Most Learn: US Greenback Jumps After NFPs Smash Estimates, Gold Slumps

The U.S. greenback surged on Friday after financial information revealed that U.S. employers added 353,000 employees in January, practically double market expectations. The exceptionally sturdy job creation, together with red-hot common hourly earnings, indicators that the financial system is holding up remarkably nicely and will even be reaccelerating, a state of affairs that might deter the Fed from transferring off its restrictive stance imminently.

Instantly following the discharge of the NFP report, Treasury yields rocketed upwards, as merchants unwound dovish bets on the central financial institution’s coverage path. These strikes could acquire traction within the close to time period if incoming data stays according to sturdy progress and sticky inflation. Because of this, it’s crucial to keep watch over the financial calendar within the coming weeks.

US DOLLAR (DXY INDEX) & US YIELDS

Supply: TradingView

Placing fundamentals apart, this text will concentrate on the technical outlook for 3 U.S. greenback pairs: EUR/USD. USD/JPY and GBP/USD, dissecting necessary value thresholds that needs to be on each dealer’s radar within the coming days following the U.S. employment report – a launch that introduced important volatility to FX markets.

Occupied with studying how retail positioning can provide clues about EUR/USD’s near-term trajectory? Our sentiment information has beneficial insights about this matter. Obtain it now!

| Change in | Longs | Shorts | OI |

| Day by day | 42% | -36% | -2% |

| Weekly | 26% | -29% | -2% |

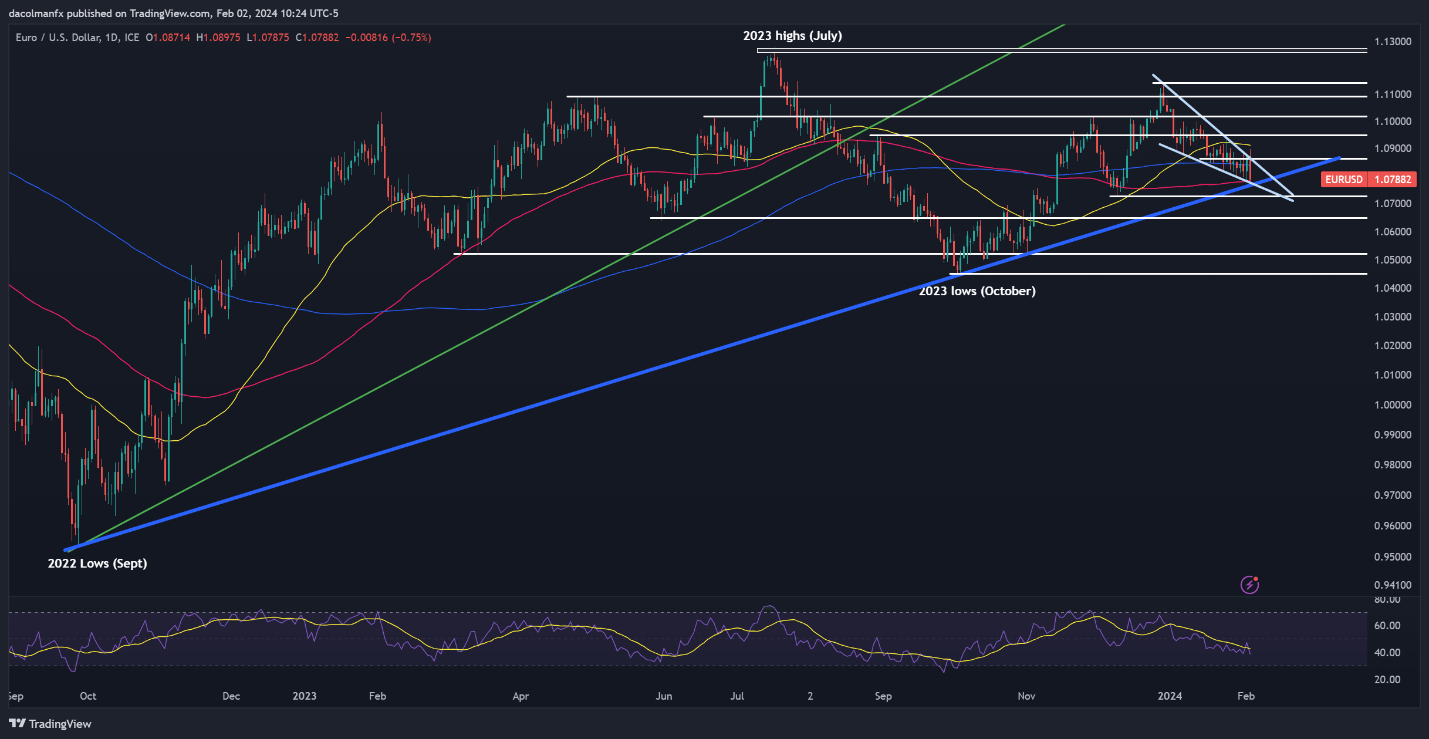

EUR/USD TECHNICAL ANALYSIS

EUR/USD was on observe to interrupt the higher boundary of a falling wedge however took a pointy flip to the draw back following the U.S. jobs report, dropping in the direction of cluster help at 1.0780. The bulls have to defend this stage vigorously; failure to take action might push costs in the direction of 1.0730, adopted by 1.0650.

