Euro (EUR/USD, EUR/GBP) Evaluation

Minutes Counsel the ECB is Content material with Charges, Centered on the Economic system

ECB minutes revealed it was a detailed name to boost rates of interest for the tenth and probably final time, the final time the Governing Council met. The vast majority of officers anticipate that document excessive rates of interest (4%) will play an enormous function in forcing inflation again to the two% goal.

Now the main target turns to the European financial system which has needed to endure the results of elevated costs throughout a world progress slowdown that has closely impacted its main buying and selling companion, China. The German manufacturing sector has been significantly onerous hit, main the remainder of Europe decrease. Little doubt the ECB shall be watching authorities bond yields after increased US borrowing prices led the way in which for different developed markets. Italian bond yields shall be high of the listing as they’ve historically been susceptible to increasing yields as a result of massive funds deficit, elevated debt and lack if fiscal self-discipline. ECB officers stay hopeful to keep away from a recession this yr. With anemic progress witnessed to date in Europe, a mushy touchdown stays a large problem.

Nevertheless, US CPI information offered the most important catalyst of the day, prompting an increase within the weaker USD as headline inflation rose barely above forecast, coming in at 3.7% vs 3.6% forecasted. Rising oil costs pose a possible problem to current progress on inflation.

Customise and filter dwell financial information through our DailyFX financial calendar

With central banks favouring an finish to the tightening cycle, how will the Euro fare in This autumn? Learn our Euro This autumn Forecast beneath:

Beneficial by Richard Snow

Get Your Free EUR Forecast

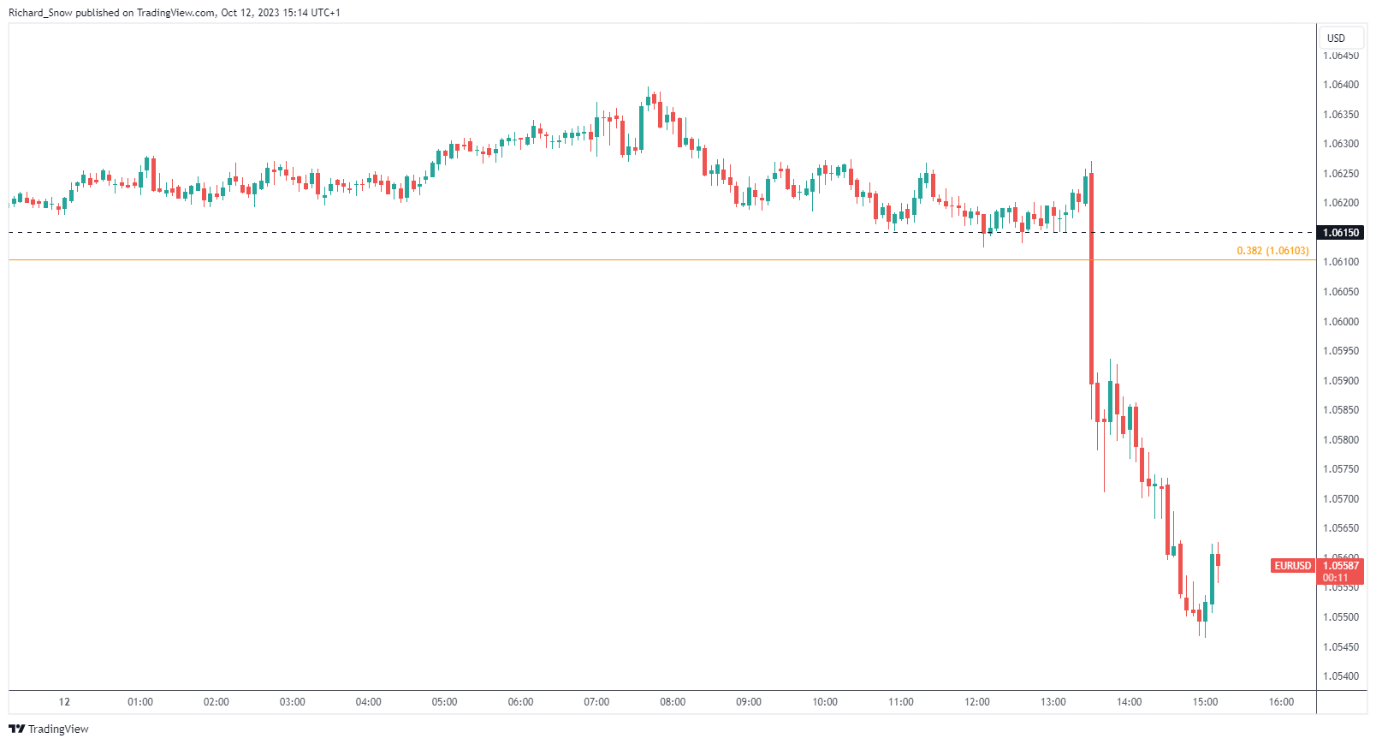

The speedy response in EUR/USD noticed a transfer to the draw back, because the shock to the upside reignited issues round sticky inflation after quite a few Fed officers communicated a cautious strategy to future tightening with many stating a satisfaction with the present degree of rates of interest.

