Drew Angerer

Amid renewed optimism within the markets, I proceed to consider that one of the simplest ways to beat the key indices all through the tip of this yr and into subsequent yr is to focus our portfolios on “progress at an inexpensive worth” shares. In my opinion, valuation will proceed to be a contentious argument – even when the Fed pauses its price hikes, the truth that most traders anticipate yields to remain within the ~5% vary is a robust argument towards paying premium valuation multiples for progress shares.

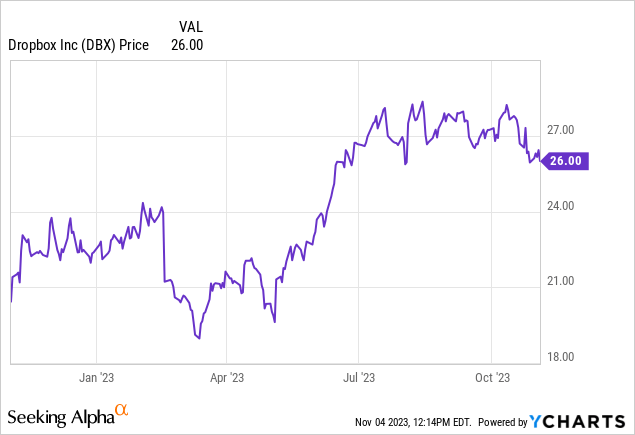

Dropbox (NASDAQ:DBX), for my part, suits the invoice completely on this macro. Traders have largely moved on from each Field and Dropbox as their progress charges have stalled. Yr thus far, the inventory is up ~15%, roughly matching the efficiency of the S&P 500.

Dropbox Sprint and the bull case for Dropbox

I final wrote on Dropbox in August, giving the inventory a bullish score and citing its robust free money circulate as a main purpose. With Q3 earnings now out, I’m retaining my bullish view on Dropbox and suggest holding on for additional positive aspects.

It is easy to overlook that Dropbox stays a “Rule of 40” software program firm (the place the sum of income progress plus professional forma working margins exceeds 40%, which few software program firms can attain). It is uncommon for an organization to get nearly all of its 40 factors from working margin and never progress, however that is the case for Dropbox, a enterprise that has matured and leveraged its huge 80%+ professional forma gross margins to generate a robust backside line.

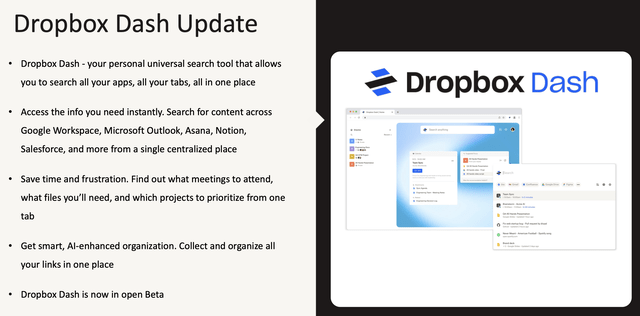

However that is to not say that Dropbox is not nonetheless persevering with to develop and innovate, both – regardless of making cuts to its R&D group, which is a serious supply of margin tailwinds (which we’ll focus on within the subsequent part). The corporate’s largest function launch is Dropbox Sprint, a function that permits customers to look content material throughout purposes:

Dropbox Sprint (Dropbox Q3 earnings deck)

As a reminder to traders who’re following this inventory for the primary time, right here is my full long-term bull case on Dropbox:

- Sticky subscription enterprise. On this macro surroundings, subscription income streams have grow to be much more fascinating as a result of ease of planning money circulate and the reliability of low-churn prospects. On prime of excessive gross margins, Dropbox has a strong method for fulfillment.

- Dropbox is not simply buying and selling on a pie-in-the-sky future projection, however on actual free money circulate immediately, singling out from different SaaS shares on this risk-averse surroundings. Development and paying premiums for progress shares are out; worth is in. The truth that Dropbox has routinely dangled a goal of hitting $1 billion in annual FCF by FY24 whereas repeatedly elevating working margins quarter after quarter is a giant draw for traders.

