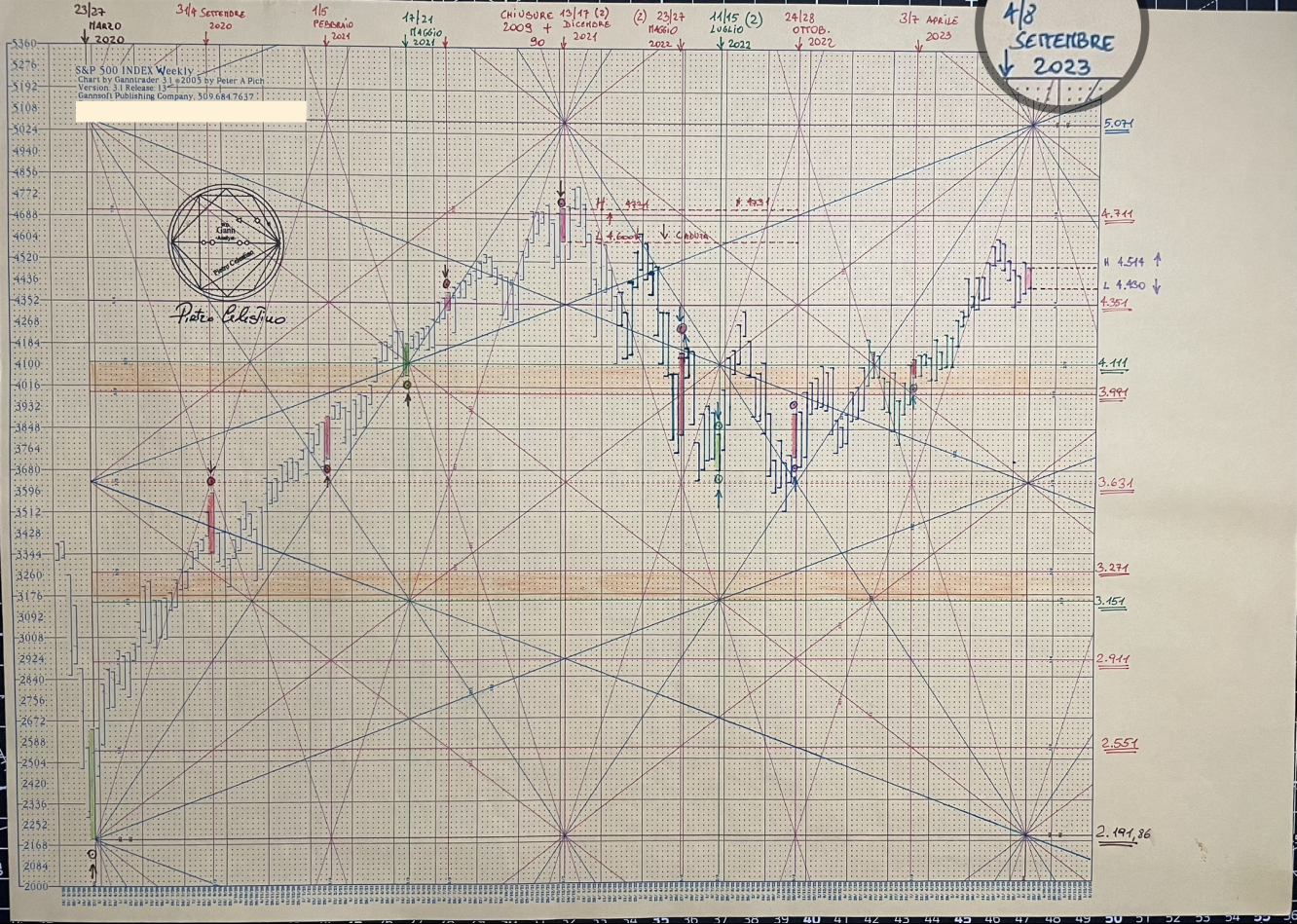

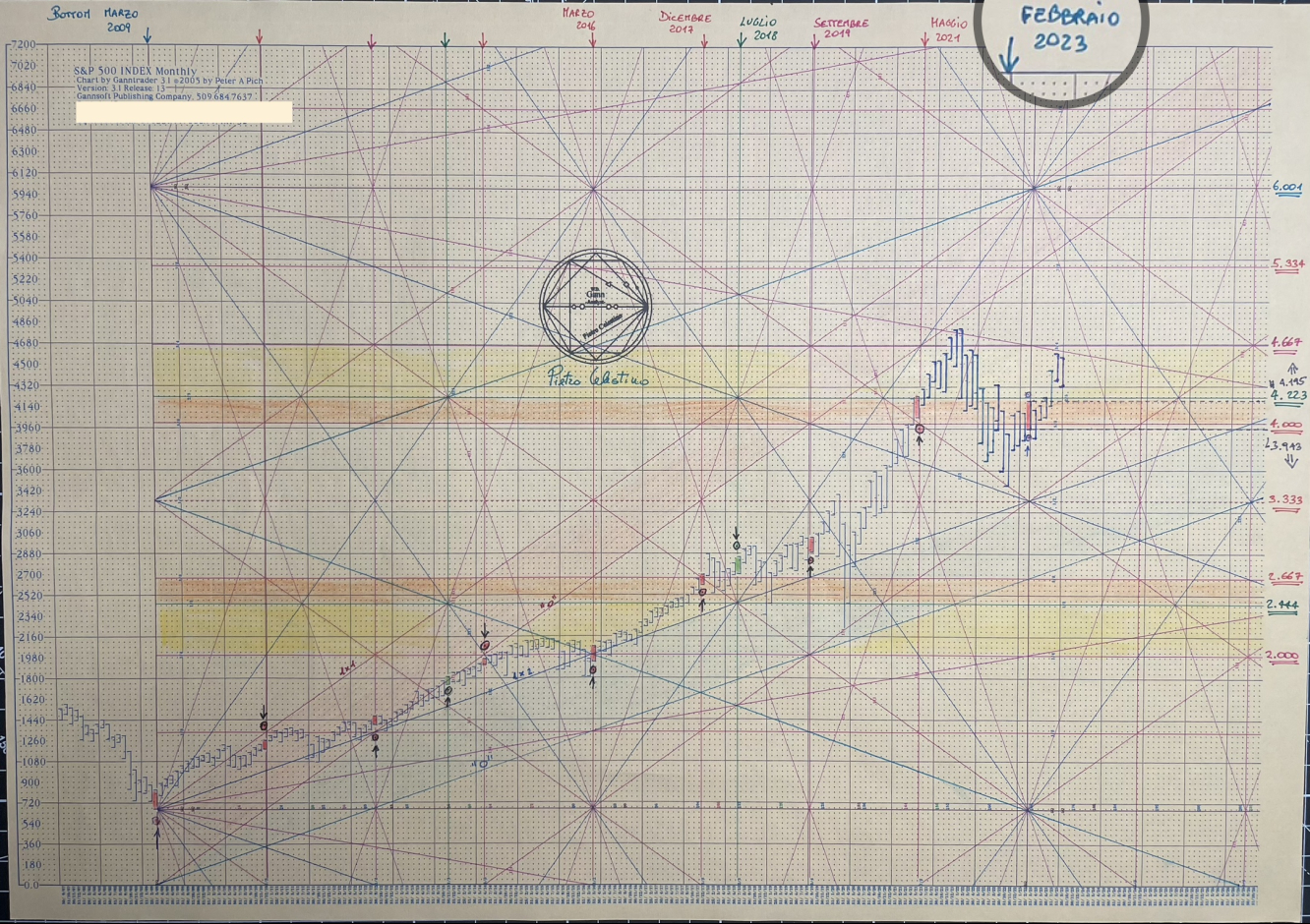

A Bullish wave, initiated by the paramount month-to-month Time Issue of February 2023 for the P/T 4.223 (Excessive 4.195 Low 3.943), punctuated a vigorous upward motion within the American inventory markets. This Climb ignited from the October 2022 Timing’s low and validated by the bullish breakout in November 2022, momentarily halted on the July 2023 setup, as beforehand outlined in our evaluation of US tech markets (particulars out there on the Italian part of the web site).

We now discover ourselves at a possible juncture for all US indexes. When observing by means of a weekly lens, the present dynamism is profoundly influenced by the Timing originating from the 2020 cycle, encompassing all US markets. Particularly, the latest 4/8 September 2023 P/T 4.351 (Excessive 4.514 Low 4.430) Timing serves as a big directional beacon for the trajectory of US inventory costs within the forthcoming weeks and months.

