Inventory markets bought off throughout Asia, with Nikkei and Grasp Seng underperforming. China jitters and the sharp rise in oil costs are weighing on sentiment. USOIL lifted above USD 94 per barrel, stoking inflation issues and fueling hypothesis of extra charge hikes, which pushed up the 10-year Treasury yields to the very best stage since 2007. The stronger than anticipated sturdy items report and hawkish feedback from the Fed dove Kashkari weighed too. Wall Road closed narrowly blended. Japan’s 10-year charge hit a 20-year 12 months excessive, with the debt selloff prone to check the BoJ’s resolve to take care of expansionary insurance policies. The US 10-year charge is holding above 4.6% however is barely down on yesterday’s shut. Inventory futures are posting fractional beneficial properties in Europe and the US as markets look ahead to central financial institution alerts and in Europe preliminary inflation knowledge for October.

- USDIndex has an excellent week, climbing for a sixth straight day to a peak of 106.51. EURUSD broke 1.05 flooring and GBPUSD settled at 1.2112. The USDJPY corrected to 149.22 submit 149.70 highs.

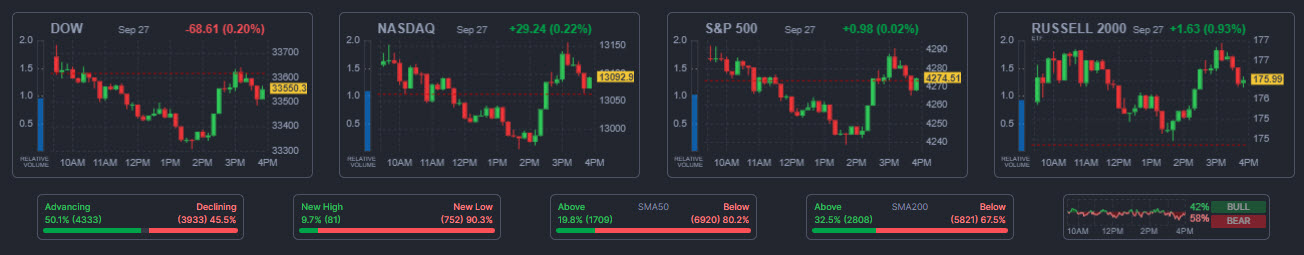

- Shares – JPN225 and Grasp Seng in the meantime misplaced -1.5% and -1.2% respectively. JPN225 posts largest 1-day drop in a month as worries for US rates of interest keep at elevated ranges. US30 slipped -0.2%. The US100 discovered a late bid and was 0.22% increased, and the US500 edged up 0.2%.

- USOil flirts 94.

- Bitcoin traded above $26,000.

As we speak: Eurozone shopper confidence, US preliminary jobless claims and GDP. Fed Chair Powell city corridor assembly with educators whereas Richmond Fed President Tom Barkin, Chicago Fed President Austan Goolsbee make speeches.

Attention-grabbing Mover: Goutdated had a run of declines this week assembly the $1870 assist (March hole). This leaves the door open to a near-term rebound however total additional selloff is predicted with Help at $1862 and $1845.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.