z1b

Shares of Tremendous Micro Pc (NASDAQ:SMCI) have been on a tear this 12 months, hovering 296% for the reason that begin of the 12 months on robust progress outcomes proven within the firm’s FQ2’24 earnings card and surging investor curiosity in an organization that’s benefiting from the AI revolution. Tremendous Micro Pc even out-performed Nvidia (NVDA) YTD and the corporate has simply been included within the S&P 500 inventory market index. Whereas the IT options and server firm has seen vital high line and earnings progress within the final 12 months, I imagine shares are probably overvalued as they commerce at 6X the common P/E within the final three years. They’re additionally overbought primarily based off of RSI which represents correction dangers and signifies that latest features have been mainly pushed by FOMO-buyers. Though SMCI clearly has quite a lot of progress potential associated to the mainstreaming of AI functions, I’d warning in opposition to shopping for Tremendous Micro Pc on the present valuation degree!

Mainstreaming of AI has been an accelerant for Tremendous Micro’s server enterprise progress

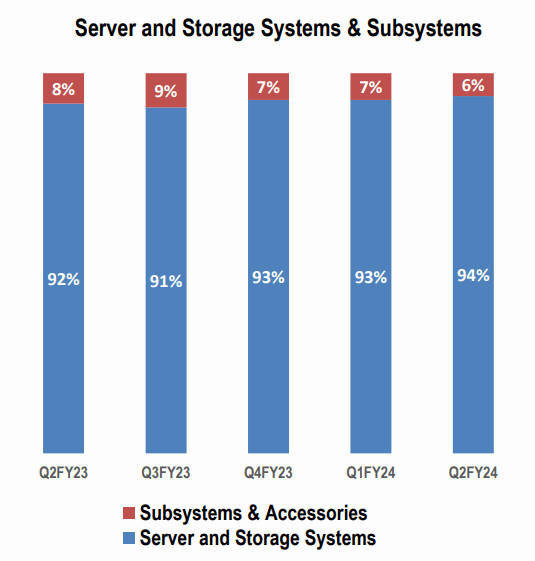

Tremendous Micro gives IT options and builds server and storage methods for information facilities. The corporate is offering server methods for an entire vary of industries reminiscent of information facilities, cloud, and edge computing. Server and storage methods, optimized to accommodate AI functions, have seen hovering demand recently which advantages Tremendous Micro’s core product providing. Servers and storage methods represented 94% of Tremendous Micro’s income combine.

Tremendous Micro

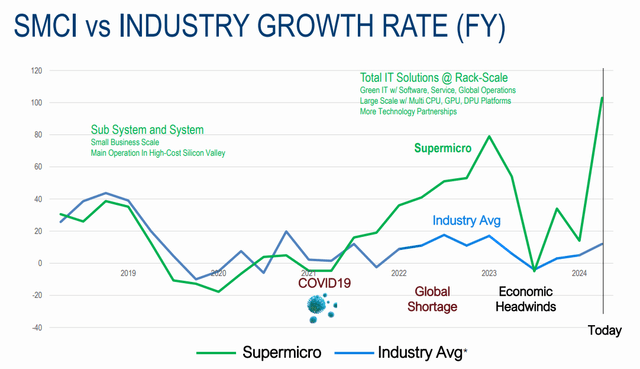

The primary catalyst that Tremendous Micro is seeing in its enterprise is the mainstreaming of synthetic intelligence functions, which is boosting the corporate’s AI-optimized server merchandise, a core product that has emerged as a income driver for the corporate within the final 12 months. This accelerating demand for AI-optimized servers has allowed the corporate to develop 5 occasions sooner than the trade within the final 12 months.

Tremendous Micro

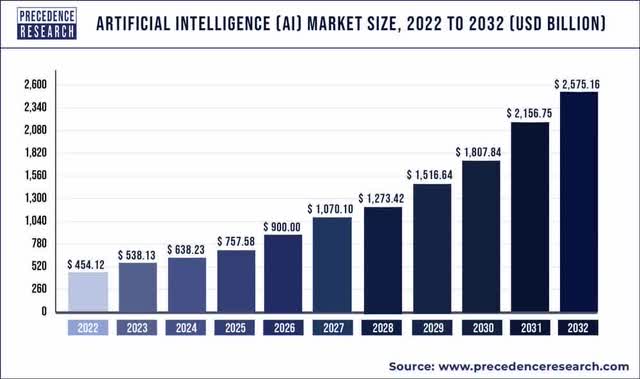

The market potential for AI computing options is clearly solely rising. With extra firms utilizing synthetic intelligence merchandise of their companies to seize cost-savings, scale their IT transformations and supply higher and sooner service to clients, firms working within the AI realm are spectacular progress prospects, each within the quick and in the long run.

Priority Analysis initiatives that the scale of the worldwide synthetic intelligence market goes to extend by an element of 4.8X between 2023 and 2032. This means a synthetic intelligence market measurement of roughly $2.6T by 2032 which calculates to an annual common market growth price of virtually 20% (Supply). Corporations like Tremendous Micro and Nvidia, to call simply two, are on the very heart of this AI revolution.

