Sundry Images

In my opinion, buyers ought to absolutely embrace the volatility that’s shaking the markets proper now. Although the vast majority of buyers are hooked into curiosity rate-driven headlines and continued hypothesis over the tempo of charge cuts this yr, volatility can also be a good time for buyers to scoop up large movers in single inventory positions.

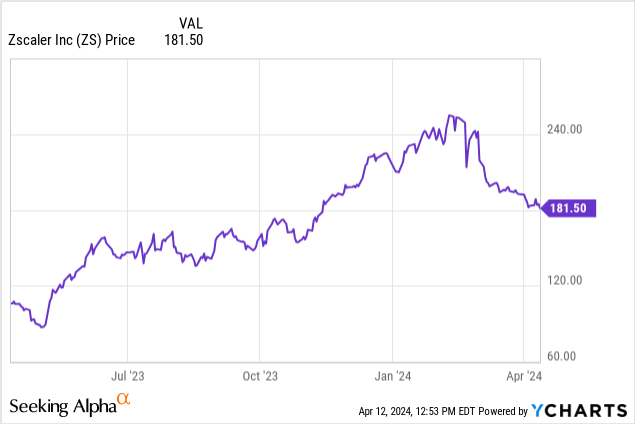

Zscaler (NASDAQ:ZS), particularly, has seen fairly a little bit of volatility this yr. Lengthy a Wall Road darling, this cloud-based safety supplier has seen its share worth tumble practically 15% this yr, whereas most of its friends have risen by greater than that quantity. The inventory took a beating after releasing fiscal Q2 ends in late February, regardless of a beat and lift throughout all the corporate’s key metrics.

After latest declines, it is time to relook on the bull case for Zscaler

I wrote a cautionary be aware on Zscaler pre-earnings again in February, when the inventory was hitting its near-term peaks above $230. On the time, I had inspired buyers to lock in beneficial properties and set a re-buy worth goal of $185 for Zscaler. Now, my threshold has been hit, and I’m bullish on Zscaler as soon as once more.

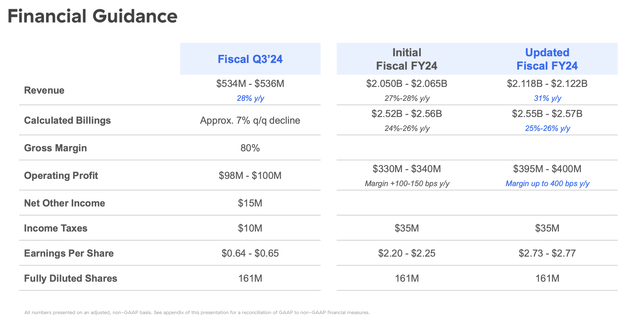

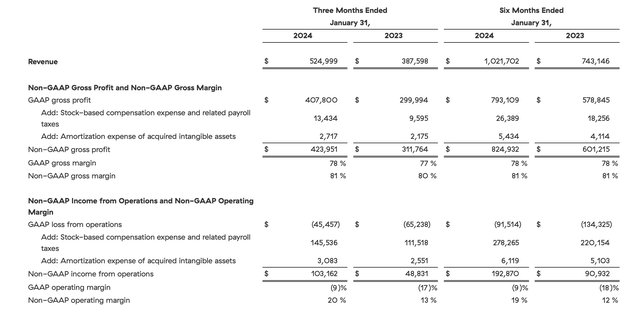

The very first thing to notice: Zscaler’s earnings cycle was removed from grim. The corporate really beat on income expectations, whereas additionally setting a pleasant enhance to current-year income expectations in addition to a significant bump to working margin expectations:

Zscaler outlook (Zscaler Q2 earnings deck)

Past the present yr, right here is my full up to date long-term bull case for Zscaler:

- Secular tailwinds towards the cloud. Zscaler made a reputation for itself by specializing in safety options for functions housed within the public cloud, whereas many present cybersecurity firms are oriented for on-premises environments. As an increasing number of workloads transfer into the cloud, Zscaler will proceed to realize prominence and share.

- Safety is recession-proof. We have heard from many firms within the software program sector that IT chiefs are delaying massive capital tasks and that every deal is getting extra closely scrutinized. It is tougher, nonetheless, to delay a important safety infrastructure buy, and that is why Zscaler has been capable of finding success in each down and up markets.

- Development at scale. Regardless of hitting over $2 billion in annual income, Zscaler remains to be rising its prime line metrics (income and billings) at a ~30% clip, which demonstrates the largesse of its market and its main aggressive place versus different cybersecurity firms.

- Extremely excessive gross margin profile. Zscaler’s professional forma gross margins within the 80s index very excessive relative to fellow software program firms, and permits for unbelievable scalability at its extra mature stage.

- Matches the “Rule of 40” mildew, distinguishing it from many software program friends. Although income development is decelerating, the corporate makes up for it with a wealthy low-teens professional forma working margin. Zscaler’s plug-and-play profitability makes it a safer guess in a extra risk-averse market that has shunned unprofitable tech shares.

Valuation replace

Although it is a stretch to name Zscaler low-cost by any means, the inventory’s latest crumble has left its share worth in a extra affordable place towards newest estimates.

