PixelsEffect

Funding Thesis: I take the view that Host Accommodations & Resorts will proceed to see modest progress as a result of plateauing RevPAR efficiency and better working bills.

In a earlier article again in February, I made the argument that Host Accommodations & Resorts (NASDAQ:HST) may even see modest progress going ahead, with indicators of slowing demand within the face of worth will increase.

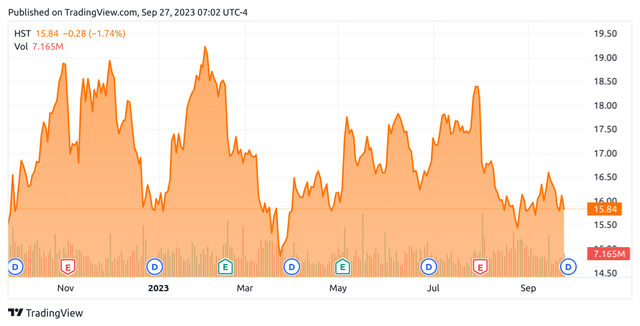

Since my final article, the inventory has descended to a worth of $15.84 on the time of writing:

TradingView.com

The aim of this text is to elaborate on why I proceed to price Host Accommodations & Resorts as a maintain right now, particularly as a result of:

- Plateauing RevPAR progress throughout lodges in each excessive and low-priced places

- Progress in bills having outpaced progress in revenues in the newest quarter

Efficiency

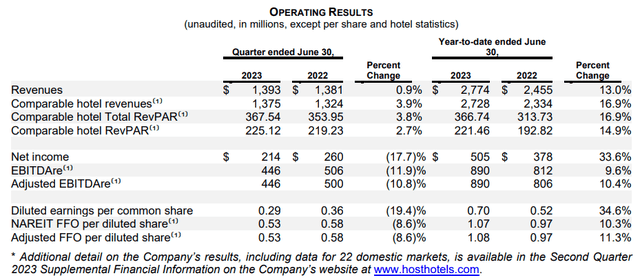

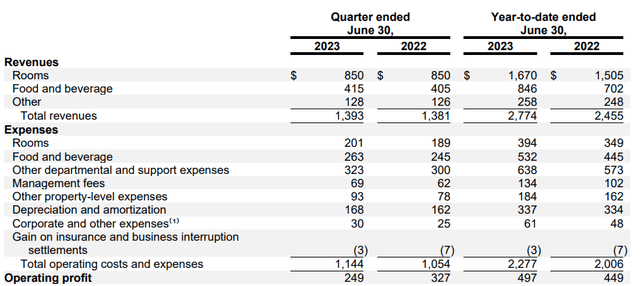

When the newest earnings outcomes for Host Accommodations & Resorts, we are able to see that whereas revenues and comparable lodge RevPAR (income per out there room) confirmed a modest improve on a quarterly foundation – we are able to see that diluted earnings per frequent share had been down by almost 20% on that of the identical quarter final yr.

Host Accommodations & Resorts: Second Quarter 2023 Outcomes

We will see that efficiency was higher on a year-to-date foundation, however this displays sturdy progress in revenues, RevPAR and earnings between Q1 2022 and Q1 2023.

