- Fed left charges unchanged yesterday, however the path forward stays data-dependent.

- Whereas the markets look like virtually sure a couple of September lower, it is good to organize for any eventuality.

- On this piece, we’ll check out 2 shares which you could add to your portfolio forward of September.

- Unlock AI-powered Inventory Picks for Below $8/Month: Summer season Sale Begins Now!

The Federal Reserve yesterday as broadly anticipated, however provided little readability on the timeline for potential cuts.

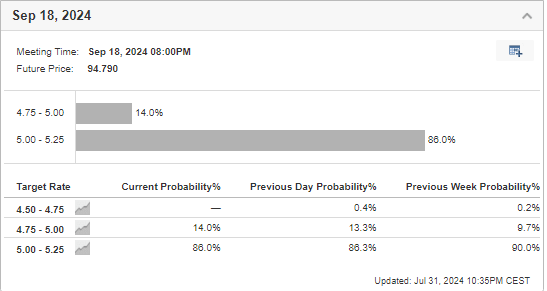

Whereas the central financial institution maintained a cautious stance, citing current financial knowledge, market expectations for a September fee discount stay sturdy, with at 87% on the time of writing.

Amid the Fed’s dovish tilt, the inventory market rallied, buoyed by a usually optimistic earnings season to this point. Main indices climbed, with the posting a 1.58% achieve.

Whereas the Fed’s choice to keep up charges was unsurprising, the trail ahead stays unsure. Upcoming and knowledge for July and August will likely be essential in figuring out the central financial institution’s subsequent transfer.

Nonetheless, present traits recommend at the least two fee cuts earlier than the top of the 12 months.

Because the Fed prepares to embark on a rate-cutting cycle, sure sectors and shares are poised to learn. Beneath, we’ll discover two shares to organize your portfolio for the altering financial panorama.

1. Qualcomm

Qualcomm’s (NASDAQ:) inventory worth surged over 8% yesterday after the corporate beat Q2 expectations.

Income climbed to $9.39 billion, surpassing forecasts by $180 million, whereas earnings per share reached $2.33, exceeding estimates by $0.08. This sturdy efficiency has halted a current downtrend and presents a possible shopping for alternative.

A 12% year-over-year enhance in processor and smartphone modem gross sales additional bolsters Qualcomm’s outlook. Technical evaluation signifies a possible breakout from a resistance stage close to $200, which might propel the inventory towards its historic excessive round $230.

2. Mastercard

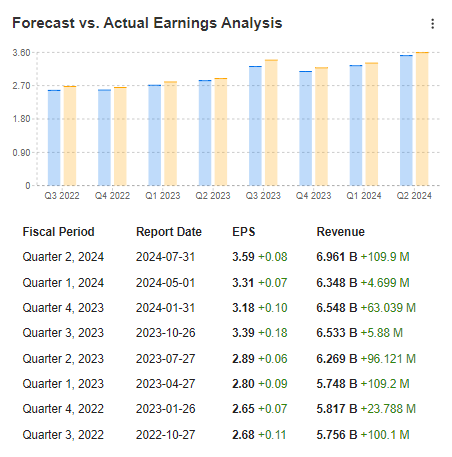

Mastercard (NYSE:), like Qualcomm, launched its quarterly outcomes yesterday, as soon as once more surpassing expectations in income and earnings per share. This continues its spectacular streak of beating quarterly consensus.

With constantly rising revenues and strong web earnings, Mastercard stays a pretty and stable alternative for stabilizing portfolios, particularly if the Fed maintains its restrictive financial coverage.

Supply: InvestingPro

The corporate’s continued optimistic pattern is underpinned by an 11% quarter-on-quarter enhance in fee transaction quantity on the Mastercard platform.

CEO Michael Miebach expressed his satisfaction, stating,

“We achieved one other sturdy quarter in all elements of our enterprise, posting double-digit development in web revenues and income.”

Throughout yesterday’s session, Mastercard’s inventory worth surged by greater than 3.6%, doubtlessly marking the top of the correction and signaling a return to upward momentum.

***

This summer season, get unique reductions on our subscriptions, together with annual plans for lower than $8 a month!

Uninterested in watching the massive gamers rake in income whilst you’re left on the sidelines?

InvestingPro’s revolutionary AI instrument, ProPicks, places the ability of Wall Road’s secret weapon – AI-powered inventory choice – at YOUR fingertips!

Do not miss this limited-time provide.

Subscribe to InvestingPro right now and take your investing sport to the following stage!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or advice to take a position as such it’s not meant to incentivize the acquisition of belongings in any approach. I wish to remind you that any sort of asset, is evaluated from a number of views and is extremely dangerous and subsequently, any funding choice and the related threat stays with the investor.