hafakot/iStock through Getty Photos

That is my first article on Palantir Applied sciences (NYSE:PLTR), a scorching IPO from 2020 that’s simply now turning the nook to working profitability. The corporate is a know-how concern, promoting software program to parse by tons of database info to search out patterns and glean outcomes from specified queries. It is most important goal is to assist the intelligence group in the US spy on folks, reworded to the politically-correct terminology as aiding in counterterrorism investigations and operations. For certain, it is a important business in as we speak’s courageous new on-line pc world. However is it actually a development business, and is Palantir actually a development inventory? These are points I’ve struggled to grasp because it started public buying and selling.

The 2023 declare to fame and future fortunes is the corporate’s remolding of its picture with buyers – as a high AI alternative (synthetic intelligence) for database administration, analytics and resolution making. I’ll say advertising the corporate as an AI winner is unquestionably sexier than saying we’re the world’s spy chief, plus the market alternative is materially bigger.

Palantir Web site – November 18th, 2023 Palantir Web site – November 18th, 2023

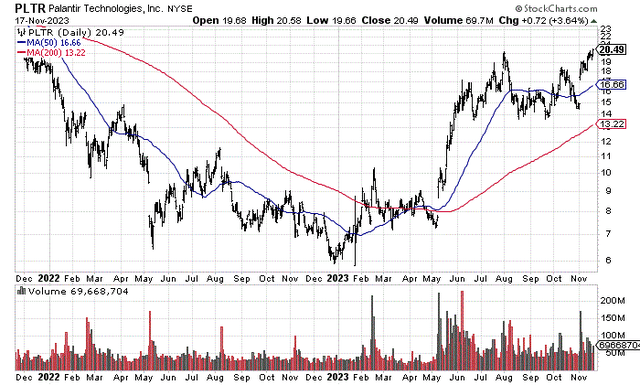

And, Palantir has turn into a high funding gainer throughout 2023 on the AI pleasure visiting Wall Avenue (will it keep or will it go?), with a year-to-date soar of +220%! The query for brand new buyers revolves round whether or not or not this dramatic change in enterprise price is sustainable. Do development charges in underlying metrics this yr and subsequent really assist the share valuation?

My easy reply is I doubt it. The valuation as we speak is amazingly stretched, whereas the share quote appears to be like fairly prone to disappointment in 2024.

So, if a bear market in Large Tech is approaching (like I’ve been explaining because the summertime in different names), Palantir will nearly absolutely take part on the draw back. My view is the rapid draw back danger of a -30% to -40% worth decline far outweighs potential upside of +10% to +25% by the tip of 2024. My conclusion is hot-money merchants and novice, simply excitable buyers have piled into PLTR throughout 2023, and pushed the valuation approach forward of working outcomes. A 6-month to 12-month interval of cooling within the share quote is my expectation. As such, I fee the corporate a Promote and Keep away from in the interim.

StockCharts.com – Palantir, 24 Months of Every day Value & Quantity Modifications

The Overvaluation Downside

As an investor you must not solely dream of what upside is coming, but in addition perceive what you’re paying for the privilege. A whole investment-process overview contains weighing each potential rewards and dangers, if you’ll.

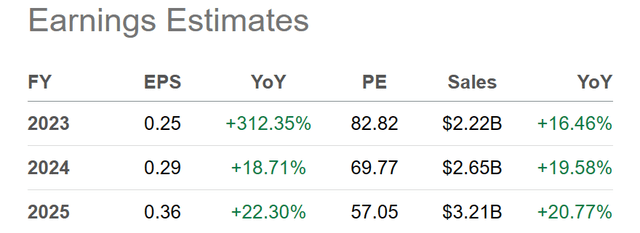

At $20+ a share, the whole fairness capitalization of Palantir is $43 billion. The excellent news is the steadiness sheet may be very robust, with practically $3.3 billion held on the finish of September vs. $922 million in complete liabilities. Nonetheless, revenues for this yr are projected at simply $2.2 billion with $520 million in non-GAAP money earnings. In the meantime, analyst projected enterprise development charges round 20% yearly for 2024-25 can be properly above common vs. different U.S. corporations, though not unimaginable.

Searching for Alpha Desk – Palantir, Analyst Estimates for 2023-25, Made November seventeenth, 2023

Even worse information, $520 million in adjusted money earnings and $475 million in “free” money stream during the last 12 months had been mainly a operate of worker compensation by inventory choices and awards of $472 million. I’ll say that is how Silicon Valley and Large Tech usually run companies as we speak, with outsized funds in inventory for work, not the same old money funds for labor. For certain, whenever you strip out inventory compensation to staff, the entire sector seems much more overvalued than you’ll guess utilizing GAAP accounting metrics.

