Dilok Klaisataporn

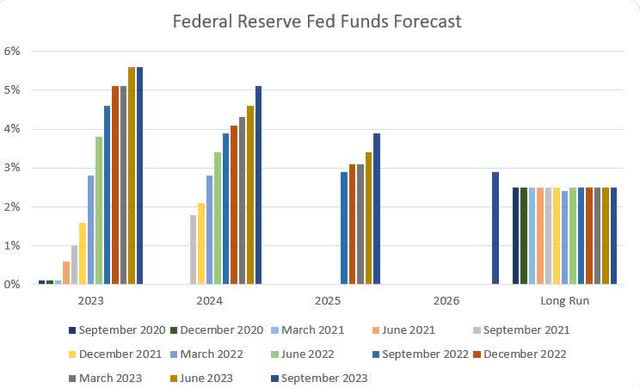

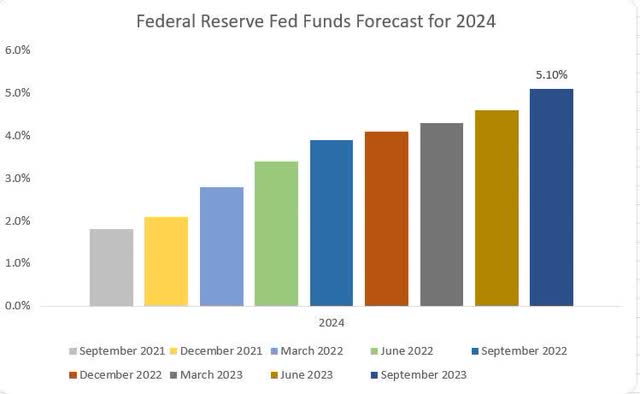

The Federal Reserve simply introduced its rate of interest coverage choice and determined to maintain the federal funds price at 5.25 to five.50%. Whereas market watchers are inclined to key in on the Fed’s price choice, one other vital announcement was being made within the type of new quarterly financial projections that traders can use as a forecast for coverage. Right now’s projections present that the Fed is ready to lift charges additional and hold them there longer, if obligatory, to stabilize costs.

Whereas the Fed held its focused rate of interest for 2023, that price is an extra 25 foundation level greater than the present fed funds price. Moreover, the Fed has elevated its 2024 fed funds goal from 4.6 to five.1% to sign that charges will keep above 5% for one more 15 months (they have been above 5% for simply over 4 months). The committee additionally raised its 2025 goal by 50 foundation factors and launched its 2026 Federal funds goal at 2.9%, 40 foundation factors above the focused price. The message is easy: we have been above the long run fed funds goal price of two.5% for a 12 months and we is not going to return there for 3 extra years!

Federal Reserve Federal Reserve

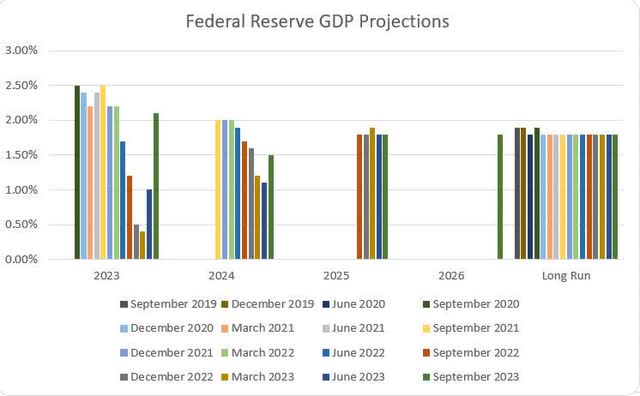

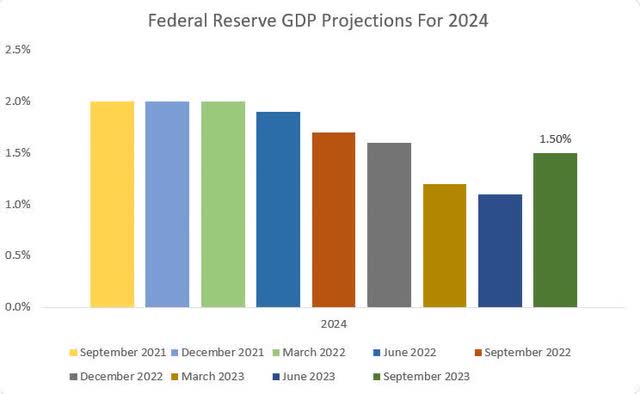

The Fed’s financial progress projections additionally signify its dedication to remain vigilant. Whereas GDP progress projections for 2023 shot as much as over 2%, the Fed’s 2024 financial progress goal stays beneath its long-term goal price of 1.8%. With an estimated progress price of 1.5% in 2024, the Fed doesn’t seem prone to pivot if financial progress (or numerous experiences that feed into financial progress) is available in tender.

