China slowdown weighs on Alibaba

Alibaba stories earnings on 15 August. It’s anticipated to see earnings per share rise to $2.12 from $1.41 within the earlier quarter, whereas income is forecast to rise to $34.71 billion, from $30.92 billion within the remaining quarter of FY 2024.

China’s financial development has been sluggish, with GDP rising simply 4.7% within the quarter ending in June, down from 5.3% within the earlier quarter. This slowdown is because of a downturn in the true property market and a gradual restoration from COVID-19 lockdowns that ended over a 12 months in the past. Furthermore, shopper spending and home consumption stay weak, with retail gross sales falling to an 18-month low on account of deflation.

Opponents nibbling at Alibaba’s heels

Alibaba’s core Taobao and Tmall on-line marketplaces noticed income development of simply 4% year-on-year in This autumn FY’24, as the corporate faces mounting competitors from new e-commerce gamers like PDD, the proprietor of Pinduoduo and Temu. Chinese language shoppers have gotten extra value-conscious because of the weak financial system, benefiting these low cost e-commerce platforms.

Slowdown in cloud computing hits income development

Alibaba’s cloud computing enterprise has additionally seen development cool off significantly, with income rising by solely 3% in the latest quarter. The slowdown is attributed to easing demand for computing energy associated to distant work, distant training, and video streaming following the COVID-19 lockdowns.

Lowly valuation pricing in a dark future?

Regardless of the headwinds, Alibaba’s valuation seems compelling at below 10x ahead earnings, in comparison with Amazon’s 42x. The corporate has additionally been doubling down on share repurchases and plans to extend service provider charges. Nevertheless, the unsure macroeconomic atmosphere and mounting competitors pose dangers to Alibaba’s future efficiency.

Regardless of the low valuation, Alibaba has an ‘outperform’ score on the IG platform, utilising information from TipRanks:

BABA TR

Supply: TipRanks/IG

In the meantime, of the 16 analysts protecting the inventory, 13 have ‘purchase’ rankings, with three ‘holds’:

BABA BR

Supply: Tipranks/IG

Alibaba inventory value below strain

Alibaba’s inventory has suffered a pointy decline of 65% from ranges of $235 in early January 2021 to round $80 now, whereas the S&P 500 has elevated by about 45% over the identical interval. The corporate has underperformed the broader market in every of the final three years.

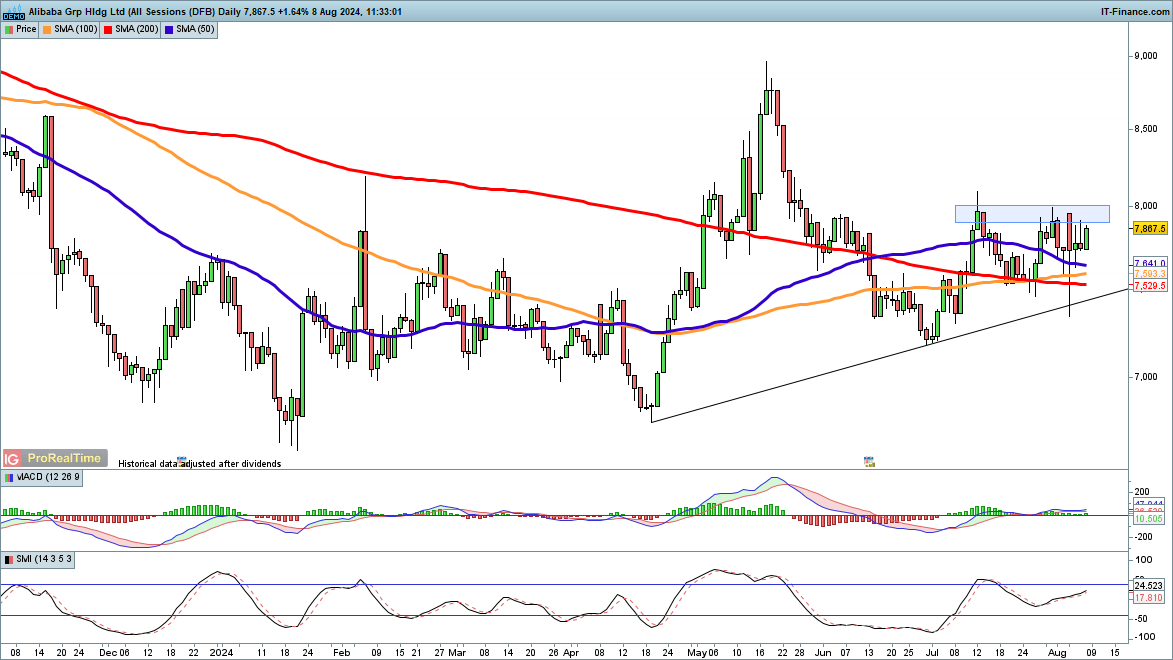

Regardless of this, there are indicators of bullishness within the brief time period. The value has risen from its April lows, forming increased lows in late June and on the finish of July. Notably, it quickly shrugged off weak spot originally of August.

The value stays above trendline help from the April lows and has additionally managed to carry above the 200-day easy shifting common (SMA). Current beneficial properties have stalled on the $80 stage, so a detailed above this might set off a bullish breakout.

BABA Worth Chart

Supply: ProRealTime/IG