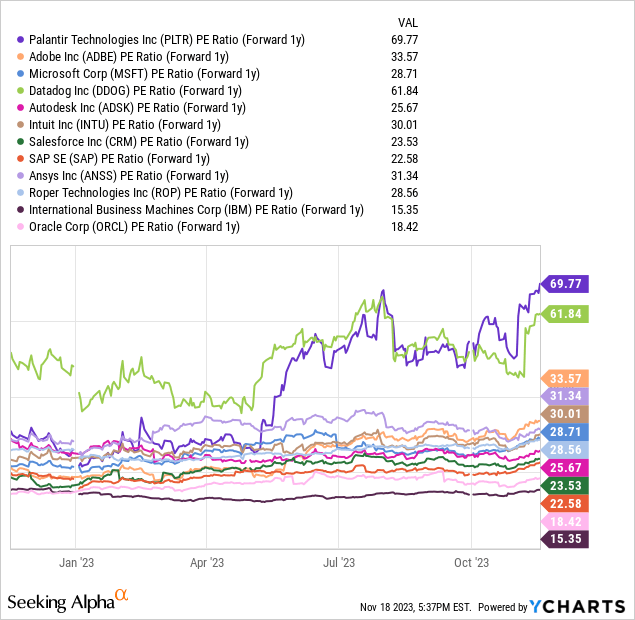

Anyway, utilizing $520 million in cash-adjusted earnings (as an alternative of GAAP accounting nearer breakeven for earnings), the share worth valuation nonetheless represents a sky-high ratio of 82x annual 2023 earnings estimates. The S&P 500 blue-chip index is within the low-20s for a comparable P/E a number of. When pricing 12 months of future anticipated development, Palantir has moved from a valuation choose in the identical space as friends a yr in the past to essentially the most overvalued place in big-data analytics and utility software program presently. The projected 1-year ahead P/E of virtually 70x is exceptionally wealthy. Compared, most friends are buying and selling underneath 30x.

YCharts – Palantir vs. Large-Information Software program Friends, Value to 1-Yr Ahead Earnings Projections, 12 Months

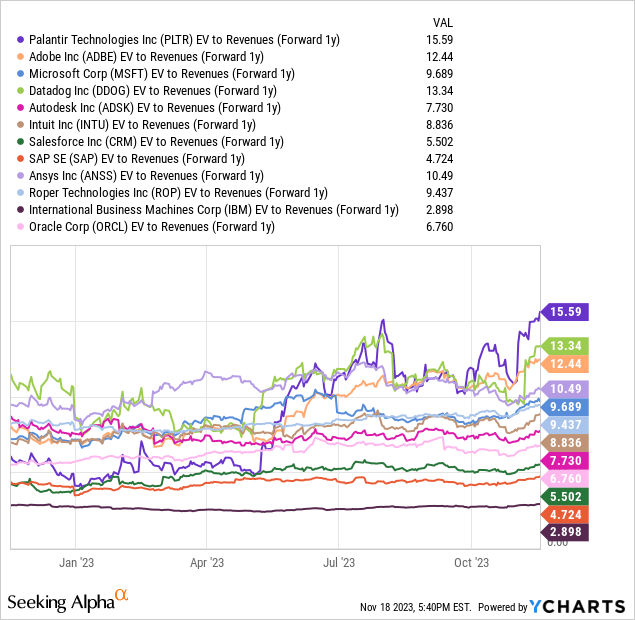

After adjusting firm values to money available and zeroed out debt, the enterprise worth calculation on 2024 gross sales can also be fairly stretched. To make any sense, enterprise development has to take off quickly to catch as much as the rocketing share quote. The 15x EV a number of on future income expectations is a tough 70% premium to the business common of 9x. If there is a silver lining, the robust steadiness sheet flush with money and strong enterprise development prospects do pull the common worth to “trailing” gross sales a number of of 20x, all the way down to an EV to gross sales ratio of 15x.

