Market Overview: S&P 500 Emini Futures

The weekly chart shaped the third leg down, an Wedge. The market additionally broke under the pattern channel line. The bulls desire a reversal up from a wedge bull flag. Nonetheless, they may want a powerful reversal bar or a micro double backside earlier than they might be prepared to purchase aggressively. The bears desire a check of the 200-day shifting common.

S&P 500 Emini Futures

S&P 500 Emini-Weekly Chart

S&P 500 Emini-Weekly Chart

S&P 500 Emini-Weekly Chart

- This week’s Emini candlestick was a consecutive bear bar closing close to its low.

- Final week, we stated that the percentages barely favor the market to commerce a minimum of somewhat decrease and for the third leg down forming the wedge sample. Merchants will see if the bears can get a powerful bear bar buying and selling far under the October 3 low, or will the market trades barely decrease, however closes with a protracted tail or a bull physique.

- This week, the bears obtained follow-through promoting closing removed from the October 3 low.

- They obtained one other leg down forming the wedge sample (Aug 18, Oct 3, and Oct 27).

- They need a powerful breakout under the bull pattern line with follow-through promoting.

- In the event that they proceed to get a few consecutive bear bars closing close to their lows, it should improve the percentages of the reversal down from a decrease excessive main pattern reversal changing into profitable.

- The following goal for the bears is the 200-day shifting common. It’s shut sufficient to be examined quickly.

- The sell-off in 2022 ended after a check of the 200-day shifting common.

- The bulls see the transfer down (from July 27) as a deep pullback of the transfer entire transfer up which began in October 2022.

- They need a reversal from a wedge bull flag (Aug 18, Oct 3, and Oct 27) and a pattern channel line overshoot.

- The issue with the bull’s case is that the transfer down is sort of sturdy, with stronger bear bars and the bull bars not getting sustained follow-through shopping for.

- The bulls will want a powerful reversal bar or a micro double backside earlier than they might be prepared to purchase aggressively.

- Since this week’s candlestick is a bear bar closing close to its low, it’s a promote sign bar for subsequent week.

- The market might hole down on Monday. Small gaps normally shut early.

- Odds proceed to barely favor the market to commerce a minimum of somewhat decrease.

- Merchants will see if the bears can get one other sturdy bear bar, or will the market trades barely decrease, however closes with a protracted tail or a bull physique.

- Whereas the market should still commerce sideways to down for a pair extra weeks, the bull pattern stays intact; greater highs, greater lows.