Priority Analysis

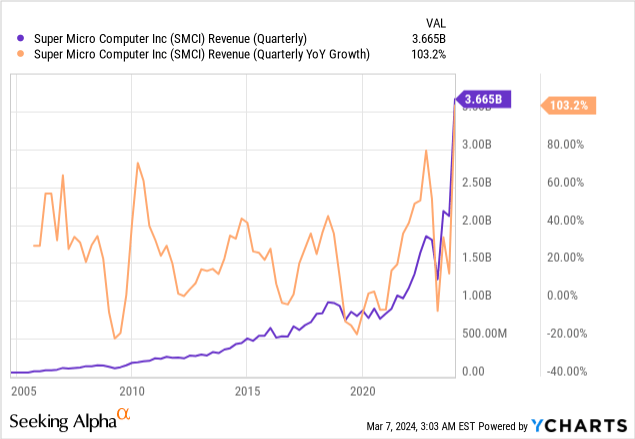

Tremendous Micro’s has seen a major acceleration of its high line progress most not too long ago: the corporate’s income base doubled in its second fiscal quarter (the quarter ended December 31, 2023). Tremendous Micro generated $3.7B in revenues in the newest quarter, displaying 103% 12 months over 12 months progress resulting from accelerating demand for AI servers. Demand can also be a lot stronger than the corporate’s forecast for FQ2’24 indicated: Tremendous Micro initially anticipated solely $2.7-2.9B in revenues for the final 12 months. Going ahead, demand for server methods is unlikely to gradual given the huge AI tailwind which in flip represents a progress alternative for Tremendous Micro’s core product.

These income achievements sq. with Nvidia’s outcomes for the newest quarter on which the corporate’s CEO, Jensen Huang, commented as the corporate seeing a “tipping level” in AI adoption. I mentioned Nvidia’s income trajectory in my work: Classes Realized From My Worst Name Ever (Ranking Improve).

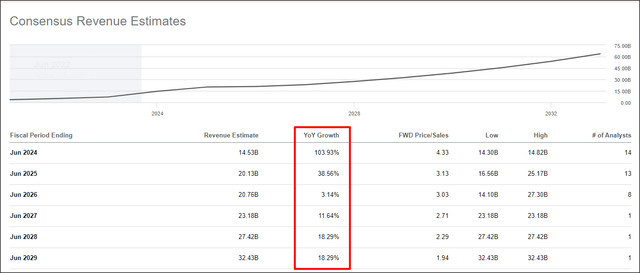

The outlook for income progress stays favorable with the consensus estimate at the moment calling for a doubling of Tremendous Micro’s income base on a full-year foundation. Nonetheless, the corporate’s high line progress price is about to normalize subsequent 12 months and the common annual income progress price within the subsequent 5 years is about to drop to 17% yearly which is way nearer to the AI market growth price.

Searching for Alpha

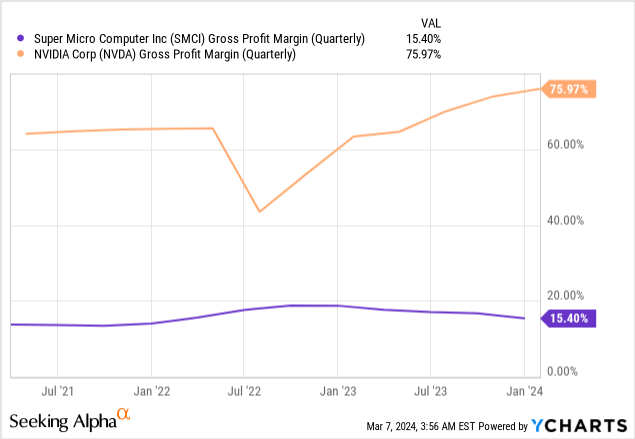

What I don’t like about Tremendous Micro: weak gross revenue margin pattern

Whereas the market outlook, the increasing measurement of the AI pie and Tremendous Micro’s AI-supportive server methods are favorable developments, the agency’s margin state of affairs doesn’t look almost pretty much as good… a minimum of not when in comparison with Nvidia.

Nvidia’s gross revenue margin as of the newest quarter was 76% which was virtually 5 occasions larger than Tremendous Micro’s gross margin of 15%. Moreover, Nvidia was capable of translate its hovering income base into vital gross revenue margin growth within the final 12 months (+12.7 PP Y/Y) whereas Tremendous Micro’s gross revenue margins declined in each single quarter (-3.3 PP Y/Y).

The explanation for that is that Nvidia has gotten an early begin with its H100 GPU that’s getting used to run AI functions which translated to vital pricing energy. Nvidia can cost high greenback for its GPUs and a normal scarcity of AI GPUs has solely additional established Nvidia as a market chief on this phase. From a gross margin perspective, I imagine Tremendous Micro leaves a lot to be desired…

S&P 500 index inclusion

SMCI made information after it was introduced that the corporate goes to be included within the S&P 500 index, which many traders comply with carefully. S&P 500 index inclusion is usually a optimistic catalyst for shares resulting from their larger visibility for traders.