Within the occasion that EUR/USD manages to reverse larger from its present place, technical resistance extends from 1.0840 to 1.0860. Above this key vary, the market focus will possible be on the 50-day easy transferring common at 1.0915, adopted by 1.0950.

EUR/USD TECHNICAL ANALYSIS CHART

For a whole overview of the yen‘s prospects, request your complimentary Q1 buying and selling forecast now!

Really helpful by Diego Colman

Get Your Free JPY Forecast

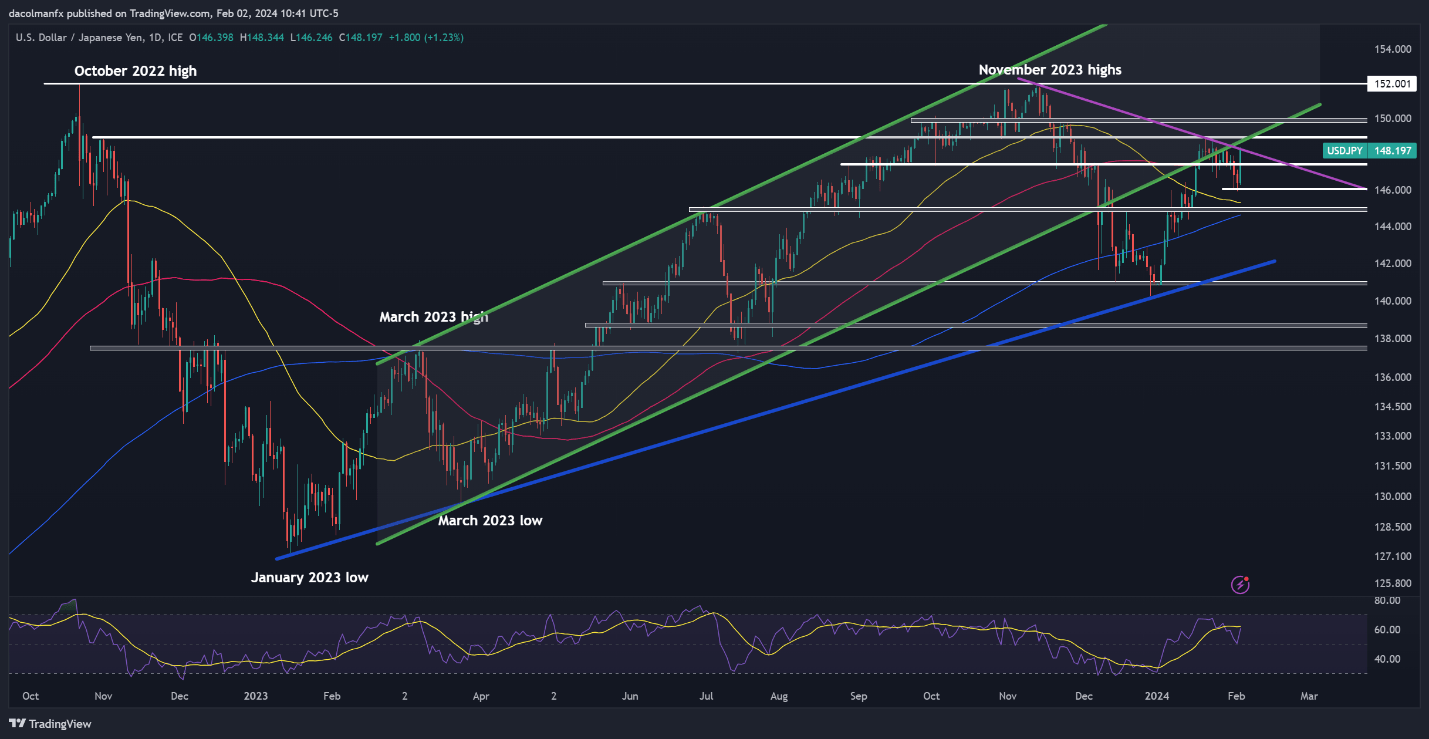

USD/JPY TECHNICAL ANALYSIS

USD/JPY blasted larger on Friday, breaking previous key ranges, and urgent towards trendline resistance at 148.35. With bullish momentum on the U.S. greenback’s aspect, the pair could quickly overcome this barrier, doubtlessly initiating a transfer in the direction of 148.90. Additional energy might result in a rally in the direction of 150.00.

