Kevin Dietsch/Getty Pictures Information

The Fed could go on elevating charges this week, however that does not imply they’re accomplished. Given the stronger-than-expected financial development witnessed over the previous few months, it appears extra doubtless than not that the Fed will sign by means of its Abstract of Financial Projections that one other hike could also be wanted whereas eradicating charge cuts for 2024.

That is important for the Fed, particularly when asset worth inflation has skyrocketed, and core inflation metrics keep elevated. On high of that, commodities like oil and gasoline are once more on the rise, and that impact can ripple by means of the financial system.

This has already resulted in charges on the again of the yield curve and market-based inflation expectations. Moreover, it places the Fed in a tricky spot as a result of if the market views the Fed as not being aggressive sufficient towards sticky inflation, yields on the again of the curve might rise even additional whereas inflation expectations rise.

For this reason the Fed might want to talk to the market that they continue to be data-dependent, {that a} charge hike in November is on the desk, and that the surprising outperformance of the US financial system means charges in 2024 could not come down as a lot as anticipated.

Communication By Projections

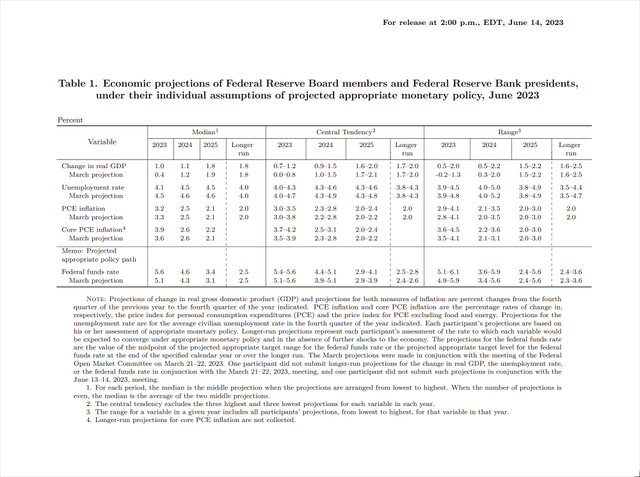

The June SEP revealed a peak Fed Funds terminal charge of 5.6% in 2023, which is then anticipated to come back all the way down to 4.6% in 2024, 3.4% in 2025, a long-run charge of two.5%. Given the present knowledge set, it appears almost definitely that the 2023 projection of 5.6% will stay whereas the 2024 and 2025 charges transfer increased and charge cuts are faraway from the equation.

Federal Reserve

Whereas the long-run charge stayed at 2.5% after the June assembly, its central tendency shifted from 2.4%-2.6% to 2.5%-2.8%. This means the Fed may even see the impartial charge, which neither stimulates nor restricts financial exercise, as doubtlessly increased than earlier than. A 2% inflation goal implies an actual rate of interest of 0.5%. The next long-run charge might imply the Fed estimates the next impartial actual charge for the financial system.

Bond Market See Greater Charges

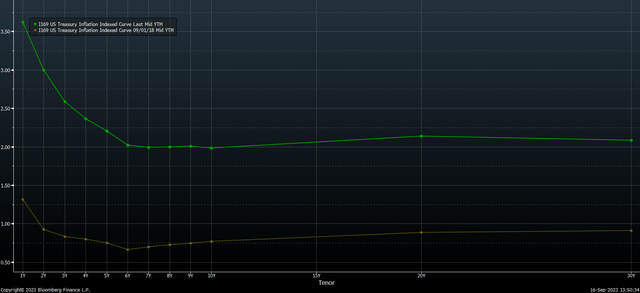

The market could already be one step forward of the Fed as a result of at present, the market sees actual charges at roughly 2% throughout your complete yield curve out to 30 years. Examine that to the place the market noticed charges again in September 2018, when the market noticed a impartial charge nearer to round 0.75%. In September 2018, the Fed’s long-run charge was 3%, with a 2% inflation charge projecting a 1% actual yield.

Bloomberg

The bond market appears to be saying immediately that the Fed’s concept of the long-run is just too low, and that will counsel that one ought to pay specific consideration to any modifications within the long-run rate of interest. As a result of it appears on the floor, simply by wanting on the route of the earnings yield of the S&P 500, the fairness market thinks a slew of charge cuts are coming. That is famous by the earnings yield shifting decrease whereas actual yields are shifting increased. This is able to counsel that the fairness market nonetheless does not consider the Fed when it says that charges should keep restrictive for a while.