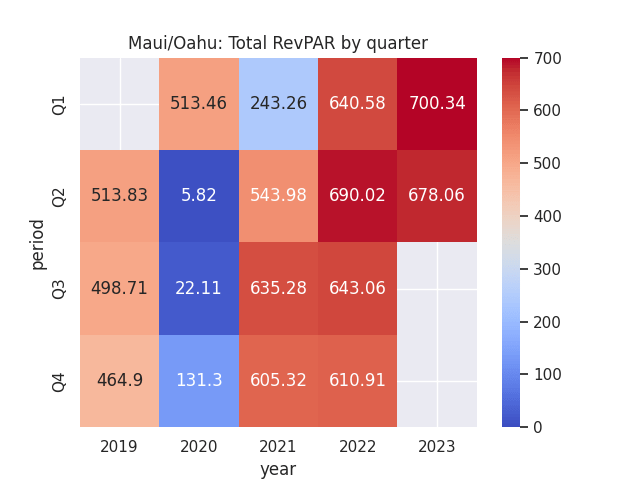

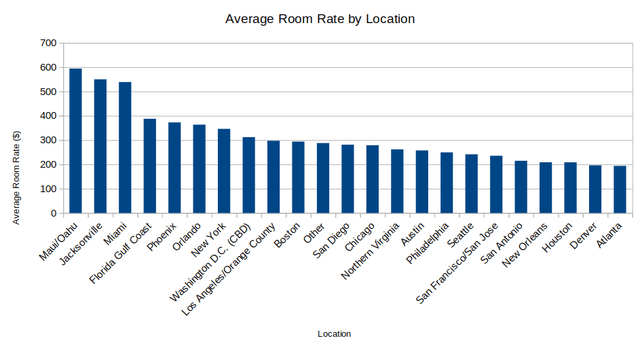

I had beforehand made the argument that throughout places with a excessive common room price – the Maui/Oahu location displaying the very best common room price at $594.07 – we might see a possible slowdown in RevPAR progress as inflationary pressures begin to dampen demand.

When Maui/Oahu for example, we are able to see that whereas RevPAR by quarter for Q1 2023 was considerably larger than Q1 2022, this development reversed in Q2 – with quarterly RevPAR decrease than that of final yr.

Figures (in U.S. {dollars}) sourced from historic Host Accommodations & Resorts quarterly monetary reviews. Heatmap generated by writer utilizing Python’s seaborn library.

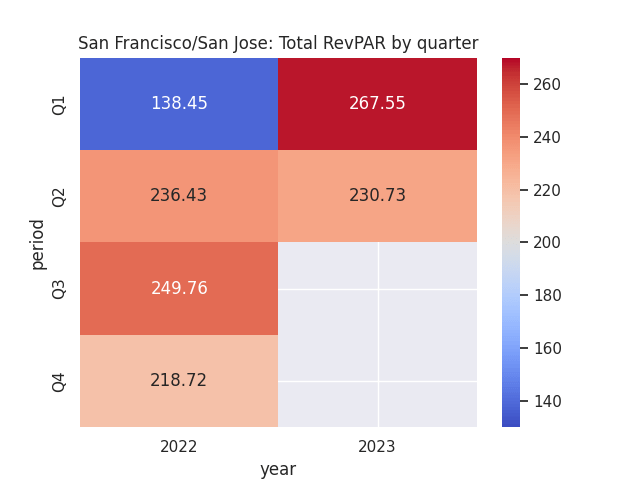

With that being stated, allow us to additionally check out the most important location by variety of rooms for Host Accommodations & Resorts: San Francisco/San Jose with 4,162 rooms as of Q2 2023.

When whole RevPAR by quarter, we are able to see that whereas RevPAR was considerably larger in Q1 of this yr as in comparison with final, Q2 RevPAR was barely decrease than that of final yr.

Figures (in U.S. {dollars}) sourced from historic Host Accommodations & Resorts quarterly monetary reviews. Heatmap generated by writer utilizing Python’s seaborn library.

Furthermore, the typical room price for San Francisco/San Jose for Q2 2023 was $235.44, which is on the decrease finish of the size when evaluating throughout different places.

Figures (in U.S. {dollars}) sourced from Host Accommodations and Resorts Q2 2023 Press Launch. Bar chart created by writer.

From this standpoint, Q2 has proven indicators of a plateau in RevPAR progress throughout places at each the upper and decrease finish of the size as regards to common room price.

From a steadiness sheet standpoint, we are able to see that the debt to belongings ratio for the final quarter remained at an identical stage as that of final December:

| Dec 2022 | Jun 2023 | |

| Complete debt | 4215 | 4210 |

| Complete belongings | 12269 | 12365 |

| Debt to belongings ratio | 34.35% | 34.05% |

Supply: Figures (in thousands and thousands of U.S. {dollars} besides ratios) sourced from Host Accommodations and Resorts Q2 2023 Press Launch. Debt to belongings ratio calculated by writer.

For context, whole debt in Q2 2019 was $3.864 billion with whole belongings of $12.525 billion, yielding a debt to belongings ratio of slightly below 31%.

With that being stated, money and money equivalents additionally noticed a rise from $667 million in December 2022 to $802 million in June 2023.

My Perspective

As regards my tackle the above outcomes and the implications for the expansion trajectory of the inventory going ahead, the developments in whole RevPAR throughout places are displaying indicators of a slowdown throughout costly places reminiscent of Maui/Oahu and cheaper places reminiscent of San Francisco/San Jose.

