US Greenback (DXY) Newest Evaluation and Charts

- S&P PMIs – companies miss, manufacturing improves

- The US greenback holds earlier good points.

The US service sector slowed down in February, whereas the manufacturing sector picked up, the newest flash PMIs confirmed at present. In accordance with information supplier S&P World,

‘US corporations continued to report an growth in exercise throughout February, albeit at a slower tempo. Output rose marginally as a softer uptick in companies enterprise exercise weighed on general development. Manufacturing, in the meantime, noticed a renewed enhance in manufacturing amid an enchancment in provide chains after opposed climate in January.’

Commenting on the information, Chris Williamson, Chief Enterprise Economist at S&P World Market Intelligence stated: “The early PMI information for February point out that the US financial system continued to broaden halfway by way of the primary quarter, pointing to annualized GDP development within the area of two%. Though service sector development cooled barely, manufacturing staged a welcome return to development, with manufacturing unit output rising on the quickest fee for ten months.”

Obtain our free information and the way to commerce financial information releases

Advisable by Nick Cawley

Buying and selling Foreign exchange Information: The Technique

For all financial information releases and occasions see the DailyFX Financial Calendar

Throughout the US session, 4 Federal audio system – Jefferson, Harker, Prepare dinner, and Kashkari – will give their views on the well being of the US financial system after final night time’s FOMC minutes gave little away.

US Greenback Trims Losses After Fed Minutes Warning In opposition to Untimely Charge Cuts

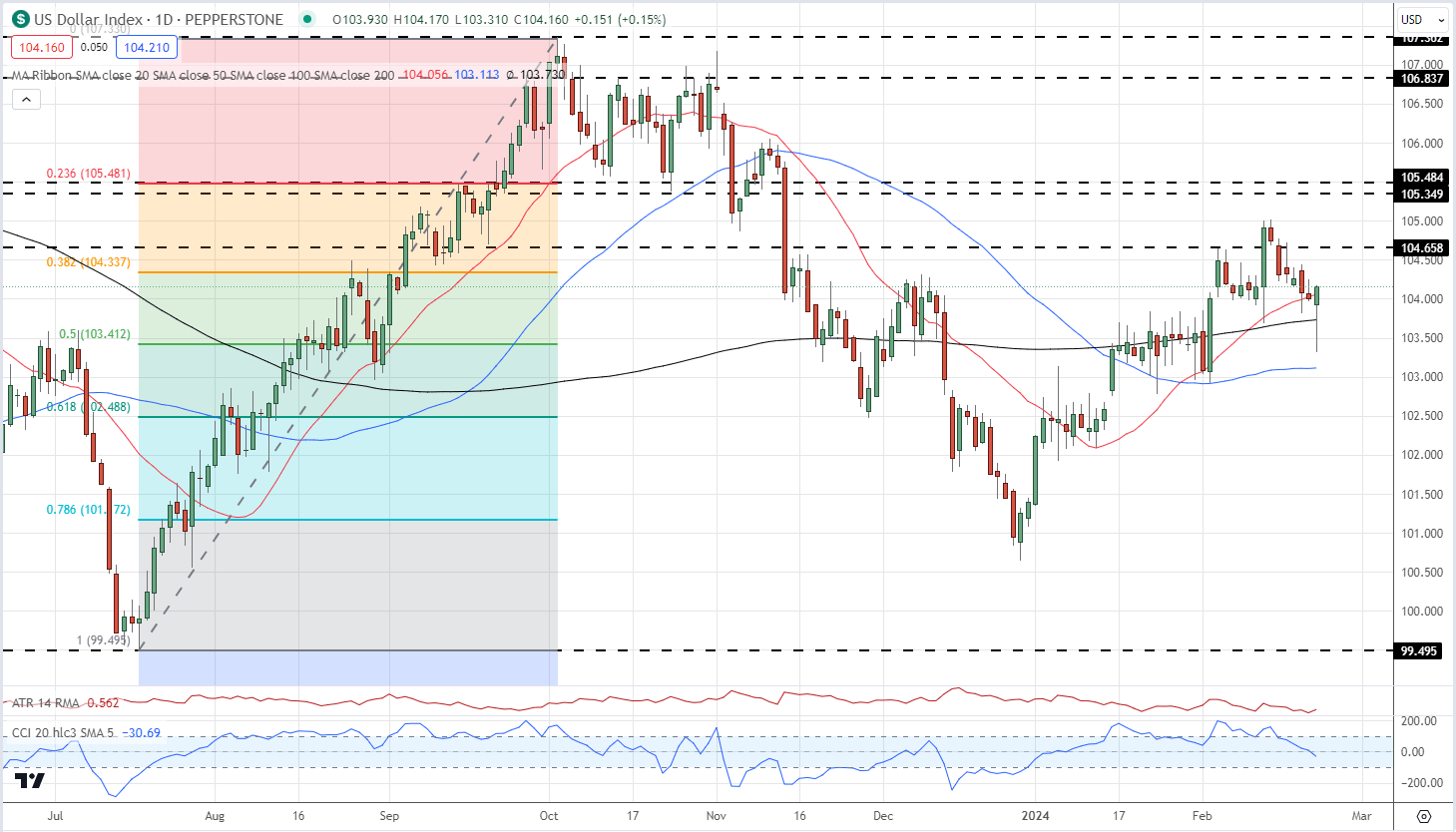

The US greenback opened the European session across the 103.50 stage earlier than firming up through the day. The US greenback index (DXY) presently trades round 104.10 and is making an attempt to interrupt a week-long sequence of decrease highs and decrease lows off final Wednesday’s 105.02 excessive. US rate of interest chances are pricing in between three and 4 25 foundation level fee cuts this 12 months with the primary reduce penciled in on the June twelfth FOMC assembly.

US Greenback Index Every day Chart

Chart through TradingView

Obtain our Free Q1 US Greenback Technical and Elementary Forecasts:

Advisable by Nick Cawley

Get Your Free USD Forecast

What’s your view on the US Greenback – bullish or bearish?? You’ll be able to tell us through the shape on the finish of this piece or you’ll be able to contact the creator through Twitter @nickcawley1.