Militants from Hamas — categorised by the overwhelming majority of western world nations as a terrorist group — infiltrated Israel by land, sea and air on Saturday, throughout a significant Jewish vacation, in what was the largest assault in many years. The incursion got here hours after the Islamist militants fired hundreds of rockets into Israel from Gaza.

As we cope with monetary markets, we’ll focus solely on the consequences on the oil market, which can ultimately cascade to different components of the economic system.

Neither facet – nor Israel nor Palestine – is a significant oil participant. Israel boasts two oil refineries with a mixed capability of virtually 300,000 barrels per day and has “nearly no crude oil and condensate manufacturing”, in line with EIA; Palestine is of even much less relevance. The state of affairs of uncertainty and heightened geopolitical danger brought on oil to spike 5.4% on the open on Monday morning to a excessive of $87.21 earlier than retracing partially to the present stage of $85.88, however for this battle to have a significant influence on oil markets, there should be a sustained discount in oil provide or transport.

The concern is that tensions will escalate and unfold to your entire Center East area: If western international locations formally hyperlink Iranian intelligence to the Hamas assault, then Iran’s oil provide and exports face imminent draw back dangers. There’s additionally the position of Iran-backed Hezbollah in Lebanon to contemplate, that’s reported to have been partaking in small scale assaults on the north border. Iran’s oil output and exports have been rising steadily the previous few years: underneath encouragement from the US and secret nuclear talks, Iran noticed its oil exports and manufacturing develop by some 600k b/d to 3.2m of output between the tip of 2022 and mid-2023 and it’s now the fifth largest producer on this planet.

There’s then the potential cease (or reversal) of the US-brokered Abraham Accords which have eased some Center East tensions and paved the way in which for larger international funding within the area by establishing relations between Israel, UAE and Bahrain, one other destructive issue for the availability chain within the space: 40% of world exports goes by way of the Strait of Hormuz and the Suez Canal.

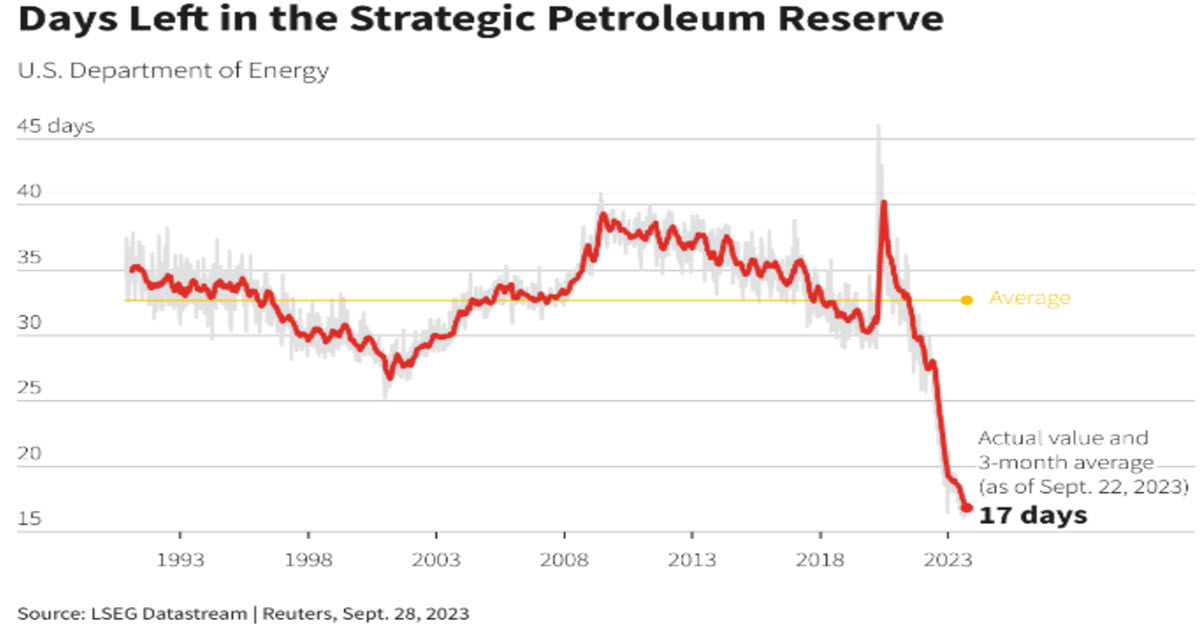

All this – in line with some analysts – may result in a premium of no less than $5-10 per barrel at a time when world oil inventories are low, US SPR is at historic low ranges and manufacturing cuts by Saudi Arabia and Russia will result in extra stock attracts over the subsequent few months.