Federal Reserve Federal Reserve

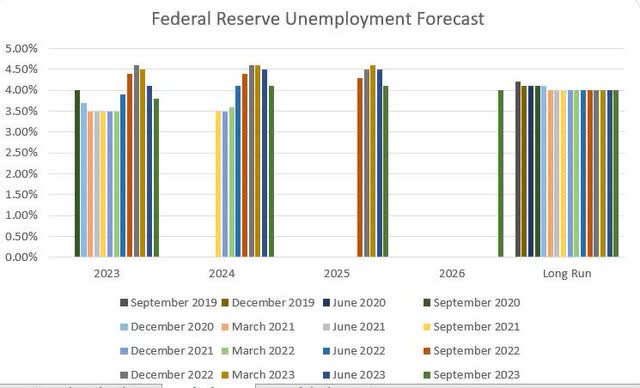

Like progress, the unemployment price has continued to outperform the Fed’s expectations in 2023, main them to decrease their present 12 months estimates to the present price of three.8%. Whereas 2024 and 2025 unemployment projections have additionally been lowered, they continue to be above the committee’s long-term goal of 4%. The Fed is speaking to the markets that it’ll tolerate barely greater than focused unemployment if it means bringing costs below management.

Federal Reserve

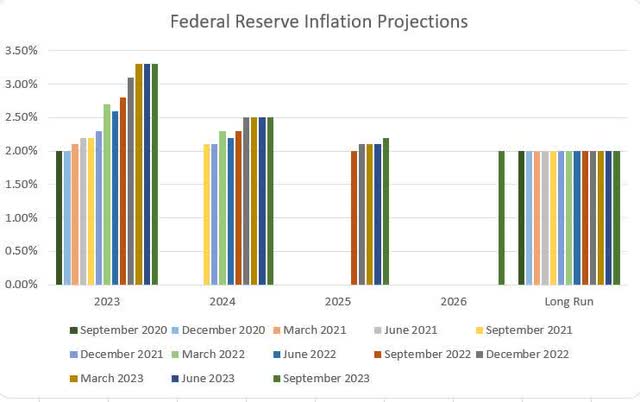

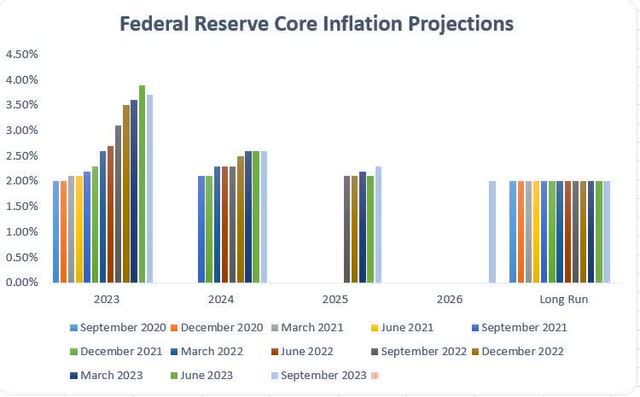

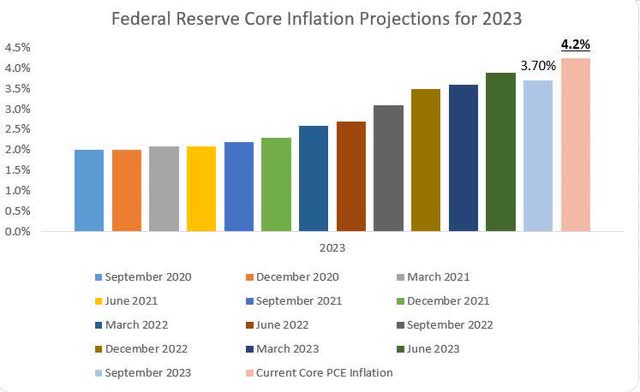

What’s the most fascinating portion of the Fed’s financial estimates is their inflation projections. The Fed has held its headline inflation estimate for 2024 at 2.5% for 4 consecutive quarters whereas additionally projecting that core PCE inflation will drop from its present 4.2% degree to three.7% by the tip of the 12 months. The Fed has disinflation ramping up in 2024 with a projected drop in core inflation to 2.6%. I consider these projections are bold and should require a 6% federal funds price to attain it, as a robust labor market and powerful consumption continues to point out pricing traits above the Fed’s 2024 projections. At a minimal, these inflation targets seemingly sign no price cuts in 2024.