Conversely, if sellers reappear and set off a pullback, preliminary help could be discovered close to the 100-day easy transferring common round 147.40. If costs dip under this stage, a retracement in the direction of 146.00 and probably even 145.30 can’t be dominated out.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

Need to know extra in regards to the British pound‘s outlook? Discover all of the insights in our Q1 buying and selling forecast. Request a free copy now!

Really helpful by Diego Colman

Get Your Free GBP Forecast

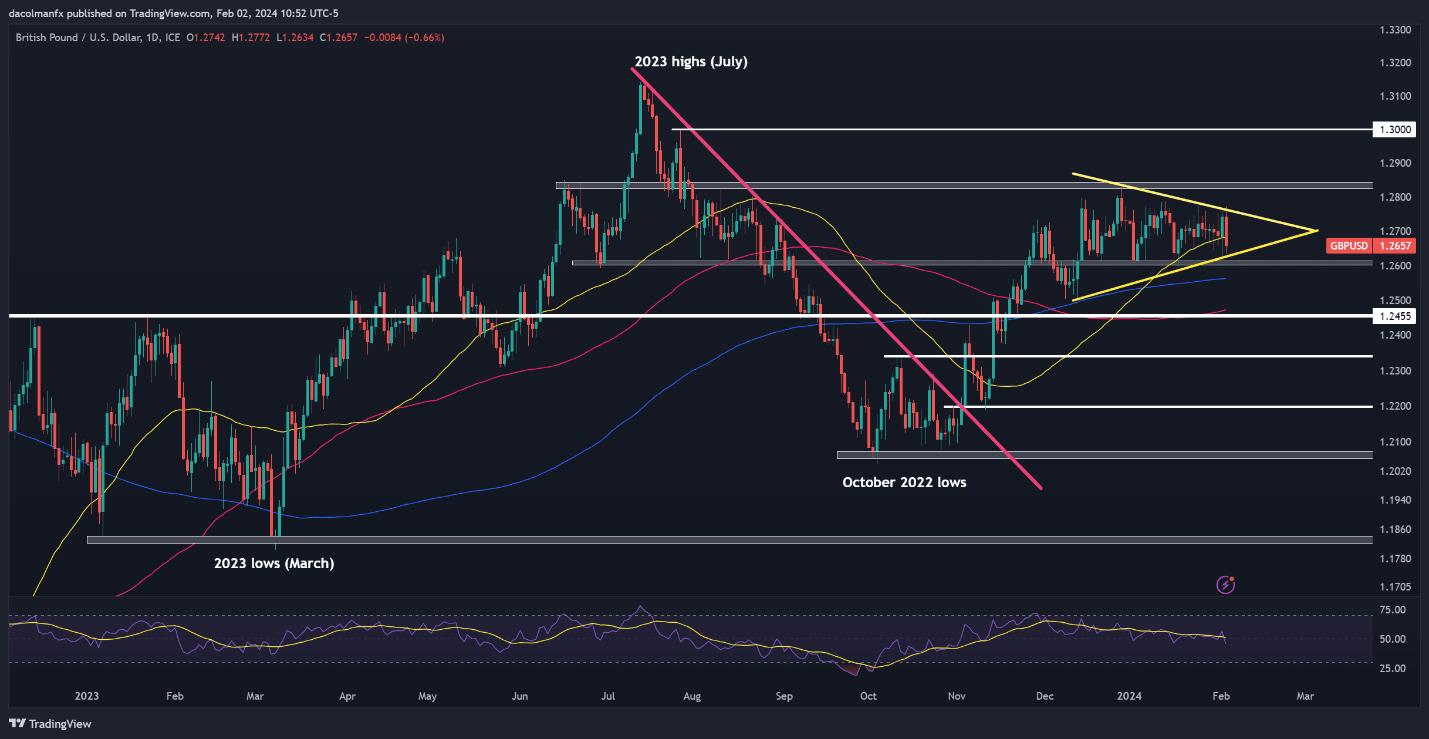

GBP/USD TECHNICAL ANALYSIS

GBP/USD has spent current weeks consolidating inside a symmetrical triangle, a continuation sample characterised by two converging trendlines: a rising one linking a sequence of upper lows and a falling one connecting a sequence of decrease highs.

Symmetrical triangles are validated when costs push past the boundaries of geometric form, with a stronger affirmation sign if the breakout aligns with broader development in play.

For GBP/USD, merchants ought to monitor two crucial ranges: resistance at 1.2750 and help at 1.2630. A breach of help could lead the bearish camp to focus on ranges resembling 1.2600, 1.2560, and 1.2455. In the meantime, a breach of resistance might convey into focus 1.2830 and doubtlessly 1.3000.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Utilizing TradingView