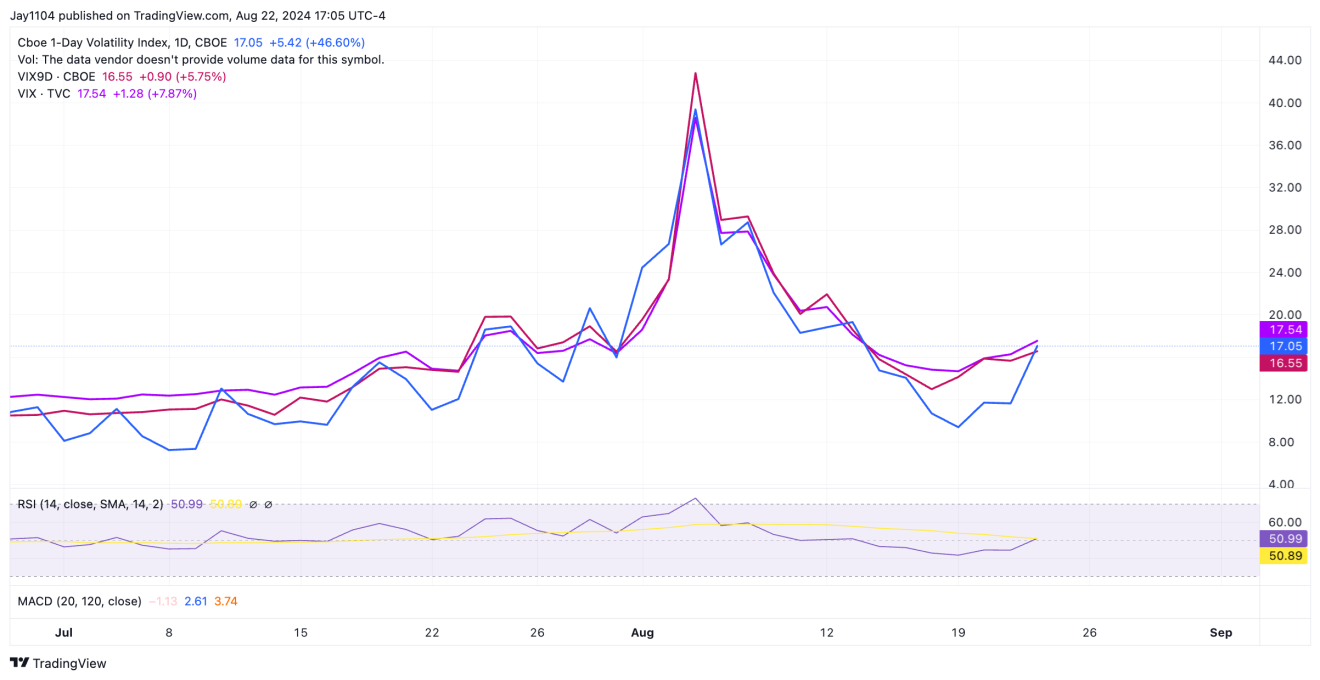

2. Volatility Crush Forward?

Moreover, the jumped yesterday, doubtless in anticipation of Powell’s speech as we speak, which units up the potential for a volatility crush as soon as he begins talking. The crucial distinction between Powell’s look at Jackson Gap and an FOMC assembly is the timing—Jackson Gap takes place within the morning and is a a lot shorter occasion.

Which means as soon as he’s accomplished talking, there’s nonetheless practically a full day of buying and selling left, not like the transient 45-minute window after an FOMC assembly. So, whereas a volatility crush may happen as he speaks, it could not final.

3. USD/CAD Correlation With S&P 500

Yesterday, we additionally noticed the flip larger, coinciding with the S&P 500 turning decrease.

The USD/CAD has discovered assist across the 1.36 degree, which aligns with a long-term uptrend and the 200-day shifting common.

This 1.36 area is a robust candidate for a possible bounce, presumably pushing the pair larger towards the 1.39 space.

4. Bearish Engulfing Candle in Nasdaq 100, Semiconductors

The approached the 78.6% retracement degree yesterday earlier than reversing and forming a bearish engulfing candle.

Whereas these bearish engulfing patterns haven’t been extremely efficient currently, it’s price noting that related patterns shaped on July 11 and August 1, each of which led to important declines within the days that adopted. So, this one ought to nonetheless be revered.

The additionally reached its 61.8% retracement degree yesterday and shaped a bearish engulfing sample, following swimsuit with the Nasdaq 100.

Nvidia (NASDAQ:) additionally hit its 78.6% retracement degree once more, forming a bearish engulfing sample yesterday.

We’ll see how issues unfold as we speak, however loads of proof suggests this might mark a turning level for the market total, doubtlessly making a decrease excessive.

Unique Put up