Shares rallied following the report, as falling power costs offset the rise within the internet good thing about medical health insurance and different medical impacts. Vitality and gasoline costs fell sharply, and so did homeowners’ equal lease.

There was disinflation within the used automotive costs and lodging. A 1/10 miss doesn’t seem to be a lot, however charges are so extremely leveraged and quick that’s all it takes to ignite one other short-squeeze in bonds, not that completely different from what we noticed within the Treasury refunding on November 1.

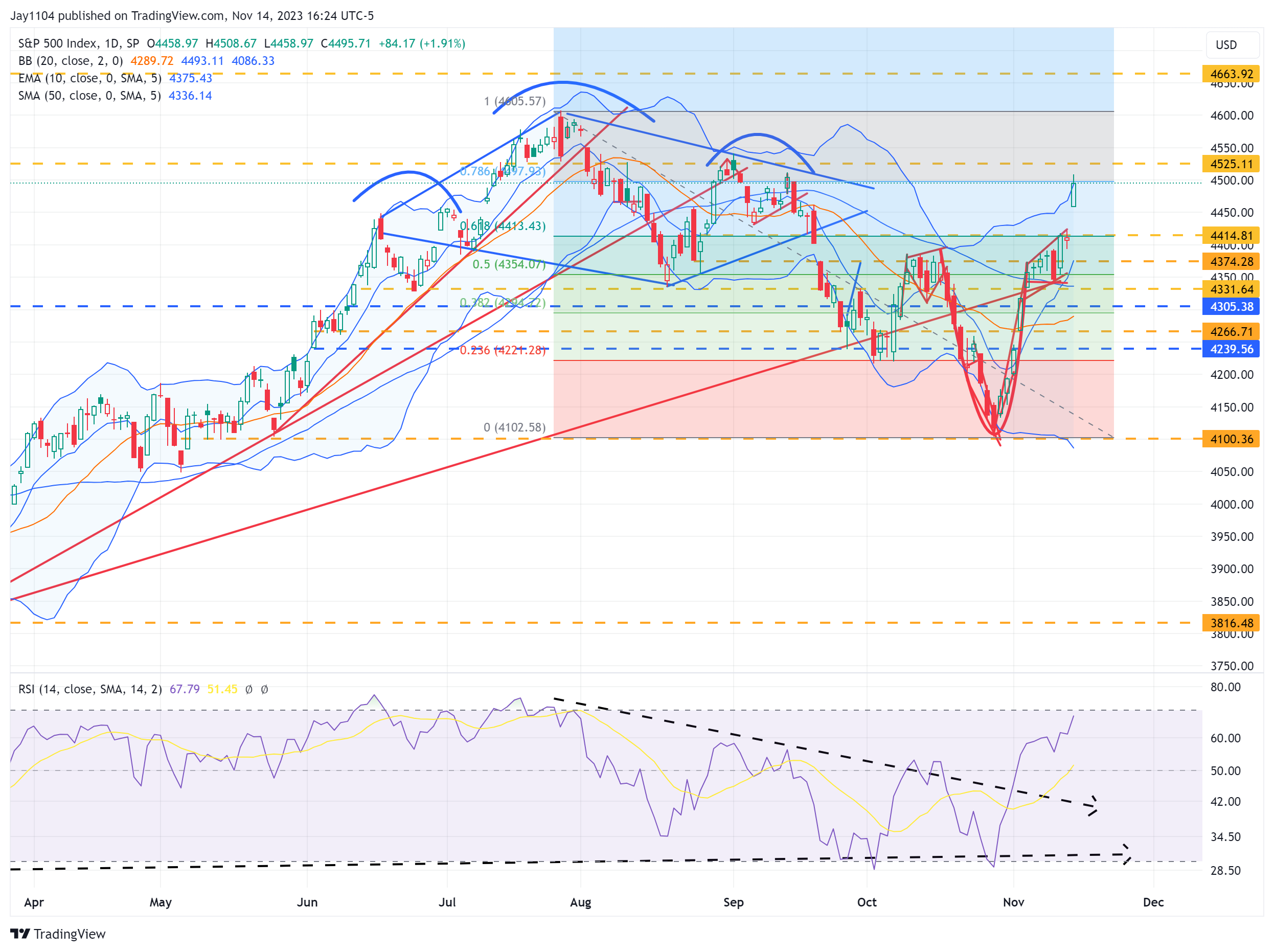

The choices market yesterday was solely pricing an 80 bps transfer available in the market, within the , and customarily, the choices market does a fairly good job at pricing occasion danger. Nonetheless, this time, it underestimated the implied transfer. As a result of the S&P 500 rose by roughly 1.9% and closed round 4,490.

As famous yesterday, the decision wall had shifted to 4,450 and was at 4,450 once more yesterday. Nevertheless, the lower in yields proved an excessive amount of, and the S&P 500 was in a position to transfer past the decision wall and rally to up the following vital resistance degree in choices forward of Friday’s OPEX at 4,500.

Moreover, it overrode what, in my expertise tends to be a comparatively bearish technical sample. However evaluation is a few recreation of odds and managing expectations across the odds. We make the most effective selections and conclusions based mostly on the knowledge now we have.

It’s a few course of and the identical course of that I used to foretell an increase within the inflation charge in August and September, the rise in charges, and the transfer down in fairness costs, was the identical course of that didn’t work this time. Such is life.

The transfer increased yesterday actually was not what I anticipated, given the historic tendencies for this CPI report and the way the technical setup seemed to be positioned.

Being conscious in October when the S&P 500 reached 4,100, I even urged that situations had reached oversold ranges and had been due for a bounce. However this bounce has been way over most have anticipated, together with myself.

Utilizing the identical customary to establish the overbought situations within the S&P 500 in July and oversold situations in October. The index is now shortly approaching or has approached over-bought ranges because the index trades by means of the higher Bollinger band and the RSI approaches 70. In fact, simply because one thing is overbought doesn’t imply it may’t go increased.

By the best way, it’s value declaring that had an identical sample. In that case, it labored as I’d have anticipated.

The has additionally moved above its higher Bollinger Band because the RSI approaches 70.

We noticed charges fall dramatically yesterday, as this is likely one of the market’s extra extremely leveraged and quick elements. The transfer down within the charge seemingly continues because the market begins to cost in charge cuts; the query, after all, is what the Fed will do relating to charges.

However at this level, what issues extra is the reshaping of the yield curve. As that morphs, it appears to me that the yield curve must steepen, and must occur within the type of the 2-year falling to the as a result of it seems to me that a lot of the info is pointing to softening of the economic system, and that may make at the moment a vital metric. As soon as the yield curve begins transferring, I feel the transfer increased might occur quick.

I’ve been utilizing the 10-year futures to hint fairness costs over the previous couple of months, however I feel that modified yesterday, and I would like to start out specializing in the curve.

The reason being that the 2-year charge has been pegged, and it has been the 10-year transferring. However now each have been launched, which suggests the curve issues extra and has turn into extra dynamic.

The has additionally considerably contributed to actions yesterday.

Regardless of the drop in yields and the , fell yesterday, too, and that’s odd, not what one would anticipated to see.

Authentic Submit