At present share costs simply north of $180, Zscaler trades at a market cap of $27.15 billion; and after netting off the $2.46 billion of money and $1.14 billion of convertible debt on Zscaler’s most up-to-date stability sheet, the corporate’s ensuing enterprise worth is $25.83 billion.

In the meantime, for subsequent fiscal yr FY25 (the yr for Zscaler ending in June 2025), Wall Road analysts have a consensus income goal of $2.66 billion for the corporate, representing 26% y/y development. This places Zscaler’s valuation at 9.7x EV/FY25 income.

In my opinion, I am snug shopping for right here and holding for a shorter rebound rally as much as 11.5x EV/FY25 income, or a promote worth goal of $210, or 16% upside from present ranges.

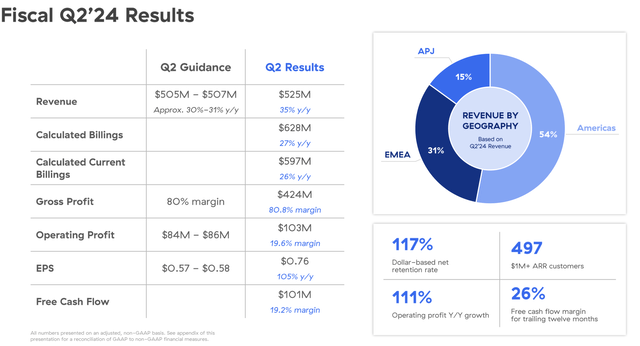

Q2 obtain

We will now undergo the outcomes of Zscaler’s most up-to-date quarter in better element. The Q2 earnings highlights are proven under:

Zscaler Q2 highlights (Zscaler Q2 earnings deck)

Q2 income got here in at $525 million, up 35% y/y and effectively forward of each the corporate’s inside steerage vary of 30-31% y/y development, in addition to Wall Road’s expectations of $507 million, on the 31% y/y excessive finish of Zscaler’s steerage vary.

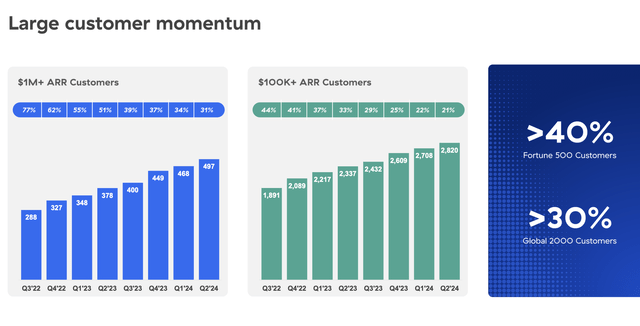

The corporate continued to make robust progress with massive buyer provides, which is typical of the final calendar quarter (December quarter) of the yr. The rely of shoppers producing greater than $1 million in ARR grew 31% y/y to 497, a internet add of 29 massive prospects inside the quarter (increased than 19 in Q1):

Zscaler buyer tendencies (Zscaler Q2 earnings deck)

The corporate continues to see a big pipeline inside authorities sector offers, as it’s FedRAMP licensed. As seasoned software program buyers are conscious, authorities offers usually can symbolize among the many most profitable offers within the software program sector. Per CEO Jay Chaudry’s remarks on the Q2 earnings name:

Subsequent, let me focus on our alternatives within the Federal market. As I discussed earlier, we noticed robust development in internet new ACV from the Federal vertical in Q2. After our preliminary lands at 12 of the 15 cupboard degree businesses, we proceed to win further awards as businesses are more and more adopting Zero Belief structure to fulfill the President’s Govt Order. For instance, in a seven-figure upsell deal, an company buyer expanded their seats with ZIA, ZPA and Knowledge Safety purchases, practically doubling their annual spend with us. With this upsell, the shopper is already approaching $5 million in annual spend, although we’re nonetheless lower than 15% penetrated by way of the variety of customers, representing a major upsell alternative on this company. With the very best ranges of FedRAMP certifications for each ZIA and ZPA, we’re very effectively positioned to learn from continued development with our federal prospects. Constructing upon our success within the US, we’re investing in constructing public sector packages for half a dozen nations which have adopted FedRAMP like certification packages. This can be a vital alternative for us, however like every authorities initiative this can take time.”

The place the corporate did expertise some moderation, albeit anticipated, is in billings, which grew “solely” 27% y/y, decelerating from 33% y/y in Q1. We be aware that the corporate’s billings development is in-line with Road expectations for income development in FY25, as billings is usually one of the best indicator of longer-term development trajectory.

Profitability, nonetheless, continues to be a significant spotlight. Professional forma working margins soared 7 factors y/y to twenty%:

Zscaler margins (Zscaler Q2 earnings deck)

Zscaler’s “Rule of 40” rating nonetheless sits comfortably above 50, with 35% y/y income development stacked on prime of a formidable 20% working margin.

Key takeaways

After Zscaler’s latest decline, it is time to flip our consideration again to the corporate’s constant development tendencies, its secular benefits in offering cloud-based safety options, and super profitability. Purchase with confidence right here and maintain on till Zscaler hits the $210s once more.