- Ever-worsening GDP information from Japan and the eurozone level to a possible recession

- In the meantime, protecting U.S. GDP progress above zero will likely be a problem in 2024

- Here is how one can decide recession-resistant shares that may add resilience to your portfolio

- Safe your Black Friday beneficial properties with InvestingPro’s as much as 55% low cost!

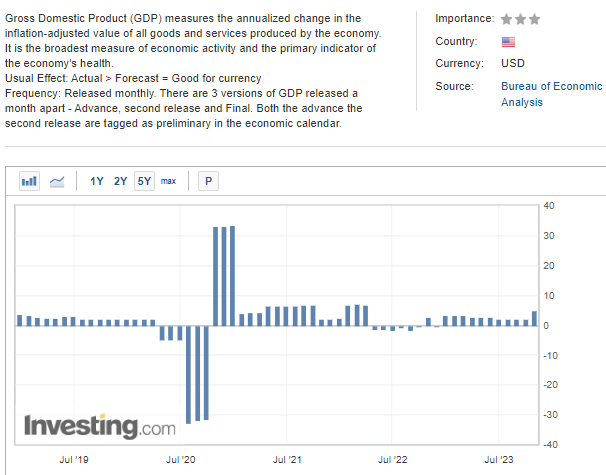

Current assessments of financial progress throughout numerous international economies fail to encourage optimism. Within the eurozone, a fragile balancing act between progress and recession is clear, highlighted by the most recent figures of 0.1% and -0.1% .

Eurozone GDP

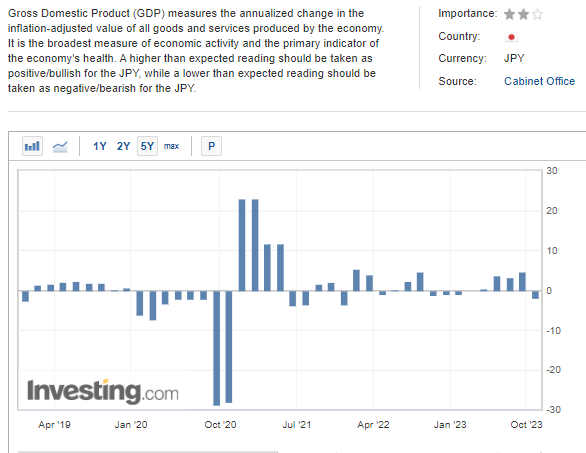

The state of affairs is extra dire in Japan, the place October outcomes considerably undershot forecasts (-2.1% in opposition to an anticipated -0.6%), signaling a possible entry into a chronic recession.

Japan GDP

Amongst developed economies, the U.S. seems comparatively robust with a 4.9% progress price (annualized). Nevertheless, in line with forecasts from the Atlanta Fed, there’s a potential drop to 1.5% within the final quarter, elevating the chance of a sustained recession within the upcoming quarters.

Widmo recesji zagląda w oczy światowej gospodarce. Jakie akcje na trudne czasy?

In gentle of those situations, the query arises: How can one successfully construction an funding portfolio that’s resilient throughout recessions?

Here is How You Can Construct a Recession-Proof Portfolio With Ease

Because the follow of the final 20 years exhibits, recessions within the economic system are accompanied by declines in inventory markets, this was the case in 2020, 2008, and 2001. Nevertheless, the crises had been shortly averted primarily by decisive motion by central banks, which resorted to a unfastened financial coverage.

Along with core property like or bonds, it’s price contemplating selecting shares which might be defensive. Such securities needs to be sought primarily amongst sectors similar to primary client items, utilities, or well being care. This is because of the truth that these sectors are indispensable within the each day lifetime of frequent individuals.

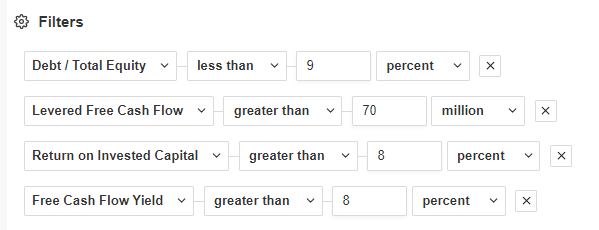

From a basic perspective, one ought to take note of indicators similar to money move, debt-to-equity ratio (particularly when rates of interest are excessive), or return on invested capital, amongst others. Utilizing the InvestingPro scanner, I chosen the next situations for choosing firms.

