SergeyZavalnyuk

Funding thesis: Betting on Vale S.A. (NYSE:VALE) may not make a lot sense if one is anticipating a kind of stagnated international economic system or worse in 2024. There’s a distinct risk that at occasions its inventory worth will see a major decline from present ranges. I see such a potential decline in its worth as a chance to purchase and maintain for a longer-term wager. If there’s a decline in international iron demand, it won’t final, as a result of a worldwide financial slowdown can be counteracted by fiscal stimulus measures, together with infrastructure initiatives that are typically a classical go-to authorities coverage for such events. Infrastructure initiatives want metal as an enter, which can most likely imply that a rise in international iron ore demand will precede an total international financial restoration. My present technique is to take care of my present place in Vale inventory, whereas I intend to deal with any retreat in its worth higher than 20% from present ranges as a window of alternative so as to add to my present place.

Q3 outcomes had been respectable, whereas This autumn may probably be even higher on larger iron ore costs.

For the third quarter of the yr, Vale noticed a rise in revenues from slightly below $10 billion in Q2, 2022, to $10.62 billion. Larger revenues didn’t translate into larger web earnings, as they declined from $4.46 billion in Q2, 2022, to $2.84 billion for the most recent quarter. Sure bills had been larger, with some which are of be aware from my perspective, together with larger gross curiosity bills of $192 million for the quarter, which quantities to 1.8% of revenues. This is a vital knowledge level from my perspective as a result of I observe the curiosity expense to revenues ratio as a very powerful measure of an organization’s monetary well being. I have a tendency to fret when curiosity prices cross above 5%, whereas something within the 10% vary I see as being outright harmful to an organization’s survival prospects.

It must be famous that once we are speaking of measurements comparable to curiosity prices/income ratios, it comes inside the context of an organization that relies upon an amazing deal on unstable uncooked materials market costs with regards to revenues, income, and so forth, thus this measure can fluctuate an amazing deal.

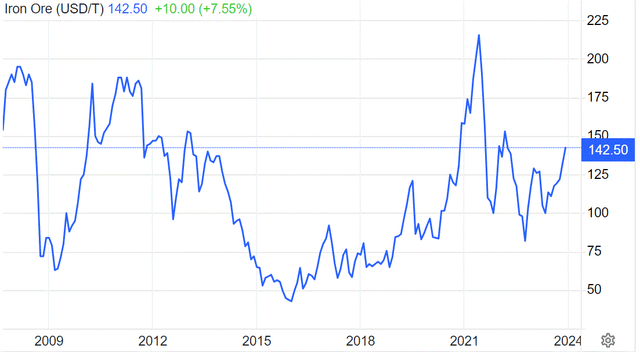

Buying and selling Economics

Iron ore costs had been considerably decrease in Q3 of this yr in contrast with This autumn, due to this fact we will assume that the curiosity/income ratio, in addition to different measures, will see an enchancment within the newest out there quarterly outcomes when This autumn outcomes are available.

Fears of potential iron demand weak point because of a possible international financial slowdown make sense till we remind ourselves that financial slowdowns are normally countered by stimulative authorities spending, usually targeted on infrastructure initiatives.

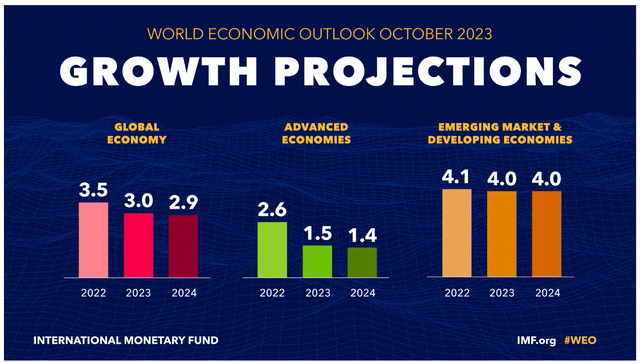

Main establishments such because the IMF are sounding the alarm on a worldwide economic system that already noticed lower than superb progress in 2023 slowing down even additional.

IMF

The IMF presently initiatives solely a slight slowdown in international financial progress for 2024 in contrast with 2023. In my opinion, there may be much more draw back threat to its present forecast than there may be potential for upside surprises.

The prospect of a worldwide financial slowdown might look like a foul time to put money into iron ore mining firms at first look. An financial slowdown may counterintuitively spark a spike in demand, as governments are inclined to react to financial slowdowns with stimulus measures, which regularly embrace infrastructure initiatives. In different phrases, much less metal could also be wanted within the manufacturing of client items, however it could be greater than compensated by an increase in infrastructure wants.

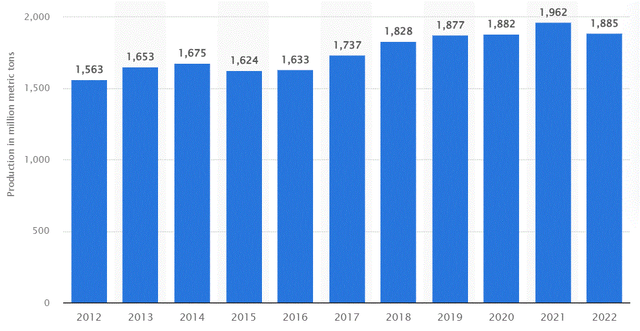

International metal manufacturing (Statista)

As we will see from the chart, international metal manufacturing didn’t decline in 2020 from 2019 ranges, regardless of the deep financial slowdown, after which it elevated considerably in 2021, which for my part is a mirrored image of worldwide efforts to maintain the economic system going, together with by infrastructure initiatives, which are inclined to require vital volumes of metal.

