Kizel/iStock by way of Getty Photos

The Background

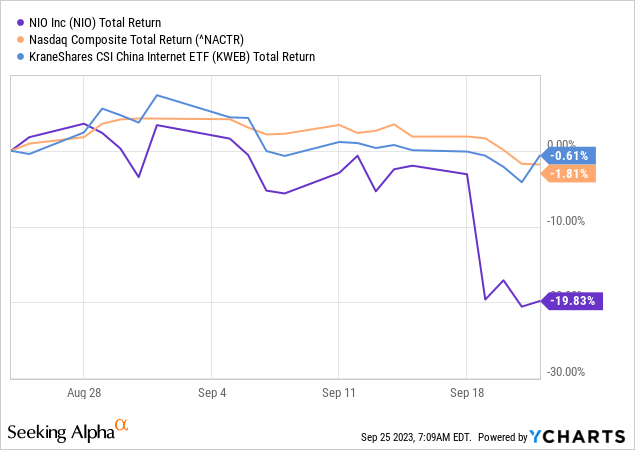

I’ve been protecting NIO Inc. (NYSE:NIO) since November 2022, when 1 share was price $11.34, and since then the inventory value has fallen over 25%, and the current rebound introduced shareholders nothing however disappointment:

Searching for Alpha, my protection of NIO inventory

The inventory’s decline has intensified considerably in current weeks, and judging by the energy of the decline, it was not on account of weak point in Chinese language shares or the excessive tech sector as a complete.

So, why is NIO correcting a lot and does the inventory have an opportunity to get out of this case? For my part, NIO does have an opportunity, however a more likely situation for the event of occasions within the foreseeable future, in my view, is the continuation of the correction that has begun.

Why Do I Assume So?

Greater than 3 months have handed since my final article on NIO, and in that point a number of new info has surfaced that must be thought of first.

On June 20, Financial institution of America’s analysts grew to become extra optimistic about NIO’s future gross sales, particularly for the ET5 Touring mannequin. On the time, NIO aimed for 10,000 gross sales in June and round 20,000 per thirty days within the latter half of the 12 months. They deliberate to open extra take a look at drive pop-up shops. There have been some gross margin strain issues, however regardless of them, Financial institution of America maintained a Purchase ranking on the inventory with a $11 value goal on account of NIO’s robust place within the premium sensible EV phase, constant mannequin launches, and a deal with autonomous driving, powertrain, and charging options.

On the identical date, we discovered that NIO had secured a $738.5 million funding from CYVN Holdings, primarily owned by the Abu Dhabi Authorities. CYVN Holdings needed to amass 84.7 million newly issued class A strange shares of Nio at a per-share value of $8.72. Moreover, CYVN Holdings had an settlement to buy 40.1 million Nio shares from a Tencent affiliate. Following this transaction, CYVN would maintain ~7% of Nio’s shares and will nominate one director to Nio’s board if it maintained a 5% possession stake. In addition they deliberate to collaborate on worldwide enterprise alternatives.

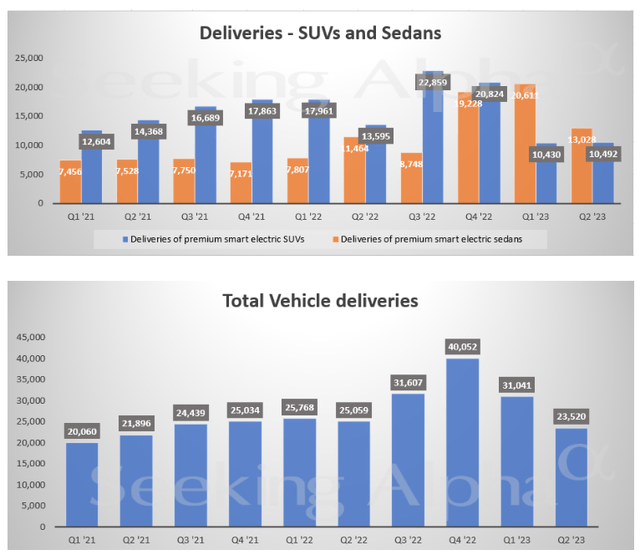

On July 1st, NIO reported delivering 10,707 autos in June 2023, totaling 23,520 deliveries for Q2. June’s deliveries included 6,383 premium electrical SUVs and 4,324 premium electrical sedans. This marked a 74% improve in comparison with the earlier month however a 17.4% lower YoY. These Q2 deliveries had been on the decrease finish of their steering. Nio additionally started delivering its All-New ES8 flagship SUV on the finish of June. The year-over-year drop in June deliveries aligns with Xpeng (XPEV) however differs from Li Auto (LI) deliveries.

