RAND TALKING POINTS & ANALYSIS

- US particular elements drive ZAR power however could also be short-lived as markets could over overreacted to Friday’s NFP knowledge.

- Fed communicate in focus later right this moment.

- USD/ZAR bulls keenly await attainable short-term reversal.

USD/ZAR FUNDAMENTAL BACKDROP

Macro-economic fundamentals underpin nearly all markets within the international economic system through development, inflation and employment – Get you FREE information now!

Beneficial by Warren Venketas

Get Your Free USD Forecast

The South African rand has managed to capitalize alongside its Rising Market (EM) counterparts post-Non-Farm Payroll (NFP) final week Friday. Many market consultants are extra inclined into considering that the Federal Reserve has now reached its peak. The weaker US greenback has given rise to many dollar-based commodities together with main South African exports, thus offering sustenance for the native ZAR.

Optimism in China after latest development statistics may very well be suggestive that stimulus measures by the federal government could also be penetrating the market and strengthening the general economic system – web optimistic for the rand.

From a South African perspective, enhanced manufacturing capability from Eskom has allowed for relieving loadshedding situations and will stoke investor optimism ought to this development proceed.

At present’s financial calendar reveals a muted buying and selling day with simply the Fed’s Cook dinner scheduled to talk (see under).

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX Financial Calendar

Wish to keep up to date with essentially the most related buying and selling info? Join our bi-weekly e-newsletter and maintain abreast of the newest market shifting occasions!

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

TECHNICAL ANALYSIS

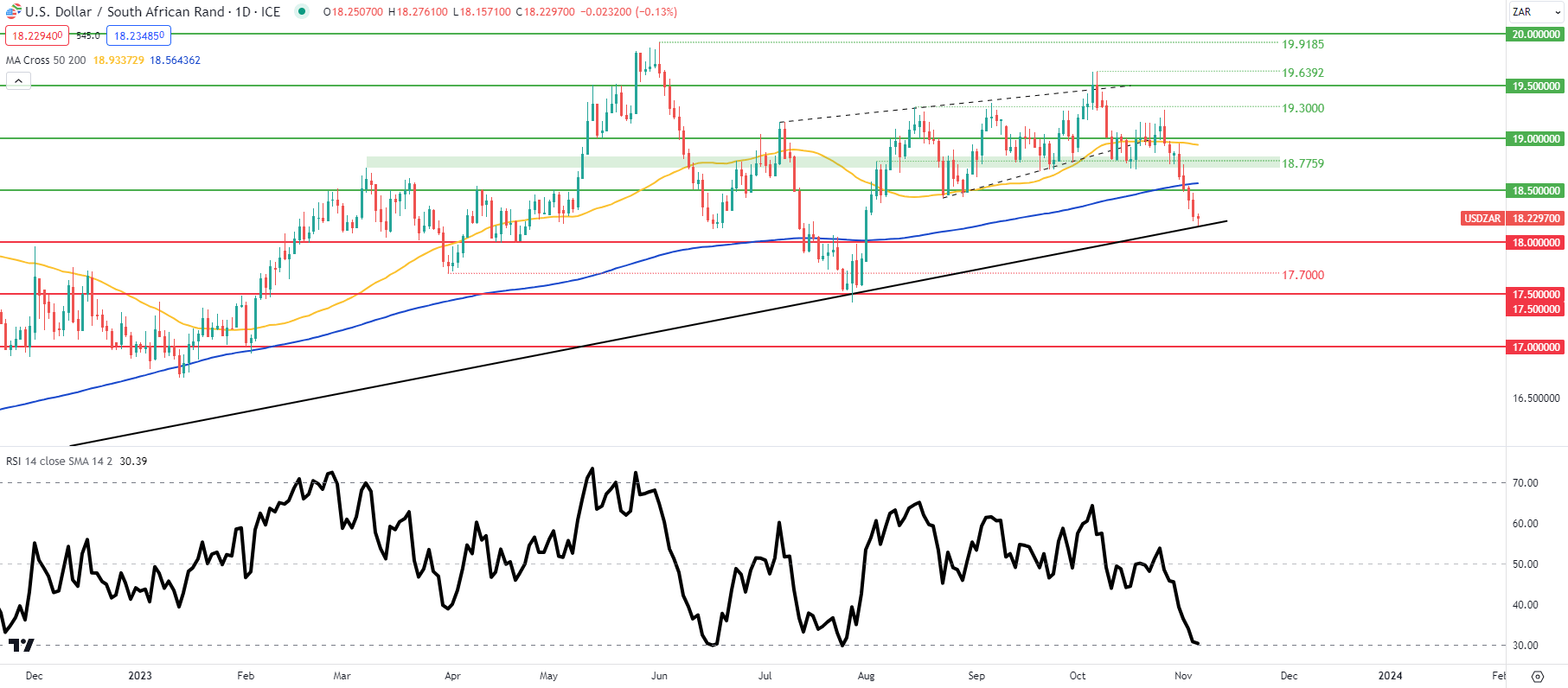

USD/ZAR DAILY CHART

Chart ready by Warren Venketas, TradingView

The day by day USD/ZAR chart above reveals value motion testing the important thing long-term trendline assist (black) starting in March 2022. This zone has held after a number of exams by bears and with the Relative Power Index (RSI) in and round oversold territory, historical past could repeat itself. The lengthy decrease wick at the moment forming may complement this view short-term.

Resistance ranges:

- 19.0000

- 50-day MA

- 18.7759

- 200-day MA

- 18.5000

Assist ranges:

Contact and followWarrenon Twitter:@WVenketas