InvestingPro Filters

Supply: InvestingPro

We used the above filters and listed here are the highest three shares we discovered:

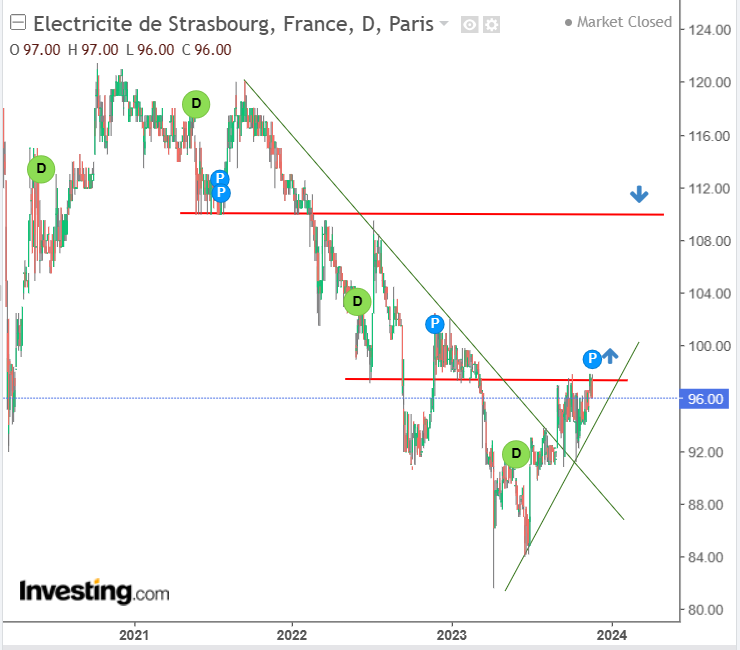

1. Electricite de Strasbourg

French firm (Electricite de Strasbourg (EPA:)) is a European power big that produces electrical energy and sells . The corporate suits completely into the traits of a defensive portfolio with a really lengthy historical past of paying dividends repeatedly for 32 years.

Trying a bit extra short-term, the corporate’s inventory value is inside the framework of a northward motion, which has presently braked within the space of the provision space at €97 per share.

Within the occasion that the demand aspect manages to interrupt out of this space, then the way in which is opened for an assault on the realm of 110 euro per share.

2. Ono Pharmaceutical

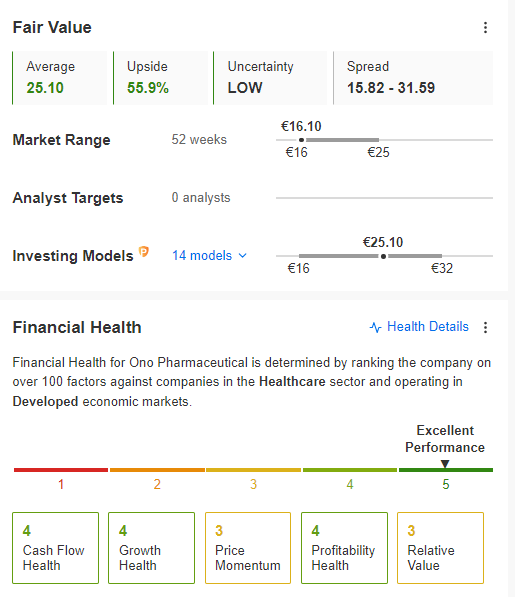

Ono Pharmaceutical (TYO:) is among the largest pharmaceutical firms in Japan with a variety of medicines on supply. What’s hanging is the excellent basic state of affairs, which is illustrated by the honest worth index and the very best rating on the monetary situation scale.

Honest Worth

Supply InvestingPro

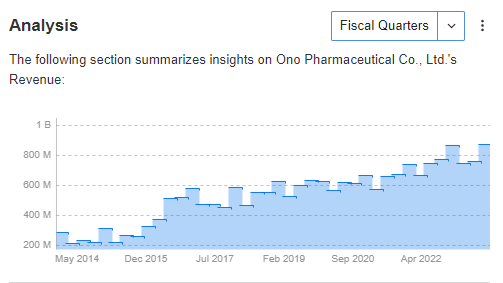

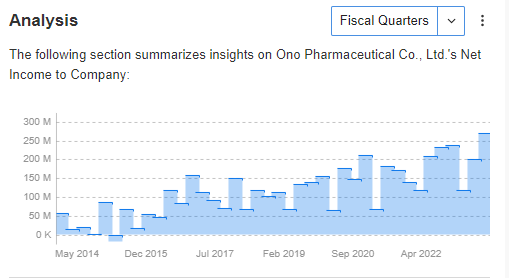

The wonderful monetary situation could not come as a shock if we glance moreover on the optimistic pattern by way of long-term progress of each internet revenue and income:

Income Pattern

Revenue to Firm

Supply: InvestingPro

3. John B. Sanfilippo

John B Sanfilippo (NASDAQ:) is a U.S.-based producer of nut-based meals whose inventory value is within the midst of a correction in current months, which might be a shopping for alternative at a greater value. Most importantly, the corporate recurrently generates internet income and revenues, which, mixed with the next optimistic basic traits, paints an image of a stable progress base.

ProTips

Supply: InvestingPro

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Value This Black Friday!

Well timed insights and knowledgeable selections are the keys to maximizing revenue potential. This Black Friday, make the neatest funding determination available in the market and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this supply is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to speculate as such it’s not supposed to incentivize the acquisition of property in any means. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding determination and the related threat stays with the investor.