luza studios

Tremendous Micro Laptop, Inc. (NASDAQ:SMCI) enters the S&P 500 (SP500) immediately. The inventory has remained on a persistent upsurge because the inclusion announcement earlier this month, because it faces larger than traditional demand in anticipation of further institutional curiosity – notably from index funds. We view this as complementary to SMCI’s AI-driven basic outperformance in supporting the inventory’s year-to-date momentum.

SMCI has clearly differentiated itself as a key chief in capturing rising AI alternatives, which is in step with our optimism as mentioned in a protection on the inventory final 12 months. Particularly, we had considered SMCI as one of many few names which have but to develop into its full AI prospects on the time of our evaluation final 12 months. However the newest outcomes have surpassed even our bull case from final 12 months’s protection, whereas is also corroborating additional upside potential to come.

Particularly, the corporate is on monitor to greater than doubling its revenues by the top of FY 2024. Administration’s upward-revised FY 2024 income steerage additionally implies that SMCI will exit the 12 months with an annualized income run-rate of $20 billion. Coupled with SMCI’s latest $1.5 billion convertible notes issuance, the corporate is properly positioned for stronger-than-expected development within the coming quarters. The extra capital injection is supportive of SMCI’s near-term capabilities in capitalizing on instantly accessible AI alternatives, which at the moment stays supply-constrained. This may also complement administration’s continued dedication to driving economies of scale and, inadvertently, bettering working leverage important to money flows.

Taken along with valuation issues, resembling SMCI’s implied perpetual development price at present ranges and value a number of on a relative foundation to friends, the inventory stays properly fueled for additional upside potential within the near-term.

Basic Issues

Demand stays a perform of provide accessible for SMCI and its cohort of friends partaking throughout the GPU and AI processor worth chain. The state of affairs mirrors that of Tesla (TSLA) in 2021 when the constrained provide of EV availability – market’s favored theme on the time – accompanied its blistering rally to all-time highs.

Wanting forward, SMCI stays properly positioned with a number of demand drivers that may proceed to gasoline its AI-driven outsized development over the near-term earlier than normalization catches up within the long-run.

1. Accelerating demand for prime efficiency compute capability to help the arrival of AI

Demand for compute capability has ballooned because the debut of OpenAI’s ChatGPT and the next curiosity in AI developments it has prompted. As 2023 was dominated by the coaching of huge language fashions that underpin the event of AI applied sciences, 2024 is more likely to mark the start of a transition to the deployment and scaled utilization of mentioned options. This may accordingly introduce incremental AI workloads attributable to inferencing – the method of working the fashions and producing output (e.g., ChatGPT responses) – along with coaching exercise.

As training-related AI workloads began in 2023 “transfer into manufacturing” and go-to-market later this 12 months, with subsequent scaled utilization of mentioned options over the longer-term, inferencing exercise will inadvertently speed up. The trade at the moment expects inferencing exercise and spending to double that of coaching’s by mid-decade. And this pervasive use of generative AI options is anticipated to escalate demand for compute energy within the near-term, which accordingly fuels the construct part for associated infrastructure.

This underscores a strong demand backdrop for SMCI options, which stays provide constrained within the near-term. We consider the capital raised from its latest $1.5 billion convertible word issuance will alleviate a few of this bottleneck by bettering SMCI’s capacity in capitalizing on fast demand.

Particularly, in F2Q24, ballooning demand was noticed in SMCI’s outsized sequential development of greater than $1 billion, in addition to the speedy drop in days of stock by greater than 26%. In the meantime, liquidity and provide availability had been bottlenecks that precluded the corporate from capitalizing extra of the fast development alternatives. And this was corroborated by administration’s repeated emphasis on the necessity for extra working capital to help near- and longer-term development:

So, we’re various totally different alternatives [to raise capital]. And the explanation now we have to is as a result of we want extra working capital for development. And the explanation that our money flows weren’t as robust as final quarter was just because we grew by a lot.

Supply: SMCI F2Q24 Earnings Name Transcript.

Wanting forward, we consider the extra capital injection might take the corporate’s near-term development past present expectations. As talked about earlier, administration’s upward-revised income steerage for FY 2024 implies an annualized income run-rate of $20 billion exiting the fiscal fourth quarter. And this steerage has doubtless not but thought of the implications of SMCI’s latest $1.5 billion convertible word issuance, which was finalized after the earnings launch. Admittedly, convertible word issuances typically introduce a level of share dilution dangers, that are sometimes unfavorable to inventory efficiency. However SMCI’s latest issuance is more likely to yield fast ROI enlargement and compensate for mentioned dangers. Particularly, the extra capital is anticipated to assist higher handle pent-up demand for SMCI’s choices and pull ahead income realization.