YCharts – Palantir vs. Large-Information Software program Friends, EV to 1-Yr Ahead Income Projections, 12 Months

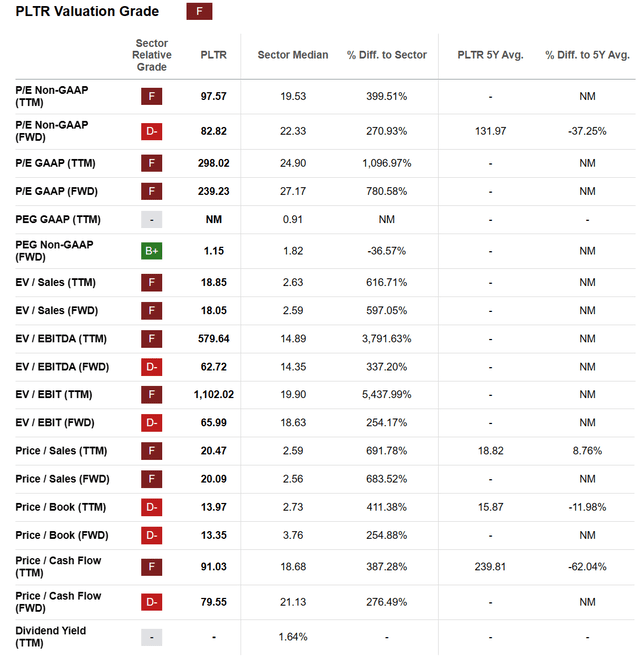

Searching for Alpha’s pc rating system offers Palantir an “F” Valuation Grade total, in comparison with a listing of sector-average basic ratios and a number of other 5-year appears to be like at previous PLTR working outcomes.

Searching for Alpha Desk – Palantir, Valuation Grade on November 18th, 2023

Ultimate Ideas

Traders considering including Palantir shares must suppose lengthy and exhausting if the premium valuation is price shopping for, particularly if development charges decelerate in a recession subsequent yr (as an alternative of accelerating on AI development).

My Promote score on Palantir is for a strict 12-month outlook. It is fully doable the group’s AI push will result in thrilling development for the working enterprise and shareholders. But, in a bear market on Wall Avenue subsequent yr (which is my baseline projection outlined in earlier articles) a drop in PLTR’s worth again to $15 and even $12 can’t be dominated out. At that stage, we’d expertise an extremely good entry for a 5-year holding interval. My abstract view is the AI craze for buyers will subside, and higher valuations will seem eventually for Palantir.

How may I be mistaken? After all, if working outcomes begin to spike past present analyst projections, a $25 or $30 worth stays an outlier risk in 2024. I’d say a zigzag sample to $30 within the first half and correction again to $25 (not far above as we speak’s quote) by the tip of 2024 can be my most bullish outlook state of affairs.

One other state of affairs with a minor likelihood is Palantir turns into the goal of a takeover by a bigger fish wanting publicity to the AI story. The likes of Microsoft (MSFT), Oracle (ORCL), or Worldwide Enterprise Machines (IBM) is likely to be all for a hookup sooner or later. My subject is as we speak’s excessive valuation could imply solely a slight share worth premium is obtainable within the low to mid-$20s. I do imagine the chances of a proposal may enhance by subsequent summer time, given a far decrease inventory quote underneath $15, and an acquisition worth round $20 with a transaction time limit in early 2025. Such would enable the enterprise to develop into the providing worth paid. Sadly, in case you purchase your PLTR shares above $20 as we speak, there would not be any upside captured ultimately.

If you’re within the AI way forward for Palantir, the inventory might be one to observe intently, with the battle plan of shopping for on weak point. I’d use a cost-average method over the following 3-6 months. You could possibly buy a small place underneath $18, add to it within the $15-16 vary, whereas getting extra aggressive underneath $14 (if this worth degree reappears in 2024).

Once more, underlying enterprise development charges of 20% don’t assist a trailing P/E properly above 70x or a a number of on gross sales near 20x. I would like half that valuation, all else being equal. Ready to buy Palantir nearer to 35x EPS and 10x gross sales would offer you much better odds of getting cash years down the street. (I personally can’t bear in mind many breakeven GAAP earnings performs with 20% development charges promoting for worth to income numbers properly above 10x, over my 36+ years of buying and selling, excluding the late-Nineteen Nineties Dotcom bubble period.)

So, both firm development has to choose as much as a fee above 30%, or the inventory quote must fall again to rebalance with its reasonable projected path of earnings and gross sales enlargement. No feelings or overoptimism, simply the mathematics.

With out the exaggerated AI hype because the spring, I determine Palantir would nonetheless be buying and selling round $11-$12 per share. As an instance the hype fades subsequent yr, whereas base firm metrics rise one other 20%. That might give us a “honest worth” goal in 12 months of $14.50 to $15 a share, down roughly -25% from as we speak.

That is my tackle Palantir in November 2023. Hopefully, this text will add worth to your analysis and resolution course of.

Thanks for studying. Please think about this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is really helpful earlier than making any commerce.