Crude Oil, WTI, Retail Dealer Positioning, Technical Evaluation – IGCS Commodities Replace

- Crude oil costs gapped upward, ended Monday 4.35% greater

- Hamas’s assault on Israel might have oil disruption implications

- Retail bets are nonetheless net-long, what are key ranges to observe?

Really useful by Daniel Dubrovsky

Get Your Free Oil Forecast

Crude oil costs gapped greater at Monday’s open and closed the session 4.35% greater, marking the perfect single-day efficiency since early April. This adopted weekend developments as Hamas attacked Israel, inflating provide disruption woes. In accordance with Bloomberg, the outbreak “threatens to embroil each the US and Iran”. The latter has lately been a contributor of additional provide this 12 months.

In response, retail merchants have been growing upside publicity in crude oil as of late. This may be seen through IG Consumer Sentiment (IGCS), which regularly features as a contrarian indicator. With that in thoughts, whereas provide disruption fears might provide near-term assist, more and more bullish retail bets might function a bearish prospect for oil.

Crude Oil Sentiment Outlook – Bearish

In accordance with IGCS, about 73% of retail merchants are net-long crude oil. Since most of them stay biased to the upside, this continues to trace that costs might fall down the highway. That is as upside bets elevated by 19.36% and 94.04% in comparison with yesterday and final week, respectively. With that in thoughts, latest modifications in IGCS provide an more and more bearish contrarian buying and selling bias.

| Change in | Longs | Shorts | OI |

| Each day | 19% | 12% | 17% |

| Weekly | 94% | -40% | 21% |

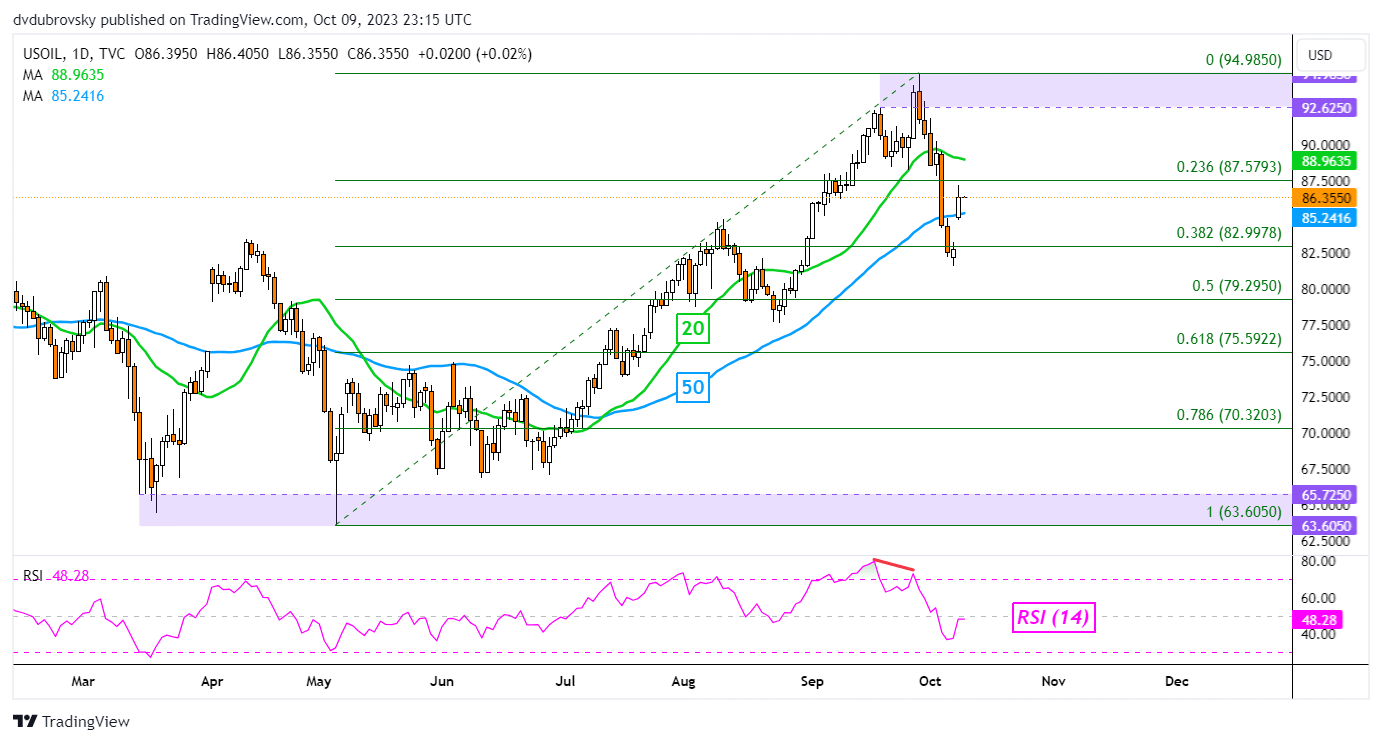

Wanting on the day by day chart, WTI bounced off the 38.2% Fibonacci retracement degree of 82.99 following latest basic developments. This additionally undermined the breakout beneath the 50-day shifting common, which has since been reversed. Resuming the uptrend entails a push above the 92.62 – 94.98 resistance zone. In the meantime, breaking beneath assist exposes the midpoint of the retracement at 79.29.

Really useful by Daniel Dubrovsky

The right way to Commerce Oil

Crude Oil Each day Chart

Chart Created in Buying and selling View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com