EUR/USD 5-Minute Chart

Supply: TradingView, ready by Richard Snow

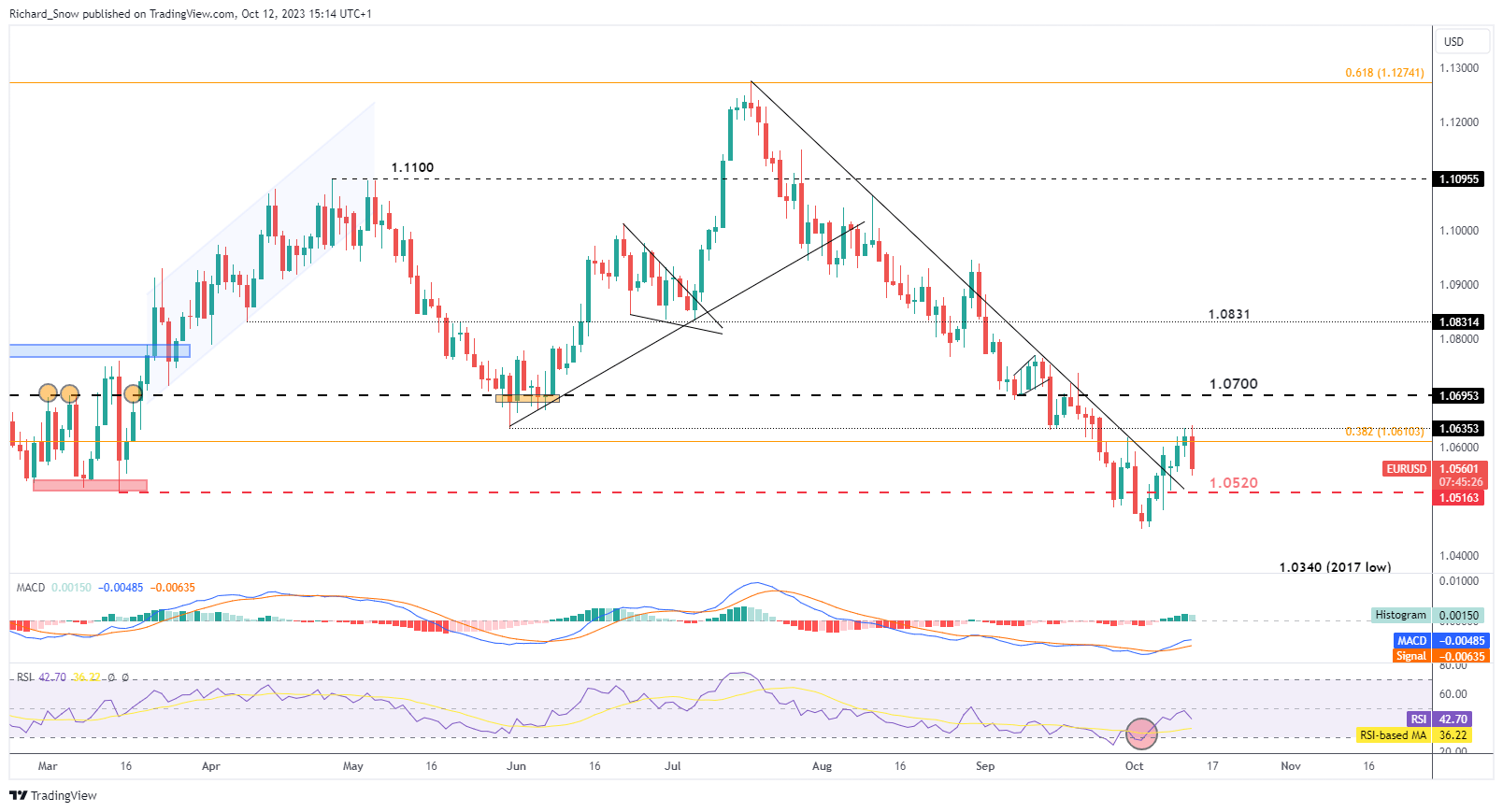

US CPI Threatens Latest EUR/USD Pullback

The upper inflation print sees EUR/USD resume the longer-term downtrend after turning round 1.0635 – the thirty first of Might swing low. 1.0520 is the subsequent degree of help which can coincide with trendline help.