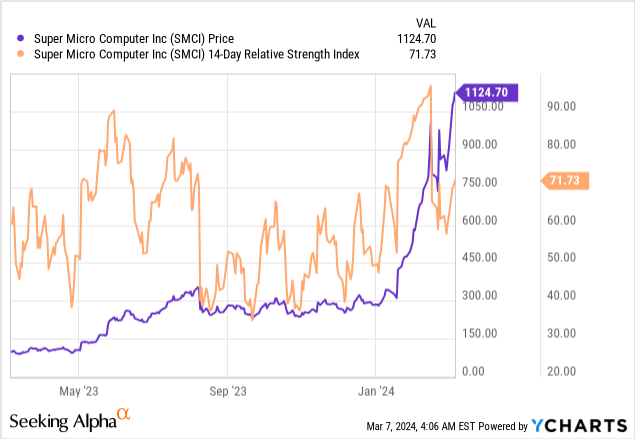

Tremendous Micro’s sentiment and valuation

Shares of Tremendous Micro have soared this 12 months and at the moment are overbought primarily based off of the Relative Energy Index as nicely. The RSI (at the moment at 71.73) signifies that Tremendous Micro is extensively overbought proper now which might foreshadow a minimum of a minor correction to the draw back within the close to future.

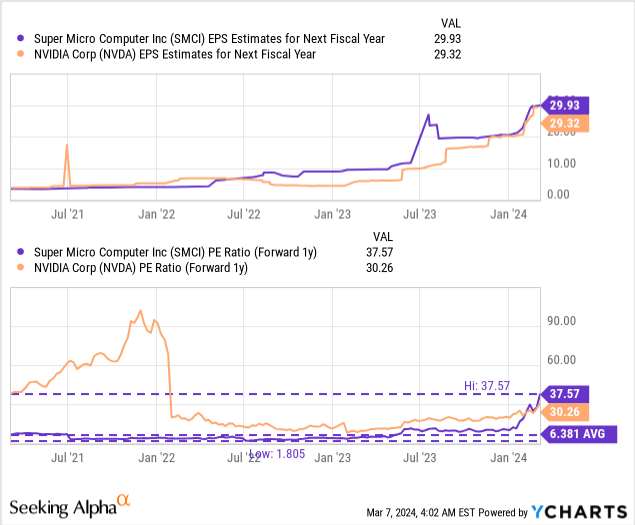

Rather more attention-grabbing than the technical profile is the valuation setup for Tremendous Micro. Sadly, the latest value surge has fully decoupled Tremendous Micro’s present earnings multiplier from the corporate’s previous valuation averages.

Tremendous Micro’s valuation now additionally exceeds Nvidia’s valuation, though Nvidia has considerably larger gross margins and stronger incremental earnings potential because of this. Tremendous Micro and Nvidia have about the identical quantity of per-share earnings anticipated for FY 2025, however SMCI is 24% dearer than Nvidia, from a multiplier perspective.

Nvidia trades at 30.3X ahead earnings in comparison with a P/E ratio of 37.6X for Tremendous Micro. Nonetheless, the overvaluation of SMCI turns into extra obvious within the context of the corporate’s historic P/E: within the final three years, SMCI traded at a median P/E ratio of solely 6.4X. The FY 2025 P/E ratio is almost 5.9 occasions larger than the 3-year common P/E, indicating at Tremendous Micro’s valuation is a minimum of pushed by hypothesis and hope for fast features. I said in my Nvidia article {that a} 25X P/E ratio could also be extra affordable for Nvidia which I additionally occur to imagine applies to Tremendous Micro. A 25X “honest worth P/E” implies a good worth of $750 at which I level I could contemplate shopping for into SMCI.

Dangers with Tremendous Micro

Clearly, the valuation is a giant danger for the know-how firm. AI functions are rising and so is the demand for AI servers and GPUs, however at almost 6 occasions the common P/E ratio within the final three years, traders are prone to falling right into a FOMO (fear-of-missing-out) lure. I imagine the 2 greatest business dangers for Tremendous Micro at this level are slowing progress within the essential AI server market and a continuation of the weaker margin pattern. What would change my thoughts about SMCI is that if the corporate noticed gross margin growth and if it maintained its high line momentum past FY 2024.

Closing ideas

Tremendous Micro’s shares have soared by virtually 300% since January and whereas many appear to imagine the rally will proceed after the corporate has been included within the widely-followed S&P 500 index, my opinion is that traders are stepping right into a FOMO lure and may take note of the corporate’s valuation.

With shares buying and selling at 37X ahead earnings, it appears to me that the agency’s progress is greater than absolutely valued and shares are clearly prone to revenue taking. SMCI seems considerably overvalued in a historic context, but additionally relative to Nvidia which is considerably extra worthwhile than Tremendous Micro. Whereas I don’t suggest to quick Tremendous Micro primarily based off of its stretched valuation and overbought RSI standing, I positively would name for warning right here. Whereas the enterprise does have momentum, a consolidation would probably supply traders a significantly better entry level into Tremendous Micro!