Most Learn: Japanese Yen Outlook & Market Sentiment: USD/JPY, EUR/JPY, GBP/JPY

The Federal Reserve will launch its March financial coverage announcement on Wednesday. Consensus estimates overwhelmingly recommend that the establishment led by Jerome Powell will maintain its benchmark price unchanged at its present 5.25% to five.50% vary, successfully sustaining the established order for the fifth consecutive assembly. Furthermore, analysts broadly anticipate that the central financial institution will maintain its quantitative tightening program intact for now, persevering with to scale back its bond holdings step by step.

Whereas the choice on rates of interest themselves could not ship dramatic surprises, markets might be laser-focused on the ahead steering. With that in thoughts, the FOMC could repeat that it doesn’t count on will probably be acceptable to scale back borrowing prices till it has gained larger confidence that inflation is converging sustainably towards 2 % – a transfer that will point out extra proof on disinflation is required earlier than pulling the set off. Present FOMC assembly chances are proven under.

Supply: CME Group

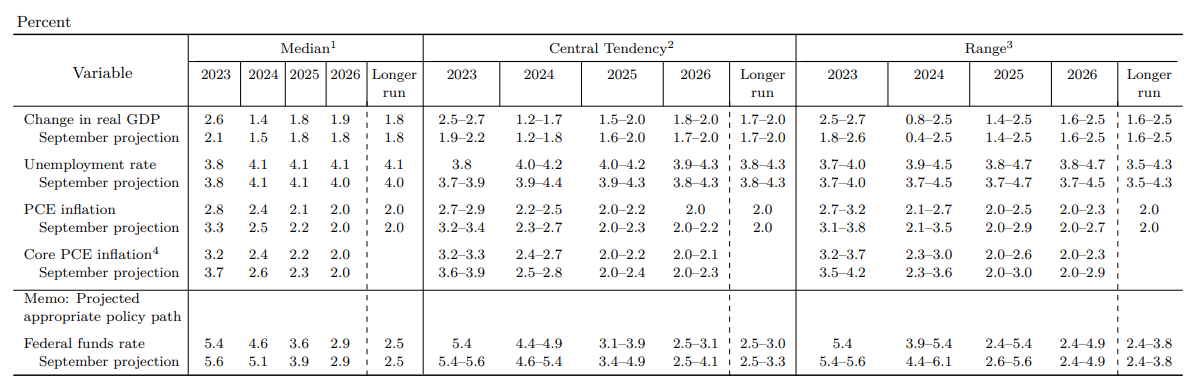

By way of macroeconomic projections, the Fed is more likely to mark up its gross home product and core PCE deflator forecasts for the yr, reflecting financial resilience and sticky value pressures evidenced by the final two CPI and PPI reviews. The revised outlook might compel policymakers to sign much less financial coverage easing over the medium time period, probably scaling again the three price cuts initially envisioned for 2024 to solely two (this info might be out there within the dot plot).

The next desk reveals projections from the December FOMC assembly.

For an entire overview of the U.S. greenback’s technical and elementary outlook, seize a duplicate of our free quarterly forecast!

Really helpful by Diego Colman

Get Your Free USD Forecast

Supply: Federal Reserve

If the Federal Reserve indicators a larger inclination to train persistence earlier than eradicating coverage restraint and reveals much less willingness to ship a number of price cuts, we might see U.S. Treasury yields and the U.S. greenback cost upwards within the close to time period, extending their latest rebound. In the meantime, shares and gold, which have rallied strongly not too long ago on the idea that the central financial institution was on the cusp of pivoting to a looser stance, may very well be in for a impolite awakening (bearish correction).