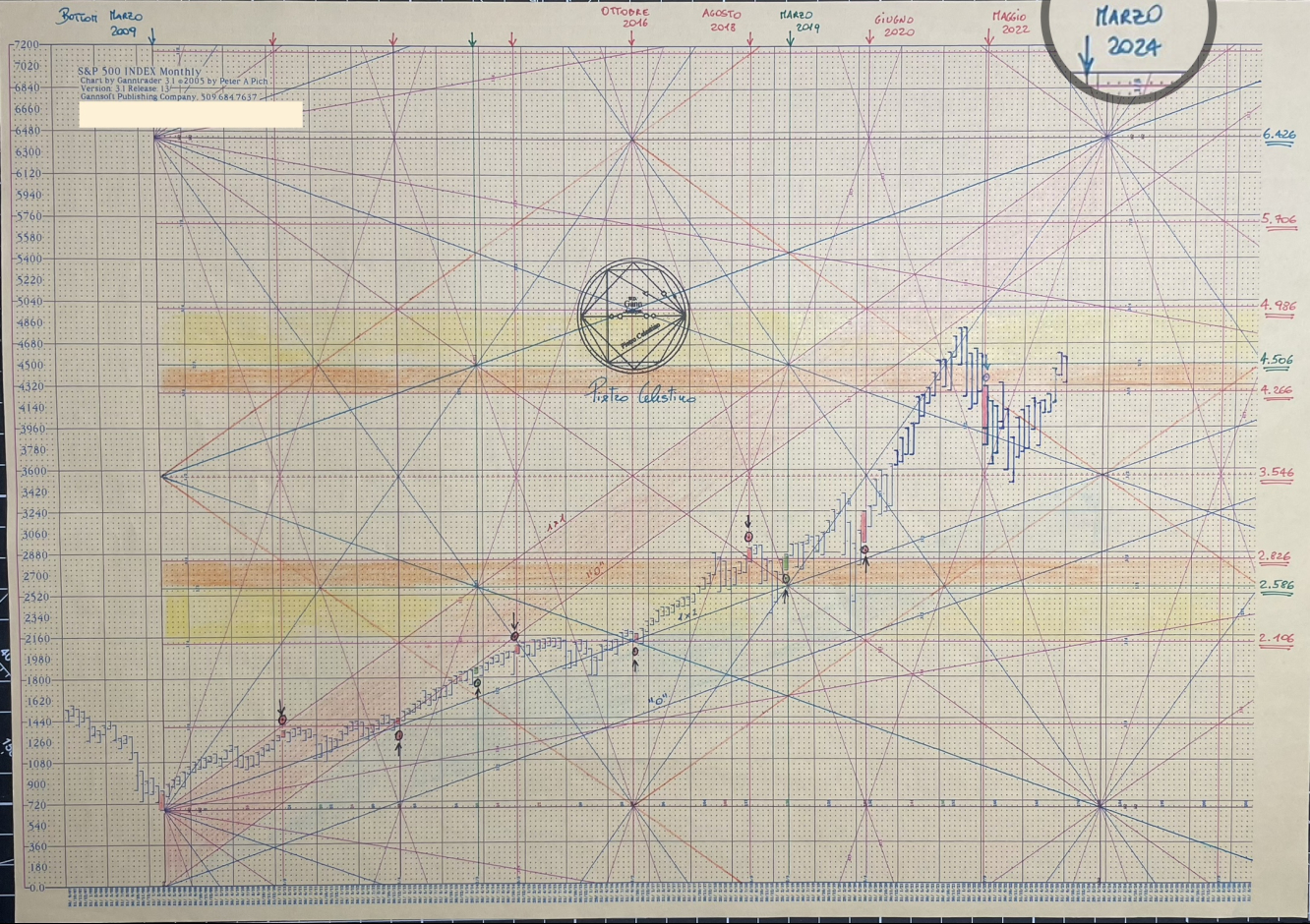

It is important to keep in mind that short-term dynamics, just like the weekly ones, usually exhibit increased situations of false breakouts earlier than markets settle in a decisive path. The final week’s tight buying and selling vary, confined inside simply 100 factors, will set the tone main as much as the essential month-to-month Timing anticipated for March 2024 P/T 4.986 / 5.071, in synergy throughout the quarterly setup of Jan/Mar 2024 P/T 4.506. The prevailing sentiment means that if the index breaks previous 4.514, it might be poised to additional escalate, probably touching new all-time highs by the third month of Q1 2024. Conversely, a structured dip beneath the 4.430 space might recalibrate the market in direction of the pivot zone round 4.111.

