Shares completed largely decrease on the day, with the dropping 19 bps and the falling by 83 bps.

At present, we get and , and based mostly on the 1-Day, the market doesn’t appear as involved, with the implied volatility gauge closing at 11.9 and effectively under the 19 ranges seen forward of the print.

So, it appears unlikely that we see a volatility crush at the moment.

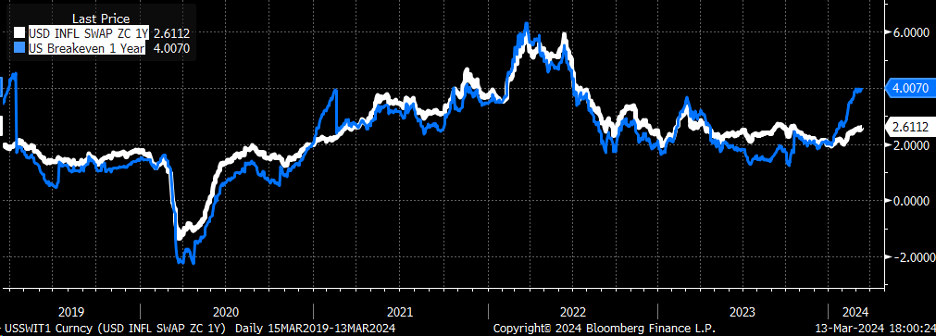

Within the meantime, one-year inflation swaps closed yesterday at their highest ranges since October 2023 (white line), and one-year breakevens (blue line) closed at their highest because the summer time of 2022.

However yesterday was an enormous day for issues like , which broke out and surged 3% above resistance and possibly has room to run to round $2.70.

It was an enormous day for which rose nearly 3.5% and seems to have damaged out.

It’s no marvel why inflation expectations are surging. The issues which have helped suppress and inform the disinflationary story at the moment are coming again to life.

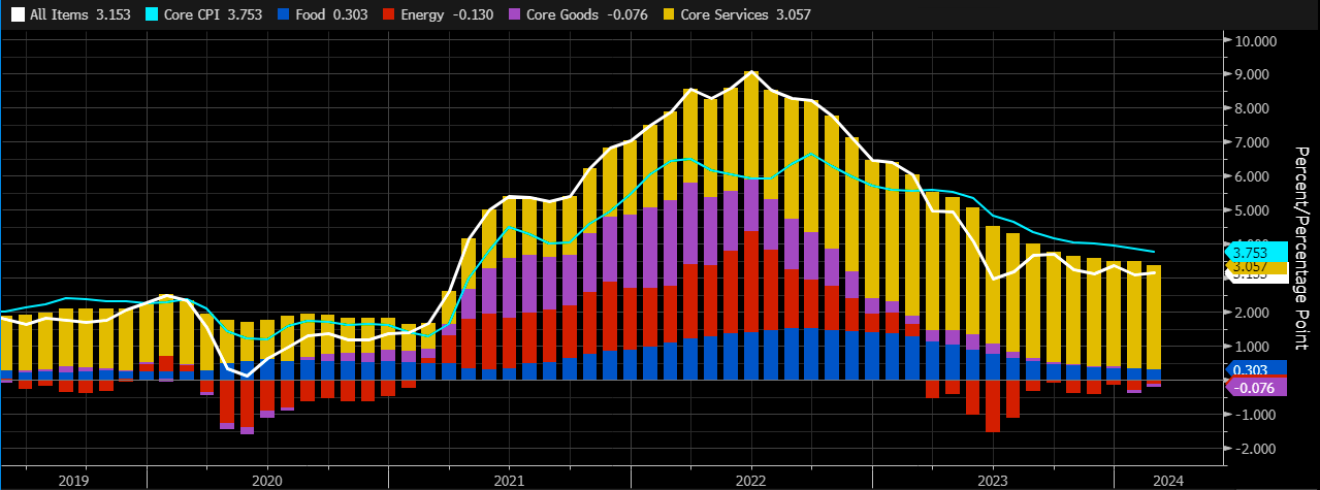

If you take a look at the CPI index, the one factor that’s accounting for inflation is core companies. Meals, power, and core items are all non-existent.

However out of the blue, this will begin to look a lot totally different if , copper, and gasoline breaks and begins to choose up steam. I haven’t talked about the transport charge surge seen because the begin of the yr.

(Bloomberg)

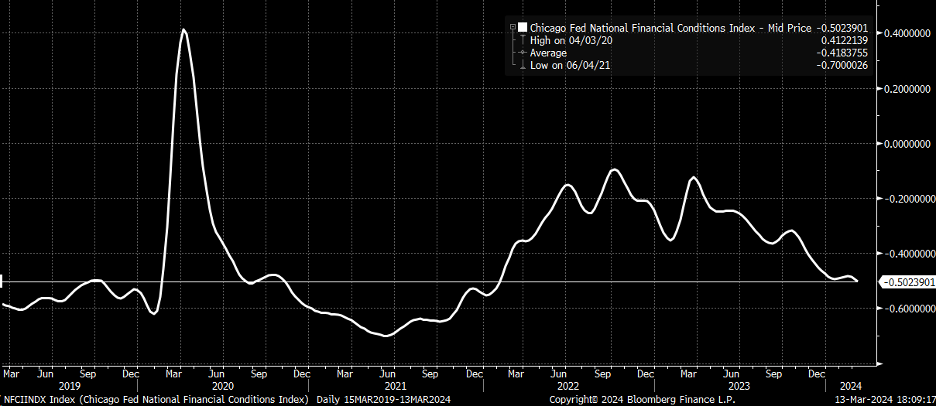

Why shouldn’t threat belongings be rising? Monetary situations, as measured by the Chicago Fed, are in the identical spot as they had been in February 2022, earlier than the Fed Funds charge was 535 bps decrease, and the stability sheet was greater than $1 trillion bigger.

On the finish of the day, shares are threat belongings, and you realize what: copper, gasoline, and oil are threat belongings.

So why ought to shares go increased and different threat belongings not go increased? This is similar cause that gold goes increased. They’re saying the identical factor: monetary situations are too simple, and inflation is now liable to coming again.

The one excellent news is that charges are slowly waking as much as the concept that charge cuts might not manifest this yr as this inflation threat is beginning to construct.

Yesterday, we had charges transfer again above the 4.19% degree, which doubtlessly opens the door for an increase again to the 4.35% area if the info at the moment is supportive.

That’s it.

Unique Submit