StockGood

Shares continued to rebound yesterday to the extent that the S&P 500 recovered all of final week’s losses and now sits simply 0.3% from a brand new all-time excessive. The sector management to date this yr is an uncommon combine with healthcare main the pack, adopted by communications companies, as development and worth battling for the lead in an total enhancing surroundings for market breadth. Whereas I’ve been anticipating new all-time highs for a while, I used to be additionally anticipating a pullback or interval of consolidation upfront of that new excessive as we started the brand new yr. I’m not assured that the two% drawdown over the primary 4 days of buying and selling will do the trick. Subsequently, I’m reviewing a few of the technical indicators I take advantage of, each brief and long run, to conclude what the potential draw back may be from right here for the broad market.

Finviz

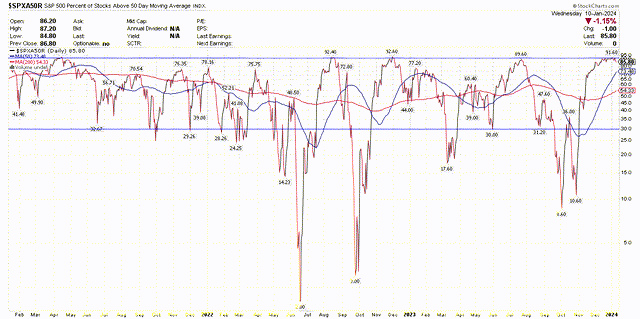

One among my favourite short-term indicators is the proportion of shares buying and selling above their 50-day shifting common for a selected index. With respect to the S&P 500, the proportion tends to peak at 90% and backside round 30%. There are a number of excessive instances the place the proportion has fallen to single digits, which have clearly been significant shopping for alternatives. After peaking at 91.6% simply days in the past, we sit at 85.8%, which has hardly resolved the overbought situation that existed in late December. Actually, each time the proportion has risen above 70% over the previous three years there was a subsequent decline to at the least 30%. One thing like this has occurred inside just some weeks.

Stockcharts

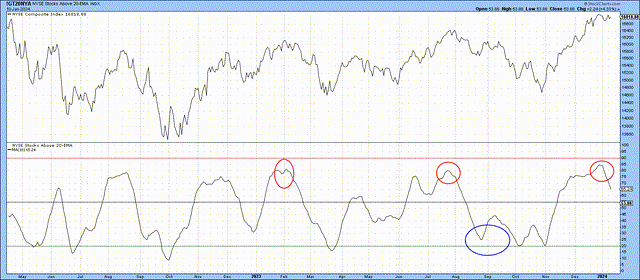

I wish to couple this indicator with the proportion of shares on the New York Inventory Change (roughly 2,400) which are buying and selling above their 20-day exponential shifting common (EMA). In a similar way, this indicator peaks near 90% and bottoms round 20%. It was this indicator that gave me pause final yr in each late February and July, as I famous concern that we might even see a pullback or interval of consolidation within the main market indexes. I used to be early in calling for an finish to the autumn correction, as this indicator approached 20% however didn’t pierce it. That didn’t occur till early October, however the truth that we remained in a bull market uptrend bailed me out of that early name.

Stockcharts

At the moment, be aware that we now have made some significant progress in bringing this proportion right down to its imply, however there’s additional to go at roughly 65% earlier than this indicator screams short-term shopping for alternative.

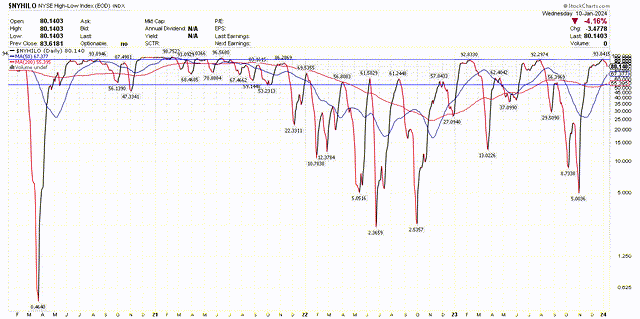

I additionally comply with the New York Inventory Change Excessive-Low Index, which calculates the proportion of shares reaching new 52-week highs relative to the whole variety of new highs plus new lows. It’s a breadth indicator that’s its most helpful at extremes. Its latest excessive of 93.8% was an excessive, however it has now fallen to 80%. Even when breadth stays robust, a stage nearer to 60-70% would point out a wholesome pullback.

Stockcharts

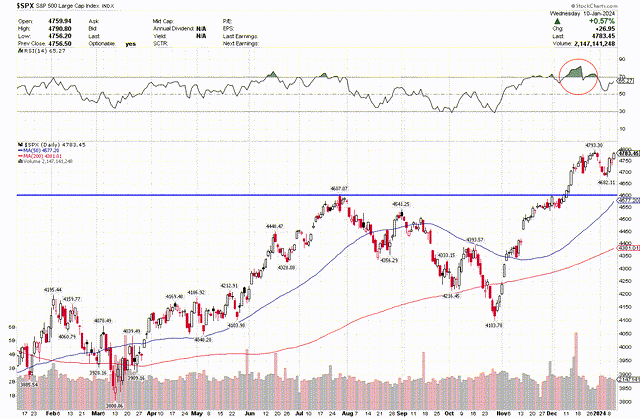

How do these indicators affect the S&P 500? It appears possible that we’ll see decrease ranges within the weeks forward if these short-term technical indicators revert to their means. The Relative Power Index (RSI) for the S&P 500 resolved its extraordinarily overbought situation from mid-December (high of chart) by the benchmark merely consolidating over the previous three weeks. But I believe we will see a check of the 50-day shifting common at roughly 4,600 earlier than we set the stage for an additional vital advance. That may be a comparatively delicate 4% drawdown from the latest excessive. After all, we might see a bigger pullback, relying on the incoming financial knowledge.

Stockcharts

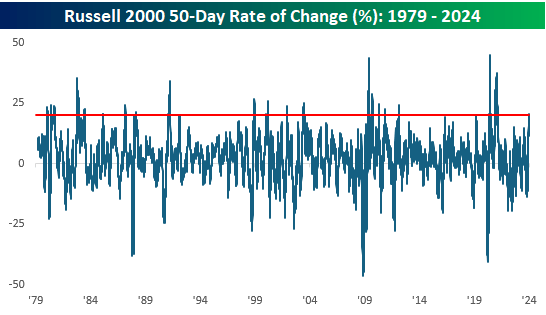

All this stated, I stay firmly within the bull camp from a basic perspective, which is why the next statistic was music to my ears for the long run uptrend. Yesterday, Bespoke Funding Group famous that it had been 50 buying and selling days because the correction low final October 27, throughout which the Russell 2000 index rallied greater than 20%. That was solely the twenty first time such a rally has occurred over a rolling 50-day interval since 1979.

Bespoke

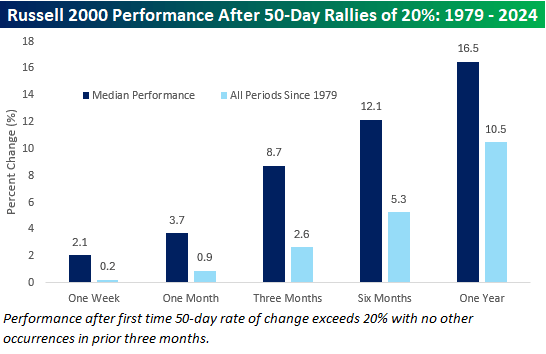

The ahead returns after such a big transfer upward for the index are spectacular. Actually, the median achieve has outperformed over the next week, month, three-month, six-month, and one-year intervals.

Bespoke

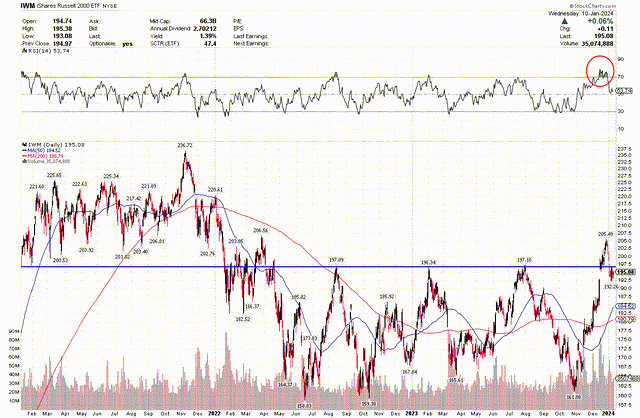

The Russell 2000 index has pulled again 5% from a serious breakout that adopted a protracted interval of consolidation over the previous two years. This index is much from overbought and poised for a transfer increased, primarily based on the technical. It’s much more unstable than the S&P 500 and will see an extra decline to its long-term shifting common, however I believe that may set the stage for a extra pronounced advance to a brand new 52-week excessive.

Stockcharts

I really like to return throughout statistics like this after they reaffirm my basic outlook for the financial system (gentle touchdown) and market (bullish). I nonetheless have to respect the short-term situation, which stays prolonged to the upside. That’s the reason I began the yr leaning modestly defensive with the hopes of placing dry powder to work on pullback in the course of the early a part of this yr.