Inquisitive about the place the British pound is headed? Discover all of the insights in our Q1 buying and selling forecast. Request your free buying and selling information immediately!

Really useful by Diego Colman

Get Your Free GBP Forecast

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD prolonged losses on Wednesday, however narrowly prevented breaking decisively under cluster assist at 1.2560, the place the 200-day easy shifting common converges with a short-term rising trendline. To forestall additional deterioration in cable’s outlook, bulls want to guard this ground in any respect prices; failure to take action may lead to a pullback in the direction of 1.2500 and presumably even 1.2455.

Within the case of a bullish turnaround, the primary technical ceiling to think about is situated across the psychological 1.2600 mark, adopted by 1.2675, situated close to the 50-day easy shifting common. Extra positive aspects past this level would possibly shift focus to trendline resistance at 1.2735. Persevering with upwards, the highlight could then transfer in the direction of 1.2830.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Utilizing TradingView

Keen to find how retail positioning can affect EUR/GBP’s short-term trajectory? Our sentiment information has precious insights about this subject. Seize a free copy now!

| Change in | Longs | Shorts | OI |

| Day by day | -15% | 50% | -2% |

| Weekly | -19% | 35% | -8% |

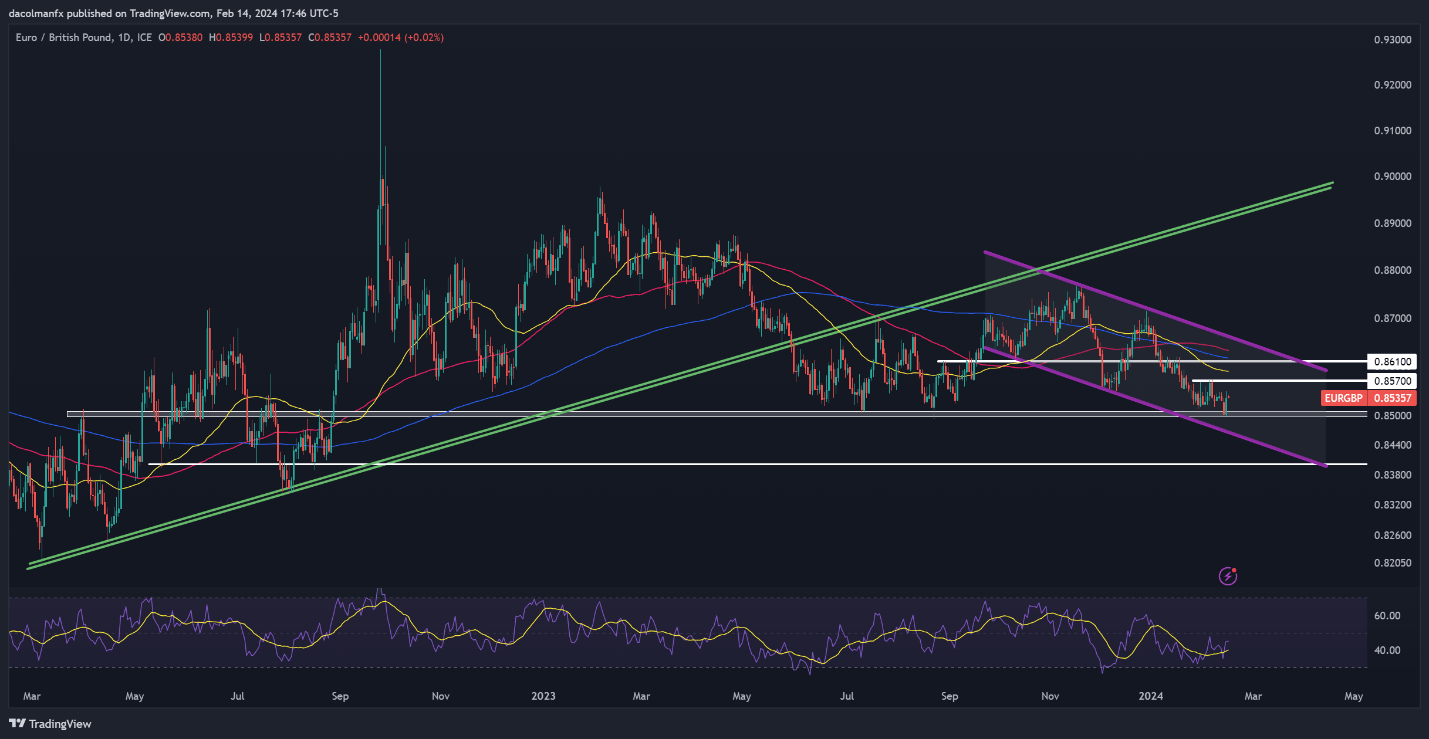

EUR/GBP FORECAST – TECHNICAL ANALYSIS

EUR/GBP has been in a sustained downtrend since late 2023, marking impeccable decrease highs and decrease lows by way of the retracement interval. This week, the pair fell to its weakest level in almost six months earlier than mounting a modest comeback after bouncing off a key technical ground round 0.8500.

To see an enchancment within the euro’s place relative to the British pound when it comes to market sentiment, it’s essential for the trade price to remain above 0.8500. If this situation is just not met and costs break under this ground, a speedy descent in the direction of channel assist at 0.8465 could ensue. From right here onwards, further losses may direct consideration to 0.8400.