TECHNICAL ANALYSIS

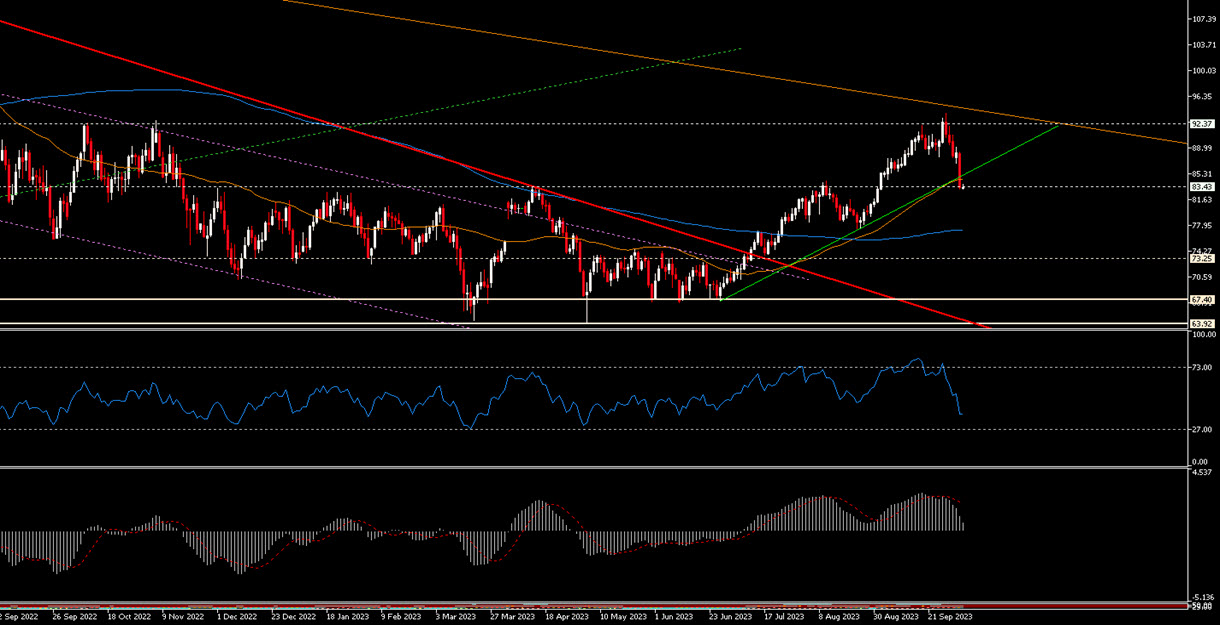

USOil closed final week 12.84% decrease than the highs reached on 28 September, under the bullish development that started on 28 June, its 50MA and the robust help within the $83.50 space. This morning it gapped up, opened above the stated static stage and went on to check from the underside the uptrend misplaced final week: proper now at $85.35 it’s simply above the 50MA. The RSI is under 50 (45.37) and tilted downwards, and the MACD histogram has turned destructive. Have been it not for the information flows, on a technical evaluation base alone, this may not seem to be such a stable state of affairs. It could possibly be a good suggestion to attend no less than till in the present day’s shut and for the state of affairs to make clear a bit of. An in depth in the present day above $86 could be fairly bullish and would imply a return to the bullish trendline: the subsequent resistances could be at in the present day’s excessive ($87.25) after which within the $88.25 space and at last $89. Downwards, the primary essential take a look at could be the closure of the Hole, then $83.30 after which final week’s low within the $81.50 space. A lot will rely upon whether or not we actually will see an escalation of pressure or the world powers will have the ability to keep away from a brand new pit of fear.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.