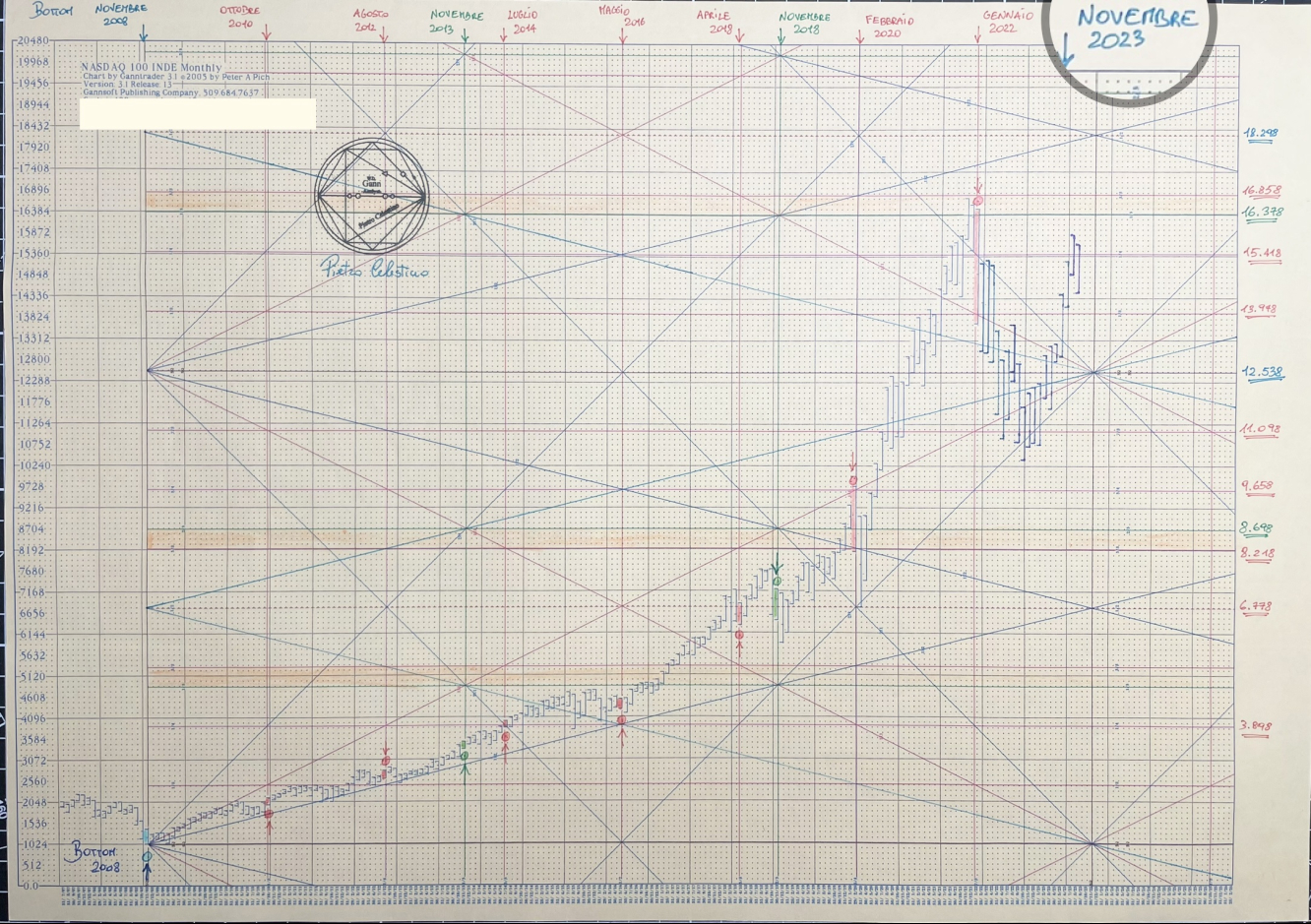

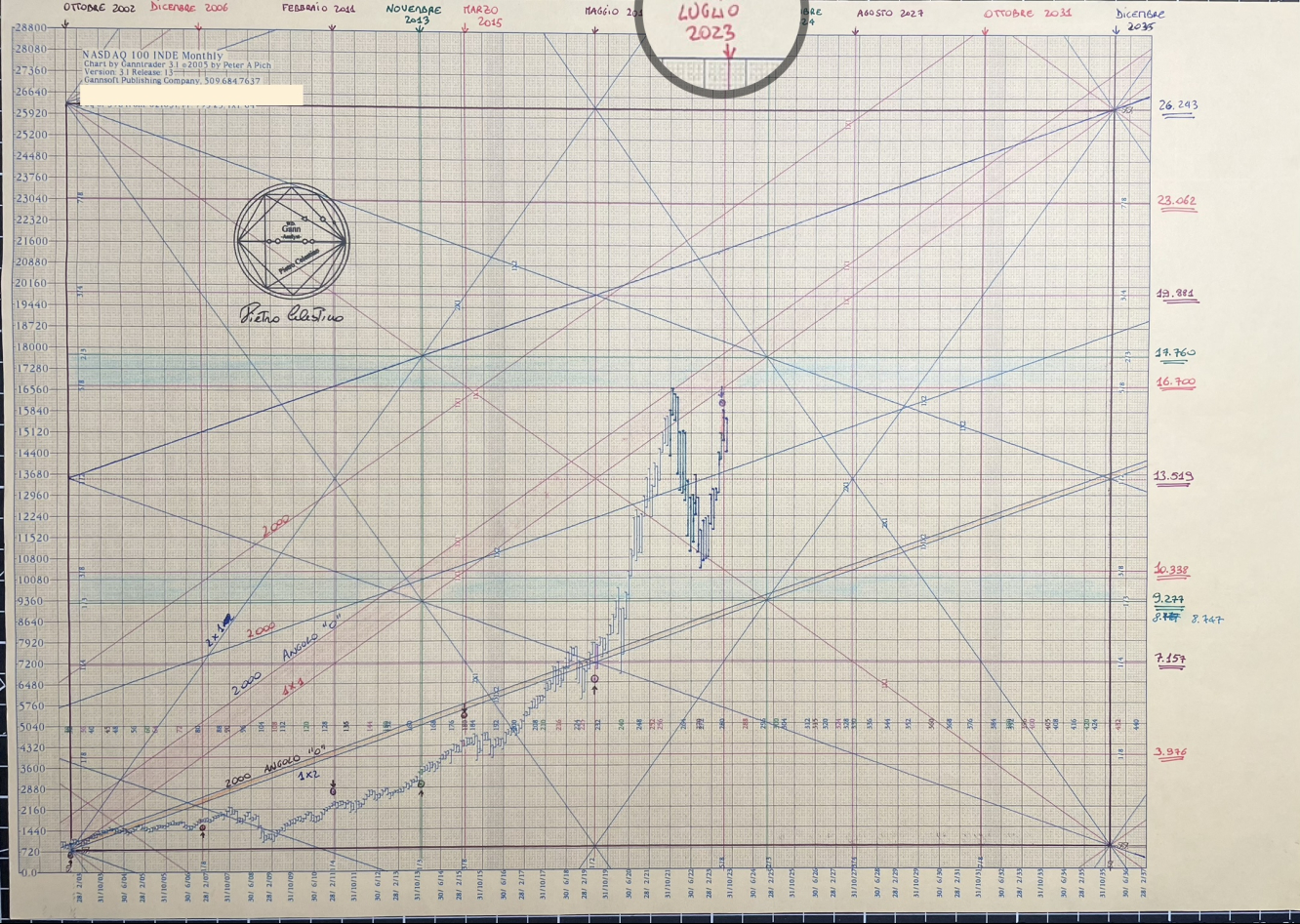

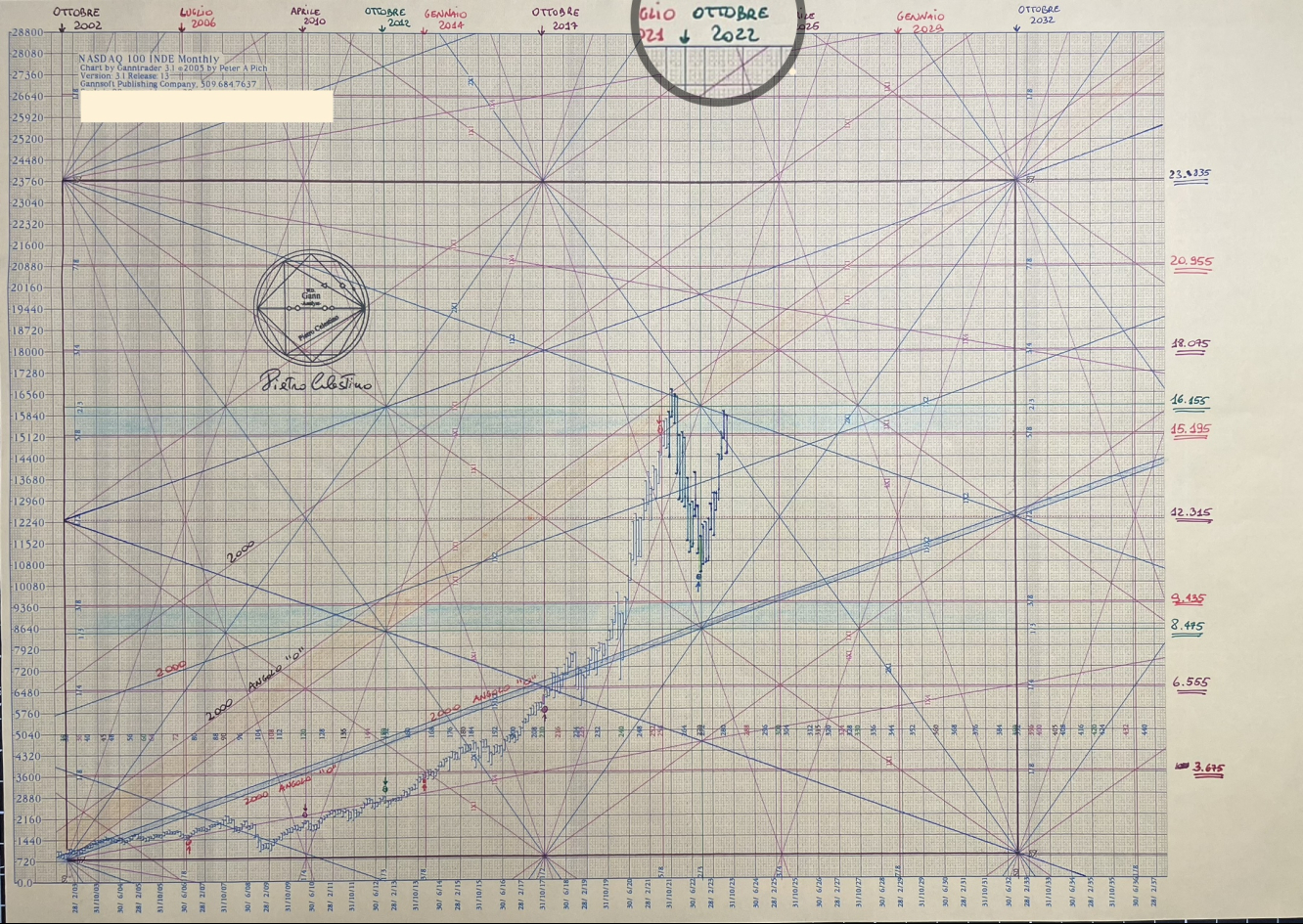

A parallel narrative unfolds for the tech markets. Recognizing their important affect on the S&P 500, we observe an identical month-to-month Timing for March and Q1 of 2024 in regards to the P/T 16.451 / 16.625. Nevertheless, it is pertinent to notice that the has a distinguished Timing, rooted within the 2008 cycle, putting it 4 months forward of different indexes. This Timing is slated for November 2023 at Nasdaq 100 P/T 16.378 / 16.858.