EUR/USD and GBP/USD Rallies Fuelled by Ongoing US Greenback Weak spot

EUR/USD and GBP/USD Newest

- The US greenback is sliding decrease as US price cuts close to

- EUR/USD and GBP/USD submit multi-month highs

Beneficial by Nick Cawley

Get Your Free USD Forecast

The minutes of the final FOMC assembly are launched later in right this moment’s session and can present a extra detailed image of why the Fed determined to maintain charges unchanged at 5.25%-5.5%. Because the July assembly, a string of knowledge releases has pointed to rising weak spot within the US economic system, suggesting that the Fed will begin to trim rates of interest in September. Monetary markets presently worth in a 67.5% probability of a 25-basis level and a 32.5% probability of a 50-basis lower.

With right this moment’s FOMC minutes already priced into the market, dealer’s consideration will flip to chair Powell’s look at this 12 months’s Jackson Gap Symposium on Friday. Chair Powell is predicted to acknowledge that circumstances, and information, at the moment are proper for a collection of rate of interest cuts to begin in September. Markets will probably be eager to see if Powell agrees with present market pricing of 100 foundation factors of cuts this 12 months, or if he pushes again towards present assumptions. With solely three FOMC conferences left this 12 months, 100 foundation factors of cuts would require a 50bp transfer at considered one of these conferences.