- Client upsells. Increasingly more freelancers have emerged from the pandemic, untethering themselves from a company way of life and constructing manufacturers and companies of their very own. Instruments like Dropbox have grow to be vital infrastructure, and one with very low boundaries to entry and ease of setup. Accordingly, Dropbox has differentiated itself from Field by interesting to those skilled solo acts and small companies, which is mirrored by Dropbox’s higher upsells to premium paid plans.

- Enterprise market alternative. Dropbox’s conventional energy has all the time been in smaller/shopper customers, although it has began ramping up its enterprise efforts currently (merchandise like Seize add to the corporate’s enterprise resume). There are nonetheless loads of alternatives for Dropbox to take market share from Field right here.

Keep lengthy right here, particularly after the beneficiant margin positive aspects we have seen in Dropbox’s Q3 outcomes.

Q3 obtain

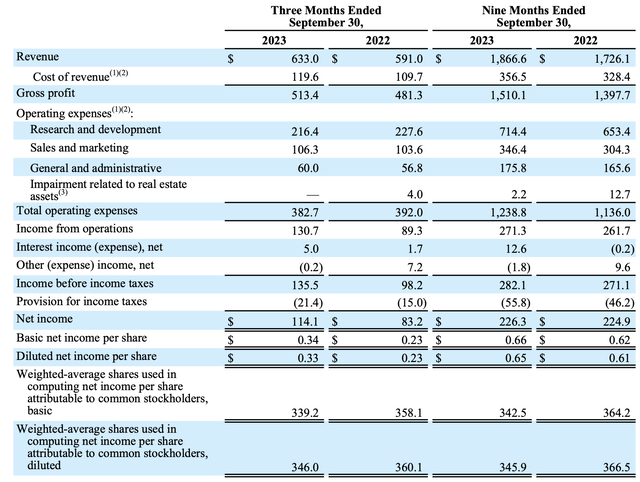

Let’s now undergo Dropbox’s newest Q3 ends in higher element. The Q3 earnings abstract is proven beneath:

Dropbox Q3 earnings outcomes (Dropbox Q3 earnings launch)

Income grew 7% y/y to $633.0 million, forward of Wall Avenue’s expectations of $628.3 million (+6% y/y) however decelerating two factors from Q2’s 9% y/y progress price. FX was a one-point headwind to the quarter; progress would have been 8% y/y on a continuing foreign money foundation.

Be aware that consensus is looking for Dropbox to proceed decelerating to a 5% progress tempo subsequent yr, however that is additionally roughly just like its extra enterprise-oriented competitor Field, for which Wall Avenue is citing solely a barely stronger progress expectation of 8% y/y for FY24.

ARR additionally continued to develop 4% y/y (7% y/y fixed foreign money) to $2.55 billion. Whereas this does symbolize a decelerated tempo from Q2’s 11% y/y constant-currency ARR progress tempo, the excellent news is that this ARR stage virtually utterly covers Wall Avenue’s $2.61 billion income expectation for FY24, probably leaving upside room to the Avenue’s 5% progress goal.

The corporate is banking on new product releases to proceed driving progress going ahead, particularly with Dropbox Sprint, which the corporate believes has opened up a $7 billion market alternative. Per founder and CEO Drew Houston’s remarks on the Q3 earnings name:

As a reminder, in June we launched our first technology of merchandise, together with Dropbox Sprint and Dropbox AI. I will give attention to Dropbox Sprint as this represents our first main product launch inside our subsequent technology of AI powered merchandise. And we see this opening a brand new market alternative of common search. Drew has talked for some time in regards to the rising problem of fragmented content material on this new world of distributed work. Final month, we met with a whole lot of shoppers in New York, and lots of echoed the identical ache factors round organizing their work. And we consider we’re in a superb place to unravel these new issues with our scale and platform neutrality.

