- General Development: Darden exhibited a sturdy 11.6% year-over-year (YoY) gross sales development in 2024.

- High quality Eating Phase: The High quality Eating section confirmed distinctive development with a staggering 49.1% YoY improve, regardless of contributing simply 10% to whole gross sales.

- Strategic Enlargement: Darden expanded its footprint via the acquisition of 77 Ruth’s Chris Steak Home eating places and the introduction of 46 new eating places.

Darden Eating places, Inc. (NYSE: NYSE:), a number one participant within the restaurant trade, has showcased spectacular development and resilience within the first quarter of 2024. The corporate’s robust efficiency highlights its various model portfolio, strategic enlargement initiatives, and proactive measures to boost shareholder worth. Darden’s dedication to buyer satisfaction, technological developments, and operational effectivity additional contribute to its development trajectory.

Sturdy Q1 2024 Efficiency and Development Technique:

Darden’s income witnessed a sturdy 11.6% year-over-year development, amounting to $2.7 billion within the first quarter of 2024. This spectacular development might be attributed to the stable efficiency throughout all segments, with the High quality Eating section main the way in which with a outstanding 49.1% development. Regardless of contributing solely 10% to the consolidated gross sales, this section’s speedy enlargement signifies Darden’s success within the upscale eating market. Olive Backyard, Darden’s largest section, skilled an 8.6% development, contributing 44.9% to the full gross sales. LongHorn Steakhouse adopted go well with with a commendable 10.8% year-over-year development, sustaining a constant contribution to Darden’s general efficiency. The Different Enterprise section noticed a modest 6.1% rise in gross sales, though its contribution barely decreased from 21.6% in 2023 to twenty.5% in 2024. General, Darden’s various model portfolio showcases a balanced development trajectory, with every section taking part in a pivotal function within the firm’s monetary ascent.

Darden’s Strategic Initiatives and Dedication to Shareholders:

Darden’s strategic initiatives embrace the acquisition of 77 Ruth’s Chris Steak Home eating places, additional diversifying and solidifying its footprint within the eating trade. The corporate’s enlargement efforts lengthen past acquisitions, with the introduction of 46 new eating places, highlighting its dedication to capturing new market alternatives. The corporate’s proactive method to enhancing shareholder worth is obvious in its dividend declaration of $1.31 per share and the repurchase of 0.9 million shares of frequent inventory, amounting to roughly $143 million. These measures sign Darden’s dedication to prioritizing shareholder returns and instilling confidence within the firm’s long-term development prospects.

Embracing Know-how and Main within the Restaurant Trade:

Darden’s adoption of expertise as a aggressive benefit units it aside inside the restaurant trade. With a safe and strong digital platform, together with on-line ordering and cell functions, the corporate addresses evolving buyer wants and enhances the general eating expertise. By leveraging technology-enabled options, Darden improves monetary management, price administration, visitor service, worker effectiveness, and e-commerce capabilities. Regardless of some softness amongst higher-income households, presumably as a consequence of elevated worldwide journey, Darden’s give attention to model execution and aggressive pricing ensures sustained buyer loyalty. The corporate stays vigilant to evolving shopper habits, significantly inside the informal eating section, and carefully screens commodity prices, particularly beef costs, to plot efficient price and pricing methods. The management transition, with Cynthia T. Jamison lately elected as Board Chair, ensures continuity whereas fostering innovation inside Darden. This seamless transition additional reinforces the corporate’s dedication to its strategic course and long-term development.

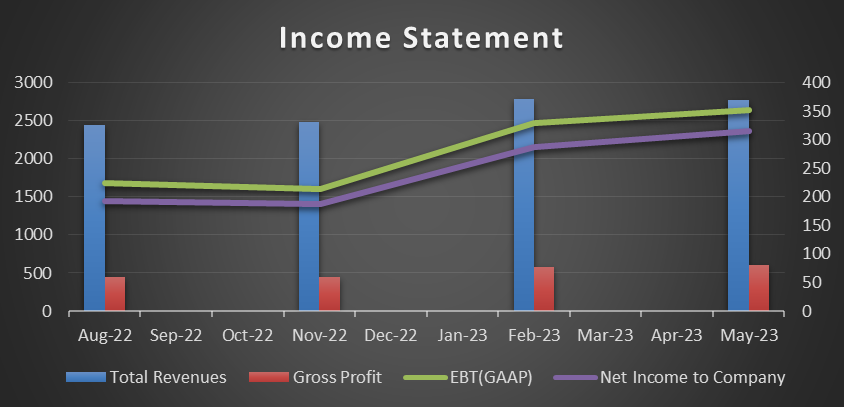

Q-o-Q Pattern

Conclusion

Darden Restuarant Chart

Darden Eating places, Inc. has showcased outstanding resilience and development potential within the first quarter of 2024. With a various model portfolio, strategic enlargement efforts, a shareholder-centric method, and technological improvements, the corporate is primed for sustained success. These elements are pivotal in underpinning its means to method the bullish value goal of $175.00 inside the subsequent 12 months. In abstract, Darden Eating places, Inc. presents an attractive funding prospect within the restaurant trade, with a robust basis for development. However, prudent monitoring of market dynamics is required to navigate potential challenges and capitalize on the corporate’s promising trajectory.

Disclosure: We don’t maintain any place within the inventory.

Authentic Put up