US Greenback and Gold Evaluation and Charts

- US NFPs – 303k vs 200k expectations and a revised decrease 270k February print.

- Gold sheds $10/oz. post-release because the US greenback turns increased.

You’ll be able to obtain our model new Q2 US Greenback Forecast beneath:

Really helpful by Nick Cawley

Get Your Free USD Forecast

For all main central financial institution assembly dates, see the DailyFX Central Financial institution Calendar

The most recent Jobs Report (NFPs) reveals the US labor market in impolite well being with 303k new jobs added in March, trouncing forecasts of 200k. The unemployment price slipped 0.1% decrease to three.8%, whereas common hourly earnings m/m met forecasts of 0.3%. Nonfarm non-public payrolls additionally beat forecasts, 232k in comparison with 160k.

For all financial knowledge releases and occasions see the DailyFX Financial Calendar

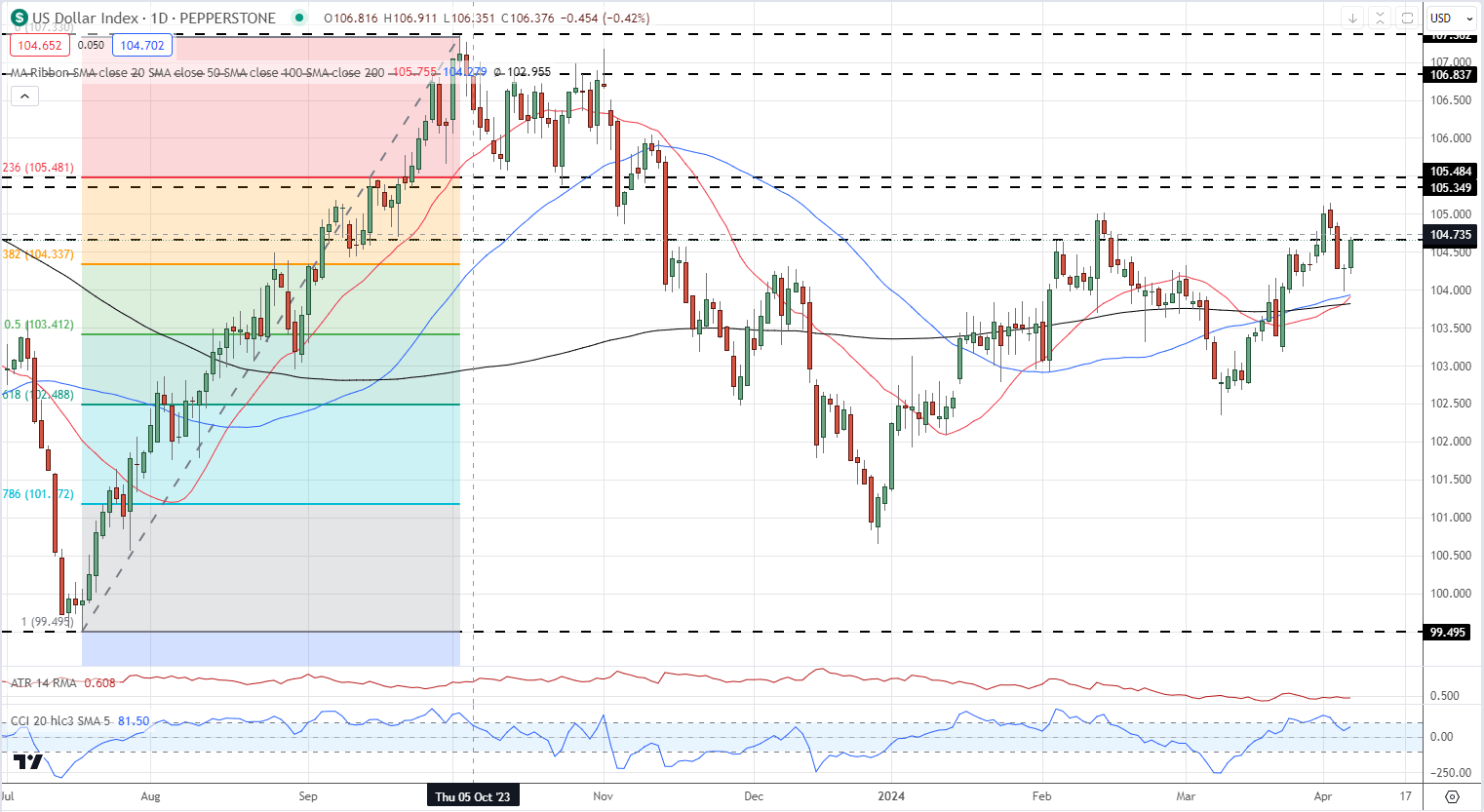

The US greenback index added 30 ticks after the discharge, persevering with Thursday’s late transfer increased after Federal Reserve member Neel Kashkari overtly queried if price cuts have been acceptable this yr. At this time’s sturdy labor report will additional stoke fears that inflation could change into stickier than anticipated, which means US charges will probably be left on maintain for longer. Market price minimize chances have been trimmed barely after the NFP launch with the June assembly now seen as simply 56/44 in favour of a 25 foundation level minimize.