Federal Reserve Federal Reserve Federal Reserve

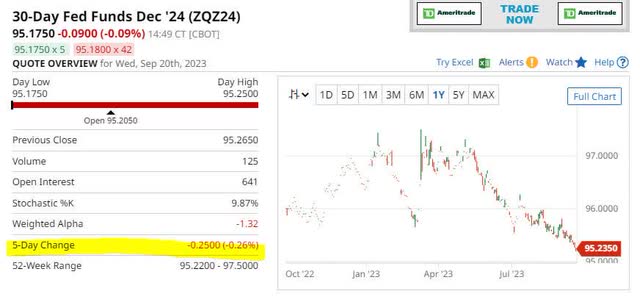

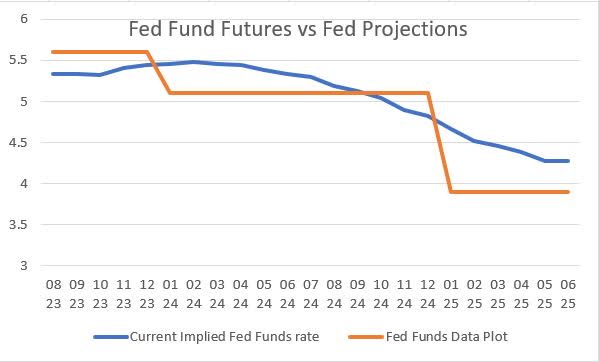

What needs to be reassuring to traders is that the market appears to be precisely pricing within the Federal Reserve’s policymaking projections. December 2024 Fed fund futures are presently priced 35 foundation factors below the Fed’s 2024 projections after rising by 25 foundation factors during the last 5 buying and selling days. This can be a smaller variance than what we noticed earlier this 12 months. Curiously, the market presently anticipates charges to average at a a lot slower price than the Fed initiatives, with 2025 fed fund futures buying and selling 75 foundation factors above projections and the total Fed funds curve is projecting charges above 4% via 2027!

Barchart Barchart

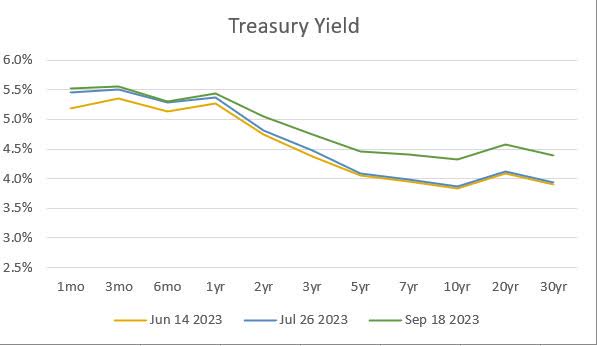

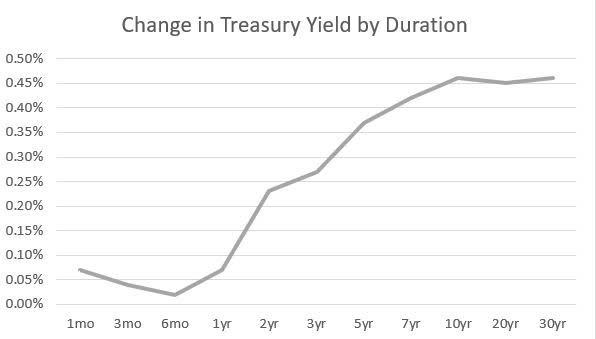

The Treasury markets are additionally starting to simply accept the fact of upper charges for an extended time. Because the final Federal Reserve assembly, long run Treasury charges have jumped noticeably greater, particularly when evaluating between the June and July conferences. It is protected to say that at 5.5% on a one-year Treasury invoice, consumers of 1 12 months Treasuries aren’t anticipating a reduce till at the least the fourth quarter of 2024.

Federal Reserve Federal Reserve

Whereas the market and the Fed are extra aligned on price outlook, issues nonetheless stay. First, fairness markets are nonetheless overvalued with earnings yield nicely beneath the risk-free price. Sooner or later, greater rates of interest will affect earnings and with out vital earnings progress, present market valuations merely can’t maintain. Secondly, I’ve vital issues concerning the flows of Treasury debt in a excessive price atmosphere (a thesis I additional element right here). These issues turn out to be additional exacerbated by an extended than anticipated high-rate cycle, however there isn’t any different choice to convey worth stability to our financial system, subsequently we should proceed on the present course.