This {couples} with broader enhancements in chip provide availability by means of calendar 2024, which had been just lately reaffirmed by a few of SMCI’s key suppliers and trade’s hottest AI chipmakers, Nvidia (NVDA) and Superior Micro Units (AMD). Paired with SMCI’s prudent funding into constructing greater than $1 billion of further stock ending F2Q24, the corporate is well-positioned to ramp up shipments over the approaching quarters to seize demand and help basic outperformance. By adequately addressing pent-up market demand and pulling ahead realization of related gross sales, SMCI additionally actively prevents loss to competitors over the longer-term. This enhances administration’s dedication to reinforcing long-term income high quality at SMCI and driving economies of scale, in our opinion.

2. Strong trade capex prioritization for AI infrastructure

As talked about within the earlier part, the transition from coaching to inferencing continues to be in its early phases – and so is the transition from CPU-based general-purpose computing to accelerated computing to deal with the more and more advanced and power-crunching workloads. This has accordingly incentivized trade capex prioritization on the build-out of AI-related infrastructure to help related workloads, which is favorable to SMCI’s present demand atmosphere.

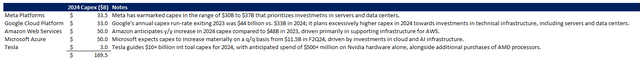

Particularly, important investments into the AI transformation are nonetheless on the way in which. Large tech alone has pledged ~$170 billion in calendar 2024 capex in direction of AI undertakings particular to information middle builds and different supporting technical infrastructure. And this fast alternative continues to underscore heated AI momentum and demand for SMCI merchandise over the near-term, no matter eventual normalization over the long-run.

Information compiled by creator

In the meantime, Nvidia CEO Jensen Huang has repeatedly emphasised the $1 trillion alternative that’s anticipated to return out of a speedy transition from CPU-based common goal to accelerated computing. And the extent of capex earmarked to broader AI developments over the longer-term is much more excessive. OpenAI’s Sam Altman is within the works of doubtless elevating $7 trillion to help the continued AI transformation, whereas SoftBank Group (OTCPK:SFTBY / OTCPK:SFTBF) founder Masayoshi Son can also be planning a $100 billion AI chip enterprise. All of this continues to underpin confidence within the longer-term outlook for AI developments and, inadvertently, sustained demand for SMCI’s experience.

3. A aggressive benefit in enabling scalability inside a performance-demanding atmosphere

SMCI additionally stays well-positioned to be a key beneficiary within the fast means of accelerating AI curiosity and ensuing demand for supporting infrastructure. Along with expanded capability and entry to bettering chip provides, the corporate additionally demonstrates a aggressive benefit in enabling scalability for patrons by means of its proprietary “constructing block structure” and superior cooling applied sciences.

Particularly, SMCI’s constructing block structure permits the corporate to ship “turnkey rack degree options to clients inside just a few weeks of putting an order”. And the constructing block structure is complemented by SMCI’s proprietary “rack scale plug-and-play” options that successfully reduces time-to-market, and addresses the present urgency for AI infrastructure build-out. The following value financial savings additionally optimizes effectivity features and permits scalability for patrons within the speedy AI transformation.

In the meantime, SMCI’s experience in liquid-cooling expertise – which is totally built-in in its rack scale plug-and-play options – additionally marks a aggressive benefit. Growing efficiency in CPU and GPU applied sciences aimed toward supporting demanding AI and different HPC workloads have subsequently intensified energy necessities and now runs “hotter” than its predecessors. And liquid-cooling shall be important to optimizing the efficiency and effectivity features of next-generation information facilities.

Particularly, SMCI’s proprietary liquid-cooling expertise can allow electrical energy value financial savings of as much as 89% in infrastructure cooling exercise, and as much as 40% within the operations of a knowledge middle as a complete. Liquid-cooling expertise can also be anticipated to enhance conventional air cooling as accelerated computing features momentum.

For example, the next-generation B100 GPUs from Nvidia are anticipated to have an influence consumption of greater than 1,000 watts every. This compares to present {hardware} that displays common energy consumption within the 600-watt to 700-watt vary, which might nonetheless be effectively managed by conventional air-cooling applied sciences.

The upcoming B100 GPUs underscore the start of a next-generation “1,000-watt GPU class” that may make liquid-cooling expertise a necessity for scalability and optimized TCO. And SMCI’s constructing block rack scale plug-and-play structure enhances the state of affairs by being available for transition with out important changes to present infrastructure. This additional permits scalability for patrons, and accordingly reinforces SMCI’s place as a share gainer within the ongoing AI transformation.