EUR/USD Every day Chart

Supply: TradingView, ready by Richard Snow

| Change in | Longs | Shorts | OI |

| Every day | 9% | -21% | -3% |

| Weekly | 1% | -11% | -3% |

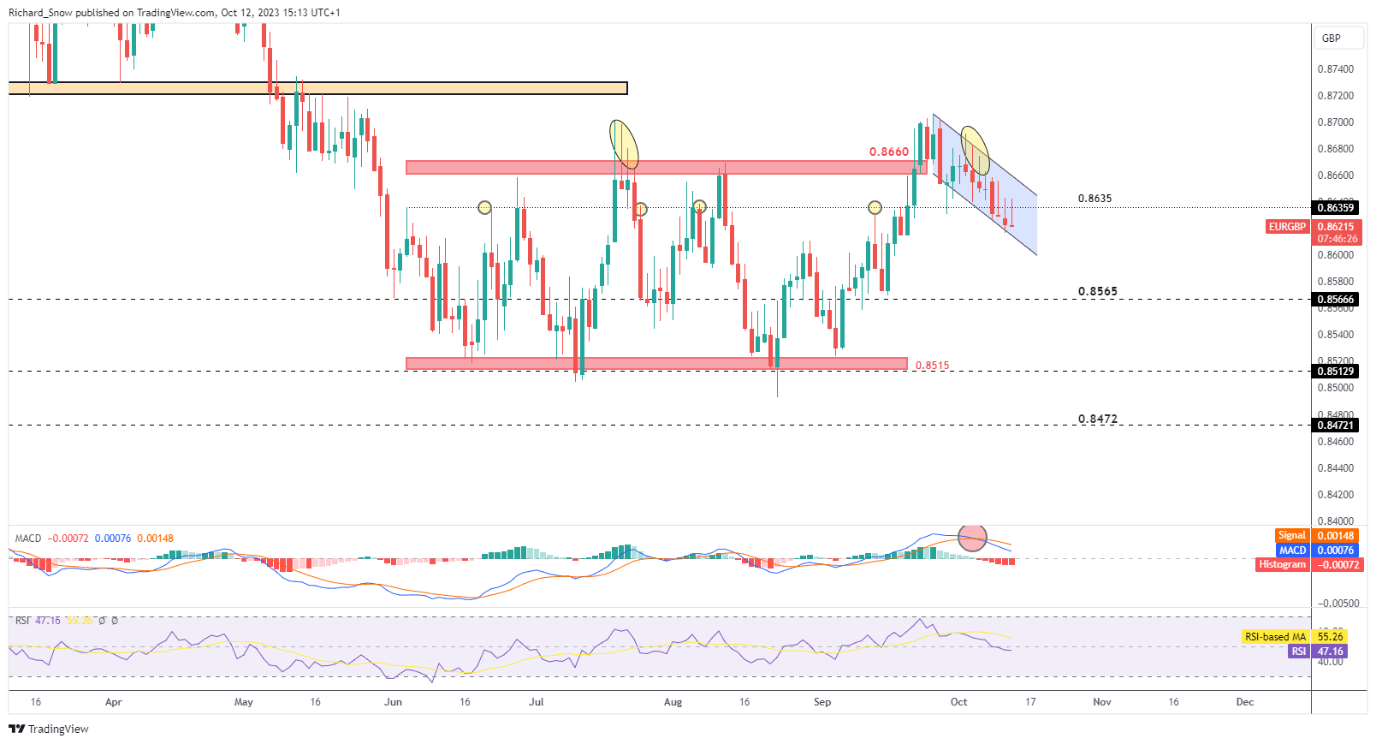

The EUR/GBP pair resumes the shorter-term transfer decrease because the every day chart displays increased higher wicks on the every day chart – a rejection of upper costs. Costs now strategy the underside of the descending channel after crossing beneath 0.8635 – a previous key degree of resistance. Momentum, in accordance with the MACD, favours additional draw back with the RSI nowhere close to oversold situations. Resistance seems at 0.8635.

EUR/GBP Every day Chart

Supply: TradingView, ready by Richard Snow

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to Publication

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX