Fast Take

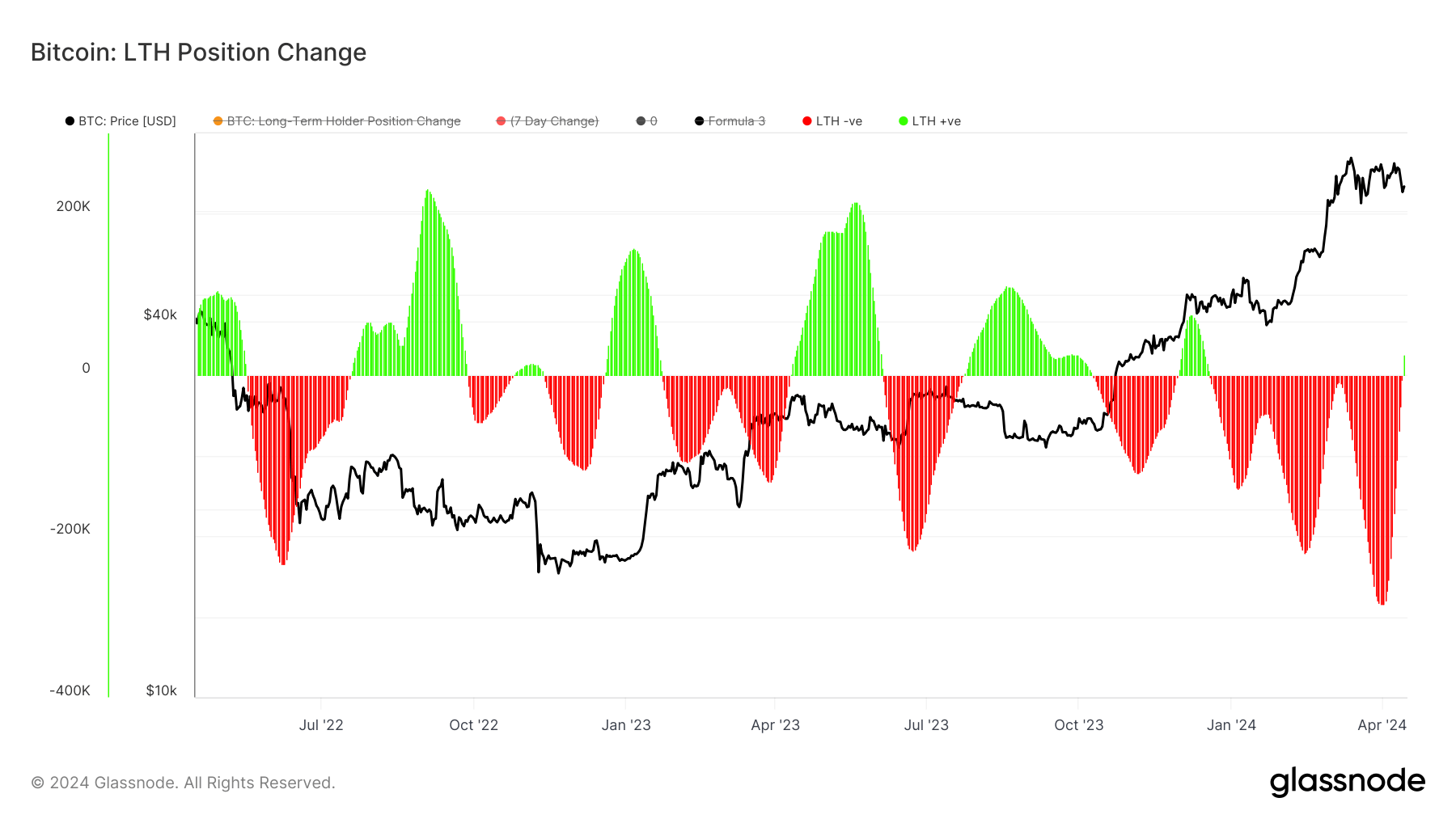

Lengthy-term holders (LTHs) are outlined by Glassnode as buyers holding Bitcoin (BTC) for 155 days or extra. Famend for his or her astute funding methods, LTHs usually accumulate BTC throughout bear markets and promote throughout bull runs to generate income.

Glassnode knowledge reveals that since December, LTHs have offloaded round 1 million BTC; nonetheless, the current GBTC sell-off has impacted Bitcoin’s long-term holder metrics. Excluding GBTC holdings, this accounts for roughly 700,000 Bitcoin offered by LTHs.

In distinction, short-term holders (STHs), these holding BTC for lower than 155 days, persist in accumulating. In the course of the interval by which LTHs offered 1 million BTC, STHs have bought roughly 1.2 million BTC, in keeping with Glassnode knowledge. Whereas STHs have tapered their acquisition tempo within the final 14 days, they continue to be energetic patrons. The interplay between LTHs and STHs signifies a promising outlook for short-term Bitcoin costs, with diminished promote stress from LTHs.

As we are able to now discern from the information, as a result of it takes 155 days to watch an LTH buy, LTHs have capitalized on the chance amid the value surge from $25,000 in October 2023. Utilizing a 14-day transferring common, the LTH provide has skilled a slight improve, indicating accumulation. At present, LTHs collectively maintain roughly 14 million cash.

The submit Bitcoin’s long-term holders shift to accumulation appeared first on CryptoSlate.