Basic Issues

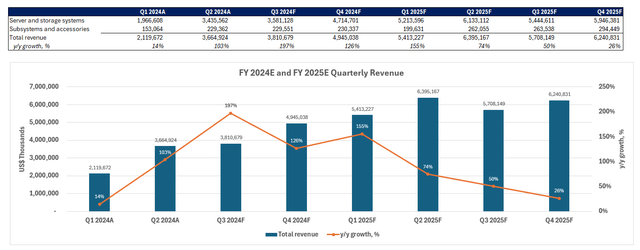

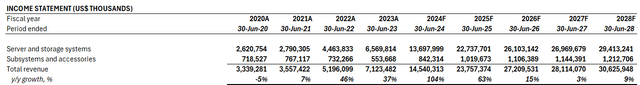

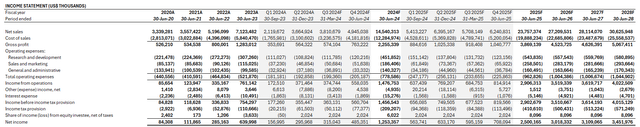

Taken collectively, we count on SMCI income to develop by 104% y/y in FY 2024 to $14.5 billion. That is largely in step with administration’s steerage and SMCI’s tempo of acceleration noticed by means of F1Q24.

Writer

Though we’re optimistic that the latest further capital injection shall be favorable to SMCI’s development outlook, associated deployments are unlikely to translate into actual gross sales till later FY 2024 and extra prominently in FY 2025. Particularly, we count on the newly injected capital and its subsequent deployment into ongoing development initiatives – resembling provide procurement, stock construct, and capability enlargement – to take time in ramping up.

Because of this, our forecast expects a stronger income step-up heading into FY 2025. The anticipated development acceleration timeline additionally enhances the continued enchancment of chip provide by means of calendar 2H24, and the upcoming addition of incremental manufacturing capability from SMCI’s Silicon Valley and Malaysia amenities. In addition they coincides with the rolling availability and subsequent cargo ramp-up of SMCI’s upcoming merchandise based mostly on new buyer platforms, resembling Nvidia’s B100 GPUs, AMD MI300X/MI300A accelerators, and Intel’s (INTC). Gaudi 3 accelerators.

Writer

Regardless of near-term gross margin compression anticipated by administration, bettering working leverage enabled by continued outsized development shall be favorable to SMCI’s backside line. Particularly, worthwhile development is SMCI’s focus and long-term theme.

Admittedly, its near-term concentrate on gaining market share, whereas additionally constructing high quality income for the long-run by prioritizing massive clients, is anticipated to weigh on near-term gross margins. However the sizable income step-up consequently will compensate by driving economies of scale. That is corroborated by the $1+ billion sequential step-up in F2Q24 income, and substantial earnings development noticed over the identical interval. The newest outcomes already present validation for SMCI’s technique, and bettering provide availability within the coming quarters are more likely to be incrementally favorable to the corporate’s backside line efficiency.

As talked about by administration, development shall be primarily pushed by quantity features within the near-term, and finally be accompanied by ASU enlargement within the long-run. This accordingly underscores the potential for gradual gross margin enlargement again to the beforehand focused 17% vary, which shall be complementary to the sturdiness of SMCI’s present tempo of revenue enlargement enabled by economies of scale.

Writer

Value Issues

We anticipate one other leg-up in SMCI’s inventory value this 12 months. We see $1,300 as an affordable marketplace for the inventory’s subsequent milestone, whereas a possible alternative within the low $1,100-range awaits.

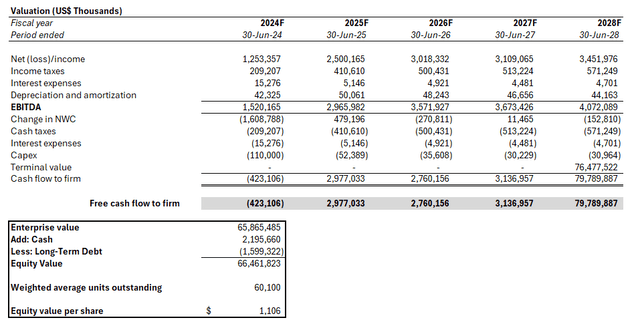

Particularly, by working a reduced money circulate (“DCF”) evaluation on projections taken at the side of the foregoing basic evaluation, together with conservative valuation assumptions, SMCI presents an estimated intrinsic worth of about $1,106.

Writer Writer

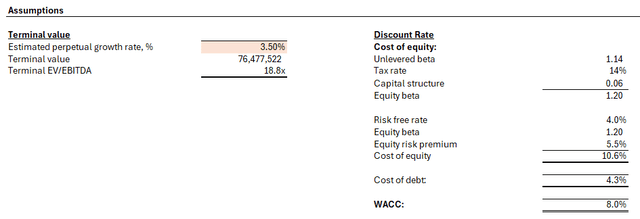

The estimated value of $1,106 is derived by making use of a terminal worth based mostly off of a 3.5% perpetual development price on SMCI’s projected FY 2028 EBITDA. The three.5% perpetual development price is in step with the estimated upper-range tempo of financial enlargement throughout SMCI’s core working areas, and aligns with the corporate’s outlook. The evaluation additionally considers an 8% WACC, which is in step with SMCI’s capital construction and threat profile.