Bloomberg

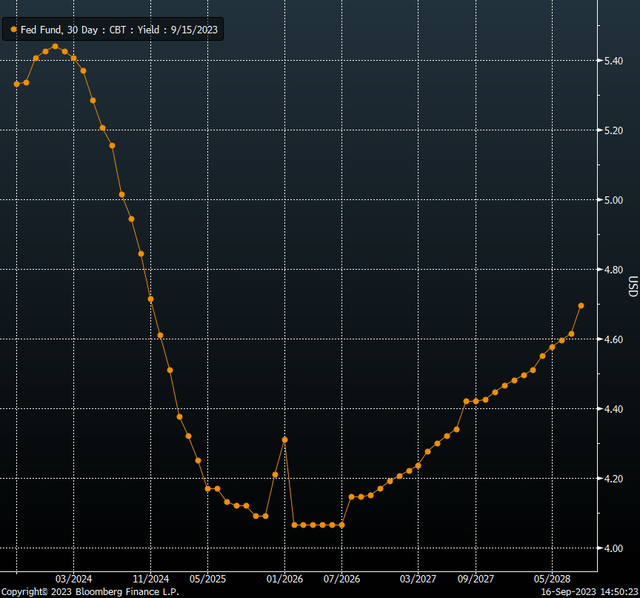

What’s fascinating at this level is that the bond market is in virtually full settlement with the Fed relating to the trail of charges, with a peak coverage charge of 5.45%, whereas seeing charges falling to round 4.6% by the tip of 2024, which is what the SEP was forecasting again in June.

Bloomberg

However the query turns into extra about that long-run charge as a result of a 2% inflation charge and a 2% actual yield would counsel that the nominal charges keep above 4.0% over a really lengthy interval. The Fed Funds futures see charges falling to round 4.1% by 2026 and by no means going under. This is able to counsel that the Fed chopping charges to 4.6% in 2024 might be unlikely, and that can end in that 2024 estimate rising, and it most likely signifies that 2025 estimates of three.4% is means too low and might want to rise above 4% as properly.

Distinction of Opinion

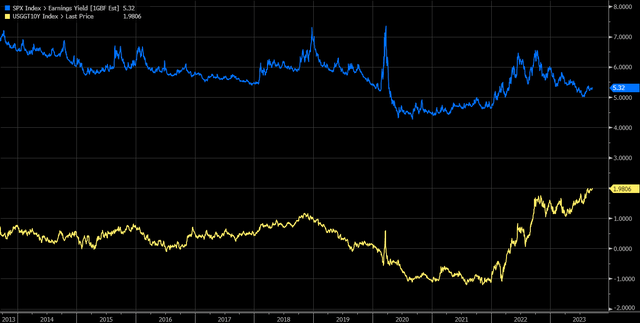

Nevertheless, the fairness market appears to be pricing a a lot decrease long-run charge than the bond market. The present earnings yield of the S&P 500 over the following 12 months is 5.3%, whereas the 10-year actual yield is 1.98%, a ramification of three.3%. Traditionally, that unfold averages round 5.4% over the previous ten years, a distinction of about 2.1%. This implies the S&P 500 must be buying and selling with an earnings yield of about 7.4% and with a 5.4% premium over the 10-year actual yield, we might get a 2% actual yield plus a 2% inflation goal charge, giving us a long-run charge of about 4%, virtually the identical as bonds. Nevertheless, at an incomes yield of 5.3% and a median premium of 5.4%, we get an actual yield of -0.1%, plus a 2% inflation goal charge would give us a long-run charge of 1.9%.

Bloomberg

These spreads can change and valuation shift. Nevertheless, if we simply put the numbers apart. The message is that the bond market thinks charges should be restrictive for a very long time, whereas the fairness market thinks that charges will not be restrictive for a very long time and that the Fed can be aggressively chopping charges.

After all, many issues can change over the following two years, and making an attempt to foretell the following six months is difficult sufficient, not to mention the following 2 or 3 years. However that isn’t the purpose; the fairness market is betting on many charge cuts, which isn’t what the bond market says. That message of upper for longer is prone to be proven on this week’s FOMC SEP, which ought to present charge cuts being eliminated whereas the fairness market nonetheless thinks huge charge cuts are coming.