We additionally see the shift from information and folders, together with latest developments in AI, giving option to new market alternatives. Particularly, the search and information discovery software program market. IDC sizes this as a $7 billion market immediately that is anticipated to triple over the following 4 years. And we consider we’re properly positioned to participate on this secular wave with Dropbox Sprint. As a reminder, Dropbox Sprint leverages AI, whereas connecting your cloud instruments, apps, and content material right into a single search bar. It permits customers to rapidly discover all the pieces in a single place, whether or not that content material is pulled from Microsoft Outlook or Google Workspace or Asana. And since Sprint is powered by machine studying, it learns about you and your priorities the extra you utilize it.”

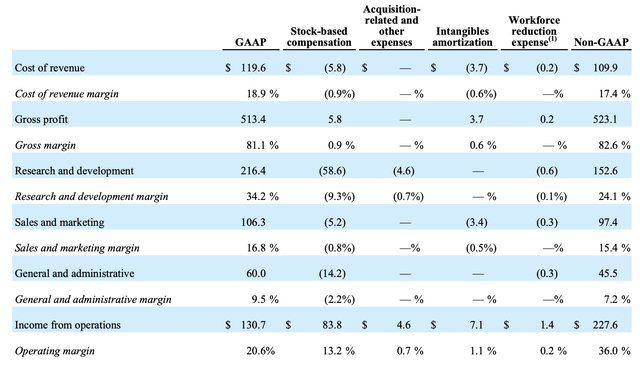

On the margin entrance, Dropbox hit a 36.0% professional forma working margin this quarter (which stacked on prime of a 7% progress price yields a Rule of 40 rating of 43):

Dropbox margins (Dropbox Q3 earnings launch)

This was a 440bps enchancment versus 31.6% within the year-ago quarter, pushed primarily by a 4-point discount in R&D prices as a share of income (in reality on a nominal foundation, professional forma R&D expense fell -8% y/y to $152.6 million).

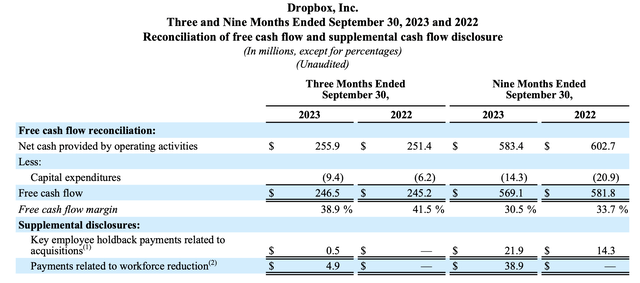

The corporate additionally generated $569.1 million in FCF within the first three quarters of the yr, roughly flat to final yr however held again by one-time funds made in connection to its layoffs. Administration remains to be anticipating to hit a 32.5% FCF margin for the total yr.

Dropbox Q3 FCF (Dropbox Q3 earnings launch)

Valuation and key takeaways

At present share costs close to $26, Dropbox trades at a market cap of $9.04 billion. After we web off the $1.31 billion of money and $1.38 billion of convertible debt on Dropbox’s most up-to-date steadiness sheet, the corporate’s ensuing enterprise worth is $8.97 billion.

As beforehand talked about, consensus is anticipating Dropbox to develop 5% y/y to $2.61 billion in income subsequent yr (information from Yahoo Finance). Given Dropbox is a mature firm, we predict FCF is one of the simplest ways to worth it – the corporate has continued to mission $1 billion in “pure” FCF subsequent yr, however given uncertainty round R&D tax laws has decreased that determine by a placeholder of $36 million till it finalizes steering targets within the February This autumn earnings launch. Towards ~$964 million of FCF (a 36.9% FCF margin on consensus income, versus 32.5% FCF margins this yr), Dropbox trades at 9.3x EV/FY24 FCF.

That single-digit FCF a number of is uncommon on this market and the most important enchantment to investing in Dropbox, regardless of the dangers of slowing progress and a saturated market. Keep lengthy right here.