Then again, if EUR/GBP continues to construct on its rebound from Wednesday and extends greater within the coming buying and selling classes, the primary technical resistance on the street to restoration looms at 0.8570, adopted by 0.8590. Above these boundaries, the 200-day easy shifting common is prone to be the following line of protection towards a bullish assault.

EUR/GBP TECHNICAL CHART

EUR/GBP Char Creating Utilizing TradingView

Feeling discouraged by buying and selling losses? Take management and enhance your technique with our information, “Traits of Profitable Merchants.” Entry invaluable insights that can assist you keep away from frequent buying and selling pitfalls and dear errors.

Really useful by Diego Colman

Traits of Profitable Merchants

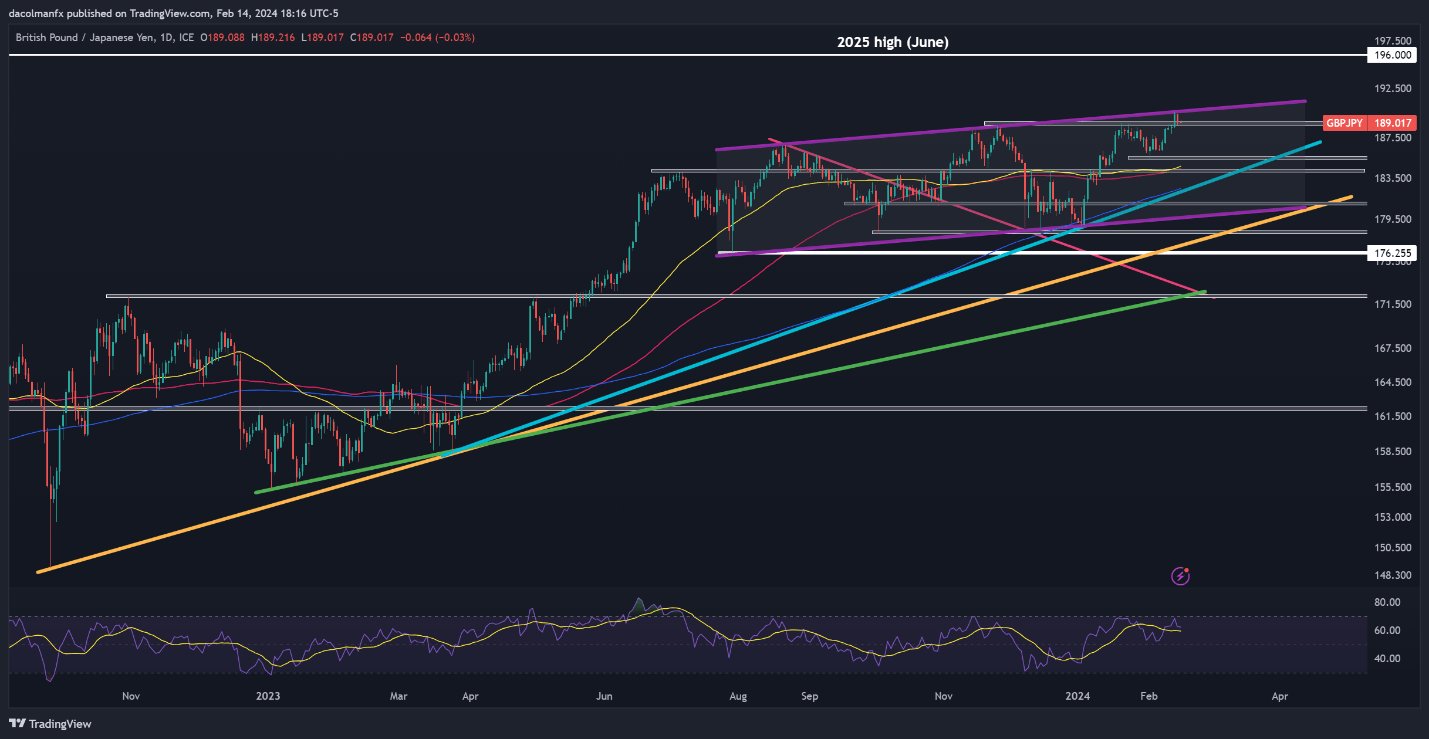

GBP/JPY FORECAST – TECHNICAL ANALYSIS

GBP/JPY rallied on Tuesday, blasting previous its latest excessive and hitting its greatest stage since August 2015. Costs, nevertheless, downshifted the following day, sliding again in the direction of the 189.00 mark when the bulls had been unable to take out channel resistance at 190.00. If the reversal accelerates and the pair loses the 189.00 deal with within the coming day, a pullback in the direction of 185.50 may very well be on the horizon.

Then again, if GBP/JPY pivots to the upside within the path of the broader uptrend from its present place, overhead resistance is situated close to 190.00, as acknowledged earlier than. Though breaching this technical ceiling would possibly show difficult for the bullish camp, a clear and clear breakout may lead consumers to set their sights on the 2025 highs close to 196.00.

GBP/JPY TECHNICAL CHART

GBP/JPY Chart Created Utilizing TradingView