We view the $1,106 degree as a sexy entry alternative within the near-term, particularly contemplating latest market volatility. Particularly, market darling Nvidia’s speedy declines final week, alongside hotter-than-expected February CPI/PPI information, has launched some risk-off sentiment. Paired with the anticipated cooldown in demand for SMCI shares instantly following its S&P 500 inclusion, ensuing volatility might doubtlessly push the inventory to its estimated intrinsic worth of about $1,106 below conservative valuation consumptions.

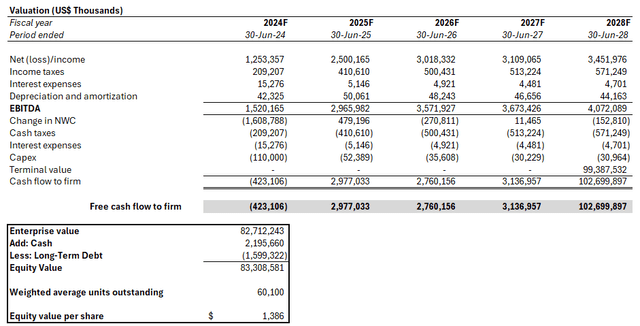

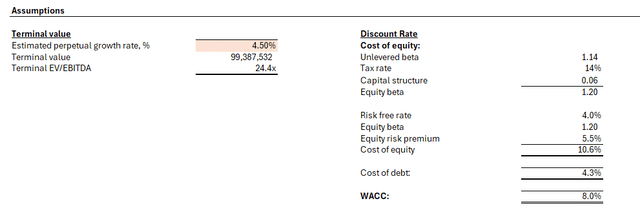

Nonetheless, based mostly on SMCI’s outsized development prospects, in addition to AI momentum that’s anticipated to stay sizzling over coming quarters, we consider its valuation warrants a premium. By working a DCF evaluation on the identical basic projections and eight% WACC, however with a premium implied perpetual development price of 4.5% utilized on FY 2028 EBITDA, SMCI would yield an estimated intrinsic worth of $1,386 apiece.

Writer Writer

We consider the premium 4.5% perpetual development price is warranted, given expectations for SMCI to outperform development expectations over the approaching quarters. The premium terminal worth assumption can also be in step with ranges noticed at successful AI friends resembling Nvidia and Microsoft (MSFT). Particularly, SMCI’s elevated working capital place to fund development, together with bettering provide availability, characterize rising tailwinds for outsized share seize. The mixture can also be favorable to its backside line and, inadvertently, money flows underpinning SMCI’s valuation.

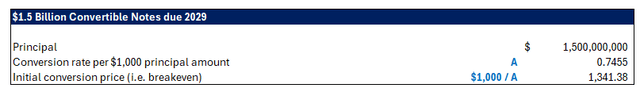

The explanation we set our value goal at $1,300 as a substitute of $1,386 is because of incremental consideration of the implications of SMCI’s $1.5 billion convertible notes. Particularly, the $1.5 billion convertible providing entitles 0.7455 shares per $1,000 principal quantity. The SMCI inventory had a closing value of $975.52 per share on the day of the providing. The set-up implies an preliminary conversion value of $1,341.38 per share on the convertible notes.

Information from ir.supermicro.com

Within the occasion that SMCI’s share value approaches our value goal of $1,386 per share, it might set off the preliminary conversion value and doubtlessly introduce further shares into the market. The convertible notes are estimated to additional dilute SMCI’s share rely by including about 1.1 million shares ($1.5 billion principal, divided by $1,341.38 preliminary conversion value). Including this to administration’s at the moment guided diluted share rely of 60.1 million shares would subsequently scale back our value goal to about $1,360. Paired with anticipated volatility that sometimes accompanies share dilution, we consider $1,300 makes a good value goal for the inventory.

Conclusion

We count on SMCI’s development engine to run full steam within the near-term, as AI demand continues to speed up. That is corroborated by a nonetheless supply-constrained atmosphere, with sturdy demand underpinned by the accelerating transition to inferencing workloads the place compute capability necessities will bounce by a number of folds. SMCI additionally displays a aggressive benefit in enabling scalability by means of its proprietary applied sciences, which is enticing to clients at the moment targeted on the speedy build-out of AI infrastructure.

Taken collectively, Tremendous Micro Laptop, Inc. stays properly positioned for a shock to the upside in its near-term basic efficiency, underpinning additional a number of enlargement for the inventory. Because of this, we’re sustaining our purchase score on the inventory.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.