It appears to me that numerous the above-mentioned optimistic information from the corporate, its Arab companions, in addition to one of many largest funding banks triggered a pointy improve within the inventory value in July-August 2023 – this conclusion is confirmed chronologically:

Searching for Alpha Information, June 20, 2023

Nonetheless, by August, NIO’s development started to weaken. Weak macro knowledge on the Chinese language financial system had been launched in early August, and by the top of the month, NIO missed each the highest and backside line estimates:

Searching for Alpha Information, NIO

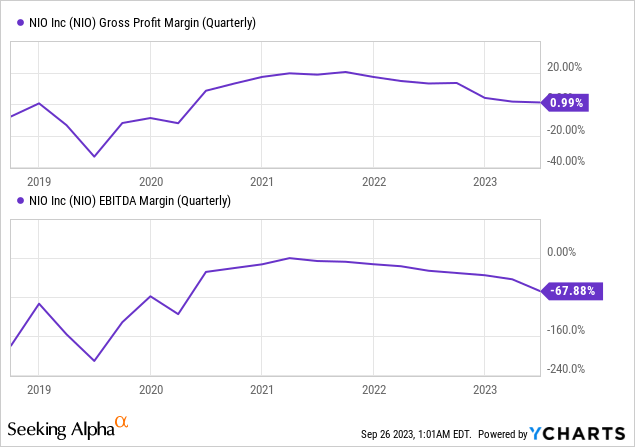

NIO’s Q2 2023 outcomes confirmed a Non-GAAP EPADS of -$0.45, lacking expectations by $0.04. Income reached $1.21 billion, a 14.8% YoY decline, lacking by $60 million. Automobile deliveries in Q2 totaled 23,520 items, comprising 10,492 electrical SUVs and 13,028 electrical sedans, marking a 6.1% lower from Q2 2022 and a 24.2% drop from Q1 2023. Automobile gross sales for Q2 had been $990.9 million, down 24.9% YoY and 22.1% QoQ. The automobile margin in Q2 2023 was 6.2%, contrasting with 16.7% in Q2 2022 and 5.1% in Q1 2023.

Searching for Alpha knowledge

Looking forward to Q3 2023, NIO anticipated delivering between 55,000 and 57,000 autos, representing a 74.0% to 80.3% improve from the identical quarter in FY2022. In addition they anticipated whole revenues to vary between RMB 18,898 million ($2,606 million) and RMB 19,520 million ($2,692 million), reflecting a forty five.3% to 50.1% development in comparison with Q3 2022, Searching for Alpha Information reported.

On September 1st, we discovered that NIO had achieved a cumulative supply milestone of 383,908 autos as of August 31, 2023, delivering 19,329 autos [+81.0% YoY, but -5.5% QoQ]. In about 2 weeks after that information got here out, NIO introduced a proposed providing of $500 million in convertible senior notes due in 2029 and one other $500 million in convertible senior notes due in 2030, intending to make use of a part of the web proceeds to repurchase a few of its present debt securities, with the rest allotted for bolstering its steadiness sheet and normal company functions.

On September 21, NIO introduced the launch of a high-end smartphone designed for use with its electrical vehicles.

For my part, the QoQ decline in deliveries [and the earnings miss], the brand new mezzanine financing, and the shift in growth focus [from EVs to smartphones] had been the turning level for the reversal of the optimism rally for NIO – once more, that is confirmed chronologically:

Searching for Alpha Information, August 29, 2023

I’m not a shareholder of NIO Inc., but when I had been an investor within the firm, I’d ask a logical query: What’s occurring with administration’s strategic imaginative and prescient?

The corporate’s key margins stay poor and proceed to say no since their peak ranges of FY2022:

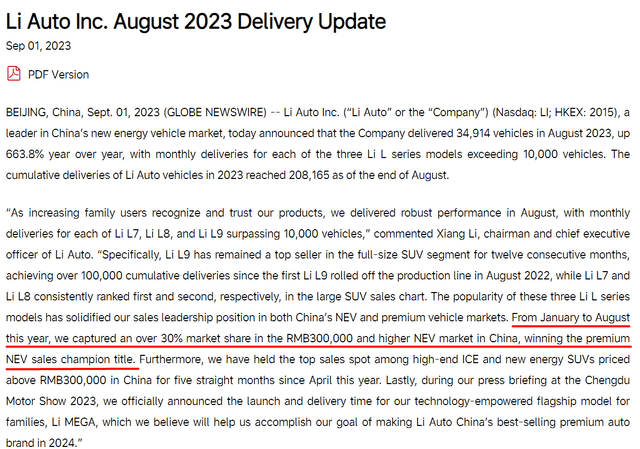

Judging by the QoQ dynamics of deliveries, NIO nonetheless can’t present development whereas different rivals are doing a lot better – take Li Auto for instance.

LI Auto’s press launch, writer’s notes

And whereas NIO continues to burn traders’ cash whereas attracting an increasing number of capital that may most certainly be burned for a number of years as nicely, administration declares the creation of a smartphone.

What do you assume: Why doesn’t Tesla (TSLA) make its personal smartphones? I feel it is a very advanced manufacturing course of that, when mixed with one other advanced manufacturing course of corresponding to electrical automobile manufacturing, threatens the general operational effectivity of the corporate that dares to do that.

NIO is deeply unprofitable, with increasing adverse EBITDA margin, QoQ supply declines, weak Chinese language financial system, and very fierce market competitors, attracting tons of of tens of millions of {dollars} in new mezzanine capital, and saying that it’s going to severely complicate its working actions, as if hinting to traders that they needn’t watch for optimistic margin development within the foreseeable future.

Because of this, I stay very skeptical about NIO’s prospects: the current company actions present me that the dangers have shifted much more to the adverse, and on the similar time, I don’t assume a lot development potential has been added. I don’t perceive why you want a separate smartphone when you may get by with an strange utility if the objective is to manage the automotive remotely to make it extra handy for drivers.

The Backside Line

After all, there are dangers to my thesis. Initially, this inventory is closely oversold, and there may be already a number of negativity in its value. If administration makes any sort of announcement (e.g., canceling the event of a smartphone with new investor cash) or exhibits robust quarterly development numbers in deliveries or financials, the NIO inventory could possibly be again as much as the $10-11 value vary briefly order. Second, I could also be misreading the state of affairs surrounding current company occasions: Maybe after a while, NIO will show that the current information was not adverse in any respect however fairly foreshadowed a qualitative turnaround on this development story.

That stated, I nonetheless need to fee NIO inventory a “Promote” as a result of I feel the dangers have solely elevated lately, however the development potential has remained unchanged.

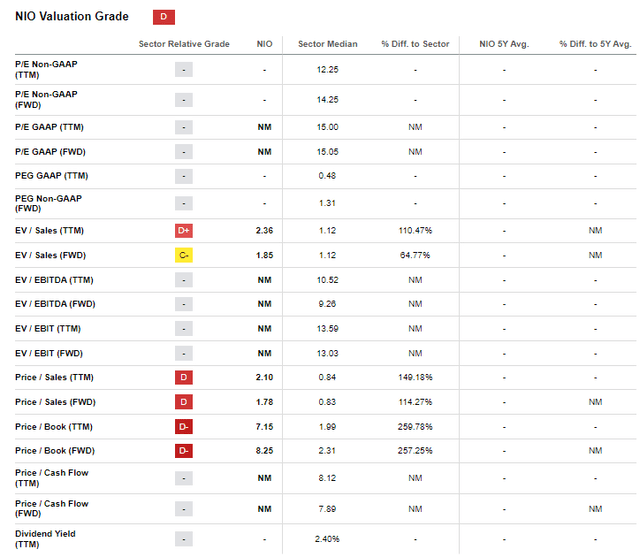

When folks say that NIO is an inexpensive firm as a result of it has a price-to-sales (P/S) ratio of lower than 2x, I smile as a result of I do know that there’s nothing extra to valuation multiples than P/S and P/B:

Searching for Alpha, NIO’s Valuation

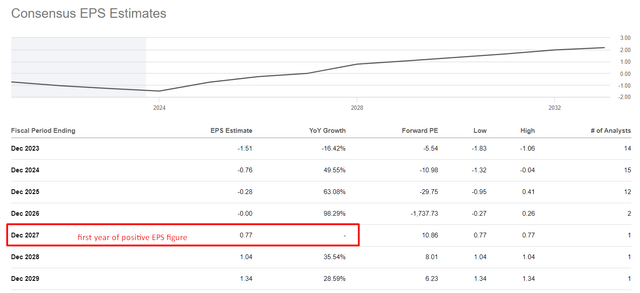

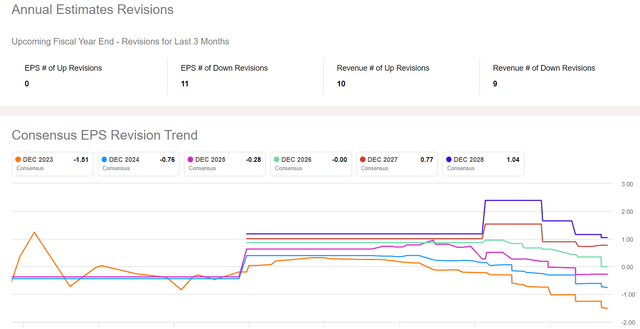

On the similar time, the corporate won’t grow to be worthwhile till 2027 – and we all know that analysts maintain reducing their forecasts. I wrote about this danger in my final articles on NIO, and what truly began to occur this 12 months.

Searching for Alpha, writer’s notes Searching for Alpha

Sadly, many appear to neglect that the automotive enterprise is a troublesome place – each when it comes to competitors and manufacturing processes. Right here, each enterprise should be justified, or the market will punish you. Sadly, in my view, the time of punishment for NIO is getting nearer and nearer.

Thanks for studying!

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.