US Greenback Index Every day Chart

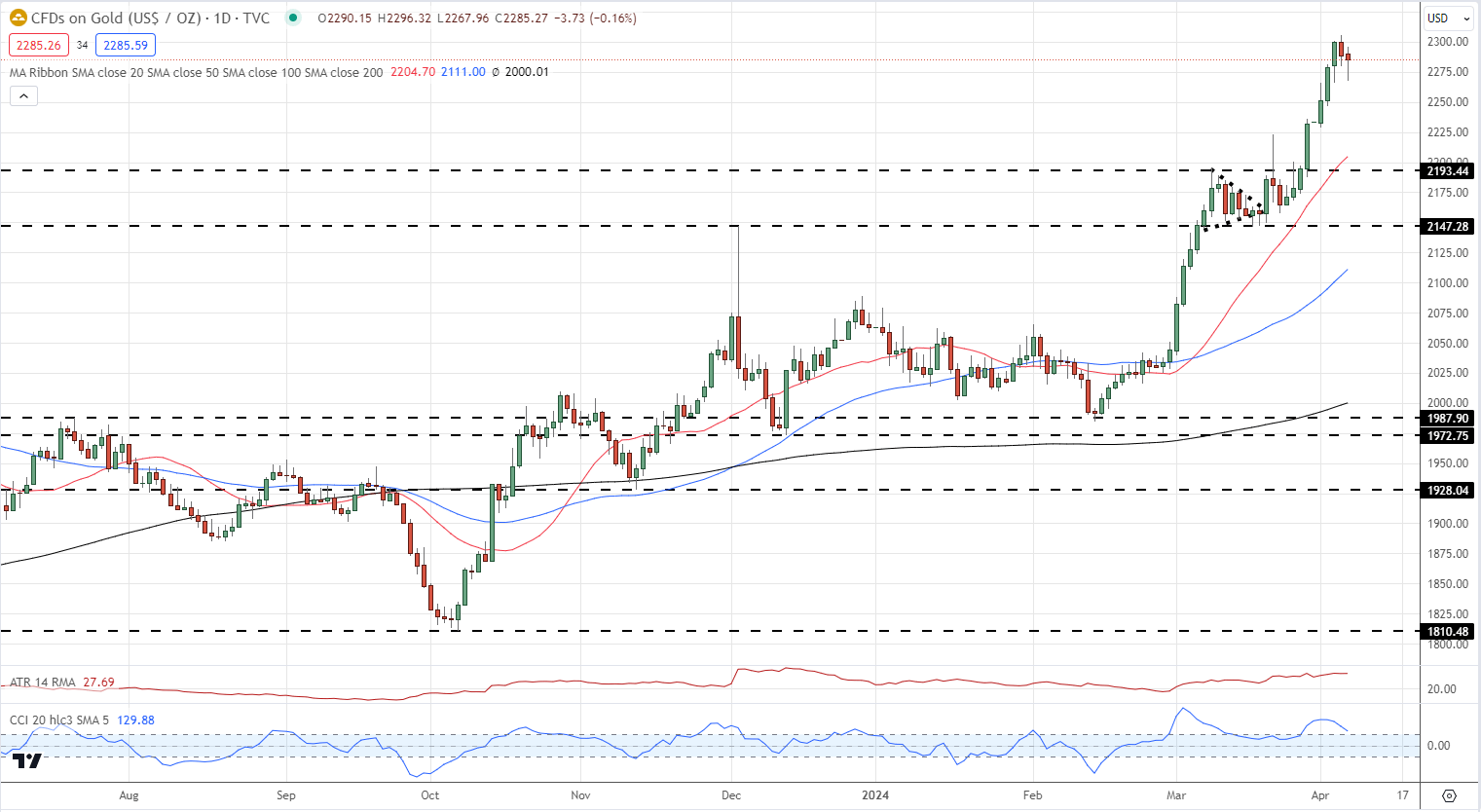

Gold’s current rally stalled post-release with a haven nonetheless supporting the valuable steel as Israel and Iran proceed to warn of additional army motion.

Gold Every day Value Chart

All Charts by way of TradingView

Retail dealer knowledge reveals 43.87% of Gold merchants are net-long with the ratio of merchants brief to lengthy at 1.28 to 1.The variety of merchants net-long is 1.06% increased than yesterday and 13.69% increased from final week, whereas the variety of merchants net-short is 5.61% decrease than yesterday and eight.50% increased from final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests Gold costs could proceed to rise.

| Change in | Longs | Shorts | OI |

| Every day | -16% | 7% | -4% |

| Weekly | 2% | 13% | 8% |

What are your views on the US Greenback – bullish or bearish?? You’ll be able to tell us by way of the shape on the finish of this piece or you possibly can contact the creator by way of Twitter @nickcawley1.