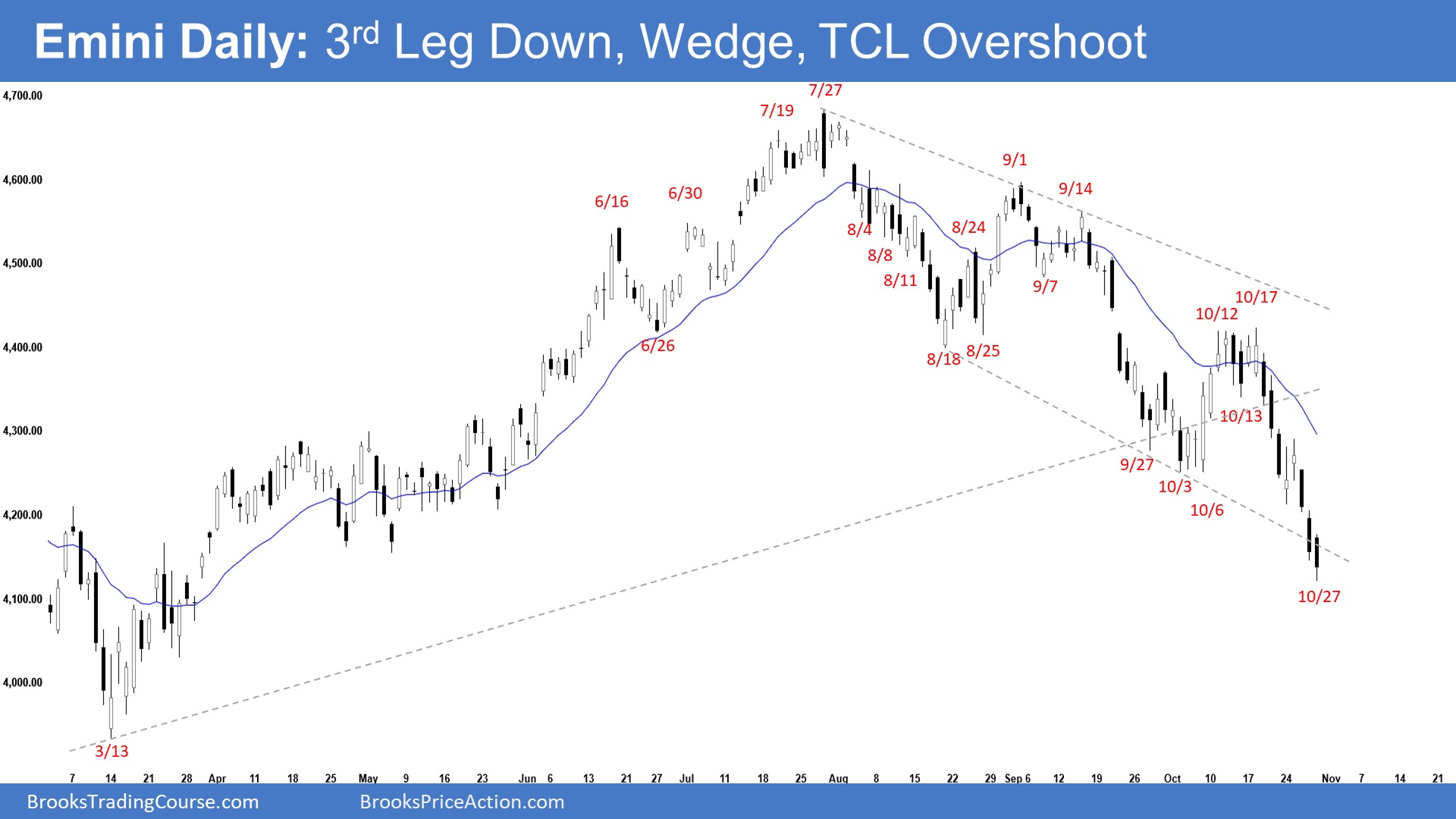

S&P 500 Emini-Each day Chart

- The Emini traded barely greater earlier within the week however offered off from Wednesday into Friday, forming 3 consecutive bear bars.

- Final week, we stated that the percentages barely favor the market to commerce a minimum of somewhat decrease. Merchants will see if the bears can create sustained follow-through promoting or will the market commerce barely decrease however stall not far-off from the October 3 low space.

- This week shaped the third leg down for the reason that July 27 excessive.

- The bears desire a sturdy breakout under the bull pattern line with sustained follow-through promoting. Up to now, they obtained what they needed.

- The transfer down is in a powerful bear channel with stronger bear bars. Odds favor a minimum of a small second leg sideways to down after a bigger pullback.

- Nonetheless, it has additionally lasted a very long time and is barely climactic. A small pullback can start inside 1-3 weeks.

- If there’s a bigger pullback (lasting a minimum of a number of weeks), the bears desire a bigger second leg sideways to right down to retest the present leg excessive low (now Oct 27).

- The bulls desire a reversal from a wedge bull flag (Aug 18, Oct 3, and Oct 27) and a pattern channel line overshoot.

- They see the present transfer down as a deep pullback of the entire rally which began in October 2022 low.

- They hope to get a retest of the July 27 excessive and a powerful breakout above.

- The bulls will want a minimum of a powerful reversal bar or a small double backside earlier than they might be prepared to purchase aggressively.

- Since Friday was a bear bar closing in its decrease half, it’s a promote sign bar for Monday.

- Odds barely favor the market to commerce a minimum of somewhat decrease.

- Merchants will see if the bears can create sustained follow-through promoting or will the market commerce decrease however stall and kind a climaxing reversal or a micro double backside.

- For now, whereas the market should still commerce sideways to down, the bull pattern stays intact.