I ought to be aware that one potential obstacle to a replay of the previous international responses to financial slowdowns could also be an absence of fiscal room for a rising variety of main economies. The US debt/GDP ratio is at over 120% presently, and deficits are approaching $2 Trillion. China appears to even have its troubles, together with some overbuilding within the residential sector which might make it much less more likely to see a growth in metal demand. On the general public infrastructure aspect, nevertheless, it appears decided to maintain constructing, a minimum of for now. The EU, Japan, and the UK are all shrinking by way of international financial relevance and are unlikely to have interaction in large-scale infrastructure initiatives. The one vivid spot could be a group of creating nations, led by India, the place infrastructure is sorely wanted and a minimum of some governments have sufficient fiscal room to have interaction in infrastructure initiatives to stimulate their economies.

Funding implications:

Iron ore costs might expertise just a few months of weak point in 2024, as an preliminary response to what can probably be a weaker international economic system than present institutional forecasts might counsel. Vale’s inventory worth may even see an outsized decline, as traders will most certainly promote your entire mining sector in response to an financial slowdown. I presently have a comparatively modest place in Vale inventory, of about 1.5% of my inventory portfolio and I intend to carry on to it, despite the fact that I consider that there’s a respectable likelihood of a short-term decline in its inventory worth this yr. If there isn’t any decline, I’ll most certainly proceed to trip out my present place and I can be content material to proceed amassing on the beneficiant dividend of 5%, whereas I look forward to a good inventory worth to start out decreasing my place. If the inventory worth sees a decline of 20% or extra from present ranges, I intend to start out shopping for.

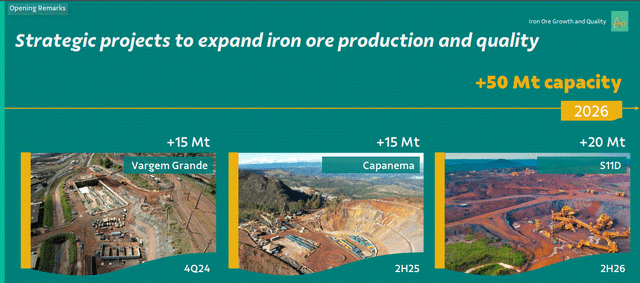

The argument in favor of shopping for Vale inventory rests on the potential exterior components I specified by the article, in addition to inner components that might probably play effectively inside the context of an assumed enhance in international iron ore demand within the shorter time period, in addition to for the long term. For example, Vale is ready to extend manufacturing by an estimated 50 Mt/yr between now and 2026.

Vale

The rise in manufacturing represents about 19% in contrast with Vale’s present iron ore manufacturing ranges.

Vale’s deliberate enhance in manufacturing is kind of in keeping with estimated provide and potential demand progress for a similar interval, provided that latest forecasts put international provide progress at 2.7% per yr for this era.

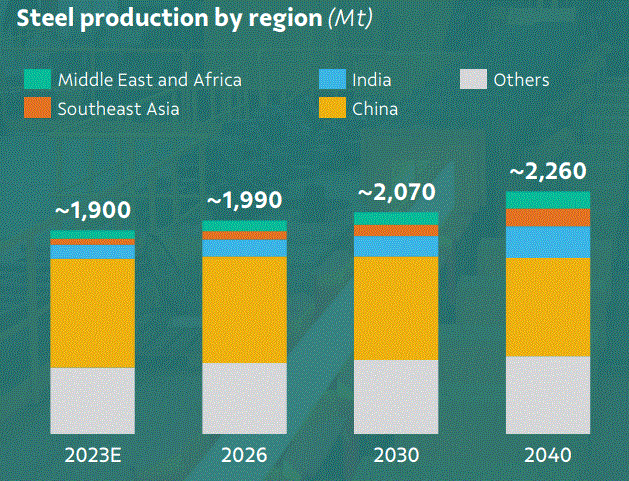

It stays to be seen whether or not or not the trade is gearing as much as ramp up manufacturing by greater than what the world wants, as demand progress isn’t essentially going to materialize at an identical tempo, wherein case, it may set off a collapse in iron ore costs within the subsequent few years. It must be famous that Vale has a extra subdued forecast for international metal manufacturing progress of nearly 5% by 2026 from the estimated 2023 ranges.

Vale

There’s a probably extra bearish end result for Vale and all different iron ore miners, and that will be a possible sustained upward shift in international power costs. Larger power costs would most certainly result in an additional decline in international financial actions, which might create downward strain on iron ore costs and on the identical time, it could push manufacturing prices up. Larger inflation in most main economies would additionally make it much less seemingly that governments can have fiscal room to have interaction in infrastructure spending as a method to restart financial progress as a result of larger inflation tends to maintain borrowing prices excessive.

Whereas Vale’s inner fundamentals are stable, with a low debt servicing burden, and an honest revenue margin, which means that its present dividend is protected, the potential exterior dangers are vital sufficient to warrant warning when investing on this inventory. Threat administration is why I intend to think about including to my already current place, provided that a extra favorable shopping for alternative arises within the coming months.

I’m in search of a pullback of about 20% earlier than I resolve so as to add extra Vale inventory, which could or may not occur within the quick time period. In case Vale’s inventory worth goes in the wrong way, I’m seeking to begin promoting as soon as it approaches $20/share, from the present worth stage of beneath $16/share. For the reason that begin of this decade, I modified my strategy to managing my portfolio, to mirror my total view that as we speak’s market carries much more threat than what the market is presently pricing in. If these had been peculiar occasions, a mining firm with a 5% dividend, a ahead P/E ratio of seven.5, and a stable monetary efficiency by way of sustaining a low debt-servicing burden as a proportion of its revenues would appear like a protected long-term wager. Sadly, we’re not dwelling by peculiar occasions and I’m adjusting my strategy to investing accordingly.