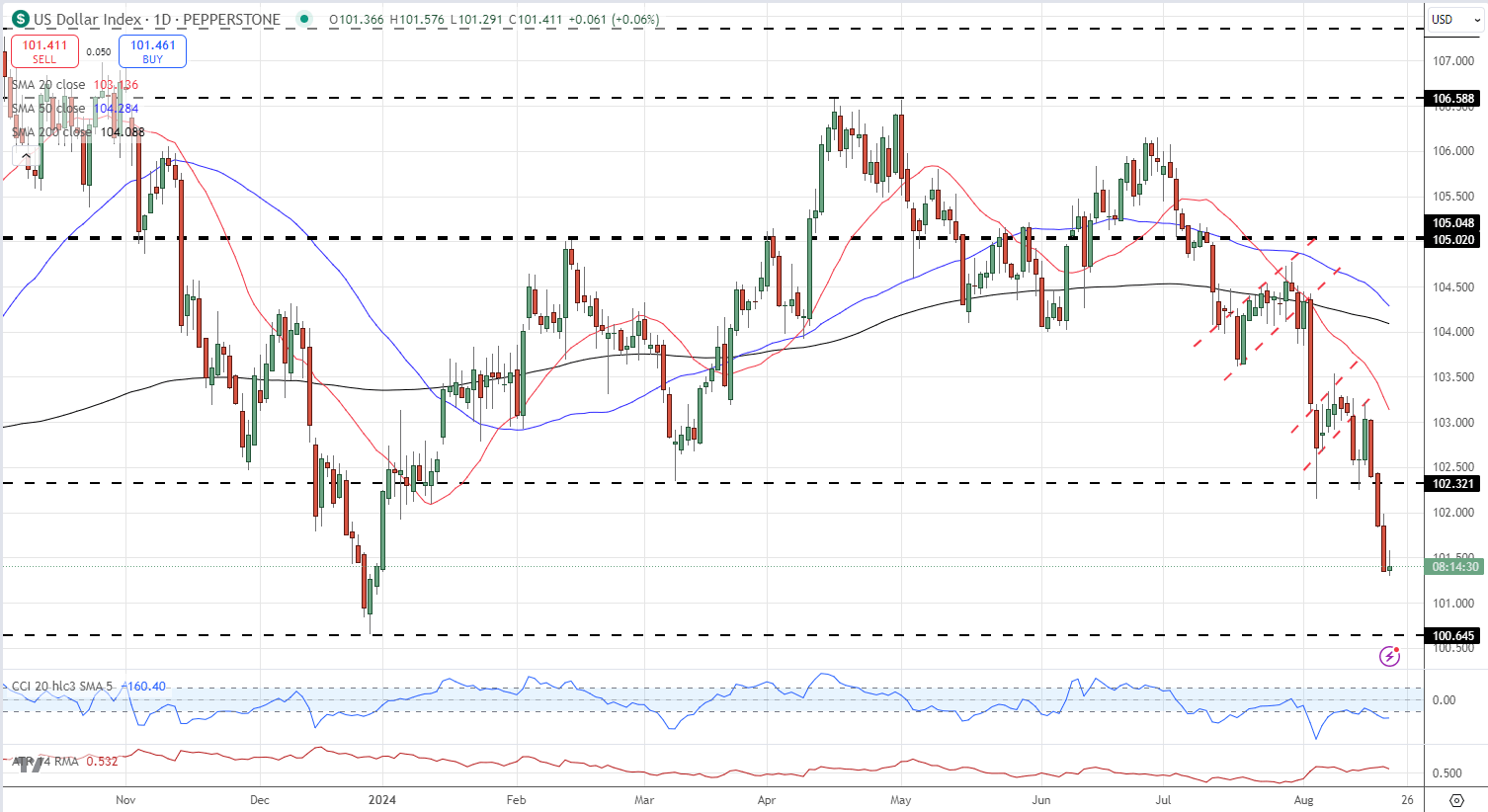

The US greenback index (DXY) has moved sharply decrease over the past two months as merchants worth in a extra dovish Fed. The technical outlook for DXY stays unfavorable with two bearish flag formations on the day by day chart retaining downward strain on the greenback.

US Greenback Index (DXY) Every day Chart

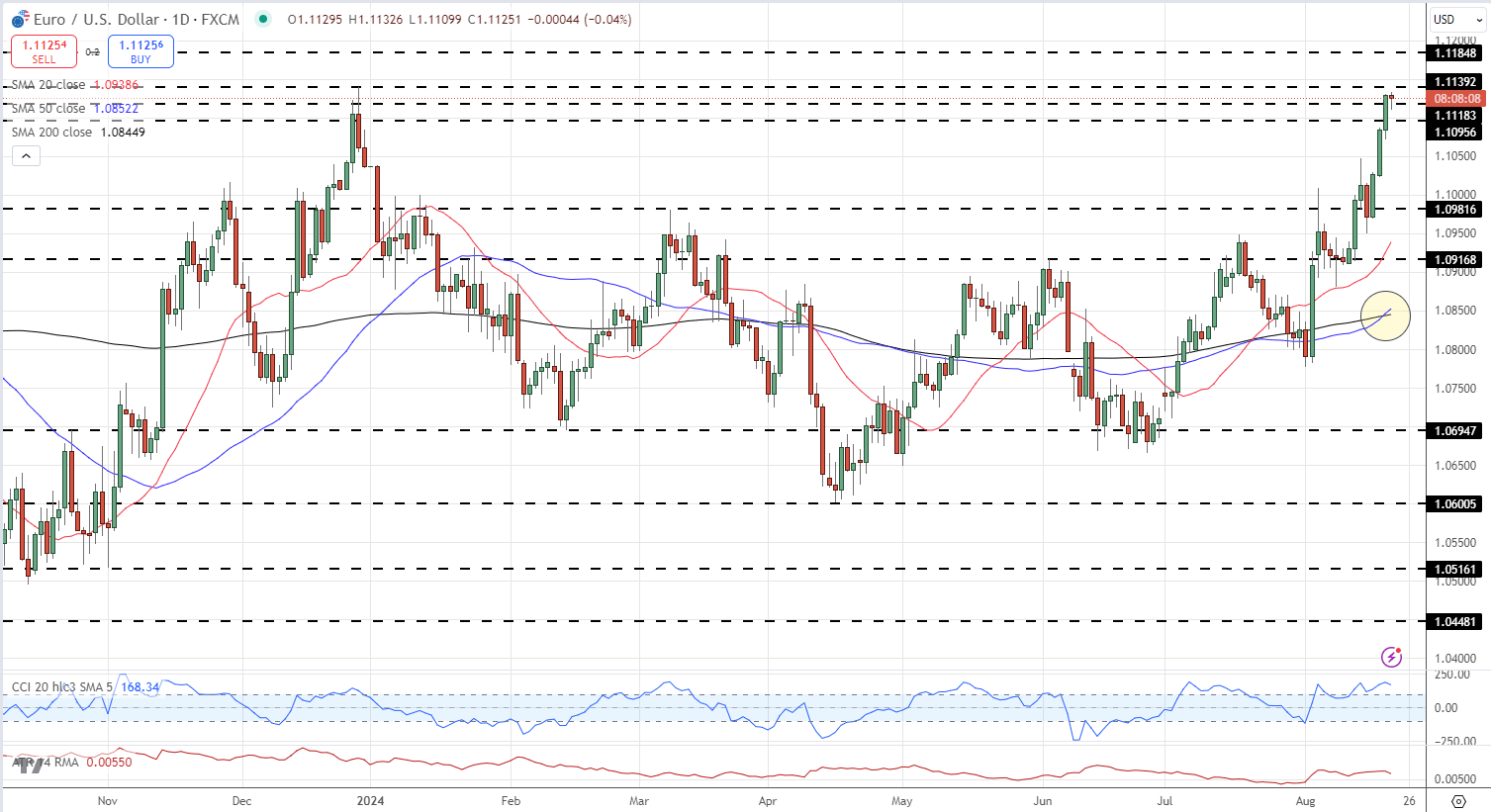

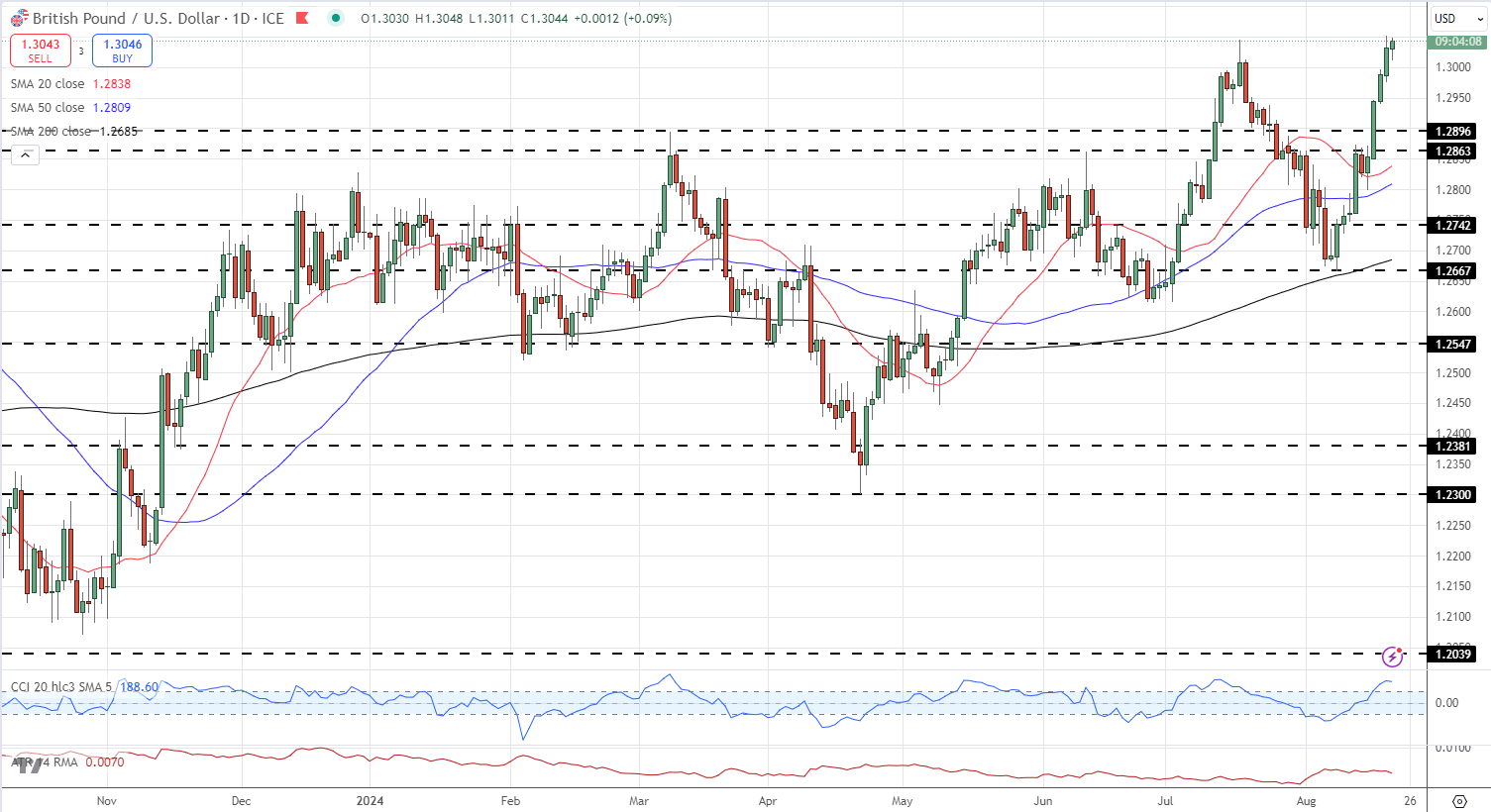

The Euro and Sterling have benefited from this weak greenback backdrop with EUR/USD and GBP/USD making recent multi-month highs yesterday.

EUR/USD has made a robust restoration after posting a five-month low of 1.0600 in mid-April and Monday’s bullish 50-day/200-day easy shifting common crossover means that the pair are prone to transfer increased within the coming weeks.

Beneficial by Nick Cawley

Methods to Commerce EUR/USD

EUR/USD Every day Chart

The GBP/USD day by day chart additionally seems constructive with an unbroken collection of upper lows and better highs made since late-April. Whereas Sterling has strengthened in its personal proper not too long ago, additional features within the pair will probably be dictated by the US greenback outlook.

GBP/USD Every day Chart

Charts usingTradingView