Article by IG Chief Market Analyst Chris Beauchamp

Dow Jones, Nikkei 225, Nasdaq 100 Evaluation and Charts

Dow struggles to push greater

The index has spent the week attempting to interrupt greater, however positive aspects above 34,700 have confirmed inconceivable to maintain. For the second, whereas the patrons haven’t been capable of seize management, sellers have been unable to drive the worth decrease, with 34,540 appearing as an space of assist. Final week’s low at 34,280, after which the late August low round 34,050 may present assist.

An in depth above the 50-day SMA would offer a extra bullish view and will see the worth take a look at the 35,000 stage once more.

Dow Jones Each day Chart

Really helpful by IG

Constructing Confidence in Buying and selling

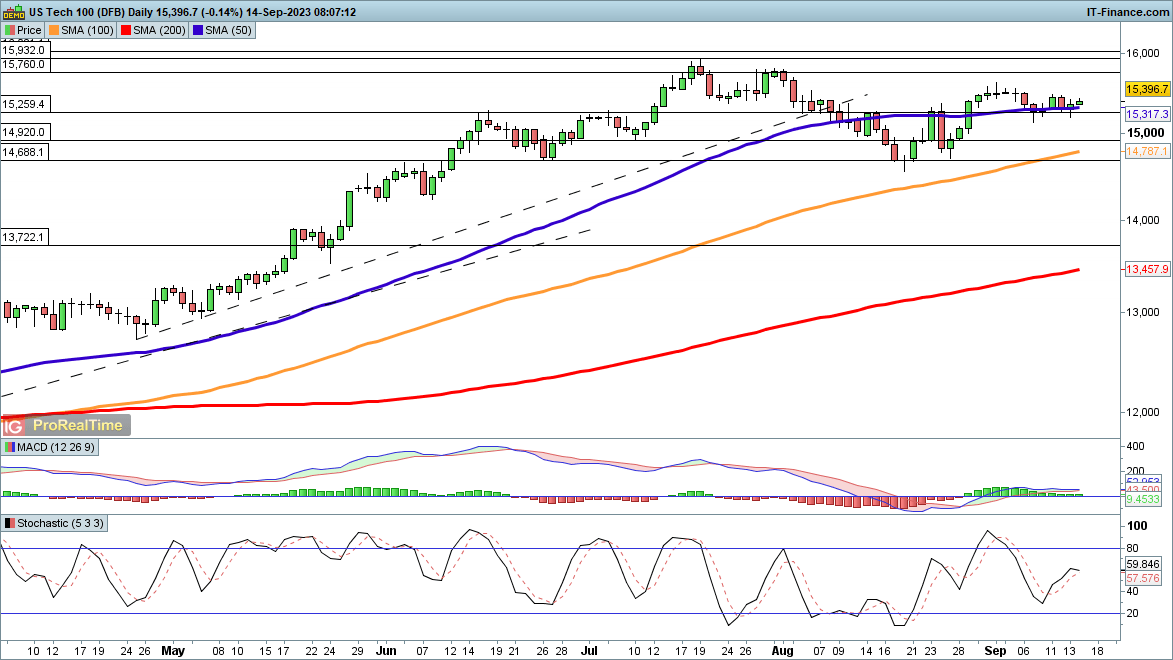

Nasdaq 100 holds above 50-day MA

Right here the bulls are exhibiting indicators of energy, holding the index above the 50-day SMA and stepping yesterday to carry the worth above 15,260.An in depth above 15,575 may assist to catalyze a extra bullish view, as it might see the worth push on above the late August excessive. From there, the 15,750 and 15,930 highs from July become visible.

The restoration from the August low is unbroken, although a drop again beneath 15,200 would put strain on that, and doubtlessly open the way in which to a different take a look at of the 100-day SMA after which the August lows round 14,690.

Nasdaq 100 Each day Chart

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

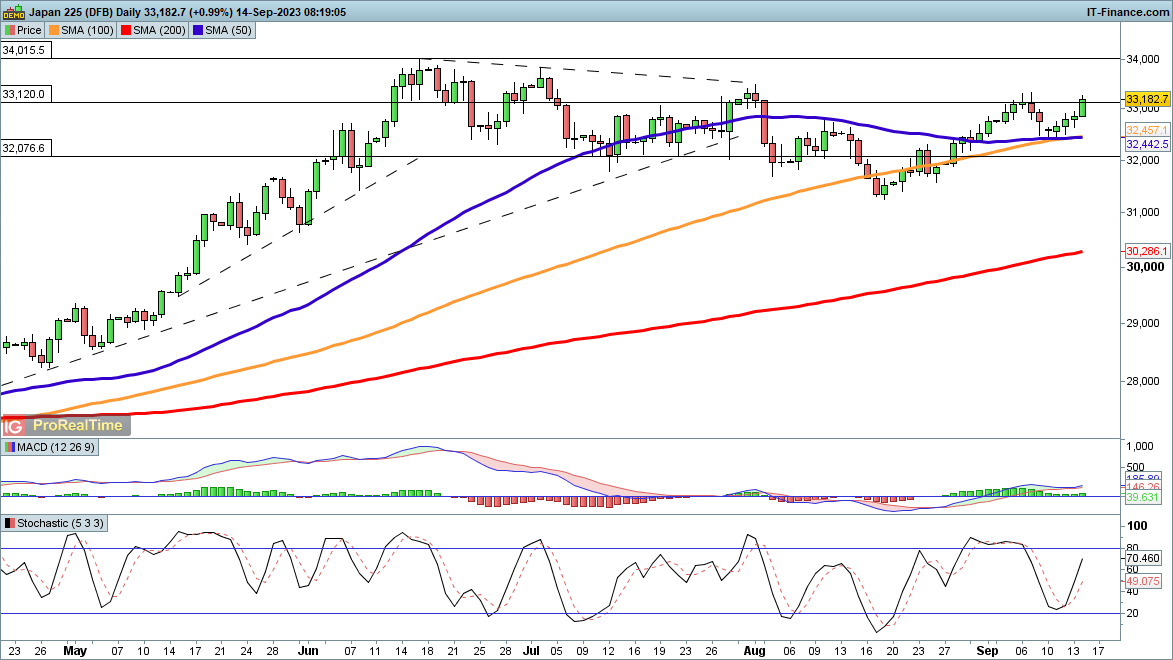

Nikkei 225 surges

Regular positive aspects within the first three days of the week have been adopted up by a surge on Thursday that has taken the index again to the early September highs.An in depth above 33,337 would mark a bullish breakout, with the following goal being the early August peak at 33,40, adopted up by the decrease highs of July after which June.

Total the rally from the August low continues to be in place, with the bounce of the previous week going down off a better low. An in depth again beneath 32,400 would negate this bullish view within the brief time period.

Nikkei 225 Each day Chart