- Netflix’s third-quarter 2023 outcomes shall be introduced on Wednesday after the inventory market closes

- The corporate has applied a coverage prohibiting the sharing of accounts exterior the family

- Will that replicate within the earnings, making the inventory correction a shopping for alternative?

The worldwide leisure panorama has undergone a transformative shift with the rise of streaming platforms, successfully eclipsing conventional media comparable to tv. Main this digital revolution is Netflix (NASDAQ:), offering audiences entry to an intensive library of films and collection for a modest subscription charge.

As we method Wednesday, expectations are working excessive for the discharge of Netflix’s third-quarter , a key occasion in gentle of the platform’s current coverage shift relating to password sharing.

Launched in Might of this 12 months, this modification aimed to curb the unauthorized sharing of accounts and seems to be having the specified impact, as person numbers proceed to develop – a change that’s poised to present itself within the forthcoming third-quarter figures.

But, intriguingly, regardless of Netflix’s strong person progress, its inventory has been navigating a broad correction part, prompting hypothesis that the conclusion of this adjustment might yield outcomes exceeding present forecasts.

Within the lead-up to the outcomes, all eyes are on Netflix’s projected earnings per share, which at present stand at an estimated $3.48, alongside revenues totaling $8.53 billion.

Notably, the forecast has skilled a outstanding 24 upward revisions, with solely 3 cases of downward revision, indicating a excessive stage of market anticipation.

Netflix Upcoming Earnings

Supply: InvestingPro

It needs to be famous that since October final 12 months, we are able to see a transparent upward pattern in earnings per share, which corresponded with the share value rising to the neighborhood of $485 at its peak in July.

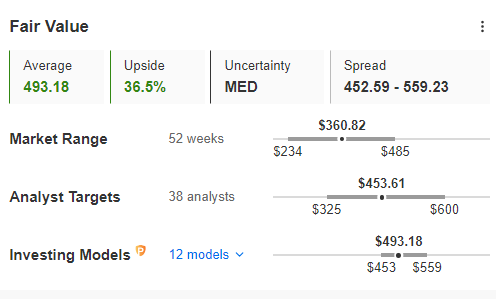

The honest worth upside goal stays at simply over 36%, which interprets into the potential of breaking out to new highs this 12 months.

Netflix Truthful Worth

Supply: InvestingPro

Nonetheless, there’s a lack of alerts from the chart within the type of a powerful demand impulse that may generate an upward technical formation, which can not occur till Thursday.

New Consumer Progress Set to Speed up

Netflix’s pivotal transfer to enact new account-sharing guidelines this Might ignited widespread curiosity about how these modifications may have an effect on the trajectory of latest person progress. The preliminary months offered compelling validation for this resolution, with the second quarter witnessing a considerable surge of 5.9 million new subscribers, doubling the earlier forecasts.

Unsurprisingly, this strong inflow considerably bolstered revenues on a worldwide scale. An optimistic tone was struck by Greg Peters, certainly one of Netflix’s executives, who emphasised the chance of this optimistic pattern persisting for a number of extra quarters.

It is price noting that the flexibility to share accounts past a single family remains to be obtainable, albeit at a further price of $7.99 monthly within the US. In the meantime, discussions are gaining momentum relating to potential value changes for the ad-free bundle within the close to future.

Technical View: Netflix Inventory’s Correction a Shopping for Alternative?

Beginning round mid-July, Netflix’s inventory costs started a southward trajectory, aligning with a broader correction throughout the US inventory market. Presently, the promoting stress has approached the native assist stage located within the value vary round $350 per share. As of now, there hasn’t been a definite market response, and any potential motion may hinge on the revelation of third-quarter information, which is able to solely emerge following Wednesday’s session.

Netflix Each day Chart

Supply: InvestingPro

Because the rebound state of affairs takes form, patrons’ major goal shall be to surpass the important thing stage of $400 per share, probably paving the best way for one more evaluation of the area round $480. Nonetheless, if patrons can’t preserve the examined assist, there’s a chance of a descent in the direction of the $300 vary, contingent on vital disappointment within the disclosed information. Nonetheless, this consequence seems much less possible in the mean time.

***

Apple Earnings: What to Anticipate?

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought-about funding recommendation.