On this regard, we’re seeing a slowdown in demand extra usually – and with the winter months approaching, RevPAR is predicted to see a seasonal decline for Q3 and This autumn.

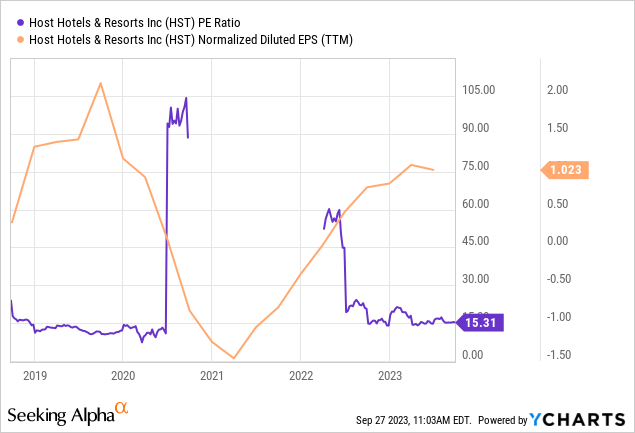

Moreover, we are able to see that whereas earnings per share has been reaching again close to ranges seen pre-pandemic, we’re seeing a slight levelling off in the identical.

ycharts.com

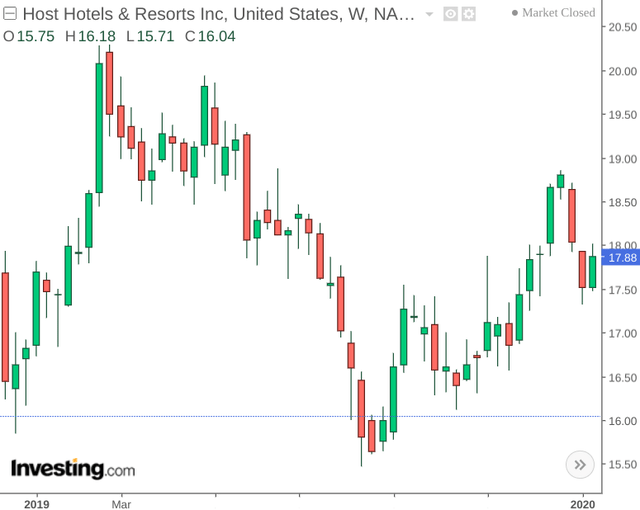

As regards an evaluation of honest worth – we are able to see that Host Accommodations and Resorts (with a P/E ratio of 15.31 and normalised diluted earnings per share of $1.023) is buying and selling at an identical stage to that seen at the start of 2019 – between $17-19 per share for the primary three months of the yr.

investing.com

At a worth of $15.84 on the time of writing – I take the view that if Host Accommodations & Resorts can proceed to maintain earnings at their present stage – then my estimate of honest worth underneath this situation could be between the vary of $17-19 per share – which is identical stage we noticed at the start of 2019 given an identical P/E ratio and earnings per share.

From a steadiness sheet and money circulation standpoint, the truth that Host Accommodations & Resorts has not seen a rise in debt ranges and has additionally managed to extend free money circulation is a constructive signal.

Dangers and Trying Ahead

Going ahead, I take the view that progress for Host Accommodations & Resorts could possibly be set to stay modest over the subsequent two quarters, as RevPAR is predicted to say no in accordance with seasonal demand.

In my opinion, the principle danger for Host Accommodations & Resorts right now is that RevPAR continues to see a plateau heading into 2024 however we don’t see a lower in bills to protect profitability. As an illustration, Host Accommodations & Resorts noticed a 8% improve in whole working prices and bills from $1.054 billion to $1.144 billion from Q2 2022 to Q2 2023, whereas income progress was far more modest at 0.86% over the identical interval (from $1.381 billion to $1.393 billion).

Host Accommodations & Resorts: Second Quarter Outcomes 2023

From this standpoint, even when we see a decline in RevPAR heading into the winter months – traders are more likely to pay shut consideration as as to whether the corporate can concurrently scale back its working bills and debt ranges going ahead.

Conclusion

To conclude, Host Accommodations & Resorts has seen a plateau in RevPAR progress throughout main places, and income progress extra usually.

I take the view that whereas a decline in RevPAR progress is possible heading into the winter months, traders are more likely to need to see proof of a discount in debt